Morningstar Fund Profile (PDF) - USAA.com

Morningstar Fund Profile (PDF) - USAA.com

Morningstar Fund Profile (PDF) - USAA.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

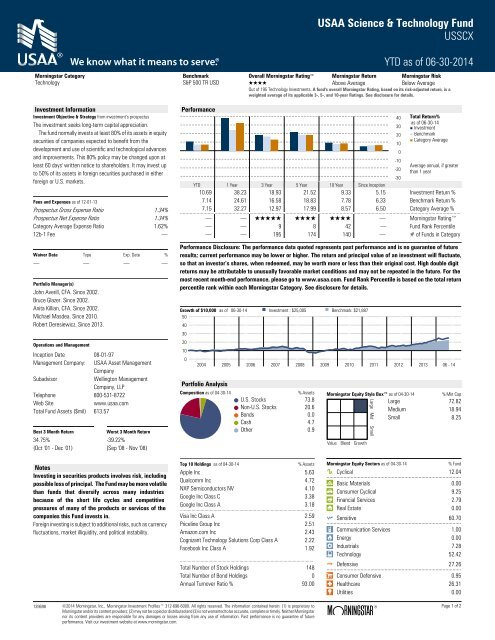

<strong>USAA</strong> Science & Technology <strong>Fund</strong><br />

USSCX<br />

YTD as of 06-30-2014<br />

<strong>Morningstar</strong> Category Benchmark Overall <strong>Morningstar</strong> Rating <strong>Morningstar</strong> Return <strong>Morningstar</strong> Risk<br />

Technology S&P 500 TR USD QQQQ Above Average Below Average<br />

Out of 195 Technology Investments. A fund's overall <strong>Morningstar</strong> Rating, based on its risk-adjusted return, is a<br />

weighted average of its applicable 3-, 5-, and 10-year Ratings. See disclosure for details.<br />

Investment Information<br />

Investment Objective & Strategy from investment’s prospectus<br />

The investment seeks long-term capital appreciation.<br />

The fund normally invests at least 80% of its assets in equity<br />

securities of <strong>com</strong>panies expected to benefit from the<br />

development and use of scientific and technological advances<br />

and improvements. This 80% policy may be changed upon at<br />

least 60 days' written notice to shareholders. It may invest up<br />

to 50% of its assets in foreign securities purchased in either<br />

foreign or U.S. markets.<br />

Fees and Expenses as of 12-01-13<br />

Prospectus Gross Expense Ratio 1.34%<br />

Prospectus Net Expense Ratio 1.34%<br />

Category Average Expense Ratio 1.62%<br />

12b-1 Fee .<br />

Waiver Data Type Exp. Date %<br />

. . . .<br />

Portfolio Manager(s)<br />

John Averill, CFA. Since 2002.<br />

Bruce Glazer. Since 2002.<br />

Anita Killian, CFA. Since 2002.<br />

Michael Masdea. Since 2010.<br />

Robert Deresiewicz. Since 2013.<br />

Operations and Management<br />

Inception Date 08-01-97<br />

Management Company: <strong>USAA</strong> Asset Management<br />

Company<br />

Subadvisor<br />

Wellington Management<br />

Company, LLP<br />

Telephone 800-531-8722<br />

Web Site<br />

www.usaa.<strong>com</strong><br />

Total <strong>Fund</strong> Assets ($mil) 613.57<br />

Best 3 Month Return<br />

Worst 3 Month Return<br />

34.75% -39.22%<br />

(Oct '01 - Dec '01)<br />

(Sep '08 - Nov '08)<br />

Performance<br />

YTD L1 1 Year L2 3 Year L3 5 Year L4 10 L5 Year Since Inception L6<br />

40 Total Return%<br />

as of 06-30-14<br />

30 Investment<br />

20 Benchmark<br />

Category Average<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

Average annual, if greater<br />

than 1 year<br />

10.69 38.23 18.93 21.52 9.33 5.15 Investment Return %<br />

7.14 24.61 16.58 18.83 7.78 6.33 Benchmark Return %<br />

7.15 32.27 12.97 17.99 8.57 6.50 Category Average %<br />

..........................................................................................................................................................................................................<br />

. . QQQQQ QQQQ QQQQ . <strong>Morningstar</strong> Rating<br />

. . 9 8 42 . <strong>Fund</strong> Rank Percentile<br />

. . 195 174 140 . # of <strong>Fund</strong>s in Category<br />

Performance Disclosure: The performance data quoted represents past performance and is no guarantee of future<br />

results; current performance may be lower or higher. The return and principal value of an investment will fluctuate,<br />

so that an investor’s shares, when redeemed, may be worth more or less than their original cost. High double digit<br />

returns may be attributable to unusually favorable market conditions and may not be repeated in the future. For the<br />

most recent month-end performance, please go to www.usaa.<strong>com</strong>. <strong>Fund</strong> Rank Percentile is based on the total return<br />

percentile rank within each <strong>Morningstar</strong> Category. See disclosure for details.<br />

Growth of $10,000 as of 06-30-14 Investment : $25,005 Benchmark: $21,887<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 06 - 14<br />

Portfolio Analysis<br />

Composition as of 04-30-14<br />

% Assets<br />

U.S. Stocks 73.8<br />

Non-U.S. Stocks 20.6<br />

Bonds 0.0<br />

Cash 4.7<br />

Other 0.9<br />

<strong>Morningstar</strong> Equity Style Box as of 04-30-14<br />

% Mkt Cap<br />

Large 72.82<br />

Medium 18.94<br />

Small 8.25<br />

Value Blend Growth<br />

Large Mid Small<br />

Notes<br />

Investing in securities products involves risk, including<br />

possible loss of principal. The <strong>Fund</strong> may be more volatile<br />

than funds that diversify across many industries<br />

because of the short life cycles and <strong>com</strong>petitive<br />

pressures of many of the products or services of the<br />

<strong>com</strong>panies this <strong>Fund</strong> invests in.<br />

Foreign investing is subject to additional risks, such as currency<br />

fluctuations, market illiquidity, and political instability.<br />

Top 10 Holdings as of 04-30-14<br />

% Assets<br />

Apple Inc 5.63<br />

Qual<strong>com</strong>m Inc 4.72<br />

NXP Semiconductors NV 4.10<br />

Google Inc Class C 3.38<br />

Google Inc Class A 3.18<br />

.......................................................................................................<br />

Visa Inc Class A 2.59<br />

Priceline Group Inc 2.51<br />

Amazon.<strong>com</strong> Inc 2.43<br />

Cognizant Technology Solutions Corp Class A 2.22<br />

Facebook Inc Class A 1.92<br />

.......................................................................................................<br />

Total Number of Stock Holdings 148<br />

Total Number of Bond Holdings 0<br />

Annual Turnover Ratio % 93.00<br />

<strong>Morningstar</strong> Equity Sectors as of 04-30-14<br />

% <strong>Fund</strong><br />

h Cyclical 12.04<br />

...............................................................................................<br />

r Basic Materials 0.00<br />

t Consumer Cyclical 9.25<br />

y Financial Services 2.79<br />

u Real Estate 0.00<br />

j Sensitive 60.70<br />

...............................................................................................<br />

i Communication Services 1.00<br />

o Energy 0.00<br />

p Industrials 7.28<br />

a Technology 52.42<br />

k Defensive 27.26<br />

...............................................................................................<br />

s Consumer Defensive 0.95<br />

d Healthcare 26.31<br />

f Utilities 0.00<br />

139698 ©2014 <strong>Morningstar</strong>, Inc., <strong>Morningstar</strong> Investment <strong>Profile</strong>s 312-696-6000. All rights reserved. The information contained herein: (1) is proprietary to<br />

<strong>Morningstar</strong> and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, <strong>com</strong>plete or timely. Neither <strong>Morningstar</strong><br />

nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future<br />

performance. Visit our investment website at www.morningstar.<strong>com</strong>.<br />

® Page 1 of 2<br />

ß

Disclosure<br />

Performance<br />

Total return reflects performance without adjusting for the<br />

effects of taxation, but is adjusted to reflect all actual ongoing<br />

fund expenses and assumes reinvestment of dividends and<br />

capital gains.<br />

The fund's performance is <strong>com</strong>pared to an index. The index<br />

is an unmanaged portfolio of specified securities and does not<br />

reflect any initial or ongoing expenses. A fund's portfolio may<br />

differ significantly from the securities in the index.<br />

<strong>Morningstar</strong> provides adjusted historical returns and an<br />

Extended Performance Rating for some mutual funds in its<br />

universe. This means that any share class that doesn't have a<br />

1, 3-, 5-, or 10-year performance history may receive a<br />

hypothetical <strong>Morningstar</strong> Rating based on the oldest surviving<br />

share class of the fund. First, <strong>Morningstar</strong> <strong>com</strong>putes the funds'<br />

new return stream by appending an adjusted return history of<br />

the oldest share class. Next, the Extended Performance Rating<br />

is determined by <strong>com</strong>paring the adjusted-historical returns to<br />

the current open-end mutual fund universe to identify<br />

placement in the bell curve used to assign the <strong>Morningstar</strong><br />

Rating.<br />

Best and Worst 3 Month Performance<br />

<strong>Morningstar</strong> calculates best and worst 3-month period<br />

(inpercentage) in-house on a monthly basis.<br />

Best 3-month Period: The highest total return the stock has<br />

posted in a consecutive three-month period over the trailing 15<br />

years, or if a fund does not have 15 years of history, it will go<br />

back as far as the inception date.<br />

Worst 3-month Period: The lowest total return the stock has<br />

posted in a consecutive three-month period over the trailing 15<br />

years, or if a fund does not have 15 years of history, it will go<br />

back as far as the inception date.<br />

Growth of $10,000 Graph<br />

This graph shows a fund's performance based on how $10,000<br />

invested in the fund would have grown over time. The returns<br />

used in the graph are not load-adjusted. The growth of $10,000<br />

begins at the date of the fund's inception, or the first year listed<br />

on the graph, whichever is appropriate. Located alongside the<br />

fund's graph line is a line that represents the growth of $10,000<br />

in an index. The inclusion of the index allows investors to<br />

<strong>com</strong>pare the performance of the fund with the performance of<br />

a benchmark index.<br />

<strong>Morningstar</strong> Rating<br />

Often simply called the Star Rating, the <strong>Morningstar</strong> Rating<br />

brings load-adjustments, performance (returns) and risk<br />

together into one evaluation. To determine a fund's star rating<br />

for a given time period (three, five, or 10 years), the fund's riskadjusted<br />

return is plotted on a bell curve: If the fund scores in<br />

the top 10% of its category, it receives 5 stars (Highest); if it<br />

falls in the next 22.5% it receives 4 stars (Above Average); a<br />

place in the middle 35% earns 3 stars (Average); those lower<br />

still, in the next 22.5%, receive 2 stars (Below Average); and<br />

the bottom 10% get only 1 star (Lowest). The Overall<br />

<strong>Morningstar</strong> Rating is a weighted average of the available<br />

three-, five-, and 10-year ratings.<br />

<strong>Morningstar</strong> Return<br />

This statistic is a measurement of a fund's excess return over<br />

a risk-free rate (the return of the 90-day Treasury bill), after<br />

adjusting for all applicable loads and sales charges. In each<br />

<strong>Morningstar</strong> Category, the top 10% of funds earn a High<br />

<strong>Morningstar</strong> Return, the next 22.5% Above Average, the middle<br />

35% Average, the next 22.5% Below Average, and the bottom<br />

10% Low. <strong>Morningstar</strong> Return is measured for up to three time<br />

periods (three-, five-, and 10-years). These separate measures<br />

are then weighted and averaged to produce an overall measure<br />

for the fund. <strong>Fund</strong>s with less than three years of performance<br />

history are not rated.<br />

<strong>Morningstar</strong> Risk<br />

This statistic evaluates the variations in a fund's monthly<br />

returns, with an emphasis on downside variations. In each<br />

<strong>Morningstar</strong> Category, the 10% of funds with the lowest<br />

measured risk are described as Low Risk, the next 22.5% Below<br />

Average, the middle 35% Average, the next 22.5% Above<br />

Average, and the top 10% High.<br />

<strong>Morningstar</strong> Risk is measured for up to three time periods<br />

(three-, five-, and 10-years). These separate measures are then<br />

weighted and averaged to produce an overall measure for the<br />

fund. <strong>Fund</strong>s with less than three years of performance history<br />

are not rated.<br />

<strong>Fund</strong> Rank Percentile<br />

This is the total return percentile rank within each <strong>Morningstar</strong><br />

Category. The highest (or most favorable) percentile rank is 1<br />

and the lowest (or least favorable) percentile rank is 100.<br />

Historical percentile ranks are based on a snapshot of the funds<br />

as they were at the time of the calculation.<br />

Percentile ranks within categories are most useful in those<br />

groups that have a large number of funds. For small universes,<br />

funds will be ranked at the highest percentage possible. For<br />

instance, if there are only two specialty-utility funds with 10-<br />

year average total returns, <strong>Morningstar</strong> will assign a percentile<br />

rank of 1 to the top-performing fund, and the second fund will<br />

earn a percentile rank of 51 (indicating the fund underperformed<br />

50% of the sample).<br />

<strong>Morningstar</strong> Style Box<br />

The <strong>Morningstar</strong> Style Box reveals a fund's investment style as<br />

of the date noted on this report.<br />

For equity funds the vertical axis shows the market<br />

capitalization of the long stocks owned and the horizontal axis<br />

shows investment style (value, blend, or growth).<br />

For fixed-in<strong>com</strong>e funds, the vertical axis shows the credit<br />

quality of the long bonds owned and the horizontal axis shows<br />

interest rate sensitivity as measured by a bond's effective<br />

duration.<br />

<strong>Morningstar</strong> seeks credit rating information from fund<br />

<strong>com</strong>panies on a periodic basis (e.g., quarterly). In <strong>com</strong>piling<br />

credit rating information <strong>Morningstar</strong> accepts credit ratings<br />

reported by fund <strong>com</strong>panies that have been issued by all<br />

Nationally Recognized Statistical Rating Organizations<br />

(NRSROs). For a list of all NRSROs, please visit http://<br />

www.sec.gov/divisions/marketreg/ratingagency.htm.<br />

Additionally, <strong>Morningstar</strong> accepts foreign credit ratings from<br />

widely recognized or registered rating agencies. If two rating<br />

organizations/agencies have rated a security, fund <strong>com</strong>panies<br />

are to report the lower rating; if three or more organizations/<br />

agencies have rated a security, fund <strong>com</strong>panies are to report<br />

the median rating, and in cases where there are more than two<br />

organization/agency ratings and a median rating does not exist,<br />

fund <strong>com</strong>panies are to use the lower of the two middle ratings.<br />

PLEASE NOTE: <strong>Morningstar</strong>, Inc. is not itself an NRSRO nor does<br />

it issue a credit rating on the fund. An NRSRO or rating agency<br />

ratings can change from time-to-time and do not remove<br />

market risk.<br />

For credit quality, <strong>Morningstar</strong> <strong>com</strong>bines the credit rating<br />

information provided by the fund <strong>com</strong>panies with an average<br />

default rate calculation to <strong>com</strong>e up with a weighted-average<br />

credit quality. The weighted-average credit quality is currently<br />

a letter that roughly corresponds to the scale used by a leading<br />

NRSRO. Bond funds are assigned a style box placement of<br />

"low", "medium", or "high" based on their average credit quality.<br />

<strong>Fund</strong>s with a low credit quality are those whose weightedaverage<br />

credit quality is determined to be less than "BBB-";<br />

medium are those less than "AA-", but greater or equal to<br />

"BBB-"; and high are those with a weighted-average credit<br />

quality of "AA-" or higher. When classifying a bond portfolio,<br />

<strong>Morningstar</strong> first maps the NRSRO credit ratings of the<br />

underlying holdings to their respective default rates (as<br />

determined by <strong>Morningstar</strong>'s analysis of actual historical default<br />

rates). <strong>Morningstar</strong> then averages these default rates to<br />

determine the average default rate for the entire bond fund.<br />

Finally, <strong>Morningstar</strong> maps this average default rate to its<br />

corresponding credit rating along a convex curve.<br />

For interest-rate sensitivity, <strong>Morningstar</strong> obtains from fund<br />

<strong>com</strong>panies the average effective duration. Generally,<br />

<strong>Morningstar</strong> classifies a fixed-in<strong>com</strong>e fund's interest-rate<br />

sensitivity based on the effective duration of the <strong>Morningstar</strong><br />

Core Bond Index (MCBI), which is currently three years. The<br />

classification of Limited will be assigned to those funds whose<br />

average effective duration is between 25% to 75% of MCBI's<br />

average effective duration; funds whose average effective<br />

duration is between 75% to 125% of the MCBI will be classified<br />

as Moderate; and those that are at 125% or greater of the<br />

average effective duration of the MCBI will be classified as<br />

Extensive.<br />

For municipal bond funds, <strong>Morningstar</strong> also obtains from<br />

fund <strong>com</strong>panies the average effective duration. In these cases<br />

static breakpoints are utilized. These breakpoints are as follows:<br />

(i) Limited: 4.5 years or less; (ii) Moderate: more than 4.5 years<br />

but less than 7 years; and (iii) Extensive: more than 7 years. In<br />

addition, for non-US taxable and non-US domiciled fixed in<strong>com</strong>e<br />

funds static duration breakpoints are used: (i) Limited: less than<br />

or equal to 3.5 years; (ii) Moderate: greater than 3.5 and less<br />

than equal to 6 years; (iii) Extensive: greater than 6 years.<br />

Additional Information<br />

Consider the investment objectives, risks, charges and<br />

expenses of the <strong>USAA</strong> mutual funds carefully before<br />

investing. Contact us at 800-531-8910 for a prospectus<br />

containing this and other information about the funds<br />

from <strong>USAA</strong> Investment Management Company,<br />

Distributor. Read it carefully before investing.<br />

Investments provided by <strong>USAA</strong> Investment Management<br />

Company and <strong>USAA</strong> Financial Advisors Inc., both registered<br />

broker dealers.<br />

139698 ©2014 <strong>Morningstar</strong>, Inc., <strong>Morningstar</strong> Investment <strong>Profile</strong>s 312-696-6000. All rights reserved. The information contained herein: (1) is proprietary to<br />

<strong>Morningstar</strong> and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, <strong>com</strong>plete or timely. Neither <strong>Morningstar</strong><br />

nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future<br />

performance. Visit our investment website at www.morningstar.<strong>com</strong>.<br />

® Page 2 of 2<br />

ß