Far North District Council

Far North District Council

Far North District Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

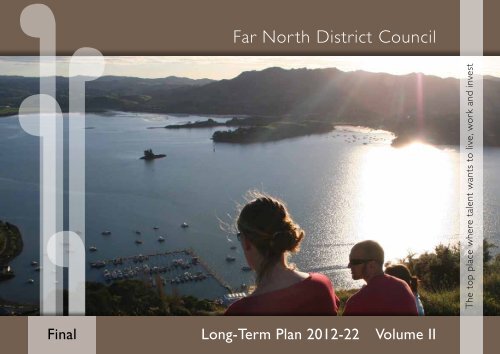

<strong>Far</strong> <strong>North</strong> <strong>District</strong> <strong>Council</strong><br />

The top place where talent wants to live, work and invest<br />

Final<br />

Long-Term Plan 2012-22 Volume II

<strong>Far</strong> <strong>North</strong> <strong>District</strong> <strong>Council</strong><br />

The top place where talent wants to live, work and invest<br />

The top place where talent wants to live, work and invest

Content<br />

Welcome 3<br />

Revenue and Financing Policy 4 - 54<br />

Funding Impact Statement 55 - 87<br />

Remission and Postponement Policies 88 - 125<br />

Development Contributions Policy 126 - 160<br />

Treasury Policies 161 - 183<br />

Statement of Accounting Policies 184 - 195<br />

Policy on Determining Significance 196 - 200<br />

Linkages 201 - 204<br />

Audit Opinion 205 - 207<br />

Representatives 208 - 212<br />

Glossary 213 - 217<br />

Contact Details 218<br />

Long-Term Plan 2012-22<br />

1

<strong>Far</strong> <strong>North</strong> <strong>District</strong> <strong>Council</strong><br />

The top place where talent wants to live, work and invest<br />

The top place where talent wants to live, work and invest

Welcome<br />

Welcome to Volume 2 of the 10 year plan. This volume is largely devoted to the major policies that underpin <strong>Council</strong>’s 10 year plans. It is a requirement of the Local Government Act<br />

2002 (LGA) that <strong>Council</strong> provides you with this information and gives you the opportunity to comment on it as part of the consultation on the Long-Term Plan (LTP). As with other<br />

aspects of the plan <strong>Council</strong> will welcome your feedback on any of the policies or other information set out in Volume 2.<br />

<strong>Council</strong> policies<br />

Here is a brief snapshot of the main policies that impact<br />

on the development of this plan and are included in<br />

more detail later in the volume.<br />

Revenue and financing policy<br />

<strong>Council</strong> has determined the best way of funding its<br />

activities. In doing this it takes account of the factors that<br />

give rise to the need for <strong>Council</strong> expenditure. Based on<br />

that analysis, it has considered who should pay towards<br />

the provision of each activity. The Revenue and Financing<br />

Policy explains the thinking behind this and shows the<br />

split in activity funding between rates, user charges,<br />

government subsidy and other funding sources, like<br />

development contributions.<br />

Funding impact statement<br />

Here you will find the fine detail of the different rates<br />

<strong>Council</strong> has set, along with pages of example rates, to<br />

enable you to see the impact on properties in different<br />

parts of the district.<br />

Remission and postponement policies<br />

<strong>Council</strong> operates a number of separate policies that<br />

provide for either the remission or the postponement of<br />

rates in appropriate circumstances.<br />

Development contributions policy<br />

This Policy has become increasingly important in recent<br />

years as <strong>Council</strong> aims to ensure that growth pays for<br />

growth, i.e. that the infrastructure required to respond<br />

to the growth of the district is appropriately funded by<br />

contributions from the developments that give rise to<br />

the need for that infrastructure. This Policy sets out what<br />

developers will have to pay and explains how each of<br />

the separate contributions – for roads, water, sewerage,<br />

etc. – are calculated.<br />

Treasury policy<br />

This Policy underpins <strong>Council</strong>’s borrowing and investment<br />

activity and includes detail on borrowing limits, interest<br />

rate exposure, and debt management, along with<br />

<strong>Council</strong>’s approach to investment risk management.<br />

Accounting policies<br />

<strong>Council</strong> is required to abide by International Financial<br />

Reporting Standards (IFRS) and the Accounting Policies<br />

explain the approach underlying the financial projections<br />

and forecast financial statements contained in this plan.<br />

Policy on determining significance<br />

The LGA sets specific requirements around significant<br />

decisions or proposals made by <strong>Council</strong> and the way<br />

in which <strong>Council</strong> deals with strategic assets. These<br />

requirements cover issues such as the need for public<br />

consultation before certain decisions are finalised.<br />

<strong>Council</strong>’s Policy on Determining Significance sets out<br />

how it approaches these issues.<br />

Links to other policies and strategies<br />

This LTP also has links with many other policies and<br />

strategies (both <strong>Council</strong> and non <strong>Council</strong>) and Volume<br />

2 includes some information to help you trace these<br />

important links.<br />

Audit opinion<br />

As a requirement of the LGA this LTP has been audited<br />

by Audit New Zealand. Their full opinion can be found in<br />

Volume 2 on page 205.<br />

Long-Term Plan 2012-22<br />

3

Revenue and Financing Policy<br />

Policy overview<br />

The LGA requires all councils to adopt a Revenue and<br />

Financing Policy as part of its Long-Term Plan. This Policy<br />

is used to demonstrate how <strong>Council</strong> proposes to fund<br />

its various operating and capital expenditures, and more<br />

importantly who will pay these and why.<br />

The policy is designed to show who benefits from<br />

different activities, the time period over which these<br />

benefits are expected to occur and whether the actions<br />

or inactions of particular groups have given rise to the<br />

need for the activity. Where an activity is separately<br />

funded, <strong>Council</strong> needs to show the benefits from<br />

maintaining this separate funding.<br />

Lastly, <strong>Council</strong> has to demonstrate that in making its<br />

overall funding decisions it has given consideration to the<br />

impact on the community and in particular the effect on<br />

its current and future wellbeing.<br />

This Policy is set out under the following major headings:<br />

••<br />

Policy statement<br />

••<br />

Legal requirements of the Revenue and Financing<br />

Policy<br />

••<br />

<strong>Council</strong>’s process for applying these legal requirements<br />

••<br />

Overall funding considerations<br />

••<br />

Individual activity analysis.<br />

Philosophy<br />

As discussed in the Financial Strategy, <strong>Council</strong> manages its<br />

financial affairs prudently and in a manner that promotes<br />

the current and future interests of the community. The<br />

aim of this Policy is to describe how <strong>Council</strong> proposes to<br />

fund its activities from the most appropriate source after<br />

considering who benefits from each activity. As a general<br />

rule, operating activities will be funded from operating<br />

revenue and capital expenditures will be funded from<br />

surpluses, borrowings, subsidies and reserves.<br />

<strong>Council</strong> activities will be funded from appropriate sources<br />

of revenue following consideration of:<br />

••<br />

The community outcomes to which the activity<br />

primarily contributes<br />

••<br />

The distribution of benefits between the community<br />

as a whole and any identifiable groups or individuals<br />

within the community<br />

••<br />

The period over which the benefits are expected to<br />

occur<br />

••<br />

The extent to which the actions or inactions of<br />

individuals contribute to the need for the activity<br />

••<br />

The costs and benefits, including consequences for<br />

transparency and accountability, of funding the activity<br />

distinctly from the other activities<br />

••<br />

The overall impacts of any allocation of liability for<br />

revenue needs on the current and future social,<br />

economic, environmental and cultural wellbeing of<br />

the community.<br />

In funding its activities, <strong>Council</strong> may need to borrow<br />

and invest funds and as a result has risks such as inter est<br />

rate changes, liquidity, credit and internal control. <strong>Council</strong>’s<br />

policies in relation to borrowing and the associated<br />

risks are contained in the Liability Management and<br />

Investment Policy, both of which have been adopted by<br />

<strong>Council</strong> and are available for review on <strong>Council</strong>’s website<br />

www.fndc.govt.nz.<br />

Policy statement<br />

Funding of operating expenditure<br />

<strong>Council</strong> funds operating expenditure from the following<br />

sources:<br />

General rates<br />

Targeted rates for:<br />

••<br />

Roading<br />

••<br />

Ward services<br />

••<br />

Kerikeri mainstreet<br />

••<br />

Land drainage and flood protection<br />

••<br />

Water supply<br />

••<br />

Wastewater<br />

••<br />

Stormwater.<br />

Charges for services including fees and charges, and<br />

fines, Interest and dividends from investments, Grants<br />

and subsidies towards operating expenses (grants and<br />

subsidies towards capital expenditure are applied to the<br />

related capital expenditure only).<br />

4<br />

The top place where talent wants to live, work and invest

Other operating revenue, including:<br />

••<br />

Petrol tax<br />

••<br />

Property rentals<br />

••<br />

Other income.<br />

Balanced budget statement<br />

Section 100 of the LGA requires that <strong>Council</strong>’s projected<br />

operating revenues match its projected operating<br />

expenditures.<br />

Despite this, <strong>Council</strong> may choose not to fully fund<br />

operating expenditure in any particular year if <strong>Council</strong><br />

can show that it is financially prudent to do so and where<br />

the deficit can be funded from operating surpluses in<br />

the immediately preceding or subsequent years. An<br />

operating deficit will only be budgeted when it would be<br />

beneficial to avoid significant fluctuations in rates, fees,<br />

or charges.<br />

<strong>Council</strong> may choose to fund from the above sources more<br />

than is necessary to meet the operating expenditure in<br />

any particular year. <strong>Council</strong> will only budget for such<br />

an operating surplus if necessary to fund an operating<br />

deficit in the immediately preceding or following years, or<br />

to repay debt. <strong>Council</strong> will have regard to forecast future<br />

debt levels when ascertaining whether it is prudent to<br />

budget for an operating surplus for debt repayment.<br />

<strong>Council</strong> has determined the proportion of operating<br />

expenditure to be funded from each of the sources listed<br />

above, and the method for apportioning rates and other<br />

charges. The details of the funding apportionment are set<br />

out in the funding sources table that is included in this Policy.<br />

The LGA requires <strong>Council</strong> to produce Funding Impact<br />

Statements (FIS), which provides details of the funding<br />

mechanisms to be used for each group of activities for<br />

each year covered by the LTP. These Funding Impact<br />

Statements show how <strong>Council</strong> intends to implement the<br />

Revenue and Financing Policy. It also shows the amounts<br />

to be collected from each available source for each group<br />

and how various rates are to be applied.<br />

Funding of capital expenditure<br />

<strong>Council</strong> funds capital expenditure from subsidies,<br />

borrowing, reserves, contributions and operating<br />

surpluses. When funded by debt, <strong>Council</strong> spreads the<br />

repayment of that borrowing over several years. This<br />

enables <strong>Council</strong> to best match the charges placed on<br />

the community against the period of time over which the<br />

benefits from capital expenditure will be received.<br />

Borrowing is managed within the framework specified<br />

in the Liability Management Policy. Whilst seeking to<br />

minimise interest costs and financial risks associated<br />

with borrowing, <strong>Council</strong> seeks to match the term of<br />

borrowings with the average life of assets when practical.<br />

<strong>Council</strong>’s overall borrowing requirement is reduced<br />

to the extent that other funds are available to finance<br />

capital expenditure. Such other funds include:<br />

••<br />

<strong>Council</strong> reserves, including reserves comprising<br />

financial contributions under the Resource<br />

Management Act 1991 and development contributions<br />

under the LGA<br />

••<br />

Contributions towards capital expenditure from other<br />

parties such as the New Zealand Transport Agency<br />

(NZTA) (in relation to certain roading projects) and<br />

the Crown (in relation to certain wastewater projects)<br />

••<br />

Revenue collected to cover depreciation charges<br />

••<br />

Proceeds from the sale of assets<br />

••<br />

Targeted rates<br />

••<br />

Operating surpluses.<br />

Legal requirements of the revenue and<br />

financing policy<br />

This Revenue and Financing Policy has been prepared<br />

in accordance with the requirements of the LGA. There<br />

are 4 key sections that apply to this policy; Section 101,<br />

Financial Management, Section 101A Financial Strategy,<br />

Section 102, Funding and Financial Policies; and Section<br />

103, which describes what the Revenue and Financing<br />

Policy must contain. Rather than reproduce these sections<br />

in full, a brief description of these has been included over<br />

the page.<br />

Long-Term Plan 2012-22<br />

5

Revenue and Financing Policy<br />

101 Financial management<br />

This section outlines the requirement for councils to<br />

manage their finances prudently and to ensure that it<br />

has adequate funds to carry out the activities that are<br />

outlined in its Annual Plan or LTP. Most importantly it<br />

discusses the key matters that have to be considered<br />

when making funding decisions. These matters are:<br />

••<br />

The community outcomes to which the activity<br />

primarily contributes<br />

••<br />

The distribution of benefits between the community<br />

as a whole, any identifiable part of the community,<br />

and individuals<br />

••<br />

The period in or over which those benefits are<br />

expected to occur<br />

••<br />

The extent to which the actions or inaction of<br />

particular individuals or a group contribute to the<br />

need to undertake the activity<br />

••<br />

The costs and benefits, including consequences for<br />

transparency and accountability, of funding the activity<br />

distinctly from other activities<br />

••<br />

The overall impact of any allocation of liability for<br />

revenue needs on the current and future social,<br />

economic, environmental, and cultural wellbeing of<br />

the community.<br />

These matters have been used to prepare the funding<br />

decisions for each of <strong>Council</strong>’s activities as is discussed in<br />

the body of this Policy.<br />

101A Financial strategy<br />

This is a new requirement introduced in 2010. Its purpose<br />

is to require councils to develop a 10 year strategy<br />

to provide a degree of certainty on how councils will<br />

fund their activities over the years covered by each LTP.<br />

The section specifies a number of matters that must be<br />

included in the policy for the next 10 years. These include:<br />

••<br />

Quantified limits on rates and rate increases<br />

••<br />

Quantified limits on borrowings<br />

••<br />

Quantified returns on investments<br />

••<br />

An assessment of <strong>Council</strong>’s ability to maintain<br />

existing levels of service and meet additional<br />

demands for service within those limits.<br />

The policy must also contain information on:<br />

••<br />

The expected changes in population and land use<br />

and the costs of providing for those changes<br />

••<br />

The expected capital infrastructure requirements<br />

needed to maintain the existing levels of service<br />

currently provided.<br />

The new Financial Strategy requirement will become<br />

one of <strong>Council</strong>’s key policies as it draws together all the<br />

different elements of the long-term planning process and<br />

encapsulates them in a single document.<br />

102 Funding and financial policies<br />

This section describes the policies that a council can<br />

introduce to allow readers to understand how <strong>Council</strong><br />

is planning to fund its activities. Some of these are<br />

mandatory, while others are optional. Some of them<br />

must be introduced or amended in the LTP, while other<br />

can be managed separately from that process.<br />

The mandatory policies are:<br />

••<br />

A Revenue and Financing Policy<br />

••<br />

A Liability Management Policy<br />

••<br />

An Investment Policy<br />

••<br />

A Development Contributions Policy or<br />

Financial Contributions Policy<br />

••<br />

A Policy on the Remission and Postponement<br />

of Rates on Māori Freehold Land.<br />

The optional policies are:<br />

••<br />

A Rates Remission Policy<br />

••<br />

A Rates Postponement Policy.<br />

103 Revenue and financing policy<br />

This section that spells out, in detail what this Policy must<br />

contain; in particular, it must set out the ways that <strong>Council</strong><br />

will fund both operating and capital expenditures.<br />

It is the key policies that are used to set the basis of<br />

rating for the district. It includes:<br />

••<br />

The basis of valuation<br />

(land value, capital value or annual value)<br />

••<br />

Details of any differential rating systems<br />

••<br />

The basis of the Uniform Annual General<br />

Charge (UAGC), if any<br />

••<br />

Details of any targeted rates.<br />

6<br />

The top place where talent wants to live, work and invest

In addition it outlines the other sources used to fund<br />

each activity, including:<br />

••<br />

Lump sum contributions<br />

••<br />

Fees and charges<br />

••<br />

Interest and dividends from investments<br />

••<br />

Borrowing<br />

••<br />

Proceeds from asset sales<br />

••<br />

Development contributions<br />

••<br />

Financial contributions under the Resource<br />

Management Act 1991<br />

••<br />

Grants and subsidies<br />

••<br />

Any other source.<br />

Finally the policy has to explain how <strong>Council</strong> has<br />

addressed the matters set out in Section 101 as discussed<br />

above.<br />

What are these matters and what do they mean?<br />

To assist readers, the key matters are described below.<br />

It is acknowledged that the terms used are complex but<br />

it is important that readers gain an understanding of the<br />

issues that <strong>Council</strong> has to balance when making funding<br />

decisions.<br />

Community outcomes<br />

Section 101(3)(a)(i) requires <strong>Council</strong> to identify the<br />

community outcome to which each activity primarily<br />

contributes.<br />

<strong>Council</strong> has taken the opportunity to revise its<br />

community outcomes as part of this LTP. Full details of<br />

the new outcomes can be found in volume I on page 38.<br />

The LTP sets out under each activity or group of<br />

activities, the outcome or outcomes to which it primarily<br />

contributes, and states why each activity is undertaken.<br />

Distribution of benefits<br />

Section 101(3)(a)(ii) requires <strong>Council</strong> to assess the<br />

benefits from each activity flowing to the community as<br />

a whole, and those flowing to individuals or identifiable<br />

parts of the community. This is often called the<br />

public/private benefit split.<br />

Essentially this is a process where every activity is examined<br />

to decide who should pay for it. Is it something that only the<br />

users should pay for, say by way of a fee, charge or targeted<br />

rate? Or, is it something that the community should pay for<br />

as a whole, say from a general rate?<br />

Period of benefits<br />

Section 101(3)(a)(iii) requires <strong>Council</strong> to assess the<br />

period over which the benefits from each activity will<br />

flow. This in turn indicates the period over which the<br />

operating and capital expenditure should be funded.<br />

For all activities, operating costs are directly related to<br />

providing benefits in the year of expenditure. As such,<br />

they are appropriately funded on an annual basis from<br />

annual revenue.<br />

Assets, purchased from capital expenditure, provide<br />

benefits for the duration of their useful lives. Useful lives<br />

range from a few years in the case of office equipment<br />

through to many decades for infrastructural assets<br />

such as pipe networks. This is often referred to as inter<br />

generational equity.<br />

This concept reflects the view that benefits occurring<br />

over time should be funded over time. This is particularly<br />

relevant for larger capital investments such as wastewater<br />

treatment plants, bridges, landfills etc.<br />

One method used to spread these costs over time is<br />

by loan funding. This ensures that current ratepayers do<br />

not pay for benefits received by future ratepayers. Each<br />

year, ratepayers pay the interest (representing the cost<br />

of capital) and depreciation charges that are associated<br />

with the asset. This results in infrastructural costs being<br />

spread more evenly across the life of the asset and the<br />

different ratepayers who benefit from it.<br />

Another method of achieving this objective is through the<br />

use of development contributions, where the calculation<br />

of the contribution includes an element to reflect the<br />

value or cost of the asset that has capacity for future<br />

growth.<br />

Long-Term Plan 2012-22<br />

7

Revenue and Financing Policy<br />

Exacerbator pays<br />

Section 101(3)(a)(iv) requires <strong>Council</strong> to assess the<br />

extent to which each activity exists only because of the<br />

actions or inaction of an individual or group. Examples<br />

are attending to a rural fire, dog control, littering, etc.<br />

Sometimes known as polluter pays, this principle aims<br />

to identify the costs to the community of controlling the<br />

negative effects of individual or group actions.<br />

The principle suggests that <strong>Council</strong> should recover any<br />

costs directly from those causing the problem. Most<br />

activities do not exhibit exacerbator pays characteristics.<br />

Costs and benefits of distinct funding<br />

101(3)(a)(v) requires <strong>Council</strong> to consider the costs and<br />

benefits of distinct funding for each activity. This section<br />

is interpreted as requiring <strong>Council</strong> to consider the costs<br />

and benefits of funding each activity in a way that relates<br />

exclusively to that activity.<br />

An example of this would be funding libraries entirely<br />

from user charges, or water from a targeted rate. The<br />

consideration of the costs and benefits of distinct funding<br />

must include the consequences of the chosen funding<br />

method for transparency and accountability.<br />

Transparency and accountability are most evident when<br />

an activity is totally distinctly funded. This allows ratepayers<br />

or payers of user charges, as the case may be, to see<br />

exactly how much money is being raised for and spent on<br />

the activity, and to assess more readily whether or not the<br />

cost to them of the activity represents good value.<br />

Funding every activity on such a distinct basis would be<br />

extremely administratively complex. For some activities<br />

the quantity of rates funding to be collected amounts<br />

to only a few cents per ratepayer. The administrative<br />

costs and lack of significance would lead <strong>Council</strong> to<br />

fund a number of activities by way of a general rate.<br />

The individual activity sections of this document do not<br />

repeat this argument for each activity, but rather assume<br />

that the requirements of transparency and accountability<br />

for each activity’s funding is adequately met by the<br />

publication of the estimates of activity expenditure in the<br />

LTP, and actual activity costs in <strong>Council</strong>’s Annual Report.<br />

Similarly, the funding method indicated by the distribution<br />

of benefits for a particular activity may include user<br />

charges.<br />

Groups of activities<br />

The latest amendment to the LGA has introduced some<br />

refinements to this requirement. <strong>Council</strong>s are now<br />

required to separately disclose and account for a number<br />

of groups of activities. The LGA specifies 5 mandatory<br />

groups but a council can chose to define as many groups<br />

as they wish. What is important to note is that <strong>Council</strong><br />

must now prepare FIS for, and separately report on the<br />

performance of, each, group.<br />

The mandatory groups are:<br />

••<br />

Water supply<br />

••<br />

Sewerage treatment and disposal group<br />

••<br />

Stormwater drainage<br />

••<br />

Flood protection and control works<br />

••<br />

The provision of roads and footpaths.<br />

The LGA does not define what individual activities<br />

these mandatory groups are made up of nor does<br />

it require that <strong>Council</strong> undertake one or all of them.<br />

As an example, it is unlikely that a Regional <strong>Council</strong> will<br />

undertake many of these activities.<br />

Consideration of the new group of activities requirement<br />

will influence how <strong>Council</strong> complies with the requirements<br />

of Section 101(3)(a)(v).<br />

Overall impact on community wellbeing<br />

101(3)(b) requires <strong>Council</strong> to consider the overall<br />

impact of its funding decisions on the current and future<br />

social, economic, environment and cultural wellbeing of<br />

the community.<br />

As part of the preparation of this Policy, <strong>Council</strong> took<br />

into account the interests of residents and ratepayers,<br />

principles of fairness and equity, <strong>Council</strong> policy, and the<br />

avoidance of hardship from significant changes in cost<br />

allocation. Where appropriate, <strong>Council</strong> modified the<br />

strict economic analysis of funding allocation to address<br />

some of the more extreme impacts.<br />

8<br />

The top place where talent wants to live, work and invest

An example of this is the use of district-wide funding of<br />

many of <strong>Council</strong>’s activities. After considering the costs<br />

of providing these services on an individual community<br />

basis, <strong>Council</strong> decided that allocating the liability for<br />

funding on a district-wide basis best met the requirements<br />

to take in to account the community’s wellbeing.<br />

It is this analysis which has led to the proposals to change<br />

the current rating system to one that is more focused on<br />

the beneficiaries of the individual activities and in particular<br />

the proposals to change the funding of the cost of capital<br />

for water and sewerage to a scheme by scheme basis.<br />

How council applied these legal requirements<br />

The final process for developing the Revenue and<br />

Financing Policy has been to analyse the requirements of<br />

Section 101(3)(a) of the LGA.<br />

This is a 2 stage process. In the first stage, <strong>Council</strong><br />

considers each of the significant activities it undertakes<br />

in the light of each of the different matters discussed<br />

above. This analysis is then used to make an initial funding<br />

decision. In the second stage, <strong>Council</strong> reconsiders its<br />

initial funding decision in the light of its impact on the<br />

current and future social, economic, environmental, and<br />

cultural wellbeing of the community.<br />

Using that 2 stage process, <strong>Council</strong> shows that it has<br />

considered how each activity should be funded and how<br />

it has responded to its overall responsibility to promote<br />

the social, economic, environmental, and cultural wellbeing<br />

of communities, in the present and for the future.<br />

Overall funding results<br />

The policy summarises the final funding decisions that<br />

have been agreed after the completion of the processes<br />

previously described. A detailed individual picture of the<br />

analysis follows on from the summary.<br />

Funding of operational expenditures<br />

The following table shows the overall results of the<br />

individual activity analysis. It indicates that the operating<br />

expenses should be funded from the following sources:<br />

Operational funding allocations<br />

Public Funding<br />

General Rates 40.76%<br />

Ward Rates 8.54%<br />

Penalties 1.80%<br />

Private Funding<br />

Drainage and Flood Protection 0.09%<br />

Stormwater 0.39%<br />

Roading 2.83%<br />

Sewerage 9.22%<br />

Water 7.08%<br />

Kerikeri Mainstreet 0.05%<br />

Paihia Central Business <strong>District</strong> 0.02%<br />

Kaitaia Business Improvement Rate 0.05%<br />

Contributions 0.45%<br />

Subsidies 20.05%<br />

Other Income 1.24%<br />

User Charges 7.44%<br />

Total Funding 100.00%<br />

Funding of capital expenditures<br />

Capital expenditures will be funded from the following<br />

sources:<br />

Capital funding allocations<br />

Contributions 2.59%<br />

Depreciation 34.26%<br />

Loan 29.86%<br />

Operating Surplus 1.35%<br />

Reserves 0.68%<br />

Other Funding 0.00%<br />

Subsidy 31.26%<br />

Long-Term Plan 2012-22<br />

9

Revenue and Financing Policy<br />

Basis of rating<br />

Proposed “fairer” system<br />

In the Draft Plan, <strong>Council</strong> set out a new system of rating<br />

which it described as being fairer for the district. This<br />

proposed system, which is described below, attracted<br />

a wide range of submissions, both in support and in<br />

opposition to the concept.<br />

The key features of the proposed new rating system were:<br />

••<br />

A change to the basis of the general rate to<br />

incorporate a new range of differentials<br />

••<br />

A modified Uniform Annual General Charge (UAGC)<br />

based on specific activities which <strong>Council</strong> believes<br />

benefit ratepayers equally<br />

••<br />

A new targeted rate for roading<br />

••<br />

The current ward rates to be incorporated into the<br />

general rate<br />

••<br />

A new range of differentials for both the roading and<br />

general rates to better match rates to benefits<br />

••<br />

A change to the system of funding water and<br />

sewerage. <strong>Council</strong> is proposing to fund the cost<br />

of capital expenditure through the use of a range<br />

of targeted rates based on the individual schemes<br />

and operating expenditure using a district wide<br />

methodology.<br />

After considering all the submissions, <strong>Council</strong> decided<br />

that, whilst it agreed with the concept in principle,<br />

they believed that it needed more work to ensure that<br />

the differential basis for roading was robust. For this<br />

reason, <strong>Council</strong> decided to continue to use the current<br />

methodology for the general and ward rates. But it did<br />

agree to introduce a new targeted uniform rate for<br />

roading and is proceeding with the proposed system for<br />

funding water and sewerage.<br />

<strong>Council</strong> decided not to introduce the proposed method<br />

of calculating the UAGC rather it would continue to set<br />

it at the maximum level after taking account of the new<br />

uniform roading targeted rate.<br />

Over the next twelve months <strong>Council</strong> will work with<br />

different ratepayer sector groups to further develop the<br />

“fairer” rating system with the intention of introducing it<br />

as part of the 2013/14 plan.<br />

Final Rating System for 2012/22<br />

The general rates for 2012/13 are set on the basis of land<br />

value using two differentials, general and commercial.<br />

Every rating unit’s general rate differential will be set on<br />

the basis of land use as described in the Funding Impact<br />

Statement set out in this document.<br />

<strong>Council</strong> will continue to set a UAGC based on the<br />

separately used or inhabited part of the rating unit<br />

(SUIP). It will also set a new uniform targeted rate for<br />

roading which will also be assessed on the basis of the<br />

SUIP.<br />

Targeted rates will continue to be used to fund a range<br />

of activities and these will also be set on a differential<br />

basis according to their purpose and need.<br />

Operational funding allocation summaries<br />

<strong>Council</strong> believes that the overall allocation of funding<br />

requirements represents a reasonable balance between<br />

user pays, targeted rates and district funding. It considers<br />

that the impacts of these do not adversely affect the<br />

current and future wellbeing of the community.<br />

Detailed below is a summary, at the activity group level, of<br />

the proposed operational funding sources. This indicates<br />

how each activity will be funded from the following<br />

sources:<br />

••<br />

User charges<br />

••<br />

Operational subsidies<br />

••<br />

Targeted rates<br />

••<br />

Other funding sources<br />

••<br />

General and other broad function rates.<br />

10<br />

The top place where talent wants to live, work and invest

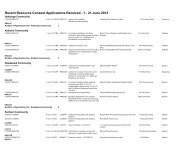

Proposed allocation of operational funding<br />

Private Funding<br />

group Group and Activity Charges Operational Subsidies Targeted Rates Other General/Ward Rates Total Funding<br />

1 Roading<br />

Roading 0% 25% 0% 7% 68% 100%<br />

Footpaths 0% 0% 0% 0% 100% 100%<br />

2 Sewerage Treatment and Disposal Group<br />

Sewerage Treatment and Disposal 0% 0% 93% 2% 5% 100%<br />

3 Stormwater Drainage Group<br />

Stormwater 0% 0% 0% 0% 100% 100%<br />

Drainage 0% 0% 100% 0% 0% 100%<br />

4 Water Supply Group<br />

Water Services 0% 0% 98% 2% 0% 100%<br />

5 <strong>District</strong> Facilities Group<br />

Community Services<br />

Cemetries 21% 0% 0% 0% 79% 100%<br />

Civic Buildings 29% 0% 0% 0% 98% 100%<br />

Motorcamps 94% 0% 0% 0% 6% 100%<br />

Pensioner Housing 52% 0% 0% 0% 48% 100%<br />

Recreation 0% 0% 0% 0% 100% 100%<br />

Town Maintenance 0% 0% 0% 0% 100% 100%<br />

Public Services<br />

Customer Services 0% 0% 0% 0% 100% 100%<br />

Information Centres - I-SITEs 25% 0% 0% 0% 75% 100%<br />

Libraries 6% 0% 0% 0% 94% 100%<br />

Public Safety 0% 0% 0% 0% 100% 100%<br />

6 Environmental Management Group<br />

Environmental Protection<br />

Animal Control 34% 0% 0% 0% 66% 100%<br />

Environmental Health 37% 0% 0% 0% 63% 100%<br />

Monitoring and Enforcement 7% 0% 0% 0% 93% 100%<br />

Liquor Control 62% 0% 0% 0% 38% 100%<br />

Parking Enforcement 0% 0% 0% 15% 63% 100%<br />

Resource Management<br />

Environmental Policy 0% 0% 0% 0% 100% 100%<br />

Resource Consent Management 59% 0% 0% 0% 41% 100%<br />

Building Control<br />

Building Compliance 27% 0% 0% 0% 73% 100%<br />

Building Consent Management 69% 0% 0% 0% 31% 100%<br />

Long-Term Plan 2012-22<br />

11

Revenue and Financing Policy<br />

Proposed allocation of operational funding<br />

Private Funding<br />

group Group and Activity Charges Operational Subsidies Targeted Rates Other General/Ward Rates Total Funding<br />

7 Governance, Strategy and Corporate Group<br />

Governance 0% 0% 0% 0% 100% 100%<br />

Strategic Planning 0% 0% 0% 0% 100% 100%<br />

Economic Development 0% 0% 0% 0% 100% 100%<br />

Maori Engagement 0% 0% 0% 0% 100% 100%<br />

8 Waste Management Group<br />

Solid Waste Management 0% 0% 0% 0% 100% 100%<br />

Potential future differential rating categories<br />

In the draft plan, <strong>Council</strong> suggested that there are 8<br />

distinct categories or classes of rateable properties, plus<br />

1 additional category of other to cover a few situations<br />

where <strong>Council</strong> cannot attach one of the main categories<br />

to the land. These are:<br />

••<br />

Residential these are generally rating units which have<br />

residential land uses or are used primarily for<br />

residential purposes<br />

••<br />

Lifestyle these are generally rating units which have<br />

lifestyle land uses<br />

••<br />

Commercial these are generally rating units which<br />

have some form of commercial land use or are used<br />

primarily for commercial purposes<br />

••<br />

Industrial these are generally rating units which have<br />

some form of industrial land use or are used primarily<br />

for industrial purposes<br />

••<br />

<strong>Far</strong>ming general these are generally rating units which<br />

have some form of primary farming land use or are<br />

used primarily for farming purposes other than land<br />

used for dairy or horticulture<br />

••<br />

Horticulture these are generally rating units which have<br />

horticultural, market garden or other similar land uses<br />

••<br />

Dairy these are generally rating units which have dairy<br />

land uses<br />

••<br />

Forestry these are generally rating units which have<br />

forestry land uses<br />

••<br />

Other these are generally rating units where the<br />

defined land use is inconsistent or cannot be<br />

determined.<br />

At this stage <strong>Council</strong> has decided not to proceed with<br />

the introduction of these differential categories however<br />

they will form the basis of future work of rating for the<br />

<strong>Far</strong> <strong>North</strong>.<br />

<strong>Council</strong> has also indicated that it intends to review the<br />

basis of rating coastal land and may introduce a special<br />

differential for coastal farm land at a later date.<br />

12<br />

The top place where talent wants to live, work and invest

Individual activity analysis<br />

As previously described, each activity has been analysed<br />

to determine which community outcomes the activity<br />

supports, who benefits directly or indirectly from its<br />

provision, over what period the benefit is provided,<br />

whether there are any exacerbators who caused the<br />

need for the activity, and lastly what are the benefits from<br />

separately funding the activity.<br />

The activity analysis has been split into a set of 8 main<br />

activity groups. In some instances, the main groups<br />

include a number of subgroups. The first 4 of these are<br />

mandatory and the remaining four have been established<br />

to best suit the way in which this <strong>Council</strong> operates.<br />

The groups are:<br />

••<br />

Roading and Footpath Group<br />

••<br />

Stormwater Drainage Group<br />

••<br />

Water Supply Group<br />

••<br />

Sewerage Treatment and Disposal Group<br />

••<br />

Waste Management Group<br />

••<br />

<strong>District</strong> Facilities Group<br />

••<br />

Environmental Management Group<br />

••<br />

Governance and Strategy Group<br />

The LGA also includes flood protection and control works<br />

as a mandatory group. These are functions undertaken by<br />

the Regional <strong>Council</strong> and are outside of this <strong>Council</strong>’s<br />

control. This group is therefore not included in the<br />

activities outlined in this Plan. Each individual activity is<br />

set out in the following format.<br />

Initial Analysis<br />

Description<br />

Community outcomes<br />

Who benefits<br />

Time period of benefits<br />

Exacerbator pays<br />

Costs and benefits of distinct funding<br />

A brief description of the activity<br />

The outcome(s) that the activity supports<br />

A statement of who benefits from the activity<br />

A description of the period over which the benefits will be received and associated funding decision<br />

A description of any exacerbators and how they will pay for the activity<br />

A statement of why the activity is separately funded and the funding mechanisms to be used<br />

This leads to:<br />

Funding Proposal<br />

The funding proposal<br />

Final funding decision<br />

This is the ideal funding arrangement based on a strict economic analysis<br />

This is the final funding arrangement <strong>Council</strong> has agreed after considering the four wellbeings<br />

Long-Term Plan 2012-22<br />

13

Revenue and Financing Policy<br />

Roading and Footpath Group<br />

The Roading and Footpaths Group is a mandatory group<br />

made up of 2 distinct activities. These have been split<br />

into separate subgroups to show their different funding<br />

arrangements.<br />

Roading<br />

<strong>Council</strong> manages and maintains the local roading<br />

network including roads, street lighting, and signage. It<br />

also provides and manages on street parking facilities and<br />

controls their use.<br />

Community outcomes<br />

This activity contributes primarily to services that support<br />

a safe and healthy district.<br />

Who benefits<br />

Roading provides a mix of private and public benefits.<br />

Private benefits accrue from the use of the roading<br />

network. Public benefits include the amenity value of a<br />

well designed roading network, accessibility for all and<br />

the facilitation of economic activity and social interaction.<br />

Notwithstanding these nominal benefits, <strong>Council</strong><br />

considers that the provision of the roading network<br />

benefits the community as a whole. Roading also<br />

provides some benefits to developers particularly where<br />

the network requires additional capital works to address<br />

the growth effects arising from new developments.<br />

For this reason development contributions have been<br />

one of the key funding sources for growth related capital<br />

works. Given the current economic climate, this growth<br />

related development is at a low ebb so the contributions<br />

to roading are significantly reduced.<br />

••<br />

Benefit to identifiable individuals or groups 0%<br />

••<br />

Benefit to community as a whole 100%<br />

Time period of benefits<br />

The benefits of the assets used in the road network<br />

last many years and are recovered through operating<br />

surpluses and/or development contributions.<br />

While recognising that there are benefits to future<br />

ratepayers, <strong>Council</strong> will only fund capital works from<br />

borrowings where there is a defined programme that is<br />

significantly varied from a sustainable annual programme<br />

with the loan costs being met from general rates and/or<br />

development contributions.<br />

Exacerbator pays<br />

The need for expenditure on this activity is increased<br />

by the amount of traffic on the roads which causes<br />

congestion and delays for the travelling public. Roading<br />

remains the single biggest expenditure of this <strong>Council</strong><br />

and whilst there is no mechanism for <strong>Council</strong> to directly<br />

charge the users of the roading network, <strong>Council</strong> is<br />

now proposing to introduce a separate targeted rate to<br />

better reflect the impact that different categories of road<br />

users have on the network.<br />

Costs and benefits of distinct funding<br />

The majority of roading and traffic costs come from<br />

maintaining the roading assets. Most of these maintenance<br />

costs are a result of heavy vehicle movements related to a<br />

variety of businesses. <strong>Council</strong> does not have the ability to<br />

directly charge road users unless it chooses to introduce<br />

tolls to assist in funding certain roading developments.<br />

While <strong>Council</strong> views NZTA subsidies and petrol taxes as<br />

a surrogate for contributions from road users, it remains<br />

the case that there are wide variations in the benefits<br />

received by different categories of road users. For this<br />

reason <strong>Council</strong> is now proposing to introduce a new<br />

targeted rate to fund roading. It is also proposed that this<br />

targeted rate will be assessed on a differential basis to<br />

reflect the benefits or impacts that different categories<br />

of road users have on the network.<br />

For this reason the benefits of separately funding roading<br />

outweigh the costs.<br />

Funding proposal<br />

Operational funding-primarily funded by user charges<br />

and rates.<br />

14<br />

The top place where talent wants to live, work and invest

Cost allocation<br />

Final Roading Cost Allocation<br />

Private Funding General Rate Total<br />

User Charges Targeted Rates Operational Subsidies Other Income Funding Funding<br />

0% 0% 25% 7% 68% 100%<br />

Reasons for cost allocation<br />

<strong>Council</strong> undertakes the roading activity for the overall<br />

benefit of the district. Historically it has been largely<br />

funded from general rates and subsidies, and more<br />

recently with financial and development contributions.<br />

Its primary source of non subsidy funding is rates. After<br />

considering the overall impact on the current and future<br />

social, economic, environment and cultural wellbeing of<br />

the community, <strong>Council</strong> set the following cost allocation.<br />

Capital Funding – Renewals are primarily funded by<br />

depreciation where available. Any minor improvements<br />

of an ongoing nature are expensed through operational<br />

funding, however any major developments will be funded<br />

by way of operating surpluses which includes subsidy<br />

income, depreciation reserves or loan. Where the<br />

expenditure is growth related, funding will be provided<br />

from development contributions on subdivision or<br />

development.<br />

Long-Term Plan 2012-22<br />

15

Revenue and Financing Policy<br />

Footpaths<br />

<strong>Council</strong> provides footpaths in most of the district’s<br />

urban centers and in some rural areas where particular<br />

safety issues are of concern.<br />

Community outcomes<br />

This activity contributes primarily to services that support<br />

a safe and healthy district.<br />

Who benefits<br />

<strong>Council</strong> provides a range of footpaths throughout<br />

the district. Footpaths contribute to public safety and<br />

provide public benefits. They provide private benefits to<br />

individuals and businesses through access to commercial<br />

and retail areas.<br />

••<br />

Benefit to identifiable individuals or groups 50%<br />

••<br />

Benefit to community as a whole 50%<br />

Time period of benefits<br />

The benefits of the assets used in the footpath network<br />

last many years and are recovered through operating<br />

surpluses and development contributions. While<br />

recognising that there are benefits to future ratepayers,<br />

<strong>Council</strong> will only fund capital works from borrowings<br />

where there is a defined programme that is significantly<br />

varied from a sustainable annual programme with the<br />

loan costs being met from rates and/or development<br />

contributions.<br />

Exacerbator pays<br />

The need for expenditure on this activity is increased by<br />

the amount of foot traffic within the urban communities.<br />

Businesses operators in tourist centres rely heavily<br />

on foot traffic to enhance commercial opportunities.<br />

Notwithstanding that, there is no effective mechanism to<br />

charge the exacerbator; therefore the activity is funded<br />

on a district basis.<br />

Costs and benefits of distinct funding<br />

<strong>Council</strong> provides footpaths both for safety and to improve<br />

pedestrian access across the district. It is recognised that<br />

the commercial properties, being reliant on foot traffic,<br />

benefit from the availability of adequate footpaths.<br />

This is recognised by the commercial differentials in the<br />

general rates.<br />

Funding proposal<br />

Operational funding-primarily funded by user charges<br />

and rates.<br />

Cost allocation<br />

After considering the overall impact on the current<br />

and future social, economic, environment and cultural<br />

wellbeing of the community, <strong>Council</strong> set the following<br />

cost allocation.<br />

Final Footpath Cost Allocation<br />

Private Funding General Rate Total<br />

User Charges Targeted Rates Other Income Funding Funding<br />

0% 0% 0% 100% 100%<br />

16<br />

The top place where talent wants to live, work and invest

Reasons for cost allocation<br />

<strong>Council</strong> undertakes this activity for the overall benefit<br />

of the district. Where possible <strong>Council</strong> endeavours to<br />

recover some capital costs from individuals by way of<br />

development contributions, other than that the primary<br />

source of revenue remains rates.<br />

Capital Funding – Renewals are primarily funded by<br />

depreciation where available. Any minor improvements<br />

of an ongoing nature are expensed through operational<br />

funding; however, any major developments will be funded<br />

by way of operating surpluses, depreciation reserves or<br />

loan. Where the expenditure is growth related, funding<br />

will be provided from development contributions on<br />

subdivision or development.<br />

Long-Term Plan 2012-22<br />

17

Revenue and Financing Policy<br />

Stormwater Drainage Group<br />

The Stormwater Drainage Group is a mandatory group.<br />

It is made up of 2 activities which have been split into<br />

separate subgroups to show their different funding<br />

arrangements.<br />

Stormwater<br />

This activity is concerned with the control of stormwater<br />

generated from urban properties, roadways and in some<br />

situations from upstream rural catchments. <strong>Council</strong><br />

provides a public stormwater network to ensure that<br />

generated stormwater from properties is disposed of<br />

in order to avoid flooding risks (especially of buildings),<br />

improve public safety, and ensure the disposal of<br />

stormwater in an environmentally acceptable manner.<br />

Community outcome<br />

This activity contributes primarily to services that support<br />

a safe and healthy district and a sustainable and liveable<br />

environment.<br />

Who benefits<br />

The benefits of the stormwater system flow to both<br />

private individuals and groups, and to the community<br />

as a whole. Individuals and groups benefit from the<br />

protection of private property and enhanced safety, while<br />

the community as a whole benefits from protection of<br />

public property and spaces and monitoring and control<br />

of flooding and pollution control.<br />

••<br />

Benefit to identifiable individuals or groups 50%<br />

••<br />

Benefit to community as a whole 50%<br />

Time period of benefits<br />

The operating costs of stormwater arise largely from its<br />

disposal. These costs are recovered on an annual basis.<br />

The capital costs of stormwater are largely long-term,<br />

over the life of the asset and will, as far as possible, be<br />

funded from development contributions on subdivision<br />

or development. The remaining capital expenditure will<br />

be funded by way of operating surpluses or loan.<br />

Exacerbator pays<br />

The need for expenditure on this activity is increased by<br />

the land coverage of buildings and pavements. The average<br />

business property has significantly more impervious<br />

surfaces than the average residential property and the<br />

average rural property has significantly less. However the<br />

benefit accruing to all because of improved access to<br />

urban communities brings equity to all sectors. While the<br />

use of site coverage might be a useful funding mechanism,<br />

it is not practical.<br />

Costs and benefits of distinct funding<br />

<strong>Council</strong> funds stormwater by a targeted rate together<br />

with a contribution from the general rate.<br />

Funding proposal<br />

Operational funding-primarily funded by user charges<br />

and rates.<br />

Cost allocation<br />

After considering the overall impact on the current and<br />

future social, economic, environment and cultural wellbeing<br />

of the community, <strong>Council</strong> set the following cost allocation.<br />

18<br />

The top place where talent wants to live, work and invest

Final Stormwater Cost Allocation<br />

Private Funding General Rate Total<br />

User Charges Targeted Rates Other Income Funding Funding<br />

0% 0% 0% 100% 100%<br />

Reasons for cost allocation<br />

Despite the private benefit received from the provision<br />

of stormwater, <strong>Council</strong> is of the view that the overall<br />

benefit to the community as a whole supports the<br />

continuation of the funding from the general rate with a<br />

smaller stormwater rate over urban communities.<br />

Capital Funding – Renewals are primarily funded by<br />

depreciation where available. Any minor improvements<br />

of an ongoing nature are expensed through operational<br />

funding, however any major developments will be funded<br />

by way of operating surpluses, depreciation reserves or loan.<br />

Where the expenditure is growth related, funding will be<br />

provided from development contributions on subdivision<br />

or development.<br />

Long-Term Plan 2012-22<br />

19

Revenue and Financing Policy<br />

Drainage<br />

This activity involves the management of a small number<br />

of drainage schemes, predominantly in the Kaitaia area<br />

of the district. These were originally established under<br />

the Land Drainage Act and are designed to lower the<br />

water tables in agricultural flatland areas to improve<br />

economic activity associated with dairy and farming and<br />

horticulture.<br />

Community outcome<br />

This activity contributes to services that support a<br />

vibrant and thriving economy.<br />

Who benefits<br />

As this activity is situated on farmland, the benefactors of<br />

the activity are those farmer/horticulturalists who require<br />

relatively well drained soils to improve farm outputs.<br />

••<br />

Benefit to identifiable individuals or groups 100%<br />

••<br />

Benefit to community as a whole 0%<br />

Time period of benefits<br />

The operating costs of land drainage arise largely from<br />

water capture and disposal. These costs are recovered on<br />

an annual basis. The capital costs of drainage are largely<br />

long-term, over the life of the asset, and will be funded<br />

from operating surpluses or loan.<br />

Exacerbator pays<br />

This activity is undertaken solely for the benefit of the<br />

land owners. Any negative effects from the management<br />

and dis posal of the drainage waters are fully funded by<br />

the land owners.<br />

Costs and benefits of distinct funding<br />

Only those who receive a benefit pay the rates and<br />

these are ring fenced specifically for the assets within the<br />

drainage register.<br />

Funding proposal<br />

Operational Funding-primarily funded by user charges<br />

and rates<br />

Cost allocation<br />

After considering the overall impact on the current and<br />

future social, economic, environment and cultural wellbeing<br />

of the community, <strong>Council</strong> set the following cost allocation.<br />

20<br />

The top place where talent wants to live, work and invest

Final Drainage Cost Allocation<br />

Private Funding General Rate Total<br />

User Charges Targeted Rates Other Income Funding Funding<br />

0% 100% 0% 0% 100%<br />

Reasons for cost allocation<br />

The benefits arising from this activity are solely private.<br />

Capital Funding – Renewals are primarily funded by<br />

depreciation where available. Any minor improvements<br />

of an ongoing nature are expensed through operational<br />

funding; however any major developments will be funded<br />

by way of operating surpluses, depreciation reserves or<br />

loan. Where the expenditure is growth related, funding<br />

will be provided from development contributions on<br />

subdivision or development.<br />

Long-Term Plan 2012-22<br />

21

Revenue and Financing Policy<br />

Water Supply Group<br />

The Water Supply Group is a mandatory group. It is also<br />

a single activity group.<br />

Water supply<br />

<strong>Council</strong> meets the need for high quality drinking<br />

water and ensures fire fighting performance standards<br />

are met within the defined water supply areas. This<br />

activity contributes significantly to present and future<br />

environmental, and economic wellbeing.<br />

Community outcomes<br />

This activity contributes to services that support a<br />

safe and healthy district and a sustainable and liveable<br />

environment.<br />

Who benefits<br />

The benefits of the water supplies flow mainly to private<br />

individuals and groups. The users of the water services<br />

are clearly identifiable and it is this sector that will<br />

contribute to the cost of this activity.<br />

<strong>Council</strong> recognises that there is a small overall benefit to<br />

the community in terms of maintaining public health, the<br />

environment, and the provision of fire fighting capability.<br />

However, this is generally within the water supply areas<br />

and therefore this activity does not receive any public<br />

funding.<br />

••<br />

Benefit to identifiable individuals or groups 100%<br />

••<br />

Benefit to community as a whole 0%<br />

Time period of benefits<br />

The operating costs of water supplies arise largely from<br />

its treatment and supply. These costs are recovered on an<br />

annual basis. The capital costs of water are largely longterm<br />

over the life of the asset and will, as far as possible,<br />

be funded from targeted rates, financial contributions<br />

on subdivision or development. The remaining capital<br />

expenditure will be funded by way of operating surpluses<br />

or loan.<br />

Exacerbator pays<br />

There is a minimal exacerbator impact related to water.<br />

The exception being where individuals damage the<br />

infrastructure. In such an event, the individual will generally<br />

be required to fund the cost of repairs. While there may<br />

well be a negative impact from the unrestricted use of<br />

the scarce water resource, this is controlled by the use of<br />

district wide metering of all water consumption.<br />

Costs and benefits of distinct funding<br />

It is important that consumers pay the true costs of<br />

their usage of water. Charging by volume encourages<br />

conservation of water and ensures the costs lie where<br />

the benefits are consumed. To achieve this, <strong>Council</strong> uses a<br />

targeted rate based on water volume supplied. The costs<br />

of connecting to the system are charged directly to those<br />

connecting.<br />

Funding proposal<br />

Operational funding-primarily funded by user charges<br />

and rates.<br />

Cost allocation<br />

After considering the overall impact on the current and<br />

future social, economic, environment and cultural wellbeing<br />

of the community, <strong>Council</strong> set the following cost allocation.<br />

22<br />

The top place where talent wants to live, work and invest

Final Water Cost Allocation<br />

Private Funding General Rate Total<br />

User Charges Targeted Rates Other Income Funding Funding<br />

0% 98% 2% 0% 100%<br />

Reasons for cost allocation<br />

The benefits arising from this activity are solely private.<br />

Capital Funding – Renewals are primarily funded by<br />

depreciation where available. Any minor improvements<br />

of an ongoing nature are expensed through operational<br />

funding; however any major developments will be funded<br />

by way of targeted rates, operating surpluses, depreciation<br />

reserves or loan. Where the expenditure is growth<br />

related, funding will be provided from development<br />

contributions on subdivision or development.<br />

Long-Term Plan 2012-22<br />

23

Revenue and Financing Policy<br />

Sewerage Treatment and Disposal Group<br />

The Sewerage Treatment and Disposal Group is a mandatory<br />

group. It is a single activity group.<br />

Sewerage<br />

The wastewater system carries liquid wastes from<br />

households, businesses and community facilities. It treats<br />

and disposes of the effluent to minimise the risk to the<br />

environment and public health.<br />

Community outcomes<br />

Wastewater contributes primarily to services that support<br />

a safe and healthy district and a sustainable and liveable<br />

environment.<br />

Who benefits<br />

The benefits of the wastewater system flow mainly<br />

to private individuals and groups. The users of the<br />

wastewater systems are clearly identifiable and it is this<br />

sector that will primarily contribute to the cost of this<br />

activity. It is recognised that there is an overall benefit<br />

to the community as a whole in terms of maintaining<br />

public health and the environment which is partly why<br />

the Crown has agreed to provide some subsidies to<br />

assist with the development of new wastewater schemes.<br />

••<br />

Benefits to identifiable individuals or groups 90%<br />

••<br />

Benefits to community as a whole 10%<br />

Time period of benefits<br />

The operating costs of wastewater arise largely from its<br />

treatment and disposal. These costs are recovered on an<br />

annual basis.<br />

The capital costs of wastewater are largely long-term,<br />

over the life of the asset, and will as far as possible be<br />

funded from targeted rates, financial contributions<br />

on subdivision or development. The remaining capital<br />

expenditure will be funded by way of subsidies, operating<br />

surpluses or loan.<br />

Exacerbator pays<br />

Wastewater is largely an exacerbator issue where the<br />

polluter should pay; this suggests that the use of targeted<br />

rates is the most appropriate funding source.<br />

The proposed Bay of Island’s scheme, which is currently<br />

being designed, will specifically address exacerbator<br />

issues in areas such as Riverview where the existing onsite<br />

wastewater systems are failing. It is issues such as that<br />

which have given rise to the proposal to fund the capital<br />

costs of sewerage on a local, scheme by scheme basis.<br />

Costs and benefits of distinct funding<br />

The majority of the costs of this activity are attributed to<br />

controlling the negative effects and the provision of private<br />

benefits. There remains a small public benefit from the<br />

presence of public reticulated sewerage schemes. It assists<br />

improve ground water standards and helps to maintain<br />

the quality of the district’s coastal waters. This is seen as<br />

benefiting overall quality of life and business opportunities.<br />

Using distinct funding allows the users to be identified<br />

and charged the full costs of the activity. This funding is<br />

obtained through the use of connection charges, targeted<br />

rates, pan fees and development contributions.<br />

Funding proposal<br />

Operational funding-primarily funded by user charges<br />

and rates.<br />

Cost allocation<br />

After considering the overall impact on the current and<br />

future social, economic, environment and cultural wellbeing<br />

of the community, <strong>Council</strong> set the following cost<br />

allocation.<br />

24<br />

The top place where talent wants to live, work and invest

Final Sewerage Cost Allocation<br />

Private Funding General Rate Total<br />

User Charges Targeted Rates Other Income Funding Funding<br />

0% 93% 2% 5% 100%<br />

Reasons for cost allocation<br />

The prime benefits are to individuals who directly receive<br />

this service; however there are also benefits to the wider<br />

community in regard to environmental protection and<br />

public health.<br />

Capital – Renewals are primarily funded by depreciation<br />

where available. Any minor improvements of an ongoing<br />

nature are expensed through operational funding,<br />

however, any major developments will be funded by<br />

way of targeted rates, operating surpluses, depreciation<br />

reserves or loan. Where the expenditure is growth<br />

related, funding will be provided from development<br />

contributions on subdivision or development.<br />

Long-Term Plan 2012-22<br />

25

Revenue and Financing Policy<br />

Waste Management Group<br />

The waste management group provides facilities for the<br />

disposal of refuse balanced with the provision of recycling<br />

and other waste minimisation facilities to minimise<br />

the risk to the environment and public health. <strong>Council</strong><br />

does not provide refuse collection services; these are<br />

undertaken by the private sector.<br />

Community outcomes<br />

This activity contributes primarily to services that support<br />

a sustainable and liveable environment.<br />

Who benefits<br />

This activity is undertaken to help protect the<br />

environment by the provision of refuse disposal sites,<br />

landfills and transfer stations and through recycling and<br />

waste minimisation programmes and to promote public<br />

health and social responsibility. Individuals who make use<br />

of the refuse disposal facilities pay the contractors who<br />

manage the facilities. Accordingly, this <strong>Council</strong> provided<br />

activity benefits the community as a whole and is funded<br />

from general rates.<br />

••<br />

Benefit to identifiable individuals or groups 0%<br />

••<br />

Benefit to community as a whole 100%<br />

Time period of benefits<br />

The operating costs of waste management are an annual<br />

cost and are funded from general rates. The capital costs of<br />

waste management are largely long-term, over the life of<br />

the asset, and will as far as possible be funded from financial<br />

contributions on subdivision or development. The remaining<br />

capital expenditure will be funded by way of operating<br />

surpluses or loan.<br />

Exacerbator pays<br />

The need for this activity is entirely due to the actions<br />

or inactions of individuals or groups. As such, it is an<br />

exacerbator issue. The users of this service pay for the<br />

disposal of their refuse via the commercial sector. <strong>Council</strong><br />

contribution is provided from the general rates.<br />

Costs and benefits of distinct funding<br />

The full costs of this activity are to provide district wide<br />

facilities for the community. Exacerbators pay for the<br />

actual cost of the disposal of their refuse via the fees<br />

charged by the commercial operators. The costs of this<br />

activity are therefore not deemed to require distinct<br />

funding and are included in the general rates. <strong>Council</strong> is<br />

considering introducing a separate targeted rate to fund<br />

the activity in the future.<br />

Funding proposal<br />

Operational funding-primarily funded by user charges<br />

and rates.<br />

Cost allocation<br />

After considering the overall impact on the current<br />

and future social, economic, environment and cultural<br />

wellbeing of the community, <strong>Council</strong> set the following<br />

cost allocation.<br />

26<br />

The top place where talent wants to live, work and invest

Final Waste Management Cost Allocation<br />

Private Funding General Rate Total<br />

User Charges Targeted Rates Other Income Funding Funding<br />

0% 0% 0% 100% 100%<br />

Reasons for cost allocation<br />

This activity is about the provision of the facilities.<br />

The use of the facilities is paid for by the users.<br />

On that basis, it is proposed that this activity be funded<br />

on a uniform basis by all ratepayers.<br />

Capital – Renewals are primarily funded by depreciation<br />

where available. Any minor improvements of an ongoing<br />

nature are expensed through operational funding;<br />

however, any major developments will be funded by way<br />

of operating surpluses, depreciation reserves, or loan.<br />

Where the expenditure is growth related, funding will be<br />

provided from development contributions on subdivision<br />

or development.<br />

Long-Term Plan 2012-22<br />

27

Revenue and Financing Policy<br />

<strong>District</strong> Facilities Group<br />

The <strong>District</strong> Facilities Group is an optional group. It<br />

contains a number of subgroups including community<br />

services, public services and public safety. Each of these<br />

sub groups is made up of a number of discrete activities.<br />

Community Services -<br />

Cemeteries<br />

<strong>Council</strong> carries out cemetery activities, as required by<br />

statute, for the public good in those areas of the district<br />

where the service is not provided by others.<br />

Community outcomes<br />

This activity contributes primarily to services that support<br />

a safe and healthy district.<br />

Who benefits<br />

This activity is in 2 distinct parts. The first relates to the<br />

provision of burial facilities and services. This is a private<br />

benefit to those who choose this service. There is also<br />

a benefit to the whole district relating to the publicly<br />

available green space, protecting public health by ensuring<br />

the safe disposal of human remains, and in maintaining<br />

cemeteries and cemetery records for future generations.<br />

••<br />

Benefit to identifiable individuals or groups 80%<br />

••<br />

Benefit to community as a whole 20%<br />

Time period of benefits<br />

The benefits of this activity can last for many years but<br />

they are paid for as part of the initial fee. There is a need<br />

for ongoing public funding because there is no effective<br />

mechanism to continue to charge the families of the<br />

deceased for future years.<br />

Exacerbator pays<br />

When someone is interned in a <strong>Council</strong> cemetery, this<br />

creates an expectation for ongoing maintenance. <strong>Council</strong><br />