Annual Report 2008-2009 - Gammon India

Annual Report 2008-2009 - Gammon India

Annual Report 2008-2009 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>-<strong>2009</strong><br />

10.80% - Redeemable Non Convertible Debentures of Rs. 100 Crores are secured by hypothecation of specific<br />

Plant & Machinery with pari passu charge by mortgage of immovable property in Gujarat with 9.95 % Secured<br />

Redeemable Non-Convertible Debentures of Rs. 50 Crores and 8.75% Secured Redeemable Non-Convertible<br />

Debentures of Rs. 5 Crores and 7.50% Secured Non-convertible Debenture of Rs. 53 Crores and 7.25% Secured<br />

Non convertible Debenture of Rs. 18 Crores. The Debentures are due for repayment at the end of 5th , 6th and 7th year<br />

from the date of allotment being, 25th 3.<br />

July, <strong>2008</strong>.<br />

Issued Share Capital includes 725,800 shares of Rs. 2/- each kept in abeyance.<br />

4. Share Forfeited account includes Rs. 0.26 Crores of Securities Premium collected on application in respect of<br />

forfeited shares.<br />

5. As per the intimation available with the Company, there are no Micro, Small and Medium Enterprises, as defined in<br />

the Micro, Small, Medium Enterprises Development Act, 2006, to whom the Company owes dues on account of<br />

principal amount together with interest and accordingly no additional disclosures have been made.<br />

The above information regarding Micro, Small and Medium Enterprises have been determined to the extent such<br />

parties have been identified on the basis of information available with the Company. This has been relied upon by<br />

the Auditors.<br />

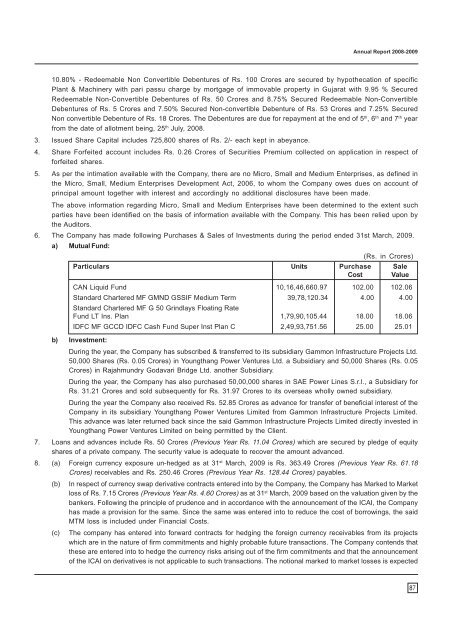

6. The Company has made following Purchases & Sales of Investments during the period ended 31st March, <strong>2009</strong>.<br />

a) Mutual Fund:<br />

(Rs. in Crores)<br />

Particulars Units Purchase Sale<br />

Cost Value<br />

CAN Liquid Fund 10,16,46,660.97 102.00 102.06<br />

Standard Chartered MF GMND GSSIF Medium Term<br />

Standard Chartered MF G 50 Grindlays Floating Rate<br />

39,78,120.34 4.00 4.00<br />

Fund LT Ins. Plan 1,79,90,105.44 18.00 18.06<br />

IDFC MF GCCD IDFC Cash Fund Super Inst Plan C 2,49,93,751.56 25.00 25.01<br />

b) Investment:<br />

During the year, the Company has subscribed & transferred to its subsidiary <strong>Gammon</strong> Infrastructure Projects Ltd.<br />

50,000 Shares (Rs. 0.05 Crores) in Youngthang Power Ventures Ltd. a Subsidiary and 50,000 Shares (Rs. 0.05<br />

Crores) in Rajahmundry Godavari Bridge Ltd. another Subsidiary.<br />

During the year, the Company has also purchased 50,00,000 shares in SAE Power Lines S.r.l., a Subsidiary for<br />

Rs. 31.21 Crores and sold subsequently for Rs. 31.97 Crores to its overseas wholly owned subsidiary.<br />

During the year the Company also received Rs. 52.85 Crores as advance for transfer of beneficial interest of the<br />

Company in its subsidiary Youngthang Power Ventures Limited from <strong>Gammon</strong> Infrastructure Projects Limited.<br />

This advance was later returned back since the said <strong>Gammon</strong> Infrastructure Projects Limited directly invested in<br />

Youngthang Power Ventures Limited on being permitted by the Client.<br />

7. Loans and advances include Rs. 50 Crores (Previous Year Rs. 11.04 Crores) which are secured by pledge of equity<br />

shares of a private company. The security value is adequate to recover the amount advanced.<br />

8. (a) Foreign currency exposure un-hedged as at 31 st March, <strong>2009</strong> is Rs. 363.49 Crores (Previous Year Rs. 61.18<br />

Crores) receivables and Rs. 250.46 Crores (Previous Year Rs. 128.44 Crores) payables.<br />

(b) In respect of currency swap derivative contracts entered into by the Company, the Company has Marked to Market<br />

loss of Rs. 7.15 Crores (Previous Year Rs. 4.60 Crores) as at 31st March, <strong>2009</strong> based on the valuation given by the<br />

bankers. Following the principle of prudence and in accordance with the announcement of the ICAI, the Company<br />

has made a provision for the same. Since the same was entered into to reduce the cost of borrowings, the said<br />

MTM loss is included under Financial Costs.<br />

(c) The company has entered into forward contracts for hedging the foreign currency receivables from its projects<br />

which are in the nature of firm commitments and highly probable future transactions. The Company contends that<br />

these are entered into to hedge the currency risks arising out of the firm commitments and that the announcement<br />

of the ICAI on derivatives is not applicable to such transactions. The notional marked to market losses is expected<br />

87