Read Report - Nuinsco Resources Limited

Read Report - Nuinsco Resources Limited

Read Report - Nuinsco Resources Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

30<br />

2005 ANNUAL REPORT<br />

(e)<br />

Cameron Lake<br />

The Cameron Lake project consists of one mining lease encompassing 979 ha, contiguous mining claims totalling<br />

3,728 ha and mineral patents at Rowan Lake of 95.7 ha. The surface rights to the Rowan lake property were sold<br />

in 2005. A NI 43-101 compliant report and resource estimate was completed. During the mid-1980s, approximately<br />

$24,000,000 was spent on the project by a former shareholder to develop the property by ramp to the 860 foot level.<br />

(f)<br />

Minago<br />

The Minago project consists of two mining leases, ML-002 (247.23 ha) and ML-003 (176.85 ha), and ten mineral<br />

claims encompassing 1,324 ha. The project is 100% owned by the Company. During 2005 <strong>Nuinsco</strong> conducted<br />

significant data verification and validation program that included drilling a series of five holes collared to support<br />

and confirm the historic drill hole data, resampling of historic drill core and vetting, and correction and digitization<br />

of historic data. A single drill hole was also collared to assess extensions to the nickel mineralized rock that<br />

comprises the main Nose Deposit which hosts the resource. A 43-101 compliant report and resource estimate was<br />

also completed.<br />

(g)<br />

Prairie Lake<br />

The Prairie Lake property consists of 600 ha of mineral claims. No work was conducted by <strong>Nuinsco</strong> during 2005<br />

and the carrying value of the property was written off. A third party is conducting diamond exploration on this<br />

property under an option agreement.<br />

(h)<br />

Fednor/Halliday<br />

In 2004, the Company and Wallbridge Mining Company <strong>Limited</strong> entered into an option agreement with<br />

Falconbridge/Noranda to explore the Abitibi greenstone belt near Timmins, Ontario. During 2005 <strong>Nuinsco</strong> and<br />

Wallbridge each completed the expenditure of $500,000 required to become vested with 50% of the project (25%<br />

each). A joint venture was formed in October whereby Falconbridge, Wallbridge and <strong>Nuinsco</strong> would fund 50%, 25%<br />

and 25% of expenditures respectively. Although the program has identified the source of a number of geophysical<br />

anomalies, no mineralization of economic significance has been found. As a result, <strong>Nuinsco</strong> has elected to not<br />

participate in the ongoing program and is accepting dilution on those portions of the project on which work has<br />

been conducted. The carrying value of $537,000 was written off in 2005.<br />

(i)<br />

Other<br />

Other properties include Muriel Lake which consists of seven contiguous claims comprising 825 ha. During 2005<br />

a program of line cutting and ground geophysics was conducted over a portion of the property. The claims<br />

encompass base metal showings with copper and zinc mineralization. Late in 2004, a ground geophysics survey<br />

identified anomalous trends. Some of these were investigated during 2005 with a prospecting and sampling<br />

program. More work is required to complete the assessment of the property.<br />

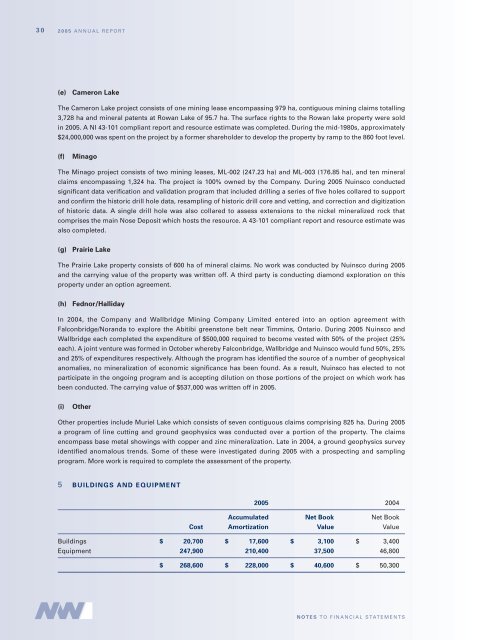

5 BUILDINGS AND EQUIPMENT<br />

2005 2004<br />

Accumulated Net Book Net Book<br />

Cost Amortization Value Value<br />

Buildings $ 20,700 $ 17,600 $ 3,100 $ 3,400<br />

Equipment 247,900 210,400 37,500 46,800<br />

$ 268,600 $ 228,000 $ 40,600 $ 50,300<br />

NOTES TO FINANCIAL STATEMENTS