asia bond monitor - AsianBondsOnline - Asian Development Bank

asia bond monitor - AsianBondsOnline - Asian Development Bank

asia bond monitor - AsianBondsOnline - Asian Development Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Asia Bond Monitor<br />

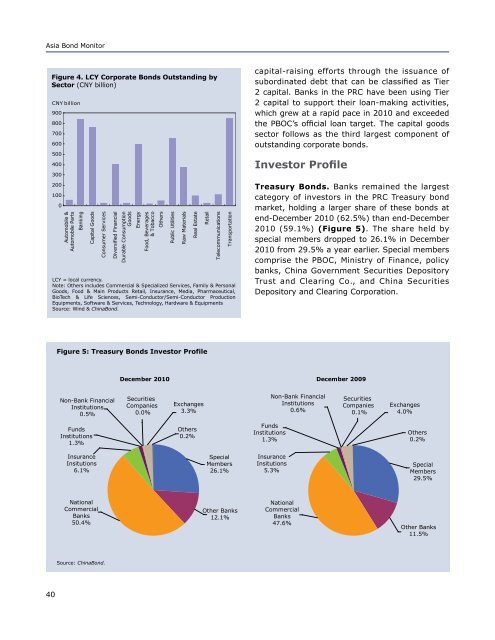

Figure 4. LCY Corporate Bonds Outstanding by<br />

Sector (CNY billion)<br />

CNY billion<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Automobile &<br />

Automobile Parts<br />

<strong>Bank</strong>ing<br />

Capital Goods<br />

Consumer Services<br />

Diversified Financial<br />

Durable Consumption<br />

Goods<br />

Energy<br />

Food, Beverages<br />

& Tobacco<br />

LCY = local currency.<br />

Note: Others includes Commercial & Specialized Services, Family & Personal<br />

Goods, Food & Main Products Retail, Insurance, Media, Pharmaceutical,<br />

BioTech & Life Sciences, Semi-Conductor/Semi-Conductor Production<br />

Equipments, Software & Services, Technology, Hardware & Equipments<br />

Source: Wind & ChinaBond.<br />

Others<br />

Public Utilities<br />

Raw Materials<br />

Real Estate<br />

Retail<br />

Telecommunications<br />

Transportation<br />

capital-raising efforts through the issuance of<br />

subordinated debt that can be classified as Tier<br />

2 capital. <strong>Bank</strong>s in the PRC have been using Tier<br />

2 capital to support their loan-making activities,<br />

which grew at a rapid pace in 2010 and exceeded<br />

the PBOC’s official loan target. The capital goods<br />

sector follows as the third largest component of<br />

outstanding corporate <strong>bond</strong>s.<br />

Investor Profile<br />

Treasury Bonds. <strong>Bank</strong>s remained the largest<br />

category of investors in the PRC Treasury <strong>bond</strong><br />

market, holding a larger share of these <strong>bond</strong>s at<br />

end-December 2010 (62.5%) than end-December<br />

2010 (59.1%) (Figure 5). The share held by<br />

special members dropped to 26.1% in December<br />

2010 from 29.5% a year earlier. Special members<br />

comprise the PBOC, Ministry of Finance, policy<br />

banks, China Government Securities Depository<br />

Trust and Clearing Co., and China Securities<br />

Depository and Clearing Corporation.<br />

Figure 5: Treasury Bonds Investor Profile<br />

December 2010<br />

December 2009<br />

Non-<strong>Bank</strong> Financial<br />

Institutions<br />

0.5%<br />

Securities<br />

Companies<br />

0.0%<br />

Exchanges<br />

3.3%<br />

Non-<strong>Bank</strong> Financial<br />

Institutions<br />

0.6%<br />

Securities<br />

Companies<br />

0.1%<br />

Exchanges<br />

4.0%<br />

Funds<br />

Institutions<br />

1.3%<br />

Others<br />

0.2%<br />

Funds<br />

Institutions<br />

1.3%<br />

Others<br />

0.2%<br />

Insurance<br />

Insitutions<br />

6.1%<br />

Special<br />

Members<br />

26.1%<br />

Insurance<br />

Insitutions<br />

5.3%<br />

Special<br />

Members<br />

29.5%<br />

National<br />

Commercial<br />

<strong>Bank</strong>s<br />

50.4%<br />

Other <strong>Bank</strong>s<br />

12.1%<br />

National<br />

Commercial<br />

<strong>Bank</strong>s<br />

47.6%<br />

Other <strong>Bank</strong>s<br />

11.5%<br />

Source: ChinaBond.<br />

40