Boardroom Briefing: Mergers & Acquisitions - Directors & Boards

Boardroom Briefing: Mergers & Acquisitions - Directors & Boards

Boardroom Briefing: Mergers & Acquisitions - Directors & Boards

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

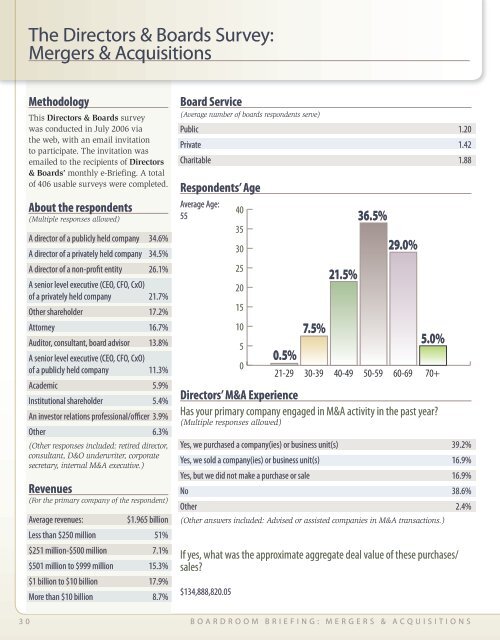

The <strong>Directors</strong> & <strong>Boards</strong> Survey:<br />

<strong>Mergers</strong> & <strong>Acquisitions</strong><br />

Methodology<br />

This <strong>Directors</strong> & <strong>Boards</strong> survey<br />

was conducted in July 2006 via<br />

the web, with an email invitation<br />

to participate. The invitation was<br />

emailed to the recipients of <strong>Directors</strong><br />

& <strong>Boards</strong>’ monthly e-<strong>Briefing</strong>. A total<br />

of 406 usable surveys were completed.<br />

About the respondents<br />

(Multiple responses allowed)<br />

A director of a publicly held company 34.6%<br />

A director of a privately held company 34.5%<br />

A director of a non-profit entity 26.1%<br />

A senior level executive (CEO, CFO, CxO)<br />

of a privately held company 21.7%<br />

Other shareholder 17.2%<br />

Attorney 16.7%<br />

Auditor, consultant, board advisor 13.8%<br />

A senior level executive (CEO, CFO, CxO)<br />

of a publicly held company 11.3%<br />

Academic 5.9%<br />

Institutional shareholder 5.4%<br />

An investor relations professional/officer 3.9%<br />

Other 6.3%<br />

(Other responses included: retired director,<br />

consultant, D&O underwriter, corporate<br />

secretary, internal M&A executive.)<br />

Revenues<br />

(For the primary company of the respondent)<br />

Average revenues:<br />

$1.965 billion<br />

Less than $250 million 51%<br />

$251 million-$500 million 7.1%<br />

$501 million to $999 million 15.3%<br />

$1 billion to $10 billion 17.9%<br />

More than $10 billion 8.7%<br />

Board Service<br />

(Average number of boards respondents serve)<br />

Public 1.20<br />

Private 1.42<br />

Charitable 1.88<br />

Respondents’ Age<br />

Average Age:<br />

55<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

0.5%<br />

7.5%<br />

21.5%<br />

36.5%<br />

29.0%<br />

5.0%<br />

21-29 30-39 40-49 50-59 60-69 70+<br />

<strong>Directors</strong>’ M&A Experience<br />

Has your primary company engaged in M&A activity in the past year?<br />

(Multiple responses allowed)<br />

Yes, we purchased a company(ies) or business unit(s) 39.2%<br />

Yes, we sold a company(ies) or business unit(s) 16.9%<br />

Yes, but we did not make a purchase or sale 16.9%<br />

No 38.6%<br />

Other 2.4%<br />

(Other answers included: Advised or assisted companies in M&A transactions.)<br />

If yes, what was the approximate aggregate deal value of these purchases/<br />

sales?<br />

$134,888,820.05<br />

3 0 B o a r d r o o m B r i e f i n g : M e r g e r s & A c q u i s i t i o n s

![[link to PDF] for a copy of the briefing paper - Directors & Boards](https://img.yumpu.com/43729022/1/190x245/link-to-pdf-for-a-copy-of-the-briefing-paper-directors-boards.jpg?quality=85)