Vision

Vision

Vision

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

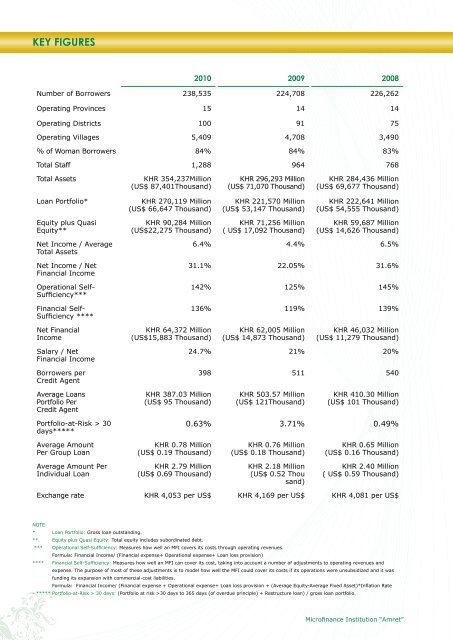

Key Figures<br />

2010 2009 2008<br />

Number of Borrowers 238,535 224,708 226,262<br />

Operating Provinces 15 14 14<br />

Operating Districts 100 91 75<br />

Operating Villages 5,409 4,708 3,490<br />

% of Woman Borrowers 84% 84% 83%<br />

Total Staff 1,288 964 768<br />

Total Assets<br />

KHR 354,237Million<br />

(US$ 87,401Thousand)<br />

KHR 296,293 Million<br />

(US$ 71,070 Thousand)<br />

KHR 284,436 Million<br />

(US$ 69,677 Thousand)<br />

Loan Portfolio*<br />

KHR 270,119 Million<br />

(US$ 66,647 Thousand)<br />

KHR 221,570 Million<br />

(US$ 53,147 Thousand)<br />

KHR 222,641 Million<br />

(US$ 54,555 Thousand)<br />

Equity plus Quasi<br />

Equity**<br />

KHR 90,284 Million<br />

(US$22,275 Thousand)<br />

KHR 71,256 Million<br />

( US$ 17,092 Thousand)<br />

KHR 59,687 Million<br />

(US$ 14,626 Thousand)<br />

Net Income / Average<br />

Total Assets<br />

Net Income / Net<br />

Financial Income<br />

Operational Self-<br />

Sufficiency***<br />

Financial Self-<br />

Sufficiency ****<br />

6.4% 4.4% 6.5%<br />

31.1% 22.05% 31.6%<br />

142% 125% 145%<br />

136% 119% 139%<br />

Net Financial<br />

Income<br />

KHR 64,372 Million<br />

(US$15,883 Thousand)<br />

KHR 62,005 Million<br />

(US$ 14,873 Thousand)<br />

KHR 46,032 Million<br />

(US$ 11,279 Thousand)<br />

Salary / Net<br />

Financial Income<br />

Borrowers per<br />

Credit Agent<br />

24.7% 21% 20%<br />

398 511 540<br />

Average Loans<br />

Portfolio Per<br />

Credit Agent<br />

KHR 387.03 Million<br />

(US$ 95 Thousand)<br />

KHR 503.57 Million<br />

(US$ 121Thousand)<br />

KHR 410.30 Million<br />

(US$ 101 Thousand)<br />

Portfolio-at-Risk > 30<br />

days*****<br />

0.63% 3.71% 0.49%<br />

Average Amount<br />

Per Group Loan<br />

KHR 0.78 Million<br />

(US$ 0.19 Thousand)<br />

KHR 0.76 Million<br />

(US$ 0.18 Thousand)<br />

KHR 0.65 Million<br />

(US$ 0.16 Thousand)<br />

Average Amount Per<br />

Individual Loan<br />

KHR 2.79 Million<br />

(US$ 0.69 Thousand)<br />

KHR 2.18 Million<br />

(US$ 0.52 Thou<br />

sand)<br />

KHR 2.40 Million<br />

( US$ 0.59 Thousand)<br />

Exchange rate KHR 4,053 per US$ KHR 4,169 per US$ KHR 4,081 per US$<br />

Note:<br />

* Loan Portfolio: Gross loan outstanding.<br />

** Equity plus Quasi Equity: Total equity includes subordinated debt.<br />

*** Operational Self-Sufficiency: Measures how well an MFI covers its costs through operating revenues.<br />

Formula: Financial Income/ (Financial expense+ Operational expense+ Loan loss provision)<br />

**** Financial Self-Sufficiency: Measures how well an MFI can cover its cost, taking into account a number of adjustments to operating revenues and<br />

expense. The purpose of most of these adjustments is to model how well the MFI could cover its costs if its operations were unsubsidized and it was<br />

funding its expansion with commercial-cost liabilities.<br />

Formula: Financial Income/ (Financial expense + Operational expense+ Loan loss provision + (Average Equity-Average Fixed Asset)*Inflation Rate<br />

- ***** Portfolio-at-Risk > 30 days: (Portfolio at risk >30 days to 365 days (of overdue principle) + Restructure loan) / gross loan portfolio.<br />

Microfinance Institution “Amret”