public real estate and private market implications - Pension Real ...

public real estate and private market implications - Pension Real ...

public real estate and private market implications - Pension Real ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

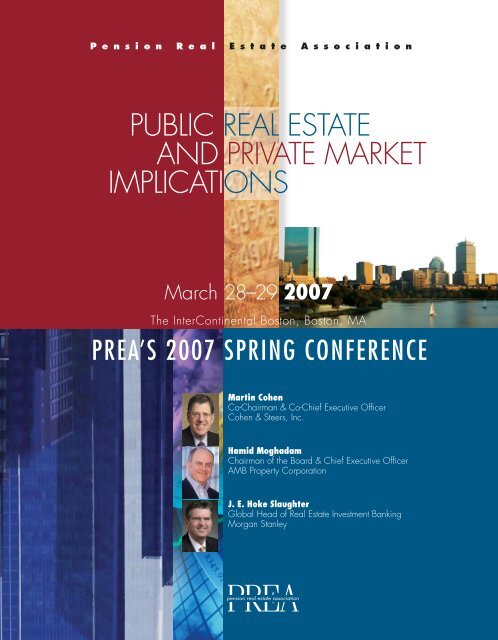

P e n s i o n R e a l E s t a t e A s s o c i a t i o n<br />

PUBLIC REAL ESTATE<br />

AND PRIVATE MARKET<br />

IMPLICATIONS<br />

March 28–29 2007<br />

The InterContinental Boston, Boston, MA<br />

PREA’s 2007 Spring Conference<br />

Martin Cohen<br />

Co-Chairman & Co-Chief Executive Officer<br />

Cohen & Steers, Inc.<br />

Hamid Moghadam<br />

Chairman of the Board & Chief Executive Officer<br />

AMB Property Corporation<br />

J. E. Hoke Slaughter<br />

Global Head of <strong>Real</strong> Estate Investment Banking<br />

Morgan Stanley<br />

PREA<br />

pension <strong>real</strong> <strong>estate</strong> association

P R E A ’ s 2 0 0 7 S p r i n g C o n f e r e n c e<br />

Letter From The President<br />

Between privatizations <strong>and</strong> M&A activity at home,<br />

<strong>and</strong> the emergence of new REIT <strong>market</strong>s internationally,<br />

there is a shift in how institutional investors look at <strong>and</strong><br />

invest in REITs.<br />

Domestically, new financing structures <strong>and</strong> bridging<br />

technologies are fueling the transfer of large <strong>public</strong><br />

portfolios into the h<strong>and</strong>s of <strong>private</strong> investors like institutions<br />

<strong>and</strong> <strong>private</strong>ly-held vehicles.<br />

Internationally, new REIT <strong>market</strong>s are exp<strong>and</strong>ing dramatically,<br />

giving all investors access to international <strong>real</strong> <strong>estate</strong>.<br />

These two opposing <strong>market</strong> forces not only present<br />

new opportunities for institutional investors but materially<br />

change the <strong>real</strong> <strong>estate</strong> investment l<strong>and</strong>scape.

P R E A ’ s 2 0 0 7 S p r i n g C o n f e r e n c e<br />

Day 1, Wednesday, March 28<br />

8:00 a.m. – 10:00 a.m. CLOSED SESSION FOR PLAN SPONSOR INVESTORS ONLY – Eleanor/Dartmouth Room, 3rd Floor<br />

9:00 a.m. – 10:00 a.m. Registration <strong>and</strong> Continental Breakfast – Rose Kennedy Ballroom Foyer, 3rd Floor<br />

James S. Corl<br />

Field Griffith<br />

Mike McCaffery<br />

Terrance Ahern<br />

David Henry<br />

10:00 a.m. – 11:15 a.m. OPENING KEYNOTE PRESENTATION: A Look Across All Asset Classes<br />

<strong>and</strong> at the Role of <strong>Real</strong> Estate – Rose Kennedy Ballroom, 3rd Floor<br />

Keynote Speaker: Mike McCaffery, Managing Director <strong>and</strong> CEO, Makena Capital<br />

The conference will begin with a keynote presentation by Mike McCaffery on the management of high<br />

performance investment portfolios <strong>and</strong> the role of <strong>real</strong> <strong>estate</strong> within them.<br />

11:15 a.m. – 12:30 p.m. GENERAL SESSION: Making Deals with Public Operating Companies<br />

– Rose Kennedy Ballroom, 3rd Floor<br />

Moderator: James S. Corl, Executive Vice President, Cohen & Steers<br />

Panelists: Terrance Ahern, Principal <strong>and</strong> Founder, Townsend Group<br />

Field Griffith, Director of <strong>Real</strong> Estate Investments, Virginia Retirement System<br />

David Henry, Vice Chairman <strong>and</strong> CIO, Kimco <strong>Real</strong>ty Corporation<br />

Marjorie Tsang, Assistant Comptroller, <strong>Real</strong> Estate Investments, New York State Common Retirement Fund<br />

This session will be devoted to analyzing various ventures between pension funds <strong>and</strong> REITs from different<br />

perspectives. The panel will discuss a variety of arrangements including acquisition of <strong>public</strong> REITs by pension<br />

funds, direct joint ventures between funds <strong>and</strong> operating companies, <strong>and</strong> accessing <strong>public</strong> operators through<br />

investment managers <strong>and</strong> other structures.<br />

12:30 p.m. – 1:45 p.m. LUNCHEON – Abigail Adams Ballroom, 2nd Floor<br />

Marjorie Tsang<br />

Lawrence Gray Paul Hughson<br />

2:00 p.m. – 3:15 p.m. GENERAL SESSION–Panel Discussion : New Bridging Technologies<br />

– Rose Kennedy Ballroom, 3rd Floor<br />

Moderator: Lawrence Gray, Managing Director, Wachovia<br />

Panelists: Susan Doyle, Investment Manager, GEAM<br />

Paul Hughson, Managing Director, Global Commercial <strong>Real</strong> Estate Group, Lehman Brothers<br />

Alan M. Leventhal, Chairman <strong>and</strong> CEO, Beacon Capital Partners, LLC<br />

Robert Weaver, Managing Director, Morgan Stanley<br />

This session will examine how bridge equity <strong>and</strong> debt is facilitating the acquisition of major properties,<br />

portfolios <strong>and</strong> <strong>real</strong> <strong>estate</strong> companies. How are these deals getting capitalized <strong>and</strong> structured? How are<br />

they getting syndicated? What opportunities do they provide for institutional investors? The panel will<br />

discuss these <strong>and</strong> other related topics that are driving <strong>real</strong> <strong>estate</strong> transaction activity.<br />

3:30 p.m. – 3:45 p.m. Annual Meeting of Members – Rose Kennedy Ballroom, 3rd Floor<br />

Susan Doyle<br />

Alan Leventhal<br />

Robert Weaver

P R E A ’ s 2 0 0 7 S p r i n g C o n f e r e n c e<br />

Day 1, Wednesday, March 28 continued<br />

3:45 p.m. – 5:00 p.m. AFFINITY GROUP BREAKOUT SESSIONS<br />

• Capital Market Trends <strong>and</strong> Innovations – Hutchinson Room 2nd Floor<br />

Group Co-Chairs: Devin Murphy, Managing Director, Global Head of <strong>Real</strong> Estate Investment<br />

Banking, Deutsche Bank Securities, Inc.<br />

Frank Schmitz, Managing Principal, Park Hill <strong>Real</strong> Estate Group<br />

• Development Trends <strong>and</strong> Opportunities – Wheeler Room, 2nd Floor<br />

Group Co-Chairs: Christopher Hughes, Sr. Vice President, Hines<br />

Bret Wilkerson, CEO, Property & Portfolio Research<br />

• Green Buildings – Dartmouth/Eleanor Room, 3rd Floor<br />

Group Co-Chairs: Mark Billeci, Managing Director, Principal <strong>Real</strong> Estate Investors<br />

Todd Briddell, Managing Director - <strong>Real</strong> Estate Securities, Urdang<br />

• International <strong>Real</strong> Estate Investment – Robinson Room, 2nd Floor<br />

Group Co-Chairs: Lisa Amzallag, Director, Columbia Investment Management Company, LLC<br />

Howard Margolis, Managing Director, Black Creek Capital<br />

• Alternative <strong>Real</strong> Estate Investments – Griffin Room, 2nd Floor<br />

Group Co-Chairs: Heather Goldman, Sr. Vice President, Investor Relations, Starwood Capital Group, LLC<br />

Peter Madden, Sr. Portfolio Manager, AMB Investments US, Inc.<br />

5:00 p.m. – 6:00 p.m. PREA COMMITTEE MEETINGS<br />

• Reporting & Valuation Committee – Hutchinson Room, 2nd Floor<br />

• Research Committee – Wheeler Room, 2nd Floor<br />

• Membership Committee – Eleanor/Dartmouth Room, 3rd Floor<br />

• Publications Committee – Robinson Room, 2nd Floor<br />

• Conference Committee – Griffin Room, 2nd Floor<br />

• Institute Committee – Montague Room, 3rd Floor<br />

• Government Affairs Committee – Sessions Room, 3rd Floor<br />

6:30 p.m. – 7:30 p.m. PREA Cocktail Reception – Rose Kennedy Ballroom Foyer, 3rd Floor<br />

David Brooks<br />

7:30 p.m. – 9:00 p.m. Dinner – Rose Kennedy Ballroom, 3rd Floor<br />

Keynote Speaker: David Brooks, Author <strong>and</strong> New York Times columnist<br />

David is an Op-Ed Columnist for the New York Times as well as a regular<br />

analyst on NewsHour with Jim Lehrer <strong>and</strong> NPR’s All Things Considered.<br />

He is the author of two books on what he calls “comic sociology”,<br />

New York Times bestseller Bobos in Paradise <strong>and</strong> On Paradise Drive.<br />

9:00 p.m. – 10:00 p.m. Dessert Reception in foyer following dinner<br />

–Open to all attendees

P R E A ’ s 2 0 0 7 S p r i n g C o n f e r e n c e<br />

Day 2, Thursday, March 29<br />

8:30 a.m. – 9:30 a.m. CLOSED SESSION FOR PLAN SPONSOR INVESTORS ONLY – Hutchinson Room, 2nd Floor<br />

8:30 a.m. – 9:30 a.m. Registration <strong>and</strong> Continental Breakfast – Rose Kennedy Ballroom Foyer, 3rd Floor<br />

Scott Crowe<br />

Michael<br />

Humphrey<br />

Ritson Ferguson<br />

Ian Marcus<br />

9:30 a.m. – 10:45 a.m. GENERAL SESSION: Global REIT Market<br />

– Rose Kennedy Ballroom, 3rd Floor<br />

Moderator: Scott Crowe, Global Strategist <strong>and</strong> Co-Portfolio Manager, Cohen & Steers, Inc.<br />

Panelists: Ritson Ferguson, Chief Investment Officer <strong>and</strong> CEO, ING Clarion <strong>Real</strong> Estate Securities<br />

Michael Humphrey, Managing Principal <strong>and</strong> Co-Founder, Courtl<strong>and</strong> Partners<br />

Ian Marcus, Chairman, European <strong>Real</strong> Estate Investment Banking, Credit Suisse<br />

John Robertson, Managing Director, Head of Global <strong>Real</strong> Estate Securities, RREEF<br />

The success of the U.S. REIT model in delivering the investment characteristics of <strong>real</strong> <strong>estate</strong> has led to the acceptance<br />

of the structure worldwide. As the governments of most major economies in the world have adopted REIT legislation,<br />

this has led to a dramatic increase in the <strong>market</strong> capitalization of REITs globally. As a result, more <strong>and</strong> more institutional<br />

investors are dedicating an increasing allocation to global REITs in their <strong>real</strong> <strong>estate</strong> portfolios. Will this trend continue?<br />

Is it here to stay? Are there pitfalls ahead that we may be ignoring?<br />

10:45 a.m. – 11:00 a.m. Refreshment Break<br />

John Robertson<br />

Gregory Wright Barry Blattman<br />

11:00 a.m. – 12:15 p.m. GENERAL SESSION: Public-to-Private <strong>and</strong> Other Trends in <strong>Real</strong> Estate M&A<br />

– Rose Kennedy Ballroom, 3rd Floor<br />

Moderator: Gregory S. Wright, Managing Director, <strong>Real</strong> Estate Investment Banking, Merrill Lynch<br />

Panelists: Barry Blattman, Managing Partner, Brookfield Asset Management<br />

Stephen Furnary, Chairman & CEO, ING Clarion<br />

Jeffery Quicksilver, Principal, Walton Street Capital, LLC<br />

Allan Sweet, President, AMLI Residential<br />

This panel will discuss the factors underlying the wave of take-<strong>private</strong>s in the <strong>real</strong> <strong>estate</strong> M&A <strong>market</strong>. What are the<br />

motivations of the sellers? How does <strong>private</strong> equity make the pricing work? Will the strategic buyer re-emerge?<br />

Stephen Furnary Jeffery Quicksilver<br />

Allan Sweet<br />

CONFERENCE CONCLUDES

P R E A ’ s 2 0 0 7 S p r i n g C o n f e r e n c e<br />

Sustaining Members <strong>and</strong> Conference Committee<br />

Sustaining Members<br />

AEW Capital<br />

Management, L.P.<br />

AMB Property<br />

Corporation<br />

American <strong>Real</strong>ty<br />

Advisors<br />

Beacon Capital<br />

Partners LLC<br />

BlackRock <strong>Real</strong>ty<br />

CB Richard Ellis<br />

Investors<br />

Chadwick, Saylor &<br />

Co. Inc.<br />

CIGNA <strong>Real</strong>ty<br />

Investors<br />

Deloitte<br />

Deutsche Bank Alex.<br />

Brown<br />

DRA Advisors LLC<br />

Fidelity Management<br />

& Research<br />

Company<br />

Goodwin Procter LLP<br />

Great Point<br />

Investors LLC<br />

Hart <strong>Real</strong>ty Advisers<br />

Heitman<br />

Hines<br />

ING Clarion<br />

INVESCO <strong>Real</strong>ty<br />

Advisors<br />

J.E. Robert<br />

Companies<br />

JPMorgan Asset<br />

Management<br />

Kennedy Associates<br />

<strong>Real</strong> Estate<br />

Counsel, Inc.<br />

L & B <strong>Real</strong>ty<br />

Advisors, Inc.<br />

L<strong>and</strong>mark Partners,<br />

Inc.<br />

LaSalle Investment<br />

Management, Inc.<br />

Lazard<br />

Lowe Enterprises<br />

Investment<br />

Management, LLC<br />

Mayer, Brown, Rowe<br />

& Maw LLP<br />

The McMahan<br />

Group<br />

Merrill Lynch & Co.<br />

Morgan Stanley<br />

Newl<strong>and</strong> Capital<br />

Advisors<br />

O’Connor Capital<br />

Partners<br />

Paul, Hastings,<br />

Janofsky &<br />

Walker LLP<br />

Praedium Group LLC<br />

Pricewaterhouse<br />

Coopers LLP<br />

Principal Global<br />

Investors, LLC<br />

Property & Portfolio<br />

Research<br />

Prudential <strong>Real</strong><br />

Estate Investors<br />

RREEF<br />

Security Capital<br />

Research &<br />

Management<br />

Incorporated<br />

Sentinel <strong>Real</strong> Estate<br />

Corp.<br />

Seyfarth Shaw LLP<br />

Starwood Capital<br />

Group Global, LLC<br />

TA Associates <strong>Real</strong>ty<br />

The Taubman<br />

Company<br />

TGM Associates L.P.<br />

UBS <strong>Real</strong>ty<br />

Investors LLC<br />

Urdang<br />

Conference Committee<br />

David Boyle,<br />

Co-Chairman<br />

Brookfield Asset<br />

Management<br />

Greg Moran,<br />

Co-Chairman<br />

Dividend Capital<br />

Group<br />

Gena Cheng<br />

Robert Davis<br />

Triton Pacific Capital<br />

Henry Delicata<br />

V<strong>and</strong>erbilt University<br />

Garret House<br />

M3 Capital Partners<br />

Howard Margolis<br />

Black Creek Capital<br />

JT Partners, LLC

Calendar of Events<br />

P R E A ’ s 2 0 0 7 S p r i n g C o n f e r e n c e<br />

2007 PREA Institute<br />

June 12–13, 2007<br />

Fisher Center for <strong>Real</strong> Estate<br />

UC Berkeley<br />

Berkeley, CA<br />

17 th Annual Plan Sponsor <strong>Real</strong> Estate Conference<br />

September 25–27, 2007<br />

The Beverly Hilton<br />

Beverly Hills, CA<br />

2008 CEO Leadership Forum<br />

March 25, 2008<br />

The InterContinental Boston<br />

Boston, MA<br />

2008 Spring Conference<br />

March 26–27, 2008<br />

The InterContinental Boston<br />

Boston, MA<br />

18 th Annual Plan Sponsor <strong>Real</strong> Estate Conference<br />

October 1–3, 2008<br />

The Fairmont Chicago<br />

Chicago, IL

P e n s i o n R e a l E s t a t e A s s o c i a t i o n<br />

<strong>Pension</strong> <strong>Real</strong> Estate Association<br />

100 Pearl Street<br />

13th Floor<br />

Hartford, CT 06103<br />

860 692 6341<br />

www.prea.org<br />

PREA<br />

pension <strong>real</strong> <strong>estate</strong> association