PEC Letterhead Template

PEC Letterhead Template

PEC Letterhead Template

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Kraft-Cadbury as a Frame of Reference for Private Equity Transactions<br />

Many reporters and market commentators subscribe to a certain narrative about the<br />

supposed excesses of the largest private equity acquisitions agreed to in the years<br />

immediately preceding the onset of the credit crunch. Yet, according to data from<br />

Standard & Poor’s, the large private equity transactions from that period were actually<br />

valued and financed more conservatively, on average, than Kraft’s acquisition of<br />

Cadbury.

Valuation. Kraft intends to pay 13-times Cadbury’s 2009 earnings before interest,<br />

taxes, depreciation and amortization (EBITDA). This is much more than private equity<br />

firms paid for large companies, on average, during 2002-2008. The chart below (from<br />

S&P Leveraged Commentary and Data), shows the average purchase price multiple for<br />

private equity acquisitions from 1987-2008. During the supposed “bubble” of 2006-<br />

2008, the average PE acquisition was valued at about 9.5-times EBITDA, or 27% less<br />

than Kraft’s bid for Cadbury (alternatively, Kraft paid a price that was 37% more than the<br />

average large private equity transaction of 2006-2008). The typical large private equity<br />

transaction during the valuation peak of 2007 was priced at a 25% discount to Kraft’s<br />

acquisition of Cadbury (Kraft paid a 33% premium relative to the 2007 large PE<br />

average).<br />

2

Financing. Based on current stock prices and exchange rates, cash comprises 60% of<br />

the bid, or $11.6 billion. According to its most recent financial report, Kraft had $2.996<br />

billion in cash on its balance sheet. The cash for the acquisition will come from the sale<br />

of existing businesses and $9 billion in acquisition financing from a syndicate of nine<br />

banks. The details of the financing will be provided in the Final Offer Documents, but<br />

the financing is expected to take the form of leveraged loans sold to institutional<br />

investors. The main proponent of the leveraged financing was Warren Buffet, who<br />

opposed the use of more equity to complete the deal.<br />

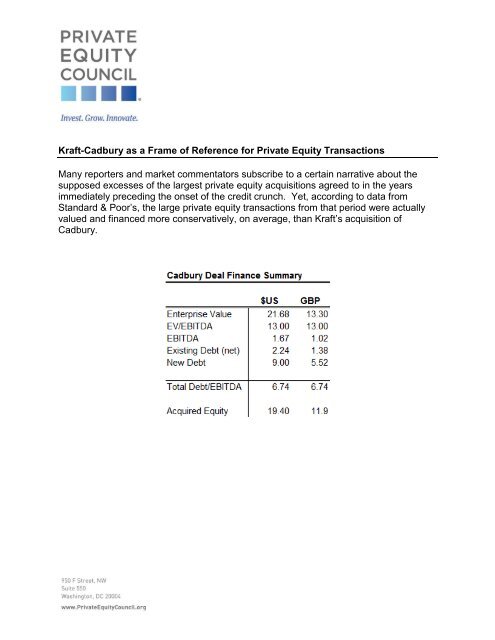

With $9 billion of acquisition financing and an existing debt load of $2.24 billion, the total<br />

debt of $11.24 billion is equal to 6.74-times Cadbury’s 2009 EBITDA of $1.67 billion.<br />

This leverage ratio is 24% higher than the average debt-to-cash flow ratio for large<br />

private equity acquisitions from 2005-2008. Even in 2007, the average large private<br />

equity transaction relied on 8% less debt than Kraft’s acquisition of Cadbury.<br />

3