Report & Financial Statements for the Year ended 31st December ...

Report & Financial Statements for the Year ended 31st December ...

Report & Financial Statements for the Year ended 31st December ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

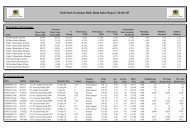

RETAIL SAVINGS<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

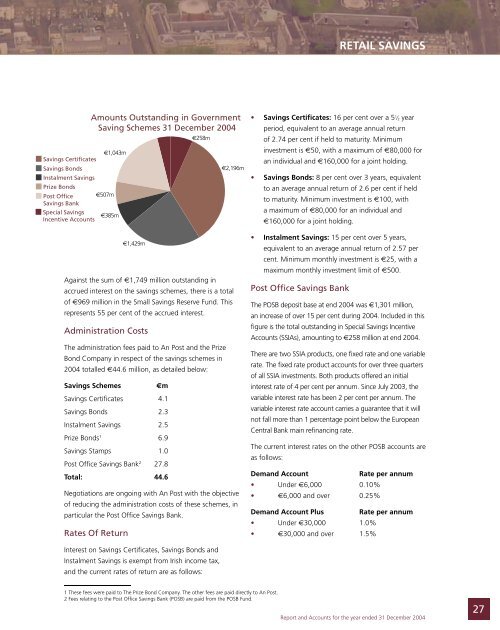

Against <strong>the</strong> sum of €1,749 million outstanding in<br />

accrued interest on <strong>the</strong> savings schemes, <strong>the</strong>re is a total<br />

of €969 million in <strong>the</strong> Small Savings Reserve Fund. This<br />

represents 55 per cent of <strong>the</strong> accrued interest.<br />

Administration Costs<br />

The administration fees paid to An Post and <strong>the</strong> Prize<br />

Bond Company in respect of <strong>the</strong> savings schemes in<br />

2004 totalled €44.6 million, as detailed below:<br />

Savings Schemes €m<br />

Savings Certificates 4.1<br />

Savings Bonds 2.3<br />

Instalment Savings 2.5<br />

Prize Bonds 1 6.9<br />

Savings Stamps 1.0<br />

Post Office Savings Bank 2 27.8<br />

Total: 44.6<br />

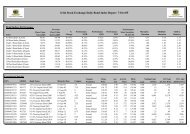

Negotiations are ongoing with An Post with <strong>the</strong> objective<br />

of reducing <strong>the</strong> administration costs of <strong>the</strong>se schemes, in<br />

particular <strong>the</strong> Post Office Savings Bank.<br />

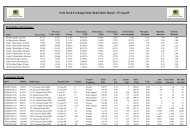

Rates Of Return<br />

<br />

<br />

<br />

• Savings Certificates: 16 per cent over a 5 1 ⁄ 2 year<br />

period, equivalent to an average annual return<br />

of 2.74 per cent if held to maturity. Minimum<br />

investment is €50, with a maximum of €80,000 <strong>for</strong><br />

an individual and €160,000 <strong>for</strong> a joint holding.<br />

• Savings Bonds: 8 per cent over 3 years, equivalent<br />

to an average annual return of 2.6 per cent if held<br />

to maturity. Minimum investment is €100, with<br />

a maximum of €80,000 <strong>for</strong> an individual and<br />

€160,000 <strong>for</strong> a joint holding.<br />

• Instalment Savings: 15 per cent over 5 years,<br />

equivalent to an average annual return of 2.57 per<br />

cent. Minimum monthly investment is €25, with a<br />

maximum monthly investment limit of €500.<br />

Post Office Savings Bank<br />

The POSB deposit base at end 2004 was €1,301 million,<br />

an increase of over 15 per cent during 2004. Included in this<br />

figure is <strong>the</strong> total outstanding in Special Savings Incentive<br />

Accounts (SSIAs), amounting to €258 million at end 2004.<br />

There are two SSIA products, one fixed rate and one variable<br />

rate. The fixed rate product accounts <strong>for</strong> over three quarters<br />

of all SSIA investments. Both products offered an initial<br />

interest rate of 4 per cent per annum. Since July 2003, <strong>the</strong><br />

variable interest rate has been 2 per cent per annum. The<br />

variable interest rate account carries a guarantee that it will<br />

not fall more than 1 percentage point below <strong>the</strong> European<br />

Central Bank main refinancing rate.<br />

The current interest rates on <strong>the</strong> o<strong>the</strong>r POSB accounts are<br />

as follows:<br />

Demand Account<br />

Rate per annum<br />

• Under €6,000 0.10%<br />

• €6,000 and over 0.25%<br />

Demand Account Plus Rate per annum<br />

• Under €30,000 1.0%<br />

• €30,000 and over 1.5%<br />

Interest on Savings Certificates, Savings Bonds and<br />

Instalment Savings is exempt from Irish income tax,<br />

and <strong>the</strong> current rates of return are as follows:<br />

1 These fees were paid to The Prize Bond Company. The o<strong>the</strong>r fees are paid directly to An Post.<br />

2 Fees relating to <strong>the</strong> Post Office Savings Bank (POSB) are paid from <strong>the</strong> POSB Fund.<br />

<strong>Report</strong> and Accounts <strong>for</strong> <strong>the</strong> year <strong>ended</strong> 31 <strong>December</strong> 2004<br />

27