atswa pilot questions answers part i - The Institute of Chartered ...

atswa pilot questions answers part i - The Institute of Chartered ...

atswa pilot questions answers part i - The Institute of Chartered ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

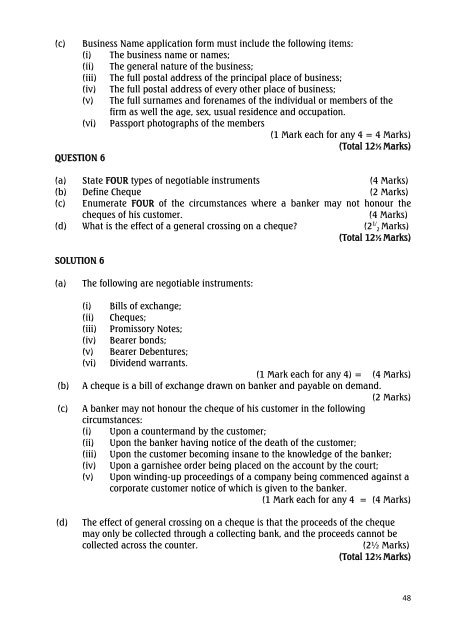

(c) Business Name application form must include the following items:<br />

(i) <strong>The</strong> business name or names;<br />

(ii) <strong>The</strong> general nature <strong>of</strong> the business;<br />

(iii) <strong>The</strong> full postal address <strong>of</strong> the principal place <strong>of</strong> business;<br />

(iv) <strong>The</strong> full postal address <strong>of</strong> every other place <strong>of</strong> business;<br />

(v) <strong>The</strong> full surnames and forenames <strong>of</strong> the individual or members <strong>of</strong> the<br />

firm as well the age, sex, usual residence and occupation.<br />

(vi) Passport photographs <strong>of</strong> the members<br />

(1 Mark each for any 4 = 4 Marks)<br />

(Total 12½ Marks)<br />

QUESTION 6<br />

(a) State FOUR types <strong>of</strong> negotiable instruments (4 Marks)<br />

(b) Define Cheque (2 Marks)<br />

(c) Enumerate FOUR <strong>of</strong> the circumstances where a banker may not honour the<br />

cheques <strong>of</strong> his customer.<br />

(4 Marks)<br />

(d) What is the effect <strong>of</strong> a general crossing on a cheque? (2 1/ 2 Marks)<br />

(Total 12½ Marks)<br />

SOLUTION 6<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

<strong>The</strong> following are negotiable instruments:<br />

(i) Bills <strong>of</strong> exchange;<br />

(ii) Cheques;<br />

(iii) Promissory Notes;<br />

(iv) Bearer bonds;<br />

(v) Bearer Debentures;<br />

(vi) Dividend warrants.<br />

(1 Mark each for any 4) = (4 Marks)<br />

A cheque is a bill <strong>of</strong> exchange drawn on banker and payable on demand.<br />

(2 Marks)<br />

A banker may not honour the cheque <strong>of</strong> his customer in the following<br />

circumstances:<br />

(i) Upon a countermand by the customer;<br />

(ii) Upon the banker having notice <strong>of</strong> the death <strong>of</strong> the customer;<br />

(iii) Upon the customer becoming insane to the knowledge <strong>of</strong> the banker;<br />

(iv) Upon a garnishee order being placed on the account by the court;<br />

(v) Upon winding-up proceedings <strong>of</strong> a company being commenced against a<br />

corporate customer notice <strong>of</strong> which is given to the banker.<br />

(1 Mark each for any 4 = (4 Marks)<br />

<strong>The</strong> effect <strong>of</strong> general crossing on a cheque is that the proceeds <strong>of</strong> the cheque<br />

may only be collected through a collecting bank, and the proceeds cannot be<br />

collected across the counter.<br />

(2½ Marks)<br />

(Total 12½ Marks)<br />

48