PRSI contribution rates and user guide from 1 January ... - Welfare.ie

PRSI contribution rates and user guide from 1 January ... - Welfare.ie

PRSI contribution rates and user guide from 1 January ... - Welfare.ie

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

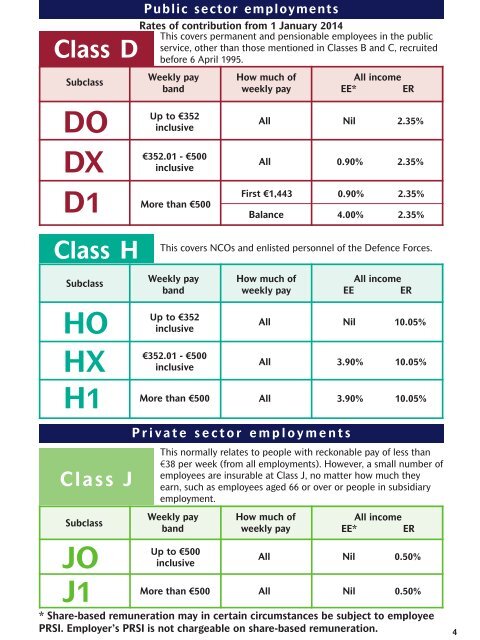

Class D<br />

Subclass<br />

Public sector employments<br />

Rates of <strong>contribution</strong> <strong>from</strong> 1 <strong>January</strong> 2014<br />

This covers permanent <strong>and</strong> pensionable employees in the public<br />

service, other than those mentioned in Classes B <strong>and</strong> C, recruited<br />

before 6 April 1995.<br />

Weekly pay<br />

b<strong>and</strong><br />

How much of<br />

weekly pay<br />

All income<br />

EE* ER<br />

DO<br />

DX<br />

D1<br />

Up to €352<br />

inclusive<br />

€352.01 - €500<br />

inclusive<br />

More than €500<br />

All Nil 2.35%<br />

All 0.90% 2.35%<br />

First €1,443 0.90% 2.35%<br />

Balance 4.00% 2.35%<br />

Class H<br />

This covers NCOs <strong>and</strong> enlisted personnel of the Defence Forces.<br />

Subclass<br />

Weekly pay<br />

b<strong>and</strong><br />

How much of<br />

weekly pay<br />

All income<br />

EE ER<br />

HO<br />

HX<br />

H1<br />

Up to €352<br />

inclusive<br />

€352.01 - €500<br />

inclusive<br />

More than €500<br />

All Nil 10.05%<br />

All 3.90% 10.05%<br />

All 3.90% 10.05%<br />

Class J<br />

Subclass<br />

JO<br />

J1<br />

P r i v a t e s e c t o r e m p l o y m e n t s<br />

This normally relates to people with reckonable pay of less than<br />

€38 per week (<strong>from</strong> all employments). However, a small number of<br />

employees are insurable at Class J, no matter how much they<br />

earn, such as employees aged 66 or over or people in subsidiary<br />

employment.<br />

Weekly pay<br />

b<strong>and</strong><br />

Up to €500<br />

inclusive<br />

How much of<br />

weekly pay<br />

All income<br />

EE* ER<br />

All Nil 0.50%<br />

More than €500 All Nil 0.50%<br />

* Share-based remuneration may in certain circumstances be subject to employee<br />

<strong>PRSI</strong>. Employer’s <strong>PRSI</strong> is not chargeable on share-based remuneration.<br />

4