Welcome to RBF Information in this brochure is ... - SuperFacts.com

Welcome to RBF Information in this brochure is ... - SuperFacts.com

Welcome to RBF Information in this brochure is ... - SuperFacts.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 <strong>Wel<strong>com</strong>e</strong> <strong>to</strong> <strong>RBF</strong><br />

Invest<strong>in</strong>g <strong>in</strong><br />

super could<br />

get you where<br />

just sav<strong>in</strong>g<br />

never will<br />

Contributions<br />

Employer contributions<br />

Your employer makes contributions <strong>to</strong><br />

your superannuation each pay period.<br />

These are called Superannuation<br />

Guarantee (SG) contributions and they<br />

are paid <strong>in</strong><strong>to</strong> your Investment Account.<br />

These contributions are calculated<br />

at the rate of n<strong>in</strong>e per cent of salary.<br />

Salary sacrifice contributions are also<br />

counted as employer contributions.<br />

There <strong>is</strong> a limit on how much your<br />

employer can contribute <strong>to</strong> your super<br />

fund each year. If your employer<br />

contributions limit <strong>is</strong> exceeded, you<br />

will have <strong>to</strong> pay tax on the excess<br />

contributions at the <strong>to</strong>p marg<strong>in</strong>al rate<br />

plus Medicare levy.<br />

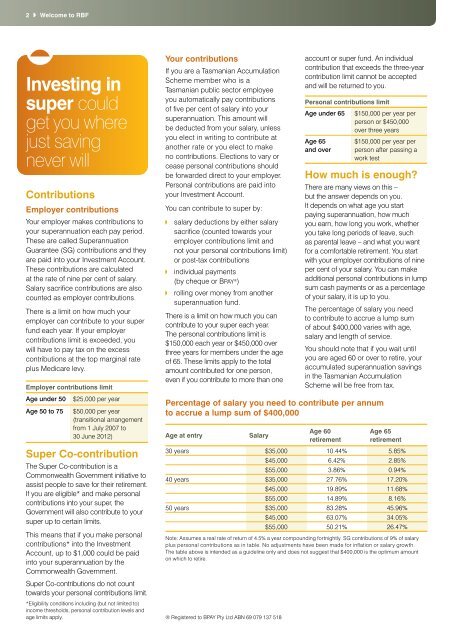

Employer contributions limit<br />

Your contributions<br />

If you are a Tasmanian Accumulation<br />

Scheme member who <strong>is</strong> a<br />

Tasmanian public sec<strong>to</strong>r employee<br />

you au<strong>to</strong>matically pay contributions<br />

of five per cent of salary <strong>in</strong><strong>to</strong> your<br />

superannuation. Th<strong>is</strong> amount will<br />

be deducted from your salary, unless<br />

you elect <strong>in</strong> writ<strong>in</strong>g <strong>to</strong> contribute at<br />

another rate or you elect <strong>to</strong> make<br />

no contributions. Elections <strong>to</strong> vary or<br />

cease personal contributions should<br />

be forwarded direct <strong>to</strong> your employer.<br />

Personal contributions are paid <strong>in</strong><strong>to</strong><br />

your Investment Account.<br />

You can contribute <strong>to</strong> super by:<br />

salary deductions by either salary<br />

sacrifice (counted <strong>to</strong>wards your<br />

employer contributions limit and<br />

not your personal contributions limit)<br />

or post-tax contributions<br />

<strong>in</strong>dividual payments<br />

(by cheque or Bpay ® )<br />

roll<strong>in</strong>g over money from another<br />

superannuation fund.<br />

There <strong>is</strong> a limit on how much you can<br />

contribute <strong>to</strong> your super each year.<br />

The personal contributions limit <strong>is</strong><br />

$150,000 each year or $450,000 over<br />

three years for members under the age<br />

of 65. These limits apply <strong>to</strong> the <strong>to</strong>tal<br />

amount contributed for one person,<br />

even if you contribute <strong>to</strong> more than one<br />

account or super fund. An <strong>in</strong>dividual<br />

contribution that exceeds the three-year<br />

contribution limit cannot be accepted<br />

and will be returned <strong>to</strong> you.<br />

Personal contributions limit<br />

Age under 65 $150,000 per year per<br />

person or $450,000<br />

over three years<br />

Age 65<br />

and over<br />

$150,000 per year per<br />

person after pass<strong>in</strong>g a<br />

work test<br />

How much <strong>is</strong> enough?<br />

There are many views on <strong>th<strong>is</strong></strong> –<br />

but the answer depends on you.<br />

It depends on what age you start<br />

pay<strong>in</strong>g superannuation, how much<br />

you earn, how long you work, whether<br />

you take long periods of leave, such<br />

as parental leave – and what you want<br />

for a <strong>com</strong>fortable retirement. You start<br />

with your employer contributions of n<strong>in</strong>e<br />

per cent of your salary. You can make<br />

additional personal contributions <strong>in</strong> lump<br />

sum cash payments or as a percentage<br />

of your salary, it <strong>is</strong> up <strong>to</strong> you.<br />

The percentage of salary you need<br />

<strong>to</strong> contribute <strong>to</strong> accrue a lump sum<br />

of about $400,000 varies with age,<br />

salary and length of service.<br />

You should note that if you wait until<br />

you are aged 60 or over <strong>to</strong> retire, your<br />

accumulated superannuation sav<strong>in</strong>gs<br />

<strong>in</strong> the Tasmanian Accumulation<br />

Scheme will be free from tax.<br />

Age under 50<br />

Age 50 <strong>to</strong> 75<br />

$25,000 per year<br />

$50,000 per year<br />

(transitional arrangement<br />

from 1 July 2007 <strong>to</strong><br />

30 June 2012)<br />

Super Co-contribution<br />

The Super Co-contribution <strong>is</strong> a<br />

Commonwealth Government <strong>in</strong>itiative <strong>to</strong><br />

ass<strong>is</strong>t people <strong>to</strong> save for their retirement.<br />

If you are eligible* and make personal<br />

contributions <strong>in</strong><strong>to</strong> your super, the<br />

Government will also contribute <strong>to</strong> your<br />

super up <strong>to</strong> certa<strong>in</strong> limits.<br />

Th<strong>is</strong> means that if you make personal<br />

contributions* <strong>in</strong><strong>to</strong> the Investment<br />

Account, up <strong>to</strong> $1,000 could be paid<br />

<strong>in</strong><strong>to</strong> your superannuation by the<br />

Commonwealth Government.<br />

Super Co-contributions do not count<br />

<strong>to</strong>wards your personal contributions limit.<br />

*Eligibility conditions <strong>in</strong>clud<strong>in</strong>g (but not limited <strong>to</strong>)<br />

<strong>in</strong><strong>com</strong>e thresholds, personal contribution levels and<br />

age limits apply.<br />

Percentage of salary you need <strong>to</strong> contribute per annum<br />

<strong>to</strong> accrue a lump sum of $400,000<br />

Age at entry<br />

Salary<br />

Age 60<br />

retirement<br />

Age 65<br />

retirement<br />

30 years $35,000 10.44% 5.85%<br />

$45,000 6.42% 2.85%<br />

$55,000 3.86% 0.94%<br />

40 years $35,000 27.76% 17.20%<br />

$45,000 19.89% 11.68%<br />

$55,000 14.89% 8.16%<br />

50 years $35,000 83.28% 45.96%<br />

$45,000 63.07% 34.05%<br />

$55,000 50.21% 26.47%<br />

Note: Assumes a real rate of return of 4.5% a year <strong>com</strong>pound<strong>in</strong>g fortnightly. SG contributions of 9% of salary<br />

plus personal contributions as <strong>in</strong> table. No adjustments have been made for <strong>in</strong>flation or salary growth.<br />

The table above <strong>is</strong> <strong>in</strong>tended as a guidel<strong>in</strong>e only and does not suggest that $400,000 <strong>is</strong> the optimum amount<br />

on which <strong>to</strong> retire.<br />

® Reg<strong>is</strong>tered <strong>to</strong> BPAY Pty Ltd ABN 69 079 137 518