VEH â VPH Monthly Report July 2010.pdf - Saigon Asset Management

VEH â VPH Monthly Report July 2010.pdf - Saigon Asset Management

VEH â VPH Monthly Report July 2010.pdf - Saigon Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Saigon</strong> <strong>Asset</strong> <strong>Management</strong><br />

172 Hai Ba Trung, 12 th Floor<br />

Ho Chi Minh City, Vietnam<br />

Tel: +84-8-5404-3488<br />

Fax: +84-8-5404-3487<br />

Email: IR@saigonam.com<br />

Website: www.saigonam.com<br />

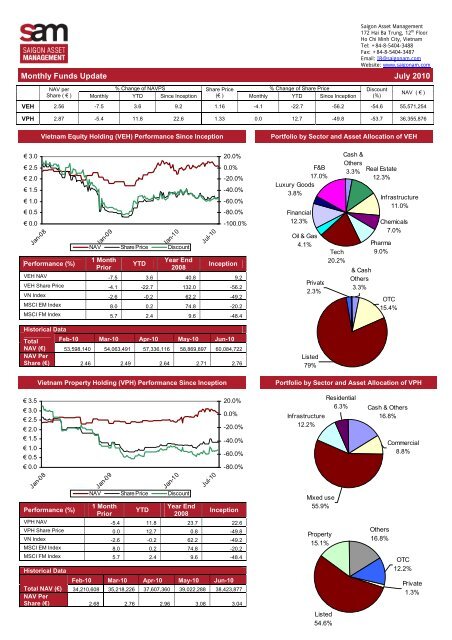

<strong>Monthly</strong> Funds Update <strong>July</strong> 2010<br />

NAV per<br />

Share ( € )<br />

<strong>Monthly</strong><br />

% Change of NAVPS Share Price<br />

% Change of Share Price<br />

YTD Since Inception (€ ) <strong>Monthly</strong> YTD Since Inception<br />

Discount<br />

(%)<br />

NAV ( € )<br />

<strong>VEH</strong> 2.56 -7.5 3.6 9.2 1.16 -4.1 -22.7 -56.2 -54.6 55,571,254<br />

<strong>VPH</strong> 2.87 -5.4 11.8 22.6 1.33 0.0 12.7 -49.8 -53.7 36,355,876<br />

Vietnam Equity Holding (<strong>VEH</strong>) Performance Since Inception<br />

Portfolio by Sector and <strong>Asset</strong> Allocation of <strong>VEH</strong><br />

€ 3.0<br />

€ 2.5<br />

€ 2.0<br />

€ 1.5<br />

€ 1.0<br />

€ 0.5<br />

€ 0.0<br />

€ 3.5<br />

€ 3.0<br />

€ 2.5<br />

€ 2.0<br />

€ 1.5<br />

€ 1.0<br />

€ 0.5<br />

€ 0.0<br />

Jan-08<br />

Performance (%)<br />

Jan-08<br />

Jan-09<br />

Jan-09<br />

Jan-10<br />

NAV Share Price Discount<br />

1 Month<br />

Prior<br />

YTD<br />

Year End<br />

2008<br />

Jan-10<br />

NAV Share Price Discount<br />

Jul-10<br />

Jul-10<br />

20.0%<br />

0.0%<br />

-20.0%<br />

-40.0%<br />

-60.0%<br />

-80.0%<br />

-100.0%<br />

Inception<br />

<strong>VEH</strong> NAV -7.5 3.6 40.8 9.2<br />

<strong>VEH</strong> Share Price -4.1 -22.7 132.0 -56.2<br />

VN Index -2.6 -0.2 62.2 -49.2<br />

MSCI EM Index 8.0 0.2 74.8 -20.2<br />

MSCI FM Index 5.7 2.4 9.6 -48.4<br />

Historical Data<br />

Total Feb-10 Mar-10 Apr-10 May-10 Jun-10<br />

NAV (€) 53,598,140 54,063,491 57,336,116 58,869,897 60,084,722<br />

NAV Per<br />

Share (€) 2.46 2.49 2.64 2.71 2.76<br />

Vietnam Property Holding (<strong>VPH</strong>) Performance Since Inception<br />

Performance (%)<br />

1 Month<br />

Prior<br />

YTD<br />

Year End<br />

2008<br />

20.0%<br />

0.0%<br />

-20.0%<br />

-40.0%<br />

-60.0%<br />

-80.0%<br />

Inception<br />

<strong>VPH</strong> NAV -5.4 11.8 23.7 22.6<br />

<strong>VPH</strong> Share Price 0.0 12.7 0.8 -49.8<br />

VN Index -2.6 -0.2 62.2 -49.2<br />

MSCI EM Index 8.0 0.2 74.8 -20.2<br />

MSCI FM Index 5.7 2.4 9.6 -48.4<br />

Historical Data<br />

Feb-10 Mar-10 Apr-10 May-10 Jun-10<br />

Total NAV (€) 34,210,608 35,218,226 37,607,360 39,022,288 38,423,877<br />

NAV Per<br />

Share (€) 2.68 2.76 2.96 3.08 3.04<br />

abc<br />

F&B<br />

17.0%<br />

Luxury Goods<br />

3.8%<br />

Financial<br />

12.3%<br />

Oil & Gas<br />

4.1%<br />

Private<br />

2.3%<br />

Listed<br />

79%<br />

Infrastructure<br />

12.2%<br />

Mixed use<br />

55.9%<br />

Property<br />

15.1%<br />

Listed<br />

54.6%<br />

Tech<br />

20.2%<br />

Cash &<br />

Others<br />

3.3%<br />

Residential<br />

6.3%<br />

& Cash<br />

Others<br />

3.3%<br />

Real Estate<br />

12.3%<br />

OTC<br />

15.4%<br />

Cash & Others<br />

16.8%<br />

Cash &<br />

Others<br />

16.8%<br />

Infrastructure<br />

11.0%<br />

Chemicals<br />

7.0%<br />

Pharma<br />

9.0%<br />

Portfolio by Sector and <strong>Asset</strong> Allocation of <strong>VPH</strong><br />

Commercial<br />

8.8%<br />

OTC<br />

12.2%<br />

Private<br />

1.3%

Vietnam Equity Holding (<strong>VEH</strong>) is a closed-end fund listed on the<br />

Frankfurt Stock Exchange. The objective of <strong>VEH</strong> is to maximize<br />

capital appreciation by making equity investments in promising<br />

listed, pre-listing and private companies in Vietnam. <strong>VEH</strong> was<br />

ranked as the No. 1 performing Vietnam-focused equity fund in<br />

2008 by LCF Rothschild. For more information, please visit<br />

www.saigonam.com<br />

Vietnam Equity Holding<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

-80%<br />

Dec-07<br />

Mar-08<br />

Jun-08<br />

Sep-08<br />

Dec-08<br />

Mar-09<br />

Jun-09<br />

Sep-09<br />

Dec-09<br />

Mar-10<br />

Jun-10<br />

VN Index MSCI EM MSCI FM <strong>VEH</strong><br />

Vietnam Property Holding (<strong>VPH</strong>) is a closed-end fund listed on<br />

the Frankfurt Stock Exchange. The objective of <strong>VPH</strong> is to maximize<br />

capital appreciation by making investments in real estate projects and<br />

companies in Vietnam. <strong>VPH</strong> was ranked as the No. 1 performing<br />

Vietnam-focused real estate fund in 2009 by LCF Rothschild. For<br />

more information, please visit www.saigonam.com<br />

<strong>VEH</strong> and <strong>VPH</strong> Key Data<br />

Vietnam Property Holding<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

-80%<br />

-100%<br />

Dec-07<br />

Mar-08<br />

Jun-08<br />

Sep-08<br />

Dec-08<br />

Mar-09<br />

Jun-09<br />

Sep-09<br />

Dec-09<br />

Mar-10<br />

Source: Reuters<br />

Jun-10<br />

VN Index MSCI EM MSCI FM <strong>VPH</strong><br />

About <strong>Saigon</strong> <strong>Asset</strong> <strong>Management</strong><br />

Source: Reuters<br />

Structure<br />

Cayman Islands registered closed-end funds<br />

Funds launch November 30, 2007<br />

Duration<br />

5 Years (subject to shareholder vote for extension)<br />

Fiscal Year End 31 December<br />

Listed<br />

Frankfurt Stock Exchange (FSE) and Xetra<br />

NAV Frequency <strong>Monthly</strong><br />

<strong>Management</strong> Fee 2% of NAV<br />

Performance Fee 20% of gains over 8% hurdle with high water mark<br />

Investment Manager <strong>Saigon</strong> <strong>Asset</strong> <strong>Management</strong><br />

Auditor<br />

Grant Thornton<br />

Legal Counsel Reed Smith LLP / Appleby<br />

Administrator<br />

Custodian<br />

Deutsche Bank (Cayman) Ltd<br />

Deutsche Bank AG, Ho Chi Minh City Branch<br />

Clearing/Settlement Euroclear or Clearstream<br />

Marcel Winand, 886 AG<br />

+49 6101 98861 18, marcel.winand@886AG.de<br />

Market Makers<br />

Hiroshi Funaki, LCF Rothschild<br />

+44 207 845 5900, h.funaki@lcfr.co.uk<br />

Judah L. Plotner, Jefferies<br />

+44 207 898 7114, jplotner@jefferies.com<br />

Bloomberg <strong>VEH</strong>: 3MS:GR <strong>VPH</strong>: 3MT:GR<br />

Reuters <strong>VEH</strong>: 3MS.DE <strong>VPH</strong>: 3MT.DE<br />

ISIN <strong>VEH</strong>: KYG936251043 <strong>VPH</strong>: KYG9361R1074<br />

German Securities <strong>VEH</strong>: A0M12V <strong>VPH</strong>: A0M12W<br />

Established in 2007 and based in Ho Chi Minh City, SAM employs<br />

over 20 professionals with diverse international financial<br />

backgrounds and proven track records. SAM currently has<br />

approximately US$125 million in assets under management.<br />

Louis Nguyen<br />

Chairman & CEO<br />

Michael Kokalari, CFA<br />

Chief Investment Officer<br />

For more information please contact:<br />

Investor Relations Department<br />

<strong>Saigon</strong> <strong>Asset</strong> <strong>Management</strong><br />

172 Hai Ba Trung, 12 th Floor<br />

Ho Chi Minh City, Vietnam<br />

Tel: +84-8-5404-3488<br />

Fax: +84-8-5404-3487<br />

Email: IR@saigonam.com<br />

Website: www.saigonam.com<br />

This document was prepared by <strong>Saigon</strong> <strong>Asset</strong> <strong>Management</strong> (SAM) and is for information only and does not constitute or form part of, and should not be construed as, any offer, inducement or an invitation to sell, acquire or issue, or any solicitation of any offer to purchase or subscribe<br />

for, any shares or securities, including any ordinary shares, in VIETNAM PROPERTY HOLDING and/or VIETNAM EQUITY HOLDING (the “Funds(s)”) in any jurisdiction. No undertaking, representation, warranty or other assurance, express or implied, is made by either SAM or any<br />

other person, in relation thereto. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact and may be "forward looking<br />

statements." Forward looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipate. All<br />

information is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. SAM has not made any independent verification of any such information and makes no implied or express warranties on the<br />

information provided. SAM does not guarantee the accurateness and completeness of statements made herein. Any opinions expressed herein are subject to change at any time without notice. Past performance of the Investment Manager and funds and any forecasts are not<br />

indicative of the future or likely performance of the Investment Manager.