PDF, 3464 KB - Roland Berger

PDF, 3464 KB - Roland Berger

PDF, 3464 KB - Roland Berger

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

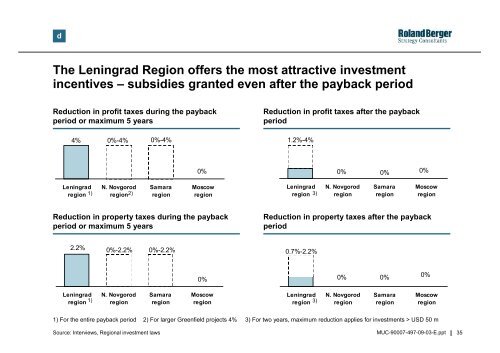

d<br />

The Leningrad Region offers the most attractive investment<br />

incentives – subsidies granted even after the payback period<br />

Reduction in profit taxes during the payback<br />

period or maximum 5 years<br />

Reduction in profit taxes after the payback<br />

period<br />

4%<br />

0%-4%<br />

0%-4%<br />

1.2%-4%<br />

0%<br />

0%<br />

0%<br />

0%<br />

Leningrad N. Novgorod Samara Moscow<br />

Leningrad<br />

region 1) region2)<br />

region region<br />

region 3)<br />

N. Novgorod<br />

region<br />

Samara<br />

region<br />

Moscow<br />

region<br />

Reduction in property taxes during the payback<br />

period or maximum 5 years<br />

Reduction in property taxes after the payback<br />

period<br />

2.2%<br />

0%-2.2%<br />

0%-2.2%<br />

0.7%-2.2%<br />

0%<br />

0%<br />

0%<br />

0%<br />

Leningrad N. Novgorod Samara Moscow<br />

Leningrad<br />

region 1) region region region<br />

region 3)<br />

N. Novgorod<br />

region<br />

Samara<br />

region<br />

Moscow<br />

region<br />

1) For the entire payback period 2) For larger Greenfield projects 4% 3) For two years, maximum reduction applies for investments > USD 50 m<br />

Source: Interviews, Regional investment laws<br />

MUC-90007-497-09-03-E.ppt 35