Keith Busse - Steel Dynamics, Inc.

Keith Busse - Steel Dynamics, Inc.

Keith Busse - Steel Dynamics, Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Keith</strong> <strong>Busse</strong><br />

Chairman & CEO<br />

Theresa Wagler<br />

Chief Financial Officer<br />

Basic Materials Conference, KeyBanc Capital Markets, Boston<br />

1<br />

September 15, 2009

Forward-Looking Statements<br />

Parts of this presentation and statements made pertaining to it may express the company’s s opinions, expectations or projections regarding<br />

future events or future results, in contrast with statements that reflect historical facts. These predictive statements, which are generally<br />

preceded or accompanied by such conditional words as “anticipate, anticipate,” “intend”, “estimate, estimate,” “plan, plan,” “seek, seek,” “project” or “expect, expect,” or by the<br />

words “may”, ”should” or “could, could,” are intended to operate as “forward looking statements” of the kind permitted by the Private Securities<br />

Litigation Reform Act of 1995. That legislation protects such predictive statements by creating a “safe harbor” from liability in the event that a<br />

particular prediction does not turn out as anticipated.<br />

Forward-looking statements are not guarantees of future performance, , and one should not place undue reliance on such statements. Forward<br />

looking statements speak only as of the date of their release and are subject to many uncertainties, many of which are outside of our control,<br />

that could cause actual results to differ materially from those that were anticipated.<br />

Some, but not necessarily all, of the factors that could cause such<br />

predictive statements to turn out other than as anticipated or predicted<br />

include, among others: cyclical changes in supply and demand affecting<br />

steel and scrap metal prices and consumption; increased price competition<br />

affecting sales or margins; excess domestic or global steelmaking capacity<br />

and imports of low priced steel; the duration and continued effects of a<br />

prolonged economic recession upon general industrial activity and upon<br />

the demand for our products; difficulties in integrating acquired<br />

businesses; risks and uncertainties involving new products or new<br />

technologies; changes in the availability or cost of steel scrap or substitute<br />

materials; increases in energy costs; occurrence of unanticipated equipment<br />

failures and plant outages; labor unrest; and the effect of the elements on<br />

production or consumption.<br />

In addition, we refer you to SDI’s s detailed explanation of these and other<br />

factors and risks that may cause such predictive statements to turn out<br />

differently, as set forth in our most recent Annual Report on Form 10-K and<br />

in other reports which we from time to time file with the Securities and<br />

Exchange Commission, available publicly on the SEC Web site,<br />

www.sec.gov, and on the SDI Web site, www.steeldynamics.com<br />

2<br />

September 15, 2009

Financial Results<br />

(Amounts in millions)<br />

2007<br />

Percent<br />

2008 Change<br />

1H 2009<br />

• Net Sales $4,385 $8,081 +84%<br />

$1,607<br />

• Net <strong>Inc</strong>ome 395 463 17%<br />

• Oper. <strong>Inc</strong>ome 691 855 24%<br />

(104)<br />

(107)<br />

• Cash Flow<br />

from Operations<br />

428<br />

775<br />

81%<br />

286<br />

• Diluted EPS<br />

$2.01<br />

$2.38<br />

18%<br />

$(0.56)<br />

3<br />

September 15, 2009

Net Sales: 1996-2008<br />

$8.1 billion<br />

$ billions<br />

8.0<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

1H 2009<br />

$1.6 billion<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

4<br />

September 15, 2009

SDI’s s Strengths<br />

• Diversified product mix<br />

• Technologically advanced assets<br />

• Strong production capability<br />

• Unique employee culture<br />

• Growth profile<br />

• Low cost structure/<br />

excellent profit potential<br />

5<br />

September 15, 2009

A Winning Culture<br />

• Performance-based incentive<br />

compensation<br />

• Employees have keen sense<br />

of ownership<br />

• Minimal bureaucracy<br />

• Productive teams<br />

• Adaptable and fast to react<br />

• Passionate<br />

6<br />

September 15, 2009

Business Segments<br />

• <strong>Steel</strong> Operations<br />

• Metals Recycling and<br />

Ferrous Resources<br />

• <strong>Steel</strong> Fabrication<br />

7<br />

September 15, 2009

Strategic Direction<br />

• Sustain employee operating culture<br />

• Grow organically in steel<br />

– Future greenfield<br />

– Expand existing facilities<br />

• Pursue M&A growth opportunities<br />

• Backward integrate to secure consistent<br />

supply of raw materials<br />

• Integrate downstream to diversify<br />

portfolio of value-added steel products<br />

8<br />

September 15, 2009

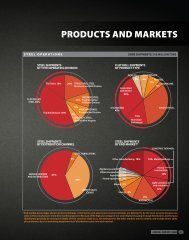

<strong>Steel</strong> Operations Shipments<br />

SWVA, <strong>Inc</strong>.<br />

265,000 tons<br />

Roanoke Bar<br />

530,000 tons<br />

Flat Roll Division<br />

2.3 million tons<br />

Engineered Bar<br />

566,000 tons<br />

Structural and Rail<br />

1.1 million tons<br />

The Techs<br />

824,000 tons<br />

2008<br />

9<br />

September 15, 2009

<strong>Steel</strong> Mills<br />

• Flat Roll Division<br />

• Structural & Rail Division<br />

• Engineered Bar Products Division<br />

• Roanoke Bar Division<br />

• <strong>Steel</strong> of West Virginia, <strong>Inc</strong>.<br />

<strong>Steel</strong> Finishing Facilities<br />

• The Techs (3 facilities)<br />

• Jeffersonville Galvanizing<br />

• Flat Roll Cold Finishing Mill<br />

• Bar Finishing<br />

Butler, Indiana<br />

Columbia City, Indiana<br />

Pittsboro, Indiana<br />

Roanoke, Virginia<br />

Huntington, West Virginia<br />

Pittsburgh, Pennsylvania<br />

Jeffersonville, Indiana<br />

Butler, Indiana<br />

Pittsboro, Indiana<br />

10<br />

September 15, 2009

<strong>Steel</strong> Operations Shipments: 1996-2008<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

0<br />

Millions of tons<br />

1997<br />

1996 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

2008<br />

1996<br />

5.6 million<br />

2009<br />

Current<br />

Capacity<br />

7.7 million<br />

tons<br />

(including<br />

The Techs)<br />

1H 2009<br />

1.6 million<br />

tons<br />

11<br />

September 15, 2009

Structural & Rail Division<br />

Columbia City, Indiana<br />

Loading Wide-Flange Beams<br />

Structural and Rail Division<br />

12<br />

12<br />

September 15, 2009

<strong>Steel</strong> Shipments: Growth and Product Diversification<br />

Long Products<br />

SWVA<br />

Roanoke Bar<br />

Engineered Bar<br />

Structural & Rail<br />

The Techs<br />

Sheet Products<br />

Flat Roll Division<br />

13<br />

September 15, 2009

<strong>Steel</strong> Operations: Revenue growth and operating income<br />

$ billions<br />

6.0<br />

External <strong>Steel</strong> Sales<br />

$5.5B<br />

$180<br />

160<br />

Operating <strong>Inc</strong>ome per Ton<br />

$153<br />

5.0<br />

4.0<br />

140<br />

120<br />

$100<br />

3.0<br />

80<br />

2.0<br />

60<br />

1.0<br />

40<br />

20<br />

2004 2005 2006 2007 2008<br />

2004 2005 2006 2007 2008<br />

14<br />

September 15, 2009

OmniSource Profile<br />

Ferrous capacity<br />

Nonferrous volume<br />

Employees<br />

Locations<br />

Shredders<br />

7.0 million tons<br />

>1 billion lbs.<br />

2,500<br />

>70<br />

11<br />

2 nd largest ferrous scrap<br />

processor in North America<br />

New shredder at Indianapolis, mid-2008<br />

15<br />

September 15, 2009

Kalamazoo<br />

OmniSource Locations<br />

Midwest<br />

Southeast<br />

16<br />

September 15, 2009

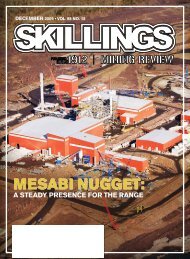

Mesabi Nugget<br />

Hoyt Lakes, Minnesota<br />

97% pure iron nuggets<br />

July 2009 photo<br />

17<br />

• Expected start-up Q4 2009<br />

• Planned 500,000 metric tons per year<br />

• $270 million project<br />

• 81% SDI / 19% Kobe <strong>Steel</strong><br />

• Plan to mine and concentrate<br />

taconite on site to produce iron<br />

feedstock for nugget plant(s)<br />

September 15, 2009

Mesabiʼs s environmentally friendly ITmk3 ironmaking process<br />

will produce only 4% of the carbon gases of blast furnaces<br />

Hoyt Lakes, Minnesota<br />

Gaseous Emissions<br />

Mesabi Mining, LLC<br />

Blast furnace process<br />

KG per MT of <strong>Steel</strong> produced<br />

ITmk3 process<br />

Carbon gases<br />

18 September 15, 2009 •<br />

•

Capitalization<br />

June 30, 2009<br />

$ Millions<br />

Cash $18<br />

Senior Secured $874 Revolver, due 2012<br />

7 3/8% Senior Notes, due 2012<br />

6 3/4% Senior Notes, due 2015<br />

7 3/4% Senior Notes, due 2016<br />

5.125% Convertible Senior Notes, due 2014<br />

Other loans<br />

Total Debt 53%<br />

$ 114<br />

700<br />

500<br />

500<br />

288<br />

43<br />

$2,145<br />

Shareholders’ Equity 47% 1,924<br />

Total Capitalization $4,069<br />

19<br />

September 15, 2009

Debt Maturities<br />

$ millions<br />

2,000<br />

$1.6 B<br />

*<br />

Cash from<br />

operations<br />

1,000<br />

$1.0 B<br />

$288<br />

0<br />

$1 $1<br />

$0<br />

2010 2011 2012 2013 2014 2015–<br />

20<br />

*<br />

$700 million of 7 3/8% senior notes,<br />

$874 million Senior Revolver matures July 2012<br />

September 15, 2009

Amended Covenants<br />

First Lien Leverage<br />

• Maximum of 2.50:1.00 through September 2010<br />

• Maximum of 3.00:1.00 December 2010 to maturity<br />

Total Debt Leverage<br />

• Covenant suspended until December 31, 2010<br />

after which it returns to a maximum of 5.00:1.00<br />

Interest Coverage Ratio<br />

• Minimum of 1.25:1.00 through December 2009<br />

• Minimum of 2.00:1.00 March 2010 to June 2010<br />

• Minimum of 2.50:1.00 September 2010 to maturity<br />

Borrowing Base Initiated<br />

• 85% of eligible accounts receivable<br />

and 65% of eligible inventory<br />

21<br />

September 15, 2009

2008 Cost of Goods Sold by Operating Segment<br />

<strong>Steel</strong><br />

2% 3%<br />

Metals Recycling<br />

Ferrous Resources<br />

<strong>Steel</strong><br />

Fabrication<br />

Gas and electricity<br />

Payroll and benefits<br />

22<br />

September 15, 2009