digital edition of UK & Ireland unquote

digital edition of UK & Ireland unquote

digital edition of UK & Ireland unquote

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

For more information on these deals, please<br />

click the URL listed in each write-up.<br />

8<br />

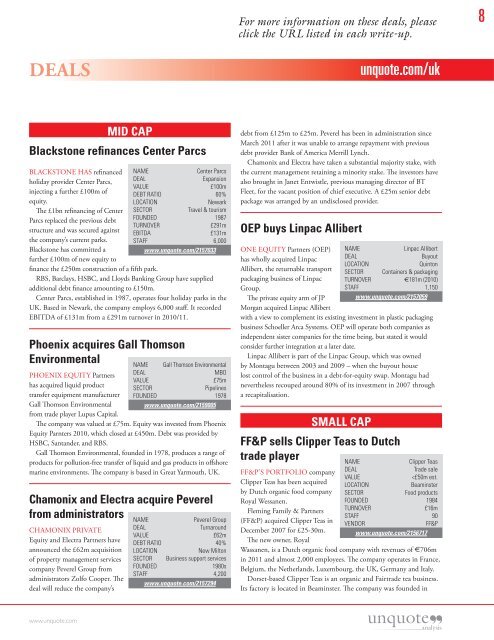

DEALS<br />

<strong>unquote</strong>.com/uk<br />

MID CAP<br />

Blackstone refinances Center Parcs<br />

BLACKSTONE HAS refinanced<br />

holiday provider Center Parcs,<br />

injecting a further £100m <strong>of</strong><br />

equity.<br />

The £1bn refinancing <strong>of</strong> Center<br />

Parcs replaced the previous debt<br />

structure and was secured against<br />

the company’s current parks.<br />

Blackstone has committed a<br />

further £100m <strong>of</strong> new equity to<br />

finance the £250m construction <strong>of</strong> a fifth park.<br />

RBS, Barclays, HSBC, and Lloyds Banking Group have supplied<br />

additional debt finance amounting to £150m.<br />

Center Parcs, established in 1987, operates four holiday parks in the<br />

<strong>UK</strong>. Based in Newark, the company employs 6,000 staff. It recorded<br />

EBITDA <strong>of</strong> £131m from a £291m turnover in 2010/11.<br />

Phoenix acquires Gall Thomson<br />

Environmental<br />

PHOENIX EQUITY Partners<br />

has acquired liquid product<br />

transfer equipment manufacturer<br />

Gall Thomson Environmental<br />

from trade player Lupus Capital.<br />

The company was valued at £75m. Equity was invested from Phoenix<br />

Equity Parnters 2010, which closed at £450m. Debt was provided by<br />

HSBC, Santander, and RBS.<br />

Gall Thomson Environmental, founded in 1978, produces a range <strong>of</strong><br />

products for pollution-free transfer <strong>of</strong> liquid and gas products in <strong>of</strong>fshore<br />

marine environments. The company is based in Great Yarmouth, <strong>UK</strong>.<br />

Chamonix and Electra acquire Peverel<br />

from administrators<br />

CHAMONIX PRIVATE<br />

Equity and Electra Partners have<br />

announced the £62m acquisition<br />

<strong>of</strong> property management services<br />

company Peverel Group from<br />

administrators Zolfo Cooper. The<br />

deal will reduce the company’s<br />

NAME<br />

Center Parcs<br />

DEAL<br />

Expansion<br />

VALUE £100m<br />

DEBT RATIO 60%<br />

LOCATION<br />

Newark<br />

SECTOR<br />

Travel & tourism<br />

FOUNDED 1987<br />

TURNOVER £291m<br />

EBITDA £131m<br />

STAFF 6,000<br />

www.<strong>unquote</strong>.com/2157033<br />

NAME Gall Thomson Environmental<br />

DEAL<br />

MBO<br />

VALUE £75m<br />

SECTOR<br />

Pipelines<br />

FOUNDED 1978<br />

www.<strong>unquote</strong>.com/2159005<br />

NAME<br />

Peverel Group<br />

DEAL<br />

Turnaround<br />

VALUE £62m<br />

DEBT RATIO 40%<br />

LOCATION<br />

New Milton<br />

SECTOR Business support services<br />

FOUNDED<br />

1980s<br />

STAFF 4,200<br />

www.<strong>unquote</strong>.com/2157294<br />

debt from £125m to £25m. Peverel has been in administration since<br />

March 2011 after it was unable to arrange repayment with previous<br />

debt provider Bank <strong>of</strong> America Merrill Lynch.<br />

Chamonix and Electra have taken a substantial majority stake, with<br />

the current management retaining a minority stake. The investors have<br />

also brought in Janet Entwistle, previous managing director <strong>of</strong> BT<br />

Fleet, for the vacant position <strong>of</strong> chief executive. A £25m senior debt<br />

package was arranged by an undisclosed provider.<br />

OEP buys Linpac Allibert<br />

ONE EQUITY Partners (OEP)<br />

has wholly acquired Linpac<br />

Allibert, the returnable transport<br />

packaging business <strong>of</strong> Linpac<br />

Group.<br />

The private equity arm <strong>of</strong> JP<br />

Morgan acquired Linpac Allibert<br />

with a view to complement its existing investment in plastic packaging<br />

business Schoeller Arca Systems. OEP will operate both companies as<br />

independent sister companies for the time being, but stated it would<br />

consider further integration at a later date.<br />

Linpac Allibert is part <strong>of</strong> the Linpac Group, which was owned<br />

by Montagu between 2003 and 2009 – when the buyout house<br />

lost control <strong>of</strong> the business in a debt-for-equity swap. Montagu had<br />

nevertheless recouped around 80% <strong>of</strong> its investment in 2007 through<br />

a recapitalisation.<br />

SMALL CAP<br />

FF&P sells Clipper Teas to Dutch<br />

trade player<br />

FF&P’S PORTFOLIO company<br />

Clipper Teas has been acquired<br />

by Dutch organic food company<br />

Royal Wessanen.<br />

Fleming Family & Partners<br />

(FF&P) acquired Clipper Teas in<br />

December 2007 for £25-30m.<br />

The new owner, Royal<br />

NAME<br />

Linpac Allibert<br />

DEAL<br />

Buyout<br />

LOCATION<br />

Quinton<br />

SECTOR Containers & packaging<br />

TURNOVER €181m (2010)<br />

STAFF 1,150<br />

www.<strong>unquote</strong>.com/2157059<br />

NAME<br />

Clipper Teas<br />

DEAL<br />

Trade sale<br />

VALUE<br />