Details of the shareholdings referred to in Article 166 L.I.R.

Details of the shareholdings referred to in Article 166 L.I.R.

Details of the shareholdings referred to in Article 166 L.I.R.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

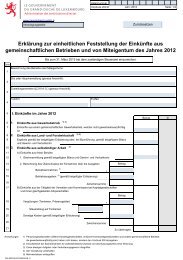

form 506A year: 2012 page: 2/2<br />

L<strong>in</strong>e<br />

25 4) Charges <strong>in</strong> relation with <strong>the</strong> sharehold<strong>in</strong>g<br />

26 a) Balance sheet data<br />

Balance sheet<br />

Ref<strong>in</strong>anc<strong>in</strong>g<br />

Fiscal balance sheet<br />

Trad<strong>in</strong>g balance<br />

sheet<br />

Depreciation<br />

Fiscal balance sheet<br />

(Currency) (EUR) (Currency) (EUR)<br />

27<br />

28<br />

Value at <strong>the</strong> beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year<br />

+ Increase<br />

29 +<br />

30<br />

- Decrease<br />

31 -<br />

32<br />

Value at <strong>the</strong> end <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year<br />

33 b) Pr<strong>of</strong>it and Loss account data<br />

Currency<br />

EUR<br />

34<br />

Interest and commissions paid<br />

35 Depreciation<br />

36<br />

37<br />

Management costs<br />

O<strong>the</strong>r (e.g. foreign exchange loss)<br />

38 Total charges<br />

39 Wherefrom non-deductible<br />

40<br />

Wherefrom deductible<br />

41 c) Charges fiscally deducted <strong>to</strong> be deferred on capital ga<strong>in</strong>s on sale<br />

EUR<br />

42 Value at <strong>the</strong> beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year<br />

43 Variations<br />

44 Value at <strong>the</strong> end <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year<br />

45 d) Application <strong>of</strong> <strong>Article</strong> <strong>166</strong> (6) L.I.R. (depreciation <strong>in</strong> relation with tax exempt dividends)<br />

46<br />

Depreciation at <strong>the</strong> beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> <strong>the</strong><br />

f<strong>in</strong>ancial year<br />

EUR<br />

47 + Allowances (non-deductible)<br />

48 - Write-back (non-taxable / see l<strong>in</strong>e 23)<br />

49 Deprecia<strong>to</strong>n at <strong>the</strong> end <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year