atswa pilot questions answers part i - The Institute of Chartered ...

atswa pilot questions answers part i - The Institute of Chartered ...

atswa pilot questions answers part i - The Institute of Chartered ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

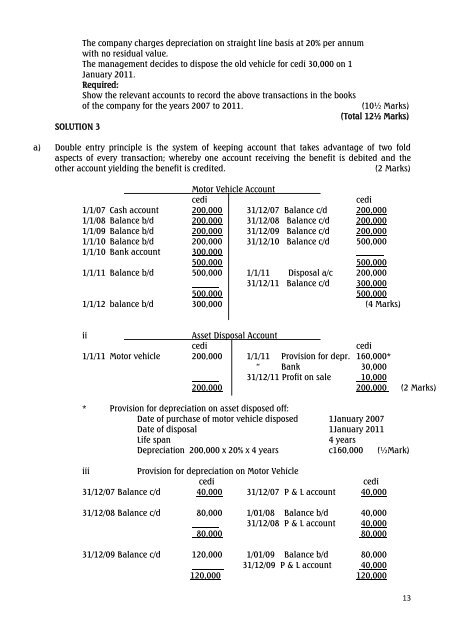

<strong>The</strong> company charges depreciation on straight line basis at 20% per annum<br />

with no residual value.<br />

<strong>The</strong> management decides to dispose the old vehicle for cedi 30,000 on 1<br />

January 2011.<br />

Required:<br />

Show the relevant accounts to record the above transactions in the books<br />

<strong>of</strong> the company for the years 2007 to 2011.<br />

(10½ Marks)<br />

(Total 12½ Marks)<br />

SOLUTION 3<br />

a) Double entry principle is the system <strong>of</strong> keeping account that takes advantage <strong>of</strong> two fold<br />

aspects <strong>of</strong> every transaction; whereby one account receiving the benefit is debited and the<br />

other account yielding the benefit is credited.<br />

(2 Marks)<br />

Motor Vehicle Account<br />

cedi<br />

cedi<br />

1/1/07 Cash account 200,000 31/12/07 Balance c/d 200,000<br />

1/1/08 Balance b/d 200,000 31/12/08 Balance c/d 200,000<br />

1/1/09 Balance b/d 200,000 31/12/09 Balance c/d 200,000<br />

1/1/10 Balance b/d 200,000 31/12/10 Balance c/d 500,000<br />

1/1/10 Bank account 300,000<br />

500,000 500,000<br />

1/1/11 Balance b/d 500,000 1/1/11 Disposal a/c 200,000<br />

31/12/11 Balance c/d 300,000<br />

500,000 500,000<br />

1/1/12 balance b/d 300,000 (4 Marks)<br />

ii<br />

Asset Disposal Account<br />

cedi<br />

cedi<br />

1/1/11 Motor vehicle 200,000 1/1/11 Provision for depr. 160,000*<br />

“ Bank 30,000<br />

31/12/11 Pr<strong>of</strong>it on sale 10,000<br />

200,000 200,000 (2 Marks)<br />

* Provision for depreciation on asset disposed <strong>of</strong>f:<br />

Date <strong>of</strong> purchase <strong>of</strong> motor vehicle disposed 1January 2007<br />

Date <strong>of</strong> disposal 1January 2011<br />

Life span<br />

4 years<br />

Depreciation 200,000 x 20% x 4 years c160,000 (½Mark)<br />

iii<br />

Provision for depreciation on Motor Vehicle<br />

cedi<br />

cedi<br />

31/12/07 Balance c/d 40,000 31/12/07 P & L account 40,000<br />

31/12/08 Balance c/d 80,000 1/01/08 Balance b/d 40,000<br />

31/12/08 P & L account 40,000<br />

80,000 80,000<br />

31/12/09 Balance c/d 120,000 1/01/09 Balance b/d 80,000<br />

31/12/09 P & L account 40,000<br />

120,000 120,000<br />

13