The Energy Issue - School of International and Public Affairs ...

The Energy Issue - School of International and Public Affairs ...

The Energy Issue - School of International and Public Affairs ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

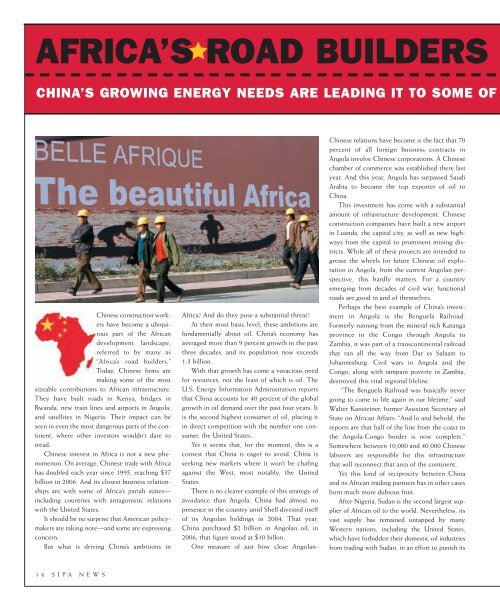

AFRICA’S ROAD BUILDERS<br />

CHINA’S GROWING ENERGY NEEDS ARE LEADING IT TO SOME OF<br />

Chinese construction workers<br />

have become a ubiquitous<br />

part <strong>of</strong> the African<br />

development l<strong>and</strong>scape,<br />

referred to by many as<br />

“Africa’s road builders.”<br />

Today, Chinese firms are<br />

making some <strong>of</strong> the most<br />

sizeable contributions to African infrastructure.<br />

<strong>The</strong>y have built roads in Kenya, bridges in<br />

Rw<strong>and</strong>a, new train lines <strong>and</strong> airports in Angola,<br />

<strong>and</strong> satellites in Nigeria. <strong>The</strong>ir impact can be<br />

seen in even the most dangerous parts <strong>of</strong> the continent,<br />

where other investors wouldn’t dare to<br />

tread.<br />

Chinese interest in Africa is not a new phenomenon.<br />

On average, Chinese trade with Africa<br />

has doubled each year since 1995, reaching $37<br />

billion in 2006. And its closest business relationships<br />

are with some <strong>of</strong> Africa’s pariah states—<br />

including countries with antagonistic relations<br />

with the United States.<br />

It should be no surprise that American policymakers<br />

are taking note—<strong>and</strong> some are expressing<br />

concern.<br />

But what is driving China’s ambitions in<br />

Africa? And do they pose a substantial threat?<br />

At their most basic level, these ambitions are<br />

fundamentally about oil. China’s economy has<br />

averaged more than 9 percent growth in the past<br />

three decades, <strong>and</strong> its population now exceeds<br />

1.3 billion.<br />

With that growth has come a voracious need<br />

for resources, not the least <strong>of</strong> which is oil. <strong>The</strong><br />

U.S. <strong>Energy</strong> Information Administration reports<br />

that China accounts for 40 percent <strong>of</strong> the global<br />

growth in oil dem<strong>and</strong> over the past four years. It<br />

is the second highest consumer <strong>of</strong> oil, placing it<br />

in direct competition with the number one consumer,<br />

the United States.<br />

Yet it seems that, for the moment, this is a<br />

contest that China is eager to avoid. China is<br />

seeking new markets where it won’t be chafing<br />

against the West, most notably, the United<br />

States.<br />

<strong>The</strong>re is no clearer example <strong>of</strong> this strategy <strong>of</strong><br />

avoidance than Angola. China had almost no<br />

presence in the country until Shell divested itself<br />

<strong>of</strong> its Angolan holdings in 2004. That year,<br />

China purchased $2 billion in Angolan oil; in<br />

2006, that figure stood at $10 billon.<br />

One measure <strong>of</strong> just how close Angolan-<br />

Chinese relations have become is the fact that 70<br />

percent <strong>of</strong> all foreign business contracts in<br />

Angola involve Chinese corporations. A Chinese<br />

chamber <strong>of</strong> commerce was established there last<br />

year. And this year, Angola has surpassed Saudi<br />

Arabia to become the top exporter <strong>of</strong> oil to<br />

China.<br />

This investment has come with a substantial<br />

amount <strong>of</strong> infrastructure development. Chinese<br />

construction companies have built a new airport<br />

in Lu<strong>and</strong>a, the capital city, as well as new highways<br />

from the capital to prominent mining districts.<br />

While all <strong>of</strong> these projects are intended to<br />

grease the wheels for future Chinese oil exploration<br />

in Angola, from the current Angolan perspective,<br />

this hardly matters. For a country<br />

emerging from decades <strong>of</strong> civil war, functional<br />

roads are good in <strong>and</strong> <strong>of</strong> themselves.<br />

Perhaps the best example <strong>of</strong> China’s investment<br />

in Angola is the Benguela Railroad.<br />

Formerly running from the mineral rich Katanga<br />

province in the Congo through Angola to<br />

Zambia, it was part <strong>of</strong> a transcontinental railroad<br />

that ran all the way from Dar es Salaam to<br />

Johannesburg. Civil wars in Angola <strong>and</strong> the<br />

Congo, along with rampant poverty in Zambia,<br />

destroyed this vital regional lifeline.<br />

“<strong>The</strong> Benguela Railroad was basically never<br />

going to come to life again in our lifetime,” said<br />

Walter Kansteiner, former Assistant Secretary <strong>of</strong><br />

State on African <strong>Affairs</strong>. “And lo <strong>and</strong> behold, the<br />

reports are that half <strong>of</strong> the line from the coast to<br />

the Angola-Congo border is now complete.”<br />

Somewhere between 10,000 <strong>and</strong> 40,000 Chinese<br />

laborers are responsible for this infrastructure<br />

that will reconnect that area <strong>of</strong> the continent.<br />

Yet this kind <strong>of</strong> reciprocity between China<br />

<strong>and</strong> its African trading partners has in other cases<br />

born much more dubious fruit.<br />

After Nigeria, Sudan is the second largest supplier<br />

<strong>of</strong> African oil to the world. Nevertheless, its<br />

vast supply has remained untapped by many<br />

Western nations, including the United States,<br />

which have forbidden their domestic oil industries<br />

from trading with Sudan, in an effort to punish its<br />

16 SIPA NEWS