Read Report - Nuinsco Resources Limited

Read Report - Nuinsco Resources Limited

Read Report - Nuinsco Resources Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

12<br />

2005 ANNUAL REPORT<br />

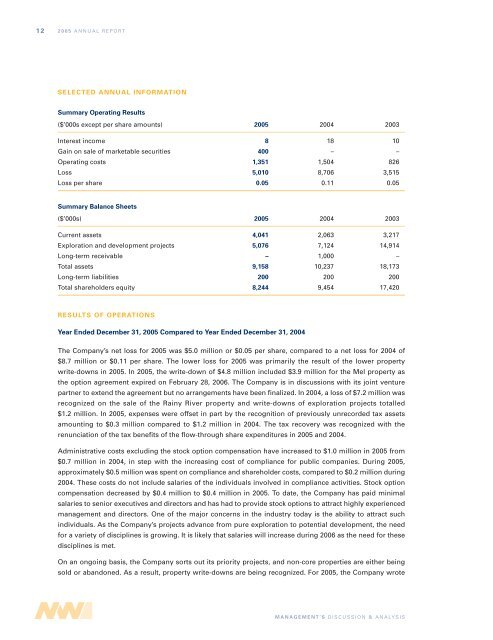

SELECTED ANNUAL INFORMATION<br />

Summary Operating Results<br />

($’000s except per share amounts) 2005 2004 2003<br />

Interest income 8 18 10<br />

Gain on sale of marketable securities 400 – –<br />

Operating costs 1,351 1,504 826<br />

Loss 5,010 8,706 3,515<br />

Loss per share 0.05 0.11 0.05<br />

Summary Balance Sheets<br />

($’000s) 2005 2004 2003<br />

Current assets 4,041 2,063 3,217<br />

Exploration and development projects 5,076 7,124 14,914<br />

Long-term receivable – 1,000 –<br />

Total assets 9,158 10,237 18,173<br />

Long-term liabilities 200 200 200<br />

Total shareholders equity 8,244 9,454 17,420<br />

RESULTS OF OPERATIONS<br />

Year Ended December 31, 2005 Compared to Year Ended December 31, 2004<br />

The Company’s net loss for 2005 was $5.0 million or $0.05 per share, compared to a net loss for 2004 of<br />

$8.7 million or $0.11 per share. The lower loss for 2005 was primarily the result of the lower property<br />

write-downs in 2005. In 2005, the write-down of $4.8 million included $3.9 million for the Mel property as<br />

the option agreement expired on February 28, 2006. The Company is in discussions with its joint venture<br />

partner to extend the agreement but no arrangements have been finalized. In 2004, a loss of $7.2 million was<br />

recognized on the sale of the Rainy River property and write-downs of exploration projects totalled<br />

$1.2 million. In 2005, expenses were offset in part by the recognition of previously unrecorded tax assets<br />

amounting to $0.3 million compared to $1.2 million in 2004. The tax recovery was recognized with the<br />

renunciation of the tax benefits of the flow-through share expenditures in 2005 and 2004.<br />

Administrative costs excluding the stock option compensation have increased to $1.0 million in 2005 from<br />

$0.7 million in 2004, in step with the increasing cost of compliance for public companies. During 2005,<br />

approximately $0.5 million was spent on compliance and shareholder costs, compared to $0.2 million during<br />

2004. These costs do not include salaries of the individuals involved in compliance activities. Stock option<br />

compensation decreased by $0.4 million to $0.4 million in 2005. To date, the Company has paid minimal<br />

salaries to senior executives and directors and has had to provide stock options to attract highly experienced<br />

management and directors. One of the major concerns in the industry today is the ability to attract such<br />

individuals. As the Company’s projects advance from pure exploration to potential development, the need<br />

for a variety of disciplines is growing. It is likely that salaries will increase during 2006 as the need for these<br />

disciplines is met.<br />

On an ongoing basis, the Company sorts out its priority projects, and non-core properties are either being<br />

sold or abandoned. As a result, property write-downs are being recognized. For 2005, the Company wrote<br />

MANAGEMENT’S DISCUSSION & ANALYSIS