OWn COURSE - USAA

OWn COURSE - USAA

OWn COURSE - USAA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

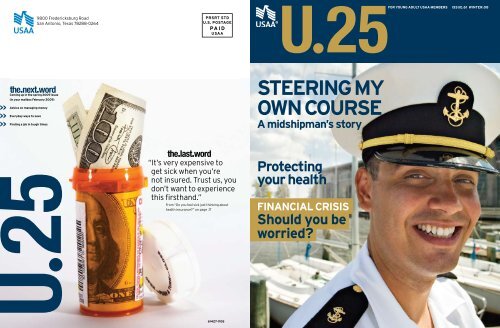

For young adult <strong>USAA</strong> members Issue •61 WINTER •089800 Fredericksburg RoadSan Antonio, Texas 78288-0264PRSRT STDU.S. POSTAGEPAID<strong>USAA</strong>>>>Coming up in the spring 2009 issue(in your mailbox February 2009)Advice on managing moneyEveryday ways to saveFinding a job in tough timesSTEERING MYOWN CourseA midshipman’s story“It’s very expensive toget sick when you’renot insured. Trust us, youdon’t want to experiencethis firsthand.”From “Do you feel sick just thinking abouthealth insurance?” on page .17Protectingyour healthFinancial crisisShould you beworried?61427-1108

winterU.25A magazine for young adult <strong>USAA</strong>membersEditorCarol BarnesDesignKym Abrams Design Inc.ContributorsJohn DiConsiglio, Alexandra Levit,Sean McCollum, Roger SlavensU.25 Editorial BoardAmy Anderson, Derrick Baylor,Derek England, Alana Herro,Sarah Hitchcock, Amanda Hoff,Emily O’Dell, Bill Oram,Jeanette Prather, Katherine Raney,Josh RhotenProductionDavid Gunn, Lisa SeversonYouth Media DirectorJulie FinlayU.259800 Fredericksburg Road, E-1-ESan Antonio, Texas 78288-0264Telephone: (800) 531-8013Fax: (210) 498-8754E-mail: U25@usaa.comOn the Web: usaa.com/u25.07 FINANCIAL CRISIS<strong>USAA</strong> experts answer your questions.ON THE COVER - Andrew Campos. PHOTOGRAPHY by rick dahms ©2008RUMOR HAS IT.03 bits.bytesUp-to-date news youcan use.06 career.coachAnswers to your questionsabout work life.22 start.smart<strong>USAA</strong> programstailored for youPhotography by Istock photo and corbisGAS ISCHEAP?Though it changesconstantly, theaverage gas price isaround $3 a gallonnationally. If you thinkgas is pricey, lookat what some otherliquids would cost ifyou purchased themby the gallon.GASOLINE$3 per gallonWant to receiveU.25 at a differentaddress?E-mail your new address to U25@usaa.com. Please include your nameand <strong>USAA</strong> member number..12 Steering myown courseLeaving the past behind.17 Sick just thinkingabout healthinsurance?It’s time to take action.PRICES PER GALLONVisit U.25 online atusaa.com/u25.U.25 is published four times a year for young adult <strong>USAA</strong> members. <strong>USAA</strong> also publishes U Mag for young members, U-TURN magazine and a weekly podcast for teen members, usaa.commagazine for members beginning their financial journey, and <strong>USAA</strong> Magazine for adult members. <strong>USAA</strong> is a member-owned financial services group that provides a complete line of insurance,investment, banking, and other services to millions of members worldwide. Material in this magazine may not be reproduced, stored in a retrieval system, or transmitted in any form or by anymeans (electronic, mechanical, photocopying, or otherwise) without permission from the publisher. Copyright ©2008 by <strong>USAA</strong>. All rights reserved. U.25 is a registered trademark of <strong>USAA</strong>. Toorder additional copies, submit writing samples, or request reprint permission, contact U.25, <strong>USAA</strong>, Attn: Youth Media,9800 Fredericksburg Road, E-1-E, San Antonio, Texas 78288-0264; (800) 531-8013.ICED TEA$9.52SPORT DRINK$10.17MOUTHWASH$84.48COUGH SYRUP$178.13BLACK INK CARTRIDGE$4,294.58.02 U.25winter2008 U.25winter2008 .03

LOANSWITH ACARPOOLCHECKL ISTIf you’re having trouble getting astudent loan, you might be temptedto go through a peer-to-peer loan site.With phrases like “financeeducation the easy, affordableway!” and “get student loans frompeople who believe in you,” siteslike fynanz.com and greennote.commake offers from private lendersthat seem too good to be true.While traditional governmentstudent loans have mandateddollar limits that fall short ofreal-world education expenses,these college lending sites boastno dollar limits. The downsidecould be a higher interest rate. Ifyou’re considering using one ofthese sites, take the followingsteps before you commit:• Know your credit score.Like many private lenders,the interest rate you may beoffered will vary based on yourcredit score.• Check to make sure the loanhas a fixed interest rate.That means the rate won’tchange throughout the lifeof the loan.• Know when the loanpayments will become due.Some loans may require youto make payments whileyou’re still in school, whichmay be hard for you to pay.Other loans may not become due until six monthsafter you graduate, which should give you time tosecure a job and a paycheck.• Know the consequences of missing payments.If you’re unable to repay the loan on time, youraccount could be turned over to a collectionagency, which will ding your credit score and makeit harder for you to get credit in the future.With gas prices unpredictable,carpooling with co-workersor other students couldbe an option. To make theride smooth, iron out thefollowing details beforedriving off.Whose car will be used? Will theparticipants switch cars periodically?Will the carpool have more thanone driver?How much will each person pay? Factorin fuel/mileage, parking, tolls, insurance,and vehicle maintenance costs.What are the rules? Who choosesthe radio station? What about talkingon a mobile phone, eating, drinking,and smoking?Stories ofdorm stalkers andpranks that went too farare as much a part of campuslife as books and bad cafeteria food.Variations of college urban legendshave been around at least since folkloreprofessor Jan Brunvand was a student inthe 1950s. He became so fascinated byRUMOR HAS ITcollege tales that he’s made a careerout of researching and teachingAmerican folklore and legends.It’s easy to spot the telltale signsof an urban legend, says Brunvand. Ifthe story is too good, scary, or funnyto be true, or if your friend heard itfrom a friend of a friend of the guy’sex-roommate, well, you decide.How long will riders wait if the driveris late?What’s Plan B? What does everyone doif the driver is sick or has car trouble?TIP:If you’re looking for a carpool to work, check withyour human resources department. To helpemployees get to work in an economical way, manycorporations are partnering with online ride-matchingservices like NuRide. By taking advantage of theseservices, you also can earn rewards like discounts atrestaurants and retail stores..04 U.25winter2008U.25winter2008.05

questions.answersU.25’s workplace expertanswers your questionsabout finding a joband employers usingsocial media sites intheir hiring decisions.Financial CrisisShould I beworried?Got a question for our career pro?E-mail HYPERLINK “mailto:U25@usaa.com” U25@usaa.com. We’llanswer a few in each issue of U.25.What do I need to do to get hiredin these tough times?Recession ProofingAlthough many firms have putthe brakes on recruiting andhiring, there are still jobs outthere. But to find one, you’ll need to beproactive by taking these three steps.1. Reconnect with former classmateswho are now working in yourfield to see if they are aware of jobopportunities.2. Make new contacts by asking yourcollege career center to set up asmany informational interviewsfor you as they can find. Afteryour interviews, follow up withhandwritten thank-you notes.Periodically, stay in touch throughphone calls and e-mails.3. Be flexible with your dream career.Check out alternate, recessionprooffields using resources like theBureau of Labor StatisticsOccupational Outlook Handbook andCareer Hub. You’ll need an open mindabout your job opportunities andwhere you’re willing to work and live.I’ve heard that employers lookat Facebook and MySpace toresearch job applicants. Becauseof that, I’m pretty careful about what Ipost. Since they are already looking, isthere anything I can do to make a goodimpression?Careful WatchA 2008 survey fromCareerBuilder.com indicatedthat 22 percent of hiringmanagers use social networking toresearch job candidates, which is upfrom 11 percent in 2006.For this reason, you’re right tobe careful. To present a mature andprofessional persona on your onlinesites, here are some things you can do:1. Make sure your profile showcasesstrong writing skills.2. Include background informationand work experience that support thequalifications listed on your résumé.3. Show your personality; just be awareof who might be looking at your site.For example, upload photos of friendsbut leave out those of last weekend’slate-night party. Or showcase yourmusical taste but forget jokes,groups, or applications that could bedeemed tasteless.Alexandra Levit speaks on workplaceissues facing young employees and isthe author of “How’d You Score ThatGig: A Guide to the Coolest Careers— and How to Get Them.” Her careeradvice has been featured in the NewYork Times, the Wall Street Journal,USA Today, the Associated Press, ABCNews, and National Public Radio.Photography BY IstockPhotography BY Veer, corbis and provided by readersThe current financialcrisis may feel farremoved, but you’ve let usknow you have questions.Members just like youare calling <strong>USAA</strong> everyday to get free adviceabout shrinking collegefunds, securing loans, andinvesting for the future.Here, <strong>USAA</strong>’s financialadvisors answer someof the most commonquestions they’veheard, and offer tips forestablishing solid financialfooting, whatever thestate of the economy..06 U.25WINTER2008 U.25WINTER2008 .07

Q: The economic crisishasn’t hit my life. Is theresomething I’m missing? Howcan I protect myself inthe future?A: If you are in college, alreadyemployed, don’t own a house, or are not incredit card debt, the financial crisis maynot be directly affecting you. The peoplemost affected probably bought homesthey are now having trouble affording,got far behind in paying back debt, or have stock market investments that arelosing value.For you, this is actually a prime time to form goodfinancial habits as you start out on your own. “Bydeveloping good day-to-day money management skills now, the economicissues that are affecting some people may not affect you,” says CERTIFIEDFINANCIAL PLANNER Michael Dubensky. Follow these three suggestions toprotect your finances:1. Pay your monthly bills on time. It’s the single biggest influence on a goodcredit score.2. Pay off any credit card debt.3. Put three to six months living expenses in an emergency fund, which shouldinclude enough money to pay for your rent, car payment, cell phone bill,and utilities.To learn more about credit scores, go to usaa.comand search “7 Tips to Boost Your Credit Score.”“Luckily, all myfinances are goingtoward my savingsaccounts to payoff credit. I’ve hadno major mishapswith the financialsituation — yet!”David Jimenez Lynch, 26,college graduate in firstjob as a pilotQ: What are increasinginterest rates going tomean for me?A: Currently, short-terminterest rates are decreasing.However, if interest rates rise,the payments on your loans will increase unless you pay over a longer periodof time. If you’re borrowing money today for school orfor a car, you may want to consider a fixed interestrate so you can budget your loan payment over thelife of the loan.Credit cards are a different story. They usually have variable interest rates,which means the rates can rise and fall. You can avoid paying interest by payingoff the balance each month.Should you avoid getting a credit card at all? Yes, if you know you can’t controlyour spending. No, if you want to build a credit history and are committed tousing the card responsibly. Using your credit card sparingly actually helps youbuild a good credit history. The better your credit history, the lower your interestrates will be. Use the following tips to get the most out of your credit card:• Don’t spend any more than 50 percent of your credit card limit. Example:If your limit is $500, don’t charge more than $200 or $250.• Create a solid credit history by paying bills on time.• Limit yourself to two credit cards, such as:1. One all-purpose credit card like <strong>USAA</strong>’s MasterCard that can be usedanywhere for emergencies.2. One card that limits your purchases (such as a gasoline credit card) butallows you to demonstrate your responsible spending habits.“If theeconomykeeps goingdown, jobswill be cut.It will be very difficult toget a job out of college. Iam afraid that if I can’t geta job, I will have difficultypaying my student loansand end up in a cycleof debt.”Emily Lang, 19, college sophomore“My retirement accountamounts have takena bit of a dip, to put itlightly. But that is thegreat thing about stillbeing young — I havetime to rebuild thosebalances.”Q: What is the bestway to quickly build up myemergency fund?A: Get into a systematic programwhere money is automatically deductedfrom your regular checking or savings account and put into a money marketaccount, where the interest rate is generally higher. With most savings programs,you can invest whatever amount you can afford. For example, if you open a moneymarket account at <strong>USAA</strong>, you can contribute as little as $20 a month.But before you start a savings program, create a budget todetermine how much you can put aside each month.List your take-home pay, then subtract your monthly expenses. The answer ishow much cash you could potentially save.Within those monthly expenses there are probably some bills you have to pay(rent and utilities), some you can control (entertainment and eating out), andsome you can eliminate (magazine subscriptions you don’t have time to read or alandline phone you don’t use). The last two categories are where you can expectto find the cash to save.TIPThink of a money market accountas the place where you put shortandlong-term savings. You canwithdraw money when you needit, but try not to. For your dayto-daylife, have at least onemonth’s living expenses in yourchecking account and at least$500 in your savings accountas a cushion to cover anyunexpected overdrafts in yourchecking account.“I will be trying to get astudent loan for nextyear. Since things keepchanging so fast, I’m notworrying about it yet. Myplan is just to hang on tomy job, keep saving andinvesting, and hope thatthings get better in thefuture!”Kimberly Reichert, 24, planningto attend law schoolVisit usaa.com/u25 and open the “BudgetWorksheet” link to create your budget.Ginger Donald, 26, graduatestudent working in part-time jobsUse of the term “member” or “membership” does not convey any legal, eligibility or ownership rights.Systematic investment plans do not assure a profit or protect against loss in a declining market.<strong>USAA</strong> means United Services Automobile Association and its affiliates. Financial advice provided by <strong>USAA</strong> Financial Planning Services Insurance Agency, Inc. (known as<strong>USAA</strong> Financial Insurance Agency in California), and <strong>USAA</strong> Financial Advisors, Inc., a registered broker dealer. Banking products provided by <strong>USAA</strong> Federal Savings Bank,an equal housing lender. Credit cards provided by <strong>USAA</strong> Savings Bank. Both Banks Member FDIC..08 U.25WINTER2008 U.25WINTER2008 .09

Q: I just started a job that offers aretirement savings plan that invests in the stockmarket and other funds. Would it be better towait to contribute to the retirement fund untilthe stock market and economy calm down?A: Don’t wait! This is a perfect time to invest in a retirement plan atwork, especially if your company matches contributions. In fact, here’s why it’sprobably one of the best and easiest ways to invest these days:1. If your company matches any portion of what you put into the savings plan,then that portion of your contribution is immediately doubled.2. When you have so many years before retirement, a market downturncan be a good time to buy. When the market is low, yourcontributions will buy more shares now andyou can reap the potential rewards later whenthe market recovers.How did we get here?For the last several years, some consumers havebeen biting off more than they can chew, andHonestly, your company’s retirement savings plan is one of the best ways toinvest right now. You’ll have fewer worries about watching the market every dayand moving money around. An organized retirement savings plan can do that foryou. If you’re concerned, talk to a qualified financial advisor about how to investyour money wisely. You also can google “risk tolerance” and take one of themany online quizzes to find out how comfortable you are with taking risk withyour money. And if you still have questions, you can get free advice by calling<strong>USAA</strong> for financial advice.certain lenders have been letting them do it. Somelenders loosened credit restrictions to the pointwhere almost anyone could charge almost anypurchase, whether they could pay for it or not. PlainTo speak to a financial advisor at <strong>USAA</strong>,call (800) 583-8293.“It’s a scary thing. Everyone can recall the vivid images fromthe Great Depression, and no one wants things to head in thatdirection. However, I have not personally been affected nor hasanyone that I know.”Sarah Hitchcock, 25; college graduate working as a manager at a nonprofit agencyand simple, some consumers overindulged. And nowwe’re all paying for this mistake.Despite a $740 billion Congressional rescuepackage, the entire economy – especially thestock market and consumer confidence – issuffering from overindulgence. The domino effectGreatDepression1930’s“I don’t think thatthe economic crisishas hit me at all.Friends and I havetalked aboutthis. It seems sohypothetical.”Justin Lintelman, 19,college sophomorehas increased prices of things you buy and hasmade credit harder to get. Going forward, youmight have trouble financing a car, house, or schoolloan. Unemployment is up so you might face morecompetition when you start your career.But the sky isn’t falling. Economic downturnsQ: My bank is one ofthose that recently wastaken over. What’s going tohappen to my money?Q: I’m depending onfinancial aid to pay forcollege. How is the economygoing to affect my ability toget a student loan?A: The only change you’llsee might be a bank namechange on your debit cardor checks. That’s because if you have $250,000 or less inyour bank accounts, the Federal Deposit InsuranceCorp., or FDIC, currently insures those deposits,including checking and savings accounts, money market deposit accounts, andcertificates of deposit, up to $250,000. That amount, a temporary increasefrom the old $100,000 limit, will be in effect until December 2009. The newamount became effective in October as part of the government’s emergencyeffort to help banks and consumers. The deposits at all banks are insured by theFDIC, but not necessarily at all credit unions because some credit unions do nothave insurance of deposit.A: You should be ableto get financial aid throughgovernment programs like thefederally funded Pell grants andlow-interest Stafford loans. They should still be available. However, itmay be harder to qualify for private loans through banks because therequirements have tightened. Your good credit history willbe more important than ever. You also may need to haveat least a part-time job to show your ability to pay back the loan. Expectthe cost of borrowing to be more expensive, too. Interest rates on privateloans are expected to rise, which will mean higher monthly paymentswhen you pay back the loan.have happened before. In fact, the U.S. hassurvived 15 recessions since 1922 – among them,the Great Depression in the 1930s, the 1970srecession caused by the oil crisis, the Savings& Loan-fueled recession of the 1980s, and the1970’soil crisisIf you have deposits at a credit union, use the “bank find” toolat FDIC.gov to check if your credit union is FDIC insured.dot-com bust from just a few years ago. Eachtime consumers feared it was the end. But itwasn’t. The U.S. economy has always bouncedback. And economists expect no less from thiscrisis. How soon that will happen, no one knows.Housingcrunch2008TIPWant to avoid the inconvenience and worryof your bank failing? Easy. Choose a bank thatis conservative, fiscally sound and employsprudent lending practices, like <strong>USAA</strong> FederalSavings Bank. If the possibility of your bankbeing bought makes you nervous, you shouldknow this: <strong>USAA</strong> Federal Savings Bank is notpublicly owned so the likelihood of its beingbought out by another financial institution ishighly doubtful.“As far as lifestyle goes, I’mnot feeling a lot of pain. I usepublic transit or walk to get towork, which shelters me fromfluctuations in gas prices. Ialready tended to do my owncooking and buy store brands.”Evan Sparks, 24, college graduateworking as an associate editorBut you can play a part in how it will happen. Theturnaround starts with everyone being financiallyresponsible. Your task: spend your moneyconservatively, save aggressively, and borrowresponsibly..10 U.25WINTER2008 U.25WINTER2008 .11

Steeringmy OwNCoursePhotography by Rick Dahms and VeerOn July 2, 2008, at the age of 22,Andrew Campos entered theU.S. Naval Academy as one of itsoldest freshmen. In four years, hehopes to graduate as an officerwith a degree in physics. But fornow, he’s enjoying this journeyone day at a time..12U.25WINTER2008U.25Winter2008 .13

HERE AT LASTOn July 2, I arrived at the academy. Iwas told to leave my past and personalitems behind. No iPods, no cell phones,not even a wallet. That was fine withme. I was looking for a new life. BecauseI was older, I worried that I wouldn’t fitin. Did I listen to the same music? DidI laugh at the same jokes? I wanted toblend in.The first days flew by at anexhausting pace. There was little timeto adjust. We were hurriedly shownwhere to sleep, where to eat, and howto dress. We climbed ropes and crawledunder nets, fired M16 rifles on theshooting range, sailed on the SevernRiver, and marched in formation. In sixweeks, I lost 10 pounds.Plebe summer was not only physical.It also was filled with instruction abouthow to be a leader and how others inhistory have stood up for what theybelieved in..16Listen to Andrew Campos tell hisstory on U-TURN’s podcast. Youcan download it for free at theiTunes Music Store. Click on the“podcast” link, and search for“<strong>USAA</strong> U-TURN.” Campos’ episodeis No. 122.iTunes is a registered trademark of Apple, Inc.U.25WINTER2008Lights outIt’s 10 p.m. Lights out. I should be sleeping. I’m dead tired.But my mind is racing. I think about the things I miss backhome — my family, good food, sleeping late. I’m worriedabout the academic year. I want to major in physics andsomeday work on a nuclear submarine crew. But I’ve beenout of school so long. I wonder if I can still hack it.Some plebes are moaning in their bunks about therigors of the day. Others are worried they’ll be yelled attomorrow. And some are wishing they’d gone to a regularuniversity. I close my eyes and turn in my bunk. I’mexactly where I want to be. At last.Photography by Punch, veer and IstockBy Sean McCollumIt’s time to turn yourqueasiness into action,especially if you’re one ofthe growing number ofcollege grads withouthealth insurance.There are options that can fit your budget andhealth needs. The cost depends on yourcircumstances, like where you live, how healthyyou are, and whether you’re a male or female.However, your age is in your favor, says Sam Gibbs,senior vice president at eHealthInsurance.com.“There are affordable individual policies out there,especially for young consumers,” says Gibbs. Seewhich one of these plans fits your situation and usethe health insurance glossary (on page 18) to wadethrough the terms.U.25Winter2008 .17

Health InsuranceGlossaryco-insurance: The percentageof coverage you are expected to payyourself. For example, if the policy’sco-insurance is 80/20 and the medicalbill is $100, insurance would cover $80and you would pay $20 until you reachan out-of-pocket maximum, then theinsurance pays 100 percent.Co-payment or co-pay: Usuallya fixed-dollar amount that you arerequired to pay to receive services.Typical co-pays might be $15 for adoctor visit or prescription, and $100for a trip to the emergency room.deductible or Out-of-pocket:Amount you pay toward your healthcarebefore insurance begins coveringeligible medical costs. As a rule, thehigher the deductible the lower theplan’s premium and vice versa.HMO (Health MaintenanceOrganization): Insurance programthat requires the use of predeterminedfacilities and doctors. In other words,you may have fewer doctors tochoose from.Medical underwriting: A processin which an insurer investigates andreviews your health history when youapply for insurance. The findings helpinsurers figure out the future risk of yougetting sick, which affects how muchyou’ll pay in premiums.PPO (Preferred providerorganization): Insurance programthat allows you to choose your doctorsand services from an approved list.pre-existing condition:A medical condition or diagnosisthat existed — or was treated — beforeyour health insurance coveragebegan. It may affect whether you canget coverage.Premium: Regular paymentsyou make in order to have insurancecoverage.Whatcostsprosconshow to get itWhatcostsprosconshow to get itShort-term insurance covers the gap when you’re no longer on your parent’spolicy or when you graduate from college. (See “Upping the Age” on page 21.)Depending on where you live, your monthly cost (or premium) may start at lessthan $50. Your deductible (or out-of-pocket costs before insurance starts tocover your expenses) could be as low as $250.You can pay month by month.Only temporary. Most plans will cover you for 12 months or less. They often donot cover preventive care, such as yearly physical exams.Before you graduate and go off your parent’s policy, shop for student healthinsurance, which may be available through your college or university. If you’vealready graduated, you can purchase short-term policies directly through healthinsurance companies.If you support yourself through freelance work, temping, or running your ownbusiness, look into permanent individual plans that offer long-term coverage.A monthly premium can begin around $100. The average deductible runs about$2,000.The variety of plans available lets you pick and choose the benefits you want, suchas your doctors and hospitals.The price of individual health insurance varies widely and usually has a highdeductible. Before you start your insurance search, ask yourself two questions: DoI need prescription drugs? Is there a particular doctor I want to continue seeing?Figure out what you want and need, and then shop around.First, find out if your alumni association, place of worship, or a professionalorganization to which you belong offers access to health insurance. Yourpremiums and out-of-pocket costs could be lower. Then, go online to such sitesas Tonik.com, GoldenRule.com, and eHealthInsurance.com to see what plans areavailable in your ZIP code. These resources let you compare options. Make surethat you do business with a reputable, well-known company that has a strongnetwork of doctors and hospitals..18U.25winter2008U.25winter2008 .19

WhatInsurance companies may do their own investigation of your healthhistory before offering an individual health plan — a process knownas medical underwriting. That means that if you have an ongoingillness or medical condition, such as asthma or diabetes, you couldface a challenge finding coverage. In insurance lingo, this is knownas having a pre-existing condition.costsAccording to eHealthInsurance, it is impossible to estimate typicalinsurance costs related to pre-existing conditions.ProsThere are insurers who will provide coverage, although theremay be certain restrictions. For example, they may impose a“pre-existing condition exclusion period” in which they will notcover treatment related to your particular health issue for acertain length of time, usually 12 months.ConsSome insurers may reject your application or chargehigher premiums.how to get itWhatSpeak with a reputable insurance agent or broker to exploreyour options. If you are currently covered by a parent’s policythrough an employer, you also can investigate COBRA. This federallaw requires most employers to allow their children to remaincovered for up to 18 months after they are no longer consideredfinancially dependent on their parents. The cost of your premium,though, is likely to be high. Also, check with your state’s insurancecommission. Most states have high-risk insurance pools thatprovide coverage to individuals with pre-existing conditions.Catastrophic coverage is another name for lower-premium,higher-deductible individual plans. As the name suggests,these plans provide coverage if something happens to you thatrequires major medical care.Whatever your age and health, going withoutcoverage is a bad move, no matter how invincibleyou feel. Period. A trip to the ER for knee surgerycan quickly add up to $10,000 or even higher. Aruptured appendix or other emergency surgerycan cost more than $30,000. There’s a reasonwhy bank-breaking medical bills are the leadingcause of bankruptcy in the United States. It’s veryexpensive to get sick when you are not insured.Trust us, you don’t want to experience it firsthandand become one more bankruptcy statistic.costsprosconsMonthly premiums range from $30 to $175 with deductibles from$500 to $20,000.Lower-cost coverage provides some protection if you have aserious injury or illness.Most catastrophic plans offer bare-bones coverage andextremely high deductibles. That means higher out-of-pocketexpenses for doctors’ visits and prescription drugs.Upping the ageWhen you turn 18 or 19 or graduate from college,you’re generally dropped from your parents’health insurance. Now, 16 states require insurersto allow you to stay on your parents’ policiesuntil you’re in your mid-twenties. To qualify, youneed to live in the same state as your parents,but you don’t have to live with your parents.For a list of the requirements for coverageon your parents’ health insurance, go to theNational Conference of State Legislatures’ Website at ncsl.org.how to get itSort through individual policies with higher deductibles andlower premiums.Sources: Agency for Healthcare Research, eHealthInsurance.com,Golden Rule Insurance Co., Insurance Information Institute, KaiserFamily Foundation, National Conference of State Legislatures.20U.25winter2008U.25winter2008 .21

usaa programs that make the most of your future now4 BudgettoolsTo help you manage your moneyand protect your things, takeadvantage of these four <strong>USAA</strong>financial tools:1. A free checking account, whichmeans no monthly service fee andfree ATM access anywhere in theworld. <strong>USAA</strong> refunds up to $15 amonth in fees other banks chargeto use their ATMs. 12. Access your account informationanytime on your mobile phone. Youcan view your balances and payyour credit card bill when you use<strong>USAA</strong>’s Web BillPay®.3. A low-rate credit card with noannual fee and your choice offree rewards, such as cash,merchandise, or travel.4. Renters insurance for as littleas $10 a month to protect $2,500worth of your things if they arestolen or damaged. 2For details on these tools,go to usaa.com/U25.Free GASBy checking out <strong>USAA</strong>’s Car BuyingService, you have a chance to win1,000 gallons of gas. To enter thecontest, go to the Car Buying Serviceat usaa.com/auto, click on “learnmore,” and fill out the entry form.You don’t have to buy anything toenter or win.Besides getting a chance to winfree gas at usaa.com/auto, you’llGetting engaged?If an engagement ring is on your holiday gift list,first shop online at <strong>USAA</strong> where you can create adiamond ring to fit your budget. As your budgetincreases later, you can upgrade the diamondthrough a special <strong>USAA</strong> program.To learn how to choose a diamondand create your ring online, go to usaa.com/u25.notice the following benefits to findinga new or used car with <strong>USAA</strong>:>Design your new car with a selection ofcolors, options, and incentives.>Read expert reviews and view photos fromall angles. You also can see side-by-side costcomparisons with other vehicles.>Find out how much it’s worth by usingthe trade-in-value estimator.Photography by istock photo and punchstock¹Free ATMs: <strong>USAA</strong> does not charge a fee for the first 10 ATM withdrawals and refunds up to $15 in other banks’ ATM usage fees each month. Currency conversion charges may apply when using ATMs outsidethe U.S.) ²Countrywide average price for policyholders who have $2,500 personal property coverage, $100,000 liability coverage, and $5,000 medical payments coverage as of February 2008. Rates vary bylocation and risk. Rates are subject to change.Renters insurance provided by United Services Automobile Association, <strong>USAA</strong> Casualty Insurance Company, <strong>USAA</strong> General Indemnity Company, Garrison Property and Casualty Insurance Company, and<strong>USAA</strong> Texas Lloyds Company, <strong>USAA</strong> Limited (Europe). San Antonio, TX. Each company has sole financial responsibility for its own products. Merchandise and Alliance services provided through <strong>USAA</strong> AllianceServices, L.L.C. Credit cards provided by <strong>USAA</strong> Savings Bank, other bank products by <strong>USAA</strong> Federal Savings Bank, both Member FDIC..22U.25winter2008U.25winter2008 .23