Texprocil News1 - Handloom Export Promotion Council

Texprocil News1 - Handloom Export Promotion Council

Texprocil News1 - Handloom Export Promotion Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2<br />

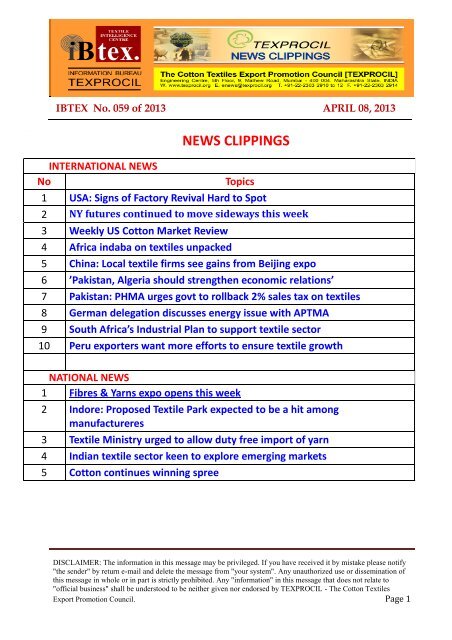

IBTEX No. 059 of 2013 APRIL 08, 2013<br />

NEWS CLIPPINGS<br />

INTERNATIONAL NEWS<br />

No<br />

Topics<br />

1 USA: Signs of Factory Revival Hard to Spot<br />

2 NY futures continued to move sideways this week<br />

3 Weekly US Cotton Market Review<br />

4 Africa indaba on textiles unpacked<br />

5 China: Local textile firms see gains from Beijing expo<br />

6 ’Pakistan, Algeria should strengthen economic relations’<br />

7 Pakistan: PHMA urges govt to rollback 2% sales tax on textiles<br />

8 German delegation discusses energy issue with APTMA<br />

9 South Africa’s Industrial Plan to support textile sector<br />

10 Peru exporters want more efforts to ensure textile growth<br />

NATIONAL NEWS<br />

1 Fibres & Yarns expo opens this week<br />

2 Indore: Proposed Textile Park expected to be a hit among<br />

manufactureres<br />

3 Textile Ministry urged to allow duty free import of yarn<br />

4 Indian textile sector keen to explore emerging markets<br />

5 Cotton continues winning spree<br />

DISCLAIMER: The information in this message may be privileged. If you have received it by mistake please notify<br />

"the sender" by return e-mail and delete the message from "your system". Any unauthorized use or dissemination of<br />

this message in whole or in part is strictly prohibited. Any "information" in this message that does not relate to<br />

"official business" shall be understood to be neither given nor endorsed by TEXPROCIL - The Cotton Textiles<br />

<strong>Export</strong> <strong>Promotion</strong> <strong>Council</strong>. Page 1

News Clippings<br />

INTERNATIONAL NEWS<br />

Signs of Factory Revival Hard to Spot<br />

The idea that American manufacturing is on the cusp of a renaissance is everywhere<br />

these days—except in the hard numbers.<br />

It's true that industrial production has grown twice as fast as the economy as a<br />

whole in this recovery, and manufacturers are adding jobs again. But economists<br />

see those gains as too small relative to what was lost in previous years to suggest<br />

a full-blown revival. Factories fell so hard, the logic goes, some gains are a given.<br />

"There's simply no statistical evidence of a broader renaissance at this point,"<br />

says Daniel Meckstroth, chief economist with the Manufacturers Alliance for<br />

Productivity and Innovation, an Arlington, Va., group that represents mostly<br />

large U.S. producers.<br />

Mr. Meckstroth says measures that look deeper inside the sector continue to<br />

flash warning signs. Take factory closings. For the past 13 years, the rate<br />

factories have been closing has been declining. That's good. The trouble is the<br />

rate of openings has been falling even faster. Simply put, America's factories are<br />

dying faster than they're being born.<br />

To be sure, many U.S. manufacturers are doing better than they have in some<br />

time. That's visible in hiring. Manufacturers have added more than 500,000 jobs<br />

since early 2010, and Monday's report from the Institute for Supply<br />

Management showed manufacturers continued expanding in March. But those<br />

gains pale compared with the deep hole created during the recession and just<br />

before it: U.S. factories lost nearly 5.7 million jobs from 2000 to 2010.<br />

www.texprocil.org.in Page 2

News Clippings<br />

There are many reasons to shutter a plant. Companies sometimes close<br />

operations as they streamline and modernize—allowing them to consolidate in<br />

fewer locations, often increasing overall output in the deal. That's good for the<br />

economy because it reflects growing productivity, the ability to produce more<br />

with less, which is crucial for lifting living standards over time. But it still can<br />

cost jobs in the short run and suggests manufacturers are far from vibrant.<br />

Tracking the birth and death of factories "isn't a perfect indicator," says Mr.<br />

Meckstroth. "But it's the one thing we have that's most current—and it doesn't<br />

show any revival."<br />

The nation's stubbornly wide trade deficit in manufactured goods is another<br />

trouble sign. If American factories have regained their competitive edge, it would<br />

make sense for them to be selling more abroad as well as at home—trimming the<br />

imbalance. But that hasn't happened.<br />

Another way to gauge competitiveness is to look at the share of manufactured<br />

goods purchased in the U.S. that are imported. This includes everything from<br />

finished products, like a blender, to car parts that are then used in a U.S. factory<br />

to build a vehicle. A revived U.S. factory sector ought to be grabbing more of its<br />

home market, but that also isn't happening, at least not yet.<br />

Mr. Meckstroth estimates that in 2012, imports accounted for nearly 40% of the<br />

manufacturing goods consumed in the U.S.—slightly more than the year before.<br />

Indeed, after dropping a bit during the recession, the share of imports has been<br />

rising for years. It was a mere 9% in 1967, when the government began tracking<br />

this measure.<br />

Many say falling energy costs, driven by the nation's natural-gas boom, will help<br />

fuel a manufacturing revival. But the price of natural gas is only one factor<br />

companies consider when they're deciding where to build.<br />

Goldman Sachs GS +0.49% economist Jan Hatzius, in a recent note to investors,<br />

said "rising productivity, subdued labor costs, low energy prices, and cost<br />

increases abroad have made the United States a much more attractive place to<br />

produce, especially on a relative basis." But he also sees no evidence that a<br />

broader revival is under way.<br />

"Measured productivity growth has been strong," he wrote, "but U.S. export<br />

performance—arguably a more reliable indicator of competitiveness—remains<br />

middling at best."<br />

Some experts insist the renaissance is simply too new to show up in the<br />

numbers. Others point to high-profile cases of companies returning jobs from<br />

overseas as evidence that the tide has turned.<br />

Examples of such "reshoring" range from tiny companies like Sleek Audio, which<br />

moved production of its high-end earphones to Florida from China, to General<br />

Electric Co., GE -0.65% which moved appliance production back to Kentucky<br />

www.texprocil.org.in Page 3

News Clippings<br />

from Mexico and China. But even advocates of reshoring admit it's still only a<br />

trickle, not a tidal wave. The Reshoring Initiative, a Chicago-based group that<br />

tracks examples, estimates that only about 50,000 jobs have been created in the<br />

U.S. as a result of reshoring since 2010.<br />

Meanwhile, many U.S. producers say some of the biggest barriers to a revival are<br />

factors like health-care costs and mounting regulations that make it costly to<br />

expand domestic operations.<br />

(Source Wall Street Journal, Apr 08, 2013)<br />

*****************<br />

HOME<br />

NY futures continued to move sideways this week, as May gave up just 13<br />

points to close at 88.33 cents, while December advanced 57 points to close at<br />

87.94 cents.<br />

The market has been forming another flagging pattern, which either signals a<br />

pause in a prevailing trend or a potential reversal in the making. For the last<br />

eleven sessions, the May contract has settled in a very tight range of just 263<br />

points, between 86.59 and 89.22 cents, and it is quite likely that we will soon see<br />

a breakout from this triangle formation. The question is in what direction?<br />

Typically these patterns are resolved in the direction of the trend, which in this<br />

case would be up, and there are still several factors acting in support of higher<br />

prices. The most important in our view remains the unusually large open interest<br />

in May and July, which as of this morning still amounted to a combined 166’424<br />

contracts or 16.6 million bales. This is just 1’868 contracts less than last week,<br />

which tells us that instead of getting out of current crop futures, traders prefer to<br />

roll their May positions into July, hoping for a better outcome down the road. In<br />

doing so they increase the likelihood for some fireworks over the next couple of<br />

months, since the July contract will mark the end of the line as far as current<br />

crop is concerned.<br />

Another element of support is the continuous strong demand for US cotton.<br />

Today’s US export sales report revealed that last week a combined 232’300<br />

running bales of Upland and Pima cotton were sold for both marketing years.<br />

Total commitments for this season now add up to 12.0 million statistical bales,<br />

whereof 8.5 million bales have already been exported. Unshipped commitments<br />

are down to just 3.5 million bales, which is 1.2 million bales less than a year ago,<br />

and at the current pace of shipments it would take just nine weeks to get these<br />

remaining commitments shipped.<br />

www.texprocil.org.in Page 4

News Clippings<br />

When we look at the current US balance sheet, we started with total supply of<br />

20.36 million bales, of which 12.0 million have so far been sold for export and<br />

3.4 million go to domestic mills. However, existing stocks will also have to supply<br />

about 0.9 million bales for domestic mill use and an estimated 0.8 million bales<br />

for export commitments between August and October, before new crop cotton<br />

becomes available. This leaves just around 3.5 million bales available for sale at<br />

this point, which at the current sales pace of 150’000 bales a week would all be<br />

gone within five months, or by the end of August. We therefore expect a<br />

slowdown in export sales from here on forward, not because mills are no longer<br />

interested, but because the US can’t possibly continue to sell at the current pace.<br />

There were some interesting developments on the macroeconomic front this<br />

week, which may have an impact on our market. Potentially bullish, especially in<br />

the longer run, is Japan’s decision to unleash US$ 1.4 trillion in quantitative<br />

easing, effectively doubling its monetary base by 2015. This is by far the most<br />

aggressive move by any central bank so far when compared to the size of the<br />

GDP.<br />

Whether this is just another chapter in an ongoing currency war or whether it is<br />

part of a concerted effort by central banks to keep their economies from<br />

imploding, the outcome is going to be the same! Running the printing press is<br />

tantamount to confiscation by eroding the purchasing power of the currency!<br />

Investors are starting to realize that having money in a bank or in a low-yielding<br />

government bond is probably not the wisest decision in the long run, because<br />

their money is at risk of being confiscated either directly, as in the case of<br />

Cyprus, or by debasement of the currency. Investors are therefore increasingly<br />

seeking diversification into tangible assets, such as real estate, stocks and<br />

commodities.<br />

Another development that needs to be watched is the recent temper tantrum by<br />

North Korea, which has the potential to grow into a full-blown conflict. So far<br />

most observers believe that North Korea is more bark than bite, but any<br />

escalation of the situation could prompt hedge funds to move to a “risk off”<br />

position, which would have a negative impact on commodity markets, as we have<br />

seen on previous occasions.<br />

So where do we go from here? The tug-of-war continues, as neither the spec<br />

longs nor the trade shorts are willing to part with their position. The shorts seem<br />

to have the weaker hand though, because they don’t really have much cotton left<br />

to back up their bets. An estimated 3.5 million bales of uncommitted US cotton,<br />

some of which is not going to be tenderable, against 16.6 million bales of open<br />

interest in May and July futures. And with every decent export sales report this<br />

pool of available US cotton shrinks further. Physical demand for US cotton<br />

shows no signs of slowing down yet, as mills still have a lot of holes to fill<br />

between now and new crop, and there aren’t that many cheap alternatives to US<br />

cotton at the moment. We therefore feel that as the trade procrastinates, it sets<br />

www.texprocil.org.in Page 5

News Clippings<br />

itself up for a short squeeze in the next couple of months! The trade of course<br />

hopes that speculators will blink first and somehow get spooked out of their<br />

longs, but this is just wishful thinking at this point.<br />

Best Regards<br />

(Source Plexus cotton, Apr 04, 2013)<br />

Weekly US Cotton Market Review<br />

*****************<br />

HOME<br />

Spot cotton quotations averaged 89 points higher than the previous week,<br />

according to the USDA, Agricultural Marketing Service’s Cotton Program.<br />

Quotations for the base quality of cotton (color 41, leaf 4, staple 34, mike 35-36<br />

and 43-49, strength 27.0-28.9, uniformity 81.0-81.9) in the seven designated<br />

markets averaged 83.57 cents per pound for the week ended Thursday, April 4,<br />

2013.<br />

The weekly average was up from 82.68 cents last week, but down 84.41 cents<br />

reported the corresponding period a year ago. Daily average quotations ranged<br />

from a low of 82.39 cents on Monday, April 1 to a high of 84.34 cents on<br />

Wednesday, April 3. Spot transactions reported in the Daily Spot Cotton<br />

Quotations for the week ended April 4 totaled 9,662 bales. This compares to<br />

5,082 bales last week and 6,699 bales reported a year ago. Total spot<br />

transactions for the season were 1,563,638 bales, compared to 818,108 bales the<br />

corresponding week a year ago. The ICE May settlement prices ended the week<br />

at 88.33 cents, compared to 88.46 cents last week.<br />

SOUTHEASTERN MARKETS<br />

Spot cotton trading was moderate. Supplies were moderate. Demand was good.<br />

Producer offerings were moderate. Average local spot prices were higher.<br />

Trading of CCC-loan equities was inactive. Producers took advantage of higher<br />

ICE futures during the period to forward contract and fixed prices on a moderate<br />

volume of 2013-crop cotton. Cool, mostly clear weather prevailed through parts<br />

of Virginia and the Carolinas during the week. Nighttime temperatures were in<br />

the low 30s. Warm, moist air from the Gulf of Mexico collided with cooler air<br />

over parts of Alabama, northern Florida, and Georgia, which resulted in tornado<br />

warnings throughout the region.<br />

www.texprocil.org.in Page 6

News Clippings<br />

No damage was reported. Daytime highs were in the mid-50s, with overnight<br />

lows in the low 40s. Many areas remained too wet to support equipment.<br />

Reports indicated that weather delays in planting grain crops due to cold, wet<br />

ground could shift additional acres to cotton.<br />

SOUTH CENTRAL MARKETS<br />

North Delta<br />

Spot cotton trading was inactive. Supplies were light. Demand was light. Average<br />

local spot prices were higher. Trading of CCCloan equities was inactive. A light<br />

volume of forward contracting was reported. Scattered showers, strong winds,<br />

and cold temperatures dominated the weather pattern during the week. Fields<br />

remained saturated due to prolonged wet weather. About one inch of rain was<br />

reported in most areas. Daytime temperatures ranged from the low 50s to the<br />

upper 60s. Overnight lows were in the low 40s. According to the National<br />

Agricultural Statistics Service, both topsoil and subsoil moisture was rated at<br />

mostly adequate to surplus throughout the region. Cold, wet conditions halted all<br />

fieldwork.<br />

South Delta<br />

Spot cotton trading was inactive. Supplies were light. Demand was light. Average<br />

local spot prices were higher. Trading of CCCloan equities was inactive. A light<br />

volume of forward contracting was reported. Cool, damp conditions dominated<br />

the weather pattern during the week. Less than one inch of rain was reported,<br />

but fields remained too soft to support equipment. Daytime high temperatures<br />

were in the 50s, while overnight lows were in the mid-40s. According to the<br />

National Agricultural Statistics Service, both topsoil and subsoil moisture was<br />

rated at mostly adequate to surplus throughout the region. Cold, wet conditions<br />

brought fieldwork to a standstill.<br />

SOUTHWESTERN MARKETS<br />

East Texas-Oklahoma<br />

Spot cotton trading was slow. Supplies were light. Demand was moderate.<br />

Average local spot prices were higher. Producer offerings were light. Trading of<br />

CCC-loan equities was inactive. Foreign mill inquiries were moderate. Interest<br />

was best from Indonesia, Taiwan, and Turkey. Producer interest in forward<br />

contracting was good.<br />

Widespread thunderstorms brought beneficial precipitation ahead of planting in<br />

some areas of Texas. Inclement weather interrupted planting activities in the<br />

Brazos Bottom. Although parts of southern Texas received rain and hail damage,<br />

much of the cotton-growing areas remained parched and need more moisture for<br />

www.texprocil.org.in Page 7

News Clippings<br />

germination. Beneficial precipitation was received that measured around one to<br />

one and one-half inches of rainfall in Kansas.<br />

Recent rain events improved subsoil moisture in southern counties, resulting in<br />

some traditional dryland cotton fields to be planted to corn and beans. Acreage<br />

planted to cotton in Kansas is expected to be reduced 16,000 acres from last year<br />

to 40,000 acres, according to the 2013 Prospective Plantings released by the<br />

National Agricultural Statistics Service (NASS).<br />

In Oklahoma, some southeastern wheat fields that failed, were plowed and<br />

prepared for cotton planting. A band of severe weather swept across the region,<br />

but droughty conditions continued. According to NASS, producers expect to<br />

plant 160,000 acres, down 48 percent from the previous year.<br />

West Texas<br />

Spot cotton trading was slow. Supplies were light. Demand was moderate.<br />

Average local spot prices were higher. Producer offerings were light. Trading of<br />

CCC-loan equities was inactive. Foreign mill inquiries were moderate. Interest<br />

was best from Indonesia, Taiwan, and Turkey. Producer interest in forward<br />

contracting was good.<br />

Thunderstorms brought up to three-quarters of an inch of beneficial rainfall to<br />

some areas that helped fortify subsoil moisture ahead of planting. Some parts of<br />

the Northern High Plains received a mixture of rain and snow. The cottongrowing<br />

areas of the Rolling Plains received around one to two inches of<br />

precipitation. Irrigated fields were watered ahead of planting before and after the<br />

winter storms. Fertilizer was applied to the fields. Meetings and trade shows<br />

were well attended.<br />

WESTERN MARKETS<br />

Desert Southwest (DSW)<br />

Spot cotton trading was slow. Supplies and demand were light. Average local<br />

spot prices were higher. No forward contracting or domestic mill activity was<br />

reported. Foreign mill inquiries were light. The crop made good progress in<br />

Yuma, Arizona. Planting expanded into western and central Arizona. According<br />

to the National Agricultural Statistics Services’ (NASS) Prospective Plantings<br />

released on March 28, Arizona cotton acreage is anticipated to be around<br />

160,000 acres, down 40,000 from the previous season. Local experts were in<br />

general agreement with the figure. Dry conditions persisted in New Mexico and<br />

El Paso, Texas.<br />

www.texprocil.org.in Page 8

News Clippings<br />

A few producers were irrigating with well water if available. Water allocations<br />

from irrigation districts would not be available until June. Local experts<br />

indicated that NASS Prospective Plantings acreage for New Mexico and El Paso,<br />

Texas was too optimistic and that acreage would be significantly lower, due to<br />

the on-going drought and limited irrigation water supplies.<br />

San Joaquin Valley (SJV)<br />

Spot cotton trading was inactive. Supplies were light. Demand was moderate.<br />

Average local spot prices were higher. No forward contracting or domestic mill<br />

activity was reported. Foreign mill inquiries were slow. Thunderstorms with<br />

rainfall were received early in the reporting period. Approximately one-third of<br />

an inch of rain was deposited in the central and northern SJV.<br />

Unusually, warm temperatures in the high 70s to low 80s advanced planting<br />

activities. According to the National Agricultural Statistics Services’ Prospective<br />

Plantings released on March 28, SJV growers intend to plant 90,000 acres,<br />

down 37 percent from the previous year. The decline is attributed to competitive<br />

crops and limited irrigation water supplies.<br />

AMERICAN PIMA (AP)<br />

Spot cotton trading was slow. Supplies were moderate. Demand was good.<br />

Average local prices were steady. Forward contracts for2013-crop were offered,<br />

but no contracts were signed. No domestic mill activity was reported.<br />

Foreign mill inquiries were steady for current crop. New-cropinquiries were<br />

mostly for the purpose of price discovery. Some shippers limited new-crop<br />

offerings. Industry representatives reported that there was a possibility that no<br />

organic AP would be planted in California and limited in Arizona.<br />

Sources cited lack of demand, over-supply from previous year, and mills offered<br />

no contracts to growers at this time. Temperatures were in the 80s for most of<br />

the region. The crop made good progress in Yuma, Arizona. Planting activities<br />

expanded in the San Joaquin Valley. Some seedling emergence was reported in<br />

the south Valley.<br />

According to the National Agricultural Statistics Services’ Prospective Plantings<br />

released on March 28, AP planted acreage is expected to be 206,000 acres, down<br />

14 percent from the previous year. However, local experts reported that acreage<br />

www.texprocil.org.in Page 9

News Clippings<br />

would be significantly lower than projected for New Mexico and Texas, due to<br />

the on-going drought.<br />

TEXTILE MILL REPORT<br />

Domestic mill buyers inquired for a moderate volume of 2013-crop cotton, color<br />

42 and better, leaf 4 and better, and staple 34 and longer for first quarter 2014<br />

delivery. Reports indicated most mills had covered all of their immediate-tonearby<br />

raw cotton needs. No sales were reported. Demand for all styles of yarn<br />

remained good and most mills were operating at capacity.<br />

Demand through export channels was light. Turkish mill buyers purchased a<br />

moderate volume of USDA Green Card Class, color 41, leaf 3 and 4, and staple 36<br />

for May/June shipment. Indonesian mill buyers inquired for a light volume of<br />

USDA Green Card Class, color 31, leaf 3, and staple 36 for May/June shipment.<br />

Representatives for mills in Vietnam inquired for a moderatevolume of color 41,<br />

leaf 4, and staple 35 for May through July shipment.<br />

USDA ANNOUNCES SPECIAL IMPORT QUOTA #8 FOR<br />

UPLAND COTTON - APRIL 4, 2013<br />

The Department of Agriculture’s Commodity Credit Corporation announced a<br />

special import quota for upland cotton that permits importation of a quantity of<br />

upland cotton equal to one week’s domestic mill use. The quota will be<br />

established on April 11, 2013 allowing importation of 14,776,787 kilograms<br />

(67,869 bales) of upland cotton.<br />

Quota number 8 will be established as of April 11, 2013, and will apply to upland<br />

cotton purchased not later than July 9, 2013, and entered into the U.S. not later<br />

than October 7, 2013. The quota is equivalent to one week’s consumption of<br />

cotton by domestic mills at the seasonally-adjusted average rate for the period<br />

August 2012 through October 2012, the most recent three months for which data<br />

are available.<br />

Future quotas, in addition to the quantity announced, will be established if price<br />

conditions warrant.<br />

(Source www.ams.usda.gov, Apr 05, 2013)<br />

*****************<br />

HOME<br />

www.texprocil.org.in Page 10

News Clippings<br />

Africa indaba on textiles unpacked<br />

Africa as an alternative source for textiles, the practicalities of getting a product<br />

to consumers and work-related social issues within factories in the region will be<br />

unpacked at a textile industries gathering in Cape Town this week.<br />

This gathering called Source Africa, a four-day meeting of business leaders from<br />

the textile and apparel industry, will be held at the Cape Town International<br />

Convention Centre starting Tuesday<br />

Rob Davies, Minister of Trade and Industry, will speak at the event opener next<br />

Tuesday. Steve Lamar, executive vice president of the American Apparel &<br />

Footwear Association, will join him.<br />

A series of business seminars will run until Friday. The first seminar will focus<br />

on the practicalities of getting a product to consumers once it is manufactured.<br />

Organisers said it would also focus on how to get raw materials to factories.<br />

“Speakers will discuss obstacles related to infrastructure and transportation and<br />

the best practices for brands in dealing with these issues. Other key points for<br />

this seminar will be speed-to-market realities and opportunities and how to deal<br />

with customs clearance,” organisers said.<br />

The African Cotton & Textile Industry Federation (ACTIF) will also host a<br />

session looking at “Africa as an alternative sourcing destination.”<br />

(Source www.thenewage.co.za, Apr 07, 2013)<br />

*****************<br />

Local textile firms see gains from Beijing expo<br />

HOME<br />

TAIPEI--Taiwanese firms have reaped benefits from their presence in the March<br />

27-29 Intertextile Beijing Apparel Fabrics, an annual textile trade show in China,<br />

The Taiwan Textile Federation (TTF) said Saturday.<br />

The 26 Taiwanese exhibitors secured about US$480,000 (NT$14.35 million) in<br />

orders from foreign buyers during the event, the local textile business grouping<br />

said.<br />

www.texprocil.org.in Page 11

News Clippings<br />

Moreover, the 26 firms are expected to receive no less than US$2.5 million in<br />

total orders in the near future as potential buyers had paid close attention to<br />

these local exhibitors, the federation said.<br />

According to the TTF, the local exhibitors had showcased innovations such as<br />

eco-friendly fabrics, sportswear, lace fabrics and embroidery items, which were<br />

seen by about 850 potential foreign buyers who visited their booths. The<br />

interested international brands included Burberry, Polo Ralph Lauren, GAP, and<br />

H&M.<br />

In the fair held at the China International Exhibition Centre in Beijing,<br />

Taiwanese firms occupied a display area of 303 square meters, which grew 10<br />

percent from a year earlier.<br />

The Intertextile Beijing is seen as the most important textile exhibition in<br />

northern China and has drawn buyers from other Asian countries and Europe.<br />

In the 2013 event, a total of 1,330 textile suppliers from 16 countries displayed<br />

their works in an area of 50,000 square meters, and trade show organizer held 17<br />

seminars on subjects ranging from fashion trends, manufacturing technology<br />

and environmental protection to marketing and legal affairs.<br />

In addition to Taiwan, exhibitors came from Italy, Germany, South Korea,<br />

Japan, Pakistan, Austria, India, Switzerland, Hong Kong, Thailand, Portugal, the<br />

United Kingdom, Turkey and the United States.<br />

The TTF said as more and more foreign buyers set store by Intertextile Beijing,<br />

the federation is determined to organize another delegation to attend the event<br />

next year, with preparatory work kicking off in late October.<br />

(Source www.chinapost.com.tw, Apr 07, 2013)<br />

*****************<br />

’Pakistan, Algeria should strengthen economic relations’<br />

HOME<br />

FAISALABAD: Pakistan and Algeria enjoy excellent political relations but the<br />

economic relations are not satisfactory, we are here to strengthen bilateral trade<br />

ties by establishing direct contact with the business community of Pakistan, said<br />

Dr. Ahmed Benflis, Ambassador of Algeria in Pakistan.<br />

Addressing the members of Faisalabad Chamber of Commerce and Industry<br />

(FCCI) here on Saturday, he said that Algeria is basically oil exporting country<br />

and most of their imports are from EU and France. Some of these countries are<br />

indirectly exporting textile products to Algeria also. He said that Pakistan is in<br />

deep energy crisis and we could help our brotherly country by increasing exports<br />

of Liquefied Natural Gas (LNG). Similarly, Pakistani businessmen should<br />

www.texprocil.org.in Page 12

News Clippings<br />

explore the opportunities and export of rice and textile products directly to<br />

Algeria.<br />

He said that there are only two Pakistan businessmen hailing from Karachi and<br />

we need to expand our business to business ties by exploiting all our available<br />

channels. He invited Pakistani businessmen to visit Algeria and have face to face<br />

meetings with the counterparts of this brotherly country.<br />

Regarding a question about visa, he said that three-month visa is issued within<br />

four days which could be further extended very easily on recommendation of<br />

FCCI.<br />

He said that an international exhibition would be held in June this year in<br />

Algeria and hoped that Pakistani businessmen would avail this opportunity by<br />

taking part in this exhibition and introducing their products there.<br />

He said that a number of agreements were signed between trade bodies of both<br />

the countries in the past but these were not really implemented.<br />

Earlier in his welcome address to the Algerian Ambassador, President Faisalabad<br />

Chamber of Commerce & Industry (FCCI), Mian Zahid Aslam, said that Pakistan<br />

and Algeria have always enjoyed extremely cordial and friendly relations. There<br />

is tremendous trade potential between the two brotherly Islamic countries.<br />

There is an excellent opportunity for Pakistani entrepreneurs to collaborate in<br />

different sectors in Algeria.<br />

He said that Algeria is Pakistan's important trading partner but still trade<br />

volume between both the countries is negligible if taking account of trade volume<br />

of Algeria as US $124 billion in 2012. He continued that in 2011 bilateral trade<br />

between Algeria and Pakistan stood at US $27 million. Algeria exported US $1.15<br />

million worth of goods to our country while Pakistan's exports stood at US $26<br />

million.<br />

He stated that there are vast prospects of expansion of bilateral trade including<br />

joint venture in textile, agro-based industry, leather goods, oil and gas and IT.<br />

Algeria has a great potential market for Pakistani products especially Pakistani<br />

textile and textile products having great demand in Algeria. However, due to<br />

prolonged energy deficit in Pakistan, power sector offers great investment<br />

potential in hydro projects and alternative energy sources. Government of<br />

Pakistan policies are also relaxed for remittance of whole profit in foreign<br />

currency, he added.<br />

Chamber chief said that by enhancing direct contacts between private sectors of<br />

both countries and facilitating them in their efforts, Pakistan and Algeria have<br />

the potential to take bilateral trade manifold in the near future. FCCI and<br />

Embassy of Algeria in Pakistan should act as bridge for connecting the business<br />

communities of both the countries as to exchange of trade delegations on<br />

www.texprocil.org.in Page 13

News Clippings<br />

reciprocal basis, single country exhibition and signing of Pak-Algeria Trade<br />

agreement etc.<br />

Ch. Muhammd Boota, Vice President FCCI, former President, Abdul Qayyum<br />

Sheikh, Algerian Trade Counsellor, Abdur Rahim, Zeeshan Umer, Ch.<br />

Muhammad Asghar, Ch. Jamil Ahmed, Shahid Mumtaz Bajwa, Ehsan Malik,<br />

Sheikh Muhammd Khalid Habib, shared their views on the occasion<br />

(Source Brecorder - Apr 07, 2013)<br />

*****************<br />

PHMA urges govt to rollback 2% sales tax on textiles<br />

HOME<br />

The Pakistan Hosiery Manufacturers and <strong>Export</strong>ers Association (PHMA) has<br />

urged the Government to rollback the two percent sales tax imposed on the<br />

domestic textile sector, which till recently enjoyed zero-tax status, as the<br />

measure would not benefit the country’s economy.<br />

Speaking at a meeting, PHMA vice chairman Syed Zia Alamdar Hussain said the<br />

decision to impose two percent sales tax was taken by the Government without<br />

taking the industry stakeholders into confidence.<br />

The statutory regulatory orders (SROs) issued by the Federal Board of Revenue<br />

(FBR) are totally impractical and unviable and they would not result in increased<br />

tax collection, he added.<br />

Mr. Hussain said the present caretaker Government has not initiated any steps<br />

to aid recovery of the economy, and if it remains reluctant to address the issues,<br />

it would lead to large scale redundancy.<br />

Besides the levy of two percent sales tax, the meeting also discussed issues like<br />

impulsive power and gas outages.<br />

Mr. Hussain said the preceding Government, which caused the textile units to<br />

endure 16 hours power outages per day, has caused irreversible damage to the<br />

domestic industry.<br />

www.texprocil.org.in Page 14

News Clippings<br />

In spite of its commitment to provide five day per week gas supply during<br />

summer, the Government directed the authorities to supply gas for just three<br />

days per week, he said.<br />

The PHMA members said that in view of the prevailing policies and situation, it<br />

has become difficult for entrepreneurs to survive in business in Pakistan, which<br />

is forcing entrepreneurs to consider relocating to other countries.<br />

(Source Fibre2fashion - Apr 06, 2013)<br />

*****************<br />

HOME<br />

German delegation discusses energy issue with APTMA<br />

A German delegation from Federal Ministry for Economic Cooperation &<br />

Development, German Embassy, KFW Bank of Germany and GIZ, visited<br />

APTMA Punjab office. Members Steering Committee on Sustainable Production<br />

Center (SPC) APTMA Seth Muhammad Akbar, Syed Ahsan Ali and Shahid Faraz<br />

welcomed the delegation at the APTMA office.<br />

Secretary APTMA Punjab Anis-ul-Haq made a detailed presentation on the<br />

APTMA and the SPC to the visiting delegation. He said the image problem and<br />

the energy shortage are two major challenges of textile industry in Pakistan,<br />

losing $10 billion opportunity in last seven years while the regional competitors<br />

were growing during the same.<br />

Briefing about the SPC, running in collaboration with the GIZ, a German firm, he<br />

said 42 mills have so far been approached by the SPC, saving 10 MW energy in<br />

general. The Sustainable Production Centre (SPC) was established in 2008. It<br />

has a potential to save 268W of energy through implementation of Energy<br />

Management System (EnMS). Presently the APTMA members are saving Rs395<br />

million with an implementation cost around Rs65 million.<br />

The objective of the SPC is to provide technical and management services to the<br />

APTMA members on energy security, affordability, conservation, Health, Safety<br />

& Environment (SHE), CSR and renewable energy. He said 90% of the member<br />

mills are keen for EnMS.<br />

www.texprocil.org.in Page 15

News Clippings<br />

Majority of them want energy management training with a lot of interest in<br />

renewable energy, which is an untapped area and the study of a project is<br />

finalised through the courtesy of GIZ. Further, there is lot of potential for solar<br />

energy, wind power, small hydro, and bio mass and geothermal energy. On the<br />

way forward, he said, it is very clear and the APTMA would like to see the<br />

specialized credit lines on energy efficiency and renewable energy for the<br />

member mills.<br />

The visiting delegation appreciated the efforts made by the GIZ in helping out<br />

the textile industry in energy management. It further hoped that things would be<br />

streamlined further once the country completes the election process ahead.<br />

(Source Fibre2fashion - Apr 06, 2013)<br />

*****************<br />

South Africa’s Industrial Plan to support textile sector<br />

HOME<br />

The fifth Industrial Policy Action Plan (IPAP) for 2013-14, launched by the<br />

Government of South Africa, aims to support the manufacturing of textiles and<br />

clothing in the country, along with other sectors.<br />

Unveiling IPAP 2013-14, Minister of Trade and Industry Rob Davies said the<br />

main objective of the plan was to promote industrialization in the country and<br />

thereby stimulate economic growth.<br />

The Minister said South African clothing and textile industry has seen a<br />

significant turnaround and local firms have been successful in recapturing<br />

domestic market share and forming working relationships with the government,<br />

retailers and other manufacturers. He added that the decline in employment in<br />

the country’s textile and apparel sector has slowed down and the negative trend<br />

is being reversed.<br />

IPAP 2013-14 gives high priority to the textiles and garment sector owing to its<br />

labour-intensive character. The plan also set standards and a strategic tariff<br />

regime to curb substandard imports.<br />

The Minister said the South African economy needs to explore new export<br />

markets, particularly in African continent, and pursue regional integration.<br />

www.texprocil.org.in Page 16

News Clippings<br />

In addition to exploring new markets, IPAP will focus on generating<br />

employment, encouraging innovation and taking benefit of new opportunities<br />

provided by South Africa’s BRICS membership.<br />

(Source Fibre2fashion - Apr 06, 2013)<br />

*****************<br />

Peru exporters want more efforts to ensure textile growth<br />

HOME<br />

The textile and clothing sector in Peru has great potential, but the difficult<br />

economic environment in major markets, fall in the exchange rate, and growing<br />

labour costs are impeding their exports, according to Asociación de<br />

<strong>Export</strong>adores (ADEX or Association of Exproters).<br />

The situation calls for doubling of efforts to ensure growth of the textile and<br />

apparel sector, ADEX said in a statement.<br />

The association’s president Varilias Juan Velasquez said the progress in<br />

increasing the country’s cotton output has been minimal in spite of the<br />

Government’s S 0.22 per quintal compensation given to farmers to encourage<br />

cotton cultivation.<br />

The availability of cotton at competitive prices is essential for growth of the<br />

country’s textile and apparel sector, and urged the Government to change its<br />

strategy, as the present strategy has not worked, Mr. Velasquez said.<br />

The chairman of ADEX’s garment division, Mr. Pedro Gamio Palacios too<br />

defended the need to retain the competitiveness of cotton and called for<br />

implementing a comprehensive strategy for increasing the productivity and<br />

strengthening cooperation among farmers.<br />

He said agriculture is very fragmented with farmers owning tiny plots of land. He<br />

suggested increasing the area under cotton plantation, and adapting modern<br />

agronomic procedures to yield a good crop that can even be exported.<br />

The cotton grown in Peru is bought by the textile industry at prices prevailing in<br />

the international market, but owing to lack of productivity and other factors,<br />

www.texprocil.org.in Page 17

News Clippings<br />

Peruvian farmers have to depend on Government subsidies to make their prices<br />

competitive.<br />

The Peruvian Government has been providing subsidy for several years but it has<br />

not yielded desired results and hence the strategy should be changed to<br />

promotion of modernization of irrigation projects, providing technical<br />

assistance, strengthening partnerships, improving access to finance, and<br />

increasing the productive areas, Mr. Gamio said.<br />

(Source Fibre2fashion - Apr 06, 2013)<br />

*****************<br />

HOME<br />

NATIONAL NEWS<br />

Fibres & Yarns expo opens this week<br />

The Indian textile and clothing industry has tremendous potential to scale new<br />

heights in the international markets. The prime reason is not only the abundant<br />

availability of all types of fibres and yarns such as cotton, viscose and polyester<br />

fibres and yarns in the domestic market, but the availability of all these raw<br />

materials at prices “lower” than international markets.<br />

Even today, all fibres and yarns manufactured in India are available to the textile<br />

and clothing value chain as prices which are below the international markets.<br />

This price edge needs to be leveraged by the Indian textile value chain to expand<br />

its foot-print in the global markets. The raw material price advantage alongwith<br />

with abundant availability is the most lethal competitive factor in favour of<br />

India. This is precisely the reason that Indian textile and clothing exports have<br />

been increasing to the international market. To make available these fibres and<br />

yarns to the downstream fabric, garment and home textiles value chain, leading<br />

fibre and yarn producers from Indian and abroad will unveil their latest and<br />

innovative collections at the 8th Edition of Fibres & Yarns Expo which is<br />

scheduled to take place in Mumbai from 11 th to 13th April 2013. Over<br />

8000 visitors are expected to attend the 3-day show.<br />

www.texprocil.org.in Page 18

News Clippings<br />

The theme for Fibres & Yarns 2013 is ‘Preserving the Past – Ensuring the<br />

Future’. Leading specialty fibers and yarns manufacturers, from India and<br />

abroad, will be display: Lycra Yarn; Silver Yarn; Soyabean, Milk and Bamboo<br />

fibers (From China); Nylon Micro fibers; Modal and Tencel Fibers; Fire<br />

Retardant Viscose; Hi-tech Polyester fibers and filaments for functional fabrics;<br />

Pure Silk, Linen and Jute Yarns. The largest collection of Fancy Yarns for woven<br />

and knit wears will also be displayed by prominent Indian and Foreign<br />

Exhibitors.<br />

The aim of the exposition is to bring different types of fiber and yarn<br />

manufacturers on one platform where weavers, knitters and garment brand<br />

managers get an opportunity to have a look at the latest and specialty yarn<br />

collections for conversion into innovative fabrics and garments.<br />

It is a fact that fashion starts with the selection of the right raw materials. And in<br />

case of textile and clothing, fibres and yarns are the most important raw<br />

materials which are converted into the final garment or home textiles. The<br />

forthcoming event has been scheduled at a time when the industry is planning its<br />

production prorgammes for the coming seasons ahead and the Fibers & Yarns<br />

Expo gives them an opportunity, not only to see the yarns but also have the<br />

fabric samples of the displayed yarns and fibers. Sourcing of the yarns, thus<br />

becomes handy for the visitors and they can commit their requirements directly<br />

to the manufacturer.<br />

(Source Tecoya Trend, Apr 08, 2013)<br />

*****************<br />

HOME<br />

Indore: Proposed Textile Park expected to be a hit among manufactureres<br />

Indore: Close to 500 textile manufacturers including some leading<br />

manufacturers of the region, are expected to set up their base at the proposed<br />

Textile Park. The park will be set up on 55-acre land in Betma.<br />

MP Garments' Manufacturers Association secretary, Ashish Nigam said that<br />

Audyogik Kendar Vikas Nigam (AKVN) Indore has approved the land allotment<br />

recently.<br />

www.texprocil.org.in Page 19

News Clippings<br />

Now association would hold a meeting for discussing allotment strategy, said<br />

Nigam adding that the association plans to persuade some leading<br />

manufacturers of the region for setting up base at the park so that other smaller<br />

manufacturers are encouraged for doing the same.<br />

"The association is already having discussions with some leading<br />

manufacturers," said Nigam.<br />

Textile manufacturers are long awaiting commencement of Textile Park in the<br />

city.<br />

The association also had got an approval for the Textile Park project under a<br />

scheme from Ministry of Textiles. However, the proposal was gathering dust for<br />

want of necessary land allotment from the state government.<br />

Neighbouring states like Maharashtra and Gujarat already have established such<br />

textile parks.<br />

AKVN, Indore has recently shown 55 acre land earmarked for this project to<br />

Indore Readymade Garments Manufacturers Association.<br />

There are around 2,200 big and small garment manufacturing units in Indore.<br />

Most of these units are functioning from cramped localities of Rajwada and<br />

nearby areas.<br />

Total 220 plots are there in Readymade Park developed years ago in<br />

Pardeshipura and 193 units function from the premises.<br />

Several manufacturers still keep making rounds at Audyogik Kendar Vikas<br />

Nigam for getting land allotments and as many as 47 applications are pending<br />

with the corporation.<br />

(Source daily.bhaskar.com, Apr 08, 2013)<br />

*****************<br />

HOME<br />

www.texprocil.org.in Page 20

News Clippings<br />

Textile Ministry urged to allow duty free import of yarn<br />

Knitwear exporters have blamed yarn manufacturers of hoarding stock and using<br />

the present situation to their advantage.<br />

Perturbed with the turn of event since the beginning of March, exporters in this<br />

knitwear hub said “yarn manufacturers have stopped delivery since March 5,<br />

albeit unofficially, with a view to hoard supply and create artificial demand. This<br />

is affecting our production schedule, particularly because the orders have started<br />

to flow in since January. There is also an abnormal increase in the rate of yarn<br />

and the mill sector is not prepared to come to the table for talks.”<br />

Recapping the scenario, an exporter explained: “Cotton was ruling at Rs 38,500<br />

a candy in October 2011. The 40s count yarn was then quoting Rs 211 a kg and<br />

the rate was maintained around that level up to February.<br />

On March 1 this year, cotton prices fell from the October 2011 level to Rs 37,500<br />

a candy. Yarn (40s count) on the other hand rose to Rs 235 a kg. There was a<br />

marginal increase in the price of the cotton on April 1 to Rs 38,800/candy, by<br />

which time, the yarn rate shot to Rs 248/kg.<br />

If you compare the Oct 2011 cotton price with the April1 price, the increase is just<br />

Rs 300 a quintal. Yarn rate on the other hand has risen by Rs 36. This is an<br />

abnormal increase,” the source said and pointed out that the Government had<br />

allowed duty free import of cotton in the last six-seven months.<br />

“The mill sector has imported nearly 21 lakh bales of cotton – duty free, at rates<br />

lower compared with the domestic rate,” allege exporters.<br />

Unhealthy competition<br />

Calling this an unhealthy competition and one that would hit – both the mill<br />

sector and the downstream garment sector hard, Tirupur <strong>Export</strong>ers’ Association<br />

President A. Sakthivel said that the association has sought the intervention of the<br />

Textile Ministry in this regard.<br />

“We are unable to renegotiate the price with the buyer, as the contracts have<br />

been finalised. How can we manage when the yarn price shoots up from Rs 211 to<br />

Rs 248 and yarn deliveries stopped abruptly?’ he asked.<br />

Stating that the sector was prepared for some increase, say up to Rs 225-227/kg<br />

of yarn, he said, “We can actually resolve this issue if only the mill sector is<br />

prepared to talk to us. The situation is affecting not just the knitwear exporters<br />

but the powerloom and made-up sectors as well,” he added.<br />

www.texprocil.org.in Page 21

News Clippings<br />

The association, meanwhile, has appealed to the Textile Ministry to allow duty<br />

free import of yarn against export.<br />

(Source Business Line, Apr 08, 2013)<br />

*****************<br />

HOME<br />

Indian textile sector keen to explore emerging markets<br />

Indian textile and garment manufacturers are eyeing on emerging markets,<br />

including South America, Japan, Australia, New Zealand and Africa, for exports.<br />

According to industry representatives, Indian textile sector witnessed a negative<br />

growth mainly due to decline in clothing exports in 2012-13. However, exports to<br />

non-traditional markets recorded positive growth during this period and the<br />

textile and apparel makers expect the growth to continue in the current fiscal<br />

year.<br />

Speaking to fibre2fashion, secretary of Confederation of Indian Textile Industry<br />

(CITI), Mr. DK Nair said, “Last fiscal year may have ended with a negative<br />

growth in exports of textiles, basically because of the decline in garment exports.<br />

But now the demand for our garments has started improving in the traditional<br />

markets and exports to some new markets have also started growing. Thus, our<br />

exports of textiles during 2013-14 are expected to register a significant positive<br />

growth.”<br />

“There is also a perceptible improvement in production and domestic demand<br />

for all textile products,” he adds.<br />

When asked about shifting focus to emerging markets, he says, “The focus needs<br />

to be on the traditional markets, since global consumption of textile products is<br />

substantially in our traditional markets. Emerging markets in Latin America,<br />

Africa and South East Asia including Japan are potential areas for improving our<br />

export of garments. For non-apparel textiles, Asia and Europe will remain the<br />

major markets.”<br />

During the 11 months of the last fiscal year, clothing sector recorded a shortfall in<br />

exports by 8 percent and declined to US$ 11.5 billion, compared to US$ 14 billion<br />

worth of garment exports made in the year 2011-12.<br />

Mr. Rahul Mehta, president of Clothing Manufacturers Association of India<br />

(CMAI), says, “I see a slight improvement in the exports this year since the US<br />

economy is showing signs of some recovery and efforts of the industry to<br />

diversify into non-traditional markets will start bearing some fruits.”<br />

www.texprocil.org.in Page 22

News Clippings<br />

Some of the emerging markets being focused by the textile and apparel makers<br />

for last few years include South America, Japan, Australia and New Zealand.<br />

“Entry into new markets is never easy and it is a long-term exercise. But<br />

hopefully, last few years’ efforts will start showing results this fiscal year,” Mr.<br />

Mehta opines.<br />

Last month, chairman of Apparel <strong>Export</strong> <strong>Promotion</strong> <strong>Council</strong> (AEPC), Mr. A<br />

Sakthivel proposed to the Union Minister for Commerce, Industry & Textiles Mr.<br />

Anand Sharma to increase duty credit scrip from the present 3-4 percent to 5<br />

percent for the non- traditional markets to reduce the dependency on the US and<br />

the EU.<br />

(Source Fibre2fashion - Apr 06, 2013)<br />

Cotton continues winning spree<br />

*****************<br />

HOME<br />

Cotton prices on MCX posted gains for the sixth consecutive month in March<br />

with a rise of around 2.3 per cent and a rally of around 15 per cent in the first<br />

quarter of 2013. Rising demand expectations from China and lower arrivals in<br />

the local markets acted as a supportive factor for prices. However, in the end of<br />

March, prices came under pressure as investors were worried over fibre sale by<br />

the world’s top two producers India and China. But, the Indian government did<br />

not release stocks, while China released less quantity than expected. This led<br />

cotton prices to once again move in upward.<br />

MCX cotton April contract, which rose almost 12 per cent from its lows of<br />

February, is trading at around Rs 19,000 per bale (1 bale=170 kg). In the<br />

international markets, cotton prices touched an 11-month high of 93.93 cents per<br />

pound in March and are trading around 88.20 cents per pound at present.<br />

Lower supplies in the domestic markets and rising cotton prices have caused<br />

concerns for the textile industry, which is demanding government to direct<br />

Cotton Corporation of India (CCI) and National Agricultural Cooperative<br />

Marketing Federation of India (Nafed) to offload the cotton stock to domestic<br />

mills. However, the agriculture ministry is opposing the same as offloading<br />

stocks may drag down prices their support prices.<br />

According to Cotton Advisory Board’s (CAB) latest estimates, domestic cotton<br />

production is pegged 330 lakh bales for 2012-13 season (October-September),<br />

down 7 per cent from the previous year’s estimates of 355 lakh bales. Cotton<br />

www.texprocil.org.in Page 23

News Clippings<br />

prices may trade with upward bias on account of strong demand in the domestic<br />

markets and comparatively lower supplies. Further, firm international markets<br />

may also support domestic cotton prices, said Vedika Narvekar senior research<br />

analyst commodities at Angel Broking.<br />

In the short term, cotton prices on the domestic platform are expected to recover<br />

from recent lows and to trade higher as expectations of good export demand<br />

from Pakistan, Bangladesh and China in the coming weeks may support prices,<br />

said Pallavi Munankar, research analyst at Geojit Comtrade. In addition to this,<br />

lower arrivals in the markets will also lead to further rise in prices. Moreover,<br />

less than expected release from China and forecast of lower acreage in the US<br />

report where the country’s cotton planting intentions were reported at a fouryear<br />

low will also help further upside in fibre prices. However, weak global<br />

market sentiments may cap some gains in prices, she added.<br />

According to Nalini Rao, analyst at India Infoline: Technically, prices of MCX<br />

cotton have crucial support around Rs 18,500/bale each bales weighs 170 kg. On<br />

the higher side resistance is likely to be seen at Rs 19,500/bale. If, prices<br />

consistently trade above the Rs 19,500/bale an upside move towards Rs 20,100-<br />

21,000/bale might be seen. On the NCDEX April 2013 cotton contract might<br />

observe strong support around Rs 850/20kg and resistance may be seen at Rs<br />

1,021/20 kg. zz<br />

(Source cottonyarnmarket - Apr 07, 2013)<br />

*****************<br />

HOME<br />

www.texprocil.org.in Page 24