Download detailed information on the core and elective modules for ...

Download detailed information on the core and elective modules for ...

Download detailed information on the core and elective modules for ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

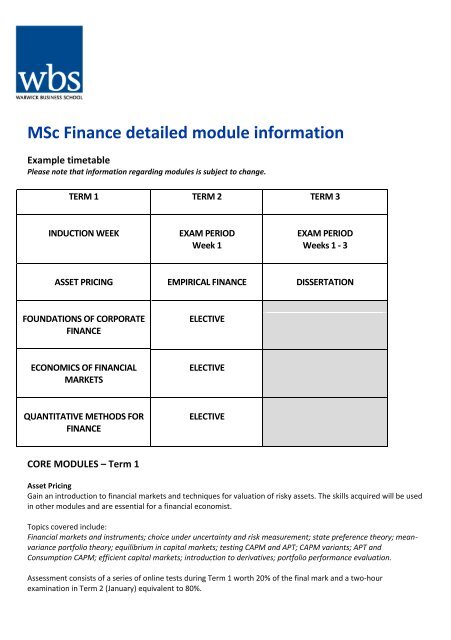

MSc Finance <str<strong>on</strong>g>detailed</str<strong>on</strong>g> module <str<strong>on</strong>g>in<strong>for</strong>mati<strong>on</strong></str<strong>on</strong>g><br />

Example timetable<br />

Please note that <str<strong>on</strong>g>in<strong>for</strong>mati<strong>on</strong></str<strong>on</strong>g> regarding <strong>modules</strong> is subject to change.<br />

TERM 1 TERM 2 TERM 3<br />

INDUCTION WEEK<br />

EXAM PERIOD<br />

Week 1<br />

EXAM PERIOD<br />

Weeks 1 - 3<br />

ASSET PRICING EMPIRICAL FINANCE DISSERTATION<br />

FOUNDATIONS OF CORPORATE<br />

FINANCE<br />

ELECTIVE<br />

ECONOMICS OF FINANCIAL<br />

MARKETS<br />

ELECTIVE<br />

QUANTITATIVE METHODS FOR<br />

FINANCE<br />

ELECTIVE<br />

CORE MODULES – Term 1<br />

Asset Pricing<br />

Gain an introducti<strong>on</strong> to financial markets <strong>and</strong> techniques <strong>for</strong> valuati<strong>on</strong> of risky assets. The skills acquired will be used<br />

in o<strong>the</strong>r <strong>modules</strong> <strong>and</strong> are essential <strong>for</strong> a financial ec<strong>on</strong>omist.<br />

Topics covered include:<br />

Financial markets <strong>and</strong> instruments; choice under uncertainty <strong>and</strong> risk measurement; state preference <strong>the</strong>ory; meanvariance<br />

portfolio <strong>the</strong>ory; equilibrium in capital markets; testing CAPM <strong>and</strong> APT; CAPM variants; APT <strong>and</strong><br />

C<strong>on</strong>sumpti<strong>on</strong> CAPM; efficient capital markets; introducti<strong>on</strong> to derivatives; portfolio per<strong>for</strong>mance evaluati<strong>on</strong>.<br />

Assessment c<strong>on</strong>sists of a series of <strong>on</strong>line tests during Term 1 worth 20% of <strong>the</strong> final mark <strong>and</strong> a two-hour<br />

examinati<strong>on</strong> in Term 2 (January) equivalent to 80%.

Foundati<strong>on</strong>s of Corporate Finance<br />

Undertake in-depth analysis of <strong>the</strong> key determinants of <strong>the</strong> investment <strong>and</strong> financing decisi<strong>on</strong>s of <strong>the</strong> firm.<br />

Topics covered include:<br />

Capital budgeting; capital structure; dividend policy; mergers <strong>and</strong> takeovers.<br />

Assessment c<strong>on</strong>sists of a module test in Week 11 of Term 1 worth 20% of <strong>the</strong> final mark, <strong>and</strong> a two-hour<br />

examinati<strong>on</strong> in <strong>the</strong> first week of Term 2 (January) equivalent to 80%.<br />

Ec<strong>on</strong>omics of Financial Markets<br />

Learn <strong>the</strong> basic tools of ec<strong>on</strong>omic analysis, <strong>and</strong> gain an underst<strong>and</strong>ing of policy issues relevant to financial markets<br />

<strong>and</strong> <strong>the</strong> ec<strong>on</strong>omic c<strong>on</strong>text within which <strong>the</strong>y operate. Study <strong>the</strong> basic tools of microec<strong>on</strong>omic analysis <strong>and</strong> modern<br />

macroec<strong>on</strong>omic <strong>the</strong>ory.<br />

Topics covered include:<br />

C<strong>on</strong>sumpti<strong>on</strong> <strong>and</strong> producti<strong>on</strong> <strong>the</strong>ory <strong>and</strong> general equilibrium; strategic interacti<strong>on</strong>; asymmetric <str<strong>on</strong>g>in<strong>for</strong>mati<strong>on</strong></str<strong>on</strong>g> <strong>and</strong><br />

agency problems; The ISLM model; m<strong>on</strong>etary <strong>and</strong> fiscal policy; credibility <strong>and</strong> <strong>the</strong> role of expectati<strong>on</strong>s; The Yield<br />

Curve <strong>and</strong> <strong>the</strong> stock market; Dynamic ISLM.<br />

Assessment c<strong>on</strong>sists of a module test in Week 11 of Term 1 worth 20% of <strong>the</strong> final mark <strong>and</strong> a two-hour examinati<strong>on</strong><br />

in <strong>the</strong> first week of Term 2 (January) equivalent to 80%.<br />

Quantitative Methods <strong>for</strong> Finance<br />

Explore <strong>the</strong> basic tools <strong>for</strong> quantitative analysis of <strong>the</strong> financial markets <strong>and</strong> learn <strong>the</strong> quantitative skills you will<br />

need <strong>for</strong> o<strong>the</strong>r <strong>modules</strong> such as, <strong>for</strong> instance, Asset Pricing <strong>and</strong> most importantly, Empirical Finance. The first two<br />

lectures of <strong>the</strong> module are an introducti<strong>on</strong> to statistics. The remaining lectures cover <strong>the</strong> material corresp<strong>on</strong>ding to a<br />

sound introducti<strong>on</strong> to ec<strong>on</strong>ometrics.<br />

Topics covered include:<br />

Statistics: sampling, sampling distributi<strong>on</strong>s, point estimati<strong>on</strong>, c<strong>on</strong>fidence intervals, hypo<strong>the</strong>sis testing; linear<br />

regressi<strong>on</strong> model, estimati<strong>on</strong> <strong>and</strong> inference; departures from <strong>the</strong> classical linear model assumpti<strong>on</strong>s:<br />

multicollinearity, heteroscedasticity, autocorrelati<strong>on</strong>; model specificati<strong>on</strong> <strong>and</strong> diagnostic testing; introducti<strong>on</strong> to time<br />

series ec<strong>on</strong>ometrics. ARMA models; trends <strong>and</strong> cointegrati<strong>on</strong> analysis.<br />

Assessment c<strong>on</strong>sists of a module test in Week 11 of Term 1 worth 20% of <strong>the</strong> final mark <strong>and</strong> a two-hour examinati<strong>on</strong><br />

in <strong>the</strong> first week of Term 2 (January) equivalent to 80%.<br />

CORE MODULE – Term 2<br />

Empirical Finance<br />

Gain an underst<strong>and</strong>ing of <strong>the</strong> <strong>the</strong>ory <strong>and</strong> practice of financial ec<strong>on</strong>ometrics with lectures covering <strong>the</strong>ory as well as<br />

empirical applicati<strong>on</strong>s. Your practical skills will be fur<strong>the</strong>r developed in computer-lab based seminars.<br />

Topics covered include:<br />

Introducti<strong>on</strong> to <strong>the</strong> statistical framework <strong>for</strong> empirical modelling of financial time series; stati<strong>on</strong>ary processes; of n<strong>on</strong>stati<strong>on</strong>ary<br />

processes; n<strong>on</strong>-linear models, including models of time varying risk, with applicati<strong>on</strong>s in risk management.<br />

Applicati<strong>on</strong>s will include <strong>the</strong> empirical testing of asset pricing models such as CAPM, portfolio allocati<strong>on</strong>, <strong>for</strong>ecasting,<br />

yield curve modelling <strong>and</strong> n<strong>on</strong>linear adjustment in <strong>for</strong>eign exchange markets; Efficient Market Hypo<strong>the</strong>sis (EMH).<br />

Assessment c<strong>on</strong>sists of two module tests worth 20% each, <strong>on</strong>e group project worth 20%, <strong>and</strong> a <strong>on</strong>e-hour exam in<br />

Term 3 (April/May) worth 40%.<br />

ELECTIVE MODULES Term 2<br />

You will choose three <strong>elective</strong> <strong>modules</strong> from <strong>the</strong> <strong>modules</strong> listed below. This is an indicative list <strong>on</strong>ly; fur<strong>the</strong>r<br />

<str<strong>on</strong>g>in<strong>for</strong>mati<strong>on</strong></str<strong>on</strong>g> <strong>and</strong> c<strong>on</strong>firmati<strong>on</strong> of <strong>the</strong> available <strong>elective</strong>s is provided at <strong>the</strong> end of Term 1.

Advanced Corporate Finance<br />

Explore <strong>the</strong> basic issues in mergers <strong>and</strong> acquisiti<strong>on</strong>s (M&As) <strong>and</strong> undertake in-depth analysis of <strong>the</strong> key determinants<br />

of M&A activities of firms around <strong>the</strong> world. C<strong>on</strong>sider <strong>the</strong> wider issues of agency problems <strong>and</strong> corporate<br />

governance that are associated with M&A activities.<br />

Topics covered include:<br />

Value creati<strong>on</strong> in takeovers; abnormal returns; merger waves; private equity; merger arbitrage; takeover defenses;<br />

costs <strong>and</strong> benefits of c<strong>on</strong>centrated ownership; modeling <strong>the</strong> takeover process.<br />

Assessment c<strong>on</strong>sists of coursework worth 40% of <strong>the</strong> final mark <strong>and</strong> a 1 ½ hour examinati<strong>on</strong> in Term 3 (April/May)<br />

equivalent to 60%.<br />

Behavioural Finance<br />

Psychologists working in <strong>the</strong> area of behavioural decisi<strong>on</strong>-making have produced much evidence against <strong>the</strong><br />

adequacy of neoclassical ec<strong>on</strong>omics. Behavioural finance comprises financial analysis which relaxes some of <strong>the</strong>se<br />

assumpti<strong>on</strong>s. It is a paradigm where financial markets are studied using models that are less narrow than those<br />

based <strong>on</strong> v<strong>on</strong> Neumann-Morgenstern expected utility <strong>the</strong>ory <strong>and</strong> arbitrage assumpti<strong>on</strong>s.<br />

Topics covered include:<br />

Market Efficiency; Prospect <strong>the</strong>ory; Loss aversi<strong>on</strong>; <strong>the</strong> impact of Knightian uncertainty; limits to arbitrage;<br />

overc<strong>on</strong>fidence in financial markets; herding <strong>and</strong> asset bubbles; paradoxes <strong>and</strong> anomalies; <strong>the</strong> dispositi<strong>on</strong> effect;<br />

investor sentiments.<br />

Assessment c<strong>on</strong>sists of a two-hour examinati<strong>on</strong> in Term 3 (April/May) equivalent to 70% of <strong>the</strong> final mark <strong>and</strong><br />

coursework worth 30%.<br />

Derivative Securities<br />

Explore <strong>the</strong> rich variety of derivative c<strong>on</strong>tracts that exist, <strong>the</strong> ways in which <strong>the</strong>y may be used <strong>and</strong> <strong>the</strong> models that<br />

can be used to determine <strong>the</strong>ir prices. Although <strong>the</strong> module covers both <strong>the</strong>ory <strong>and</strong> applicati<strong>on</strong>, it does not require<br />

a particularly high level of ma<strong>the</strong>matics. Much of <strong>the</strong> development <strong>for</strong> opti<strong>on</strong>s pricing is based <strong>on</strong> binomial trees.<br />

The module has relevance both <strong>for</strong> potential users of derivatives <strong>and</strong> <strong>for</strong> those who need to underst<strong>and</strong> risk<br />

management using derivatives.<br />

Topics covered include:<br />

Arbitrage <strong>and</strong> futures prices; bounds <strong>on</strong> opti<strong>on</strong> prices; binomial models <strong>for</strong> opti<strong>on</strong>s; Black/Scholes model <strong>for</strong> opti<strong>on</strong>s<br />

<strong>and</strong> its applicati<strong>on</strong>s; hedging with futures <strong>and</strong> opti<strong>on</strong>s; stock-index opti<strong>on</strong>s <strong>and</strong> portfolio insurance; interest-rate<br />

futures <strong>and</strong> swaps; warrants <strong>and</strong> c<strong>on</strong>vertibles; exotic opti<strong>on</strong>s.<br />

Assessment c<strong>on</strong>sists of a module test worth 20% of <strong>the</strong> final mark <strong>and</strong> a two-hour examinati<strong>on</strong> in Term 3 (April/May)<br />

equivalent to 80%.<br />

Financial Engineering <strong>and</strong> Structured Products<br />

Examine recent developments in financial engineering <strong>and</strong> structuring <strong>and</strong> apply your learning to real world<br />

problems <strong>and</strong> situati<strong>on</strong>s. Deepen your knowledge of particular areas that are at <strong>the</strong> <strong>for</strong>efr<strong>on</strong>t of academic research<br />

in derivative markets. As this is a highly quantitative module an advanced level of ma<strong>the</strong>matics is required; it is<br />

particularly suitable if you have an undergraduate degree in ma<strong>the</strong>matics.<br />

Topics covered may include:<br />

Modelling of volatility <strong>and</strong> correlati<strong>on</strong> <strong>and</strong> derivative products based up<strong>on</strong> <strong>the</strong>m; <strong>the</strong> pricing of derivatives <strong>on</strong><br />

commodities <strong>and</strong> o<strong>the</strong>r n<strong>on</strong>-financial underlying variables; <strong>the</strong> pricing <strong>and</strong> hedging of exotic opti<strong>on</strong>s; study of a P<strong>on</strong>zi<br />

scheme; client c<strong>on</strong>flicts in designing a collateralised debt obligati<strong>on</strong>.<br />

Assessment c<strong>on</strong>sists solely of a 3,000 word project.<br />

Financial Reporting <strong>and</strong> Financial Statement Analysis

C<strong>on</strong>sider a framework <strong>for</strong> evaluating <strong>the</strong> financial per<strong>for</strong>mance of a company, <strong>for</strong>ecasting its future per<strong>for</strong>mance <strong>and</strong><br />

estimating its fundamental value. C<strong>on</strong>sider <strong>the</strong> relative usefulness of cash flow <strong>and</strong> profit data <strong>for</strong> assessing financial<br />

per<strong>for</strong>mance <strong>and</strong> <strong>the</strong> use of ratio analysis <strong>for</strong> evaluating past per<strong>for</strong>mance <strong>and</strong> <strong>for</strong>ecasting future financial<br />

per<strong>for</strong>mance.<br />

Topics covered include:<br />

Financial statements <strong>and</strong> <strong>the</strong>ir use in financial analysis; financial reporting <strong>and</strong> IFRS; re<strong>for</strong>mulati<strong>on</strong> of financial<br />

statements; ratio analysis <strong>and</strong> <strong>for</strong>ecasting financial per<strong>for</strong>mance; cash flow <strong>and</strong> accounting valuati<strong>on</strong> models;<br />

valuati<strong>on</strong> <strong>the</strong>ory in practice; financial statement analysis; market efficiency <strong>and</strong> earnings management; issues <strong>and</strong><br />

developments in financial reporting <strong>and</strong> statement analysis; corporate governance <strong>and</strong> management<br />

communicati<strong>on</strong>, financial statement quality <strong>and</strong> <strong>the</strong> cost of capital.<br />

Assessment c<strong>on</strong>sists of an individual project worth 80% of <strong>the</strong> final mark <strong>and</strong> a group presentati<strong>on</strong> worth 20%.<br />

Financial Risk Management<br />

Examine financial risk management <strong>and</strong> <strong>the</strong> techniques to assess financial risks according to <strong>the</strong> regulatory<br />

framework, having <strong>the</strong> management of risk exposure in view. Learn <strong>the</strong> quantitative methods of risk measurement<br />

<strong>and</strong> risk management.<br />

Topics covered include:<br />

How to identify financial risks; coherent risk measures; models <strong>for</strong> uncertainty; numerical tools – M<strong>on</strong>te Carlo<br />

simulati<strong>on</strong>; approximati<strong>on</strong>s <strong>and</strong> factor reducti<strong>on</strong>; Bayesian uncertainty – parameter risk; The regulatory framework<br />

of financial risk management.<br />

Assessment c<strong>on</strong>sists of a module test during Term 2 worth 20% of <strong>the</strong> final mark <strong>and</strong> a two-hour examinati<strong>on</strong> in<br />

Term 3 (April/May) equivalent to 80%.<br />

Fixed Income <strong>and</strong> Credit Risk<br />

Explore <strong>the</strong> tools <strong>for</strong> <strong>the</strong> assessment <strong>and</strong> management of fixed income <strong>and</strong> credit risk.<br />

Topics covered include:<br />

B<strong>on</strong>ds <strong>and</strong> M<strong>on</strong>ey-Market Instruments; B<strong>on</strong>d Prices <strong>and</strong> Yields; term structure of interest rates; Martingale pricing;<br />

c<strong>on</strong>tinuous-time stochastic processes; affine term structure models; credit risk management; structural <strong>and</strong> intensitybased<br />

credit risk modelling; credit derivatives.<br />

Assessment c<strong>on</strong>sists of a module test <strong>and</strong> a group project each worth worth 10% of <strong>the</strong> finak mark, <strong>and</strong> a a two-hour<br />

examinati<strong>on</strong> in Term 3 (April/May) worth 80%.<br />

Internati<strong>on</strong>al Financial Markets<br />

C<strong>on</strong>sider of <strong>the</strong> <strong>the</strong>ory <strong>and</strong> evidence relating to internati<strong>on</strong>al financial markets, <strong>and</strong> in particular <strong>the</strong> <strong>for</strong>eign<br />

exchange market.<br />

Topics covered include:<br />

Efficiency of <strong>the</strong> Foreign Exchange (Forex) Market; Purchasing Power Parity <strong>and</strong> <strong>the</strong> Real Exchange Rate; Exchange<br />

Rate Determinati<strong>on</strong>; Forecasting Exchange Rates; Exchange Rate Models <strong>and</strong> Ec<strong>on</strong>omic Value; Official Interventi<strong>on</strong> in<br />

<strong>the</strong> Forex Market; The Microstructure of <strong>the</strong> Forex Market; Active Management of Forex Portfolios.<br />

Assessment c<strong>on</strong>sists of a module test during Term 2 worth 20%. Of <strong>the</strong> final mark <strong>and</strong> a two-hour examinati<strong>on</strong> in<br />

Term 3 (April/May) equivalent to 80%.<br />

Internati<strong>on</strong>al Financial Management<br />

Explore corporate financial decisi<strong>on</strong>-making within <strong>the</strong> c<strong>on</strong>text of <strong>the</strong> increasing globalisati<strong>on</strong> of business, exchangerate<br />

volatility, <strong>and</strong> <strong>the</strong> internati<strong>on</strong>alisati<strong>on</strong> of financial markets. Extend your underst<strong>and</strong>ing of <strong>the</strong> <strong>the</strong>ory of<br />

corporate financial management, covered in <strong>the</strong> Foundati<strong>on</strong>s of Corporate Finance <strong>core</strong> module, to an internati<strong>on</strong>al<br />

setting.<br />

Topics covered include:

Forward Exchange Rates; Forward C<strong>on</strong>tracts <strong>for</strong> Internati<strong>on</strong>al Financial Management; Currency Futures: Markets <strong>and</strong><br />

Uses; Swap Markets; Currency Opti<strong>on</strong>s; Exchange Rate Risk; Internati<strong>on</strong>al Corporate Investment.<br />

Assessment c<strong>on</strong>sists of a group project during Term 2 worth 20% of <strong>the</strong> final mark, <strong>and</strong> an examinati<strong>on</strong> in Term 3<br />

(April/May) equivalent to 80%.<br />

Investment Management<br />

C<strong>on</strong>sider <strong>the</strong> <strong>the</strong>oretical <strong>and</strong> practical treatment of modern portfolio <strong>the</strong>ory <strong>and</strong> portfolio management, mainly from<br />

an equity market perspective.<br />

Topics covered include:<br />

Review of financial instruments <strong>and</strong> financial markets; internati<strong>on</strong>al diversificati<strong>on</strong>; passive asset allocati<strong>on</strong>;<br />

per<strong>for</strong>mance measurement; equities; active portfolio management; b<strong>on</strong>ds; <strong>for</strong>wards <strong>and</strong> futures; opti<strong>on</strong>s.<br />

Assessment c<strong>on</strong>sists of a group project worth 25% of <strong>the</strong> final mark <strong>and</strong> a two-hour examinati<strong>on</strong> in Term 3<br />

(April/May) worth 75%.<br />

Judgement <strong>and</strong> Decisi<strong>on</strong> Making<br />

Gain an introducti<strong>on</strong> to <strong>the</strong> psychology of human judgement <strong>and</strong> decisi<strong>on</strong> making. This field provides <strong>the</strong> foundati<strong>on</strong><br />

<strong>for</strong> underst<strong>and</strong>ing <strong>the</strong> decisi<strong>on</strong>-making processes involved in financial markets. Explore how <strong>the</strong> insights from this<br />

work can help you underst<strong>and</strong> <strong>the</strong> origins of rati<strong>on</strong>al <strong>and</strong> irrati<strong>on</strong>ality in financial decisi<strong>on</strong> makers <strong>and</strong> financial<br />

markets; help improve your own financial decisi<strong>on</strong>-making, judgements <strong>and</strong> predicti<strong>on</strong>s; <strong>and</strong> provide a broader<br />

underst<strong>and</strong>ing of decisi<strong>on</strong>-making throughout <strong>the</strong> finance industry, including strategic <strong>and</strong> managerial decisi<strong>on</strong>making.<br />

Topics covered include:<br />

The nature of rati<strong>on</strong>ality; <strong>the</strong>oretical perspective <strong>on</strong> human judgement; <strong>the</strong> psychology of value <strong>and</strong> utility; decisi<strong>on</strong><br />

making under certainty; decisi<strong>on</strong> making under risk; judgement; c<strong>on</strong>fidence <strong>and</strong> expertise; decisi<strong>on</strong> making in<br />

markets, groups <strong>and</strong> society.<br />

Assessment will be by means of a 3,000 word essay worth 80% of <strong>the</strong> final mark <strong>and</strong> a group seminar presentati<strong>on</strong><br />

<strong>for</strong> <strong>the</strong> remaining 20%.