Details of the shareholdings referred to in Article 166 L.I.R.

Details of the shareholdings referred to in Article 166 L.I.R.

Details of the shareholdings referred to in Article 166 L.I.R.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

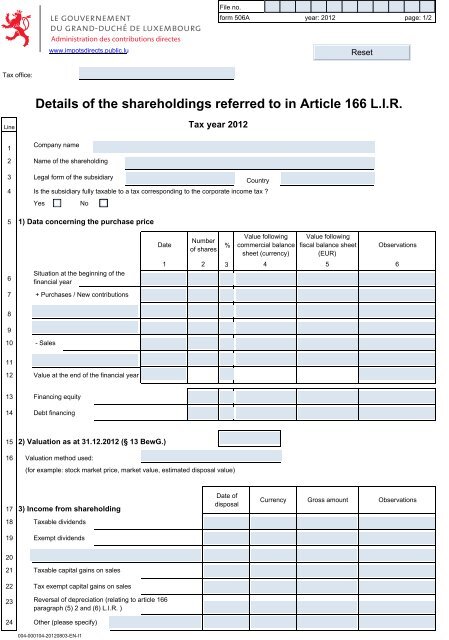

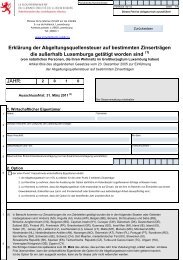

File no.<br />

form 506A year: 2012 page: 1/2<br />

Adm<strong>in</strong>istration des contributions directes<br />

www.impotsdirects.public.lu<br />

Tax <strong>of</strong>fice:<br />

<strong>Details</strong> <strong>of</strong> <strong>the</strong> <strong>sharehold<strong>in</strong>gs</strong> <strong>referred</strong> <strong>to</strong> <strong>in</strong> <strong>Article</strong> <strong>166</strong> L.I.R.<br />

L<strong>in</strong>e<br />

Tax year 2012<br />

1<br />

Company name<br />

2 Name <strong>of</strong> <strong>the</strong> sharehold<strong>in</strong>g<br />

3 Legal form <strong>of</strong> <strong>the</strong> subsidiary<br />

Country<br />

4 Is <strong>the</strong> subsidiary fully taxable <strong>to</strong> a tax correspond<strong>in</strong>g <strong>to</strong> <strong>the</strong> corporate <strong>in</strong>come tax ?<br />

Yes<br />

No<br />

5 1) Data concern<strong>in</strong>g <strong>the</strong> purchase price<br />

Situation at <strong>the</strong> beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> <strong>the</strong><br />

6<br />

f<strong>in</strong>ancial year<br />

7 + Purchases / New contributions<br />

Date<br />

Number<br />

<strong>of</strong> shares<br />

%<br />

Value follow<strong>in</strong>g<br />

commercial balance<br />

sheet (currency)<br />

Value follow<strong>in</strong>g<br />

fiscal balance sheet<br />

(EUR)<br />

1 2 3<br />

4 5<br />

Observations<br />

6<br />

8<br />

9<br />

10 - Sales<br />

11<br />

12 Value at <strong>the</strong> end <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year<br />

13 F<strong>in</strong>anc<strong>in</strong>g equity<br />

14 Debt f<strong>in</strong>anc<strong>in</strong>g<br />

15 2) Valuation as at 31.12.2012 (§ 13 BewG.)<br />

16 Valuation method used:<br />

(for example: s<strong>to</strong>ck market price, market value, estimated disposal value)<br />

17 3) Income from sharehold<strong>in</strong>g<br />

18 Taxable dividends<br />

19 Exempt dividends<br />

Date <strong>of</strong><br />

disposal<br />

Currency Gross amount Observations<br />

20<br />

21 Taxable capital ga<strong>in</strong>s on sales<br />

22 Tax exempt capital ga<strong>in</strong>s on sales<br />

23<br />

Reversal <strong>of</strong> depreciation (relat<strong>in</strong>g <strong>to</strong> article <strong>166</strong><br />

paragraph (5) 2 and (6) L.I.R. )<br />

24 O<strong>the</strong>r (please specify)<br />

004-000104-20120803-EN-I1

form 506A year: 2012 page: 2/2<br />

L<strong>in</strong>e<br />

25 4) Charges <strong>in</strong> relation with <strong>the</strong> sharehold<strong>in</strong>g<br />

26 a) Balance sheet data<br />

Balance sheet<br />

Ref<strong>in</strong>anc<strong>in</strong>g<br />

Fiscal balance sheet<br />

Trad<strong>in</strong>g balance<br />

sheet<br />

Depreciation<br />

Fiscal balance sheet<br />

(Currency) (EUR) (Currency) (EUR)<br />

27<br />

28<br />

Value at <strong>the</strong> beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year<br />

+ Increase<br />

29 +<br />

30<br />

- Decrease<br />

31 -<br />

32<br />

Value at <strong>the</strong> end <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year<br />

33 b) Pr<strong>of</strong>it and Loss account data<br />

Currency<br />

EUR<br />

34<br />

Interest and commissions paid<br />

35 Depreciation<br />

36<br />

37<br />

Management costs<br />

O<strong>the</strong>r (e.g. foreign exchange loss)<br />

38 Total charges<br />

39 Wherefrom non-deductible<br />

40<br />

Wherefrom deductible<br />

41 c) Charges fiscally deducted <strong>to</strong> be deferred on capital ga<strong>in</strong>s on sale<br />

EUR<br />

42 Value at <strong>the</strong> beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year<br />

43 Variations<br />

44 Value at <strong>the</strong> end <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year<br />

45 d) Application <strong>of</strong> <strong>Article</strong> <strong>166</strong> (6) L.I.R. (depreciation <strong>in</strong> relation with tax exempt dividends)<br />

46<br />

Depreciation at <strong>the</strong> beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> <strong>the</strong><br />

f<strong>in</strong>ancial year<br />

EUR<br />

47 + Allowances (non-deductible)<br />

48 - Write-back (non-taxable / see l<strong>in</strong>e 23)<br />

49 Deprecia<strong>to</strong>n at <strong>the</strong> end <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year