Hongkong Land Holdings Limited - Bermuda Stock Exchange

Hongkong Land Holdings Limited - Bermuda Stock Exchange

Hongkong Land Holdings Limited - Bermuda Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Review<br />

<br />

<br />

<br />

Both Moody’s and Standard & Poor’s have maintained<br />

their credit ratings of <strong>Hongkong</strong> <strong>Land</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

at A3 and A- respectively.<br />

During the year, the Group refinanced a syndicated<br />

facility of S$800 million with facilities from eight<br />

relationship banks totalling S$1.12 billion. A term<br />

of five years applies to S$870 million and a term of<br />

seven years applies to the remaining S$250 million.<br />

The Group also issued US$65 million of bonds under<br />

its US$3.0 billion Medium Term Note programme,<br />

with maturities ranging from 15 to 20 years. Also,<br />

US$336 million of the Group’s 2.75% convertible<br />

bonds due in December 2012 were converted<br />

into equity leaving US$58 million outstanding at<br />

31st December 2011.<br />

The average tenor of the Group’s debt was 5.3 years<br />

at 31st December 2011, compared with 5.2 years at<br />

the end of 2010.<br />

At the end of 2011, the Group had total committed<br />

lines of approximately US$5.2 billion. Of these lines,<br />

57% was sourced from banks with the remaining<br />

43% from capital markets. The Group had drawn<br />

US$3.3 billion from these lines leaving US$1.9 billion<br />

of committed, but unused facilities. Adding the Group’s<br />

year-end cash balances, the Group had overall liquidity<br />

at 31st December 2011 of US$2.9 billion. This is in<br />

line with the Group’s overall liquidity at 31st December<br />

2010 of US$3.0 billion (after excluding the proceeds of<br />

the early refinancing in 2010 of the US$600 million<br />

bonds due in early May 2011).<br />

<br />

<br />

<br />

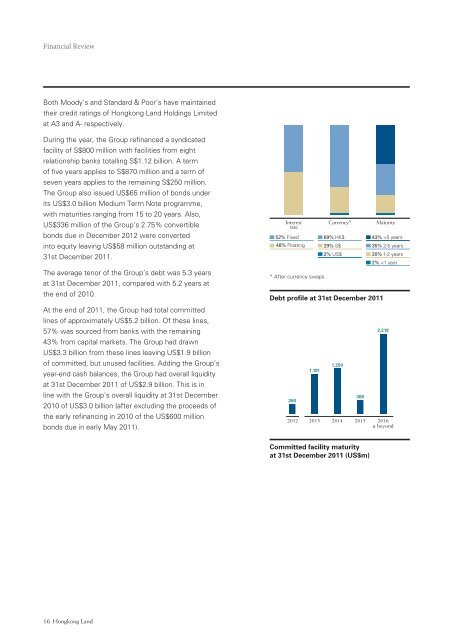

Interest<br />

rate<br />

52% Fixed<br />

48% Floating<br />

<br />

<br />

* After currency swaps<br />

Currency*<br />

69% HK$<br />

29% S$<br />

2% US$<br />

Debt profile at 31st December 2011<br />

260<br />

1,101<br />

1,250<br />

2012 2013 2014<br />

369<br />

2015<br />

Maturity<br />

43% >5 years<br />

35% 2-5 years<br />

20% 1-2 years<br />

2%