Annual Report 2008-2009 - Gammon India

Annual Report 2008-2009 - Gammon India

Annual Report 2008-2009 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>-<strong>2009</strong><br />

8.<br />

Unit Credit Method.<br />

Actuarial gains/losses are immediately taken to Profit and Loss Account and are not deferred.<br />

Fixed Assets and Depreciation:<br />

Fixed Assets are valued and stated at cost of acquisition less accumulated depreciation thereon. Revalued<br />

assets are stated at the revalued amount. Cost comprises the purchase price and any attributable cost of<br />

bringing the asset to its working condition of its intended use.<br />

Depreciation for the accounting period is provided on:<br />

(a) Straight Line Method, for assets purchased after 2-4-1987, at the rates and in the manner specified in<br />

Schedule XIV to the Companies Act, 1956<br />

(b) Written Down Value Method, for assets acquired on or prior to 2-4-1987, at the rates as specified in Schedule<br />

XIV to the Companies Act, 1956.<br />

(c) Depreciation on revalued component of the assets is withdrawn from the Revaluation Reserve.<br />

(d) The depreciation on assets used for construction has been treated as period cost.<br />

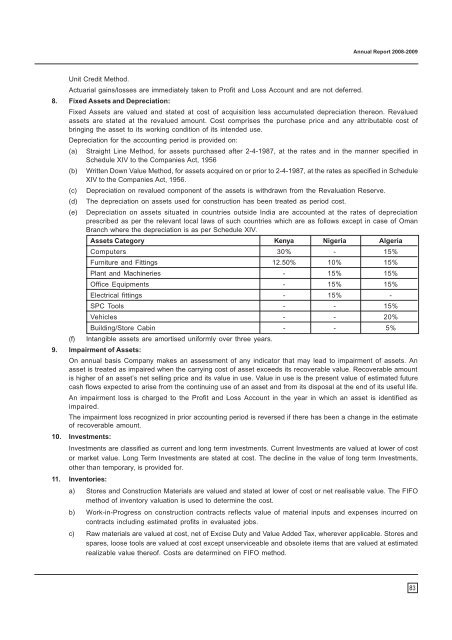

(e) Depreciation on assets situated in countries outside <strong>India</strong> are accounted at the rates of depreciation<br />

prescribed as per the relevant local laws of such countries which are as follows except in case of Oman<br />

Branch where the depreciation is as per Schedule XIV.<br />

Assets Category Kenya Nigeria Algeria<br />

Computers 30% - 15%<br />

Furniture and Fittings 12.50% 10% 15%<br />

Plant and Machineries - 15% 15%<br />

Office Equipments - 15% 15%<br />

Electrical fittings - 15% -<br />

SPC Tools - - 15%<br />

Vehicles - - 20%<br />

Building/Store Cabin - - 5%<br />

(f) Intangible assets are amortised uniformly over three years.<br />

9. Impairment of Assets:<br />

On annual basis Company makes an assessment of any indicator that may lead to impairment of assets. An<br />

asset is treated as impaired when the carrying cost of asset exceeds its recoverable value. Recoverable amount<br />

is higher of an asset’s net selling price and its value in use. Value in use is the present value of estimated future<br />

cash flows expected to arise from the continuing use of an asset and from its disposal at the end of its useful life.<br />

An impairment loss is charged to the Profit and Loss Account in the year in which an asset is identified as<br />

impaired.<br />

The impairment loss recognized in prior accounting period is reversed if there has been a change in the estimate<br />

of recoverable amount.<br />

10. Investments:<br />

Investments are classified as current and long term investments. Current Investments are valued at lower of cost<br />

or market value. Long Term Investments are stated at cost. The decline in the value of long term Investments,<br />

other than temporary, is provided for.<br />

11. Inventories:<br />

a) Stores and Construction Materials are valued and stated at lower of cost or net realisable value. The FIFO<br />

method of inventory valuation is used to determine the cost.<br />

b) Work-in-Progress on construction contracts reflects value of material inputs and expenses incurred on<br />

contracts including estimated profits in evaluated jobs.<br />

c) Raw materials are valued at cost, net of Excise Duty and Value Added Tax, wherever applicable. Stores and<br />

spares, loose tools are valued at cost except unserviceable and obsolete items that are valued at estimated<br />

realizable value thereof. Costs are determined on FIFO method.<br />

83