Application for an administrative review - Inland Revenue Department

Application for an administrative review - Inland Revenue Department

Application for an administrative review - Inland Revenue Department

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

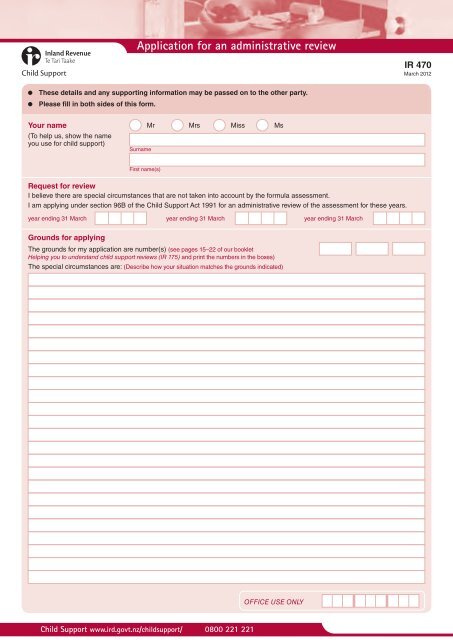

<strong>Application</strong> <strong>for</strong> <strong>an</strong> <strong>administrative</strong> <strong>review</strong><br />

IR 470<br />

March 2012<br />

These details <strong>an</strong>d <strong>an</strong>y supporting in<strong>for</strong>mation may be passed on to the other party.<br />

Please fill in both sides of this <strong>for</strong>m.<br />

Your name Mr Mrs Miss Ms<br />

(To help us, show the name<br />

you use <strong>for</strong> child support)<br />

Surname<br />

First name(s)<br />

Request <strong>for</strong> <strong>review</strong><br />

I believe there are special circumst<strong>an</strong>ces that are not taken into account by the <strong>for</strong>mula assessment.<br />

I am applying under section 96B of the Child Support Act 1991 <strong>for</strong> <strong>an</strong> <strong>administrative</strong> <strong>review</strong> of the assessment <strong>for</strong> these years.<br />

year ending 31 March year ending 31 March year ending 31 March<br />

Grounds <strong>for</strong> applying<br />

The grounds <strong>for</strong> my application are number(s) (see pages 15–22 of our booklet<br />

Helping you to underst<strong>an</strong>d child support <strong>review</strong>s (IR 175) <strong>an</strong>d print the numbers in the boxes)<br />

The special circumst<strong>an</strong>ces are: (Describe how your situation matches the grounds indicated)<br />

OFFICE USE ONLY<br />

Child Support www.ird.govt.nz/childsupport/ 0800 221 221

Your IRD number (8 digit numbers start in the second box. )<br />

Postal address<br />

Street address<br />

Town or city<br />

Postcode<br />

Telephone number ( ) ( ) ( )<br />

Day Evening Mobile<br />

Hearing requirements (tick as appropriate)<br />

Will you be present at the hearing? Yes No<br />

If “no”, would you prefer your part of the hearing to be done by phone or on the<br />

in<strong>for</strong>mation you have provided in writing?<br />

Do you w<strong>an</strong>t to bring a support person to the hearing?<br />

Please attach support person’s details.<br />

Do you w<strong>an</strong>t to have a representative attend the hearing?<br />

(See page 24 of our booklet Helping you to underst<strong>an</strong>d child support <strong>review</strong>s (IR 175))<br />

Previous applications<br />

Phone<br />

Have you previously applied <strong>for</strong> a <strong>review</strong>? Yes No<br />

Have you previously applied <strong>for</strong> a departure order or <strong>an</strong> appeal through the Family<br />

Court?<br />

Declaration<br />

To the best of my knowledge the in<strong>for</strong>mation I have provided is true <strong>an</strong>d correct.<br />

Yes<br />

Yes<br />

Yes<br />

Writing<br />

No<br />

No<br />

No<br />

In<strong>for</strong>mation about the other party<br />

Name of other party Mr Mrs Miss Ms<br />

Surname<br />

First name(s)<br />

Postal address<br />

Street address<br />

Town or city<br />

Postcode<br />

Telephone number ( ) ( ) ( )<br />

Day Evening Mobile<br />

Privacy<br />

Meeting your child support obligations involves giving accurate in<strong>for</strong>mation to Inl<strong>an</strong>d <strong>Revenue</strong>. We ask you <strong>for</strong> in<strong>for</strong>mation so we<br />

c<strong>an</strong> assess your liabilities <strong>an</strong>d entitlements under the Child Support Act 1991.<br />

We may exch<strong>an</strong>ge in<strong>for</strong>mation about you with Work <strong>an</strong>d Income, the Ministry of Justice, the Ministry of Education, New Zeal<strong>an</strong>d<br />

Customs Service, Accident Compensation Corporation, or their contracted agencies. In<strong>for</strong>mation may also be provided to<br />

overseas countries with which New Zeal<strong>an</strong>d has <strong>an</strong> in<strong>for</strong>mation supply agreement. Inl<strong>an</strong>d <strong>Revenue</strong> also has <strong>an</strong> agreement to<br />

supply in<strong>for</strong>mation to Statistics New Zeal<strong>an</strong>d <strong>for</strong> statistical purposes only.<br />

You may ask to see the personal in<strong>for</strong>mation we hold about you by calling us on 0800 221 221. Unless we have a lawful reason<br />

<strong>for</strong> withholding the in<strong>for</strong>mation, we will show it to you <strong>an</strong>d correct <strong>an</strong>y errors.

IR 178<br />

June 2010<br />

Child support <strong>administrative</strong> <strong>review</strong> – statement of<br />

fin<strong>an</strong>cial position<br />

Import<strong>an</strong>t!<br />

• Completing this <strong>for</strong>m is optional. In<strong>for</strong>mation you provide below may be passed on to the other party to the <strong>review</strong>. Although<br />

it’s not m<strong>an</strong>datory to provide this in<strong>for</strong>mation, it will help the Review Officer to consider all the circumst<strong>an</strong>ces of your case <strong>an</strong>d<br />

determine how <strong>an</strong>y ch<strong>an</strong>ge to the child support assessment would affect each party.<br />

• Please carefully fill in as m<strong>an</strong>y details as you c<strong>an</strong>. If you need more space, use <strong>an</strong> extra sheet of paper—write your name <strong>an</strong>d<br />

IRD number on it.<br />

• If you need <strong>an</strong>y help with completing this <strong>for</strong>m, please phone us on 0800 371 333.<br />

• Child Support <strong>for</strong>ms <strong>an</strong>d other in<strong>for</strong>mation are available on our website at www.ird.govt.nz/childsupport/<br />

Your details<br />

Your IRD number (8 digit numbers start in the second box )<br />

Your name<br />

Surname<br />

First names<br />

Your address<br />

Street address<br />

Town or city<br />

Postcode<br />

Phone number(s) ( ) ( ) ( )<br />

Day Evening Mobile<br />

Name <strong>an</strong>d address of employer<br />

Name<br />

Address<br />

Phone number(s) ( ) ( ) ( )<br />

Day Evening Mobile<br />

Your occupation or job<br />

(If you have more th<strong>an</strong> one employer, show the one you work the most hours <strong>for</strong>)<br />

Declaration<br />

To the best of my knowledge the in<strong>for</strong>mation I have provided is true <strong>an</strong>d correct.<br />

I underst<strong>an</strong>d that all in<strong>for</strong>mation will be provided to the other party <strong>for</strong> the purpose of this <strong>review</strong>.<br />

Notes<br />

• If you have <strong>an</strong>y other comments, or <strong>an</strong>y other in<strong>for</strong>mation you think will help us underst<strong>an</strong>d your situation, please write the details<br />

on a separate sheet of paper <strong>an</strong>d attach it to this <strong>for</strong>m. Make sure you write your name <strong>an</strong>d IRD number on the paper.<br />

• We may ask you to provide proof of details shown on this <strong>for</strong>m (such as payslips or invoices).<br />

• There are penalties <strong>for</strong> deliberately giving false or misleading in<strong>for</strong>mation.<br />

OFFICE USE ONLY Review case number Applic<strong>an</strong>t Other party Office

Income<br />

Please show your income details be<strong>for</strong>e tax <strong>an</strong>d other deductions such as super<strong>an</strong>nuation, union fees or insur<strong>an</strong>ce are taken out.<br />

Only give details about personal income <strong>an</strong>d expenses, not comp<strong>an</strong>y, partnership or trust details.<br />

Salary or wages from regular job(s)<br />

Work <strong>an</strong>d Income<br />

Type__ __ __ __ __ __ _<br />

benefit<br />

Type__ __ __ __ __ __ _<br />

ACC payments<br />

Pay <strong>for</strong> temporary, casual or part-time work<br />

Drawings from business<br />

Self-employed income<br />

Super<strong>an</strong>nuation<br />

Working <strong>for</strong> Families Tax Credits<br />

Child support or mainten<strong>an</strong>ce<br />

Rent or board<br />

Interest or dividends<br />

Other<br />

_ __ __ __ __ __ __ __ _<br />

Your yearly income Your monthly income Income of spouse or<br />

partner living with you<br />

Please give in<strong>for</strong>mation about<br />

every person you fin<strong>an</strong>cially<br />

support or help support.<br />

Name<br />

Relationship to you (<strong>for</strong> example,<br />

son, mother, partner)<br />

Date of birth<br />

(children only)<br />

/ /<br />

/ /<br />

/ /<br />

/ /<br />

/ /<br />

/ /<br />

/ /<br />

/ /<br />

Include <strong>an</strong>yone you support<br />

who doesn’t live in the same<br />

house as you.<br />

/ /<br />

/ /<br />

/ /<br />

/ /<br />

/ /<br />

/ /<br />

/ /

Expenses<br />

How much do you pay each month <strong>for</strong> the following? Your monthly share Spouse or partner’s share<br />

Rent, board or mortgage<br />

House mainten<strong>an</strong>ce<br />

House <strong>an</strong>d contents insur<strong>an</strong>ce<br />

Rates<br />

Power <strong>an</strong>d gas<br />

Telephone, including mobile<br />

Food <strong>an</strong>d groceries<br />

Cigarettes <strong>an</strong>d alcohol<br />

Entertainment<br />

Rental of household items<br />

TV rental, including Sky<br />

Hire purchase (payments only—show details of what you owe on the<br />

next page)<br />

Bus, train, taxi fares <strong>an</strong>d petrol<br />

Vehicle registration <strong>an</strong>d insur<strong>an</strong>ce<br />

Vehicle mainten<strong>an</strong>ce<br />

Clothing <strong>an</strong>d footwear<br />

Childcare<br />

School expenses<br />

Child support or mainten<strong>an</strong>ce payments<br />

Access to children (travel <strong>an</strong>d accommodation)<br />

Animal expenses (food, vet, registration)<br />

Work <strong>an</strong>d Income repayments<br />

Medical (not claimed on insur<strong>an</strong>ce)—doctor, dentist, pharmacy, optici<strong>an</strong><br />

Insur<strong>an</strong>ce (medical, life, other)<br />

Super<strong>an</strong>nuation contributions<br />

Store cards, such as Farmers, or The Warehouse (payments only—<br />

show details of what you owe on the next page)<br />

Credit card repayments (payments only—show details of what you<br />

owe on the next page)<br />

B<strong>an</strong>k or lo<strong>an</strong> repayments (payments only—show details of what you<br />

owe on the next page)<br />

Donations<br />

Tax<br />

Total monthly expenses<br />

OFFICE USE ONLY Total income Total assets<br />

Total expenses<br />

Bal<strong>an</strong>ce<br />

Total liabilities<br />

Bal<strong>an</strong>ce

Assets <strong>an</strong>d liabilities<br />

What you own <strong>an</strong>d what you owe<br />

House Ownership Value Amount owing<br />

self joint<br />

Term of lo<strong>an</strong> Date started / /<br />

Other real estate (give details, <strong>for</strong> example, flats, l<strong>an</strong>d)<br />

Term of lo<strong>an</strong> Date started / /<br />

Term of lo<strong>an</strong> Date started / /<br />

Motor vehicles<br />

Make <strong>an</strong>d year<br />

Term of lo<strong>an</strong> Date started / /<br />

Make <strong>an</strong>d year<br />

Term of lo<strong>an</strong> Date started / /<br />

Furniture <strong>an</strong>d household items<br />

Personal items (<strong>for</strong> example, jewellery)<br />

Other lo<strong>an</strong>s or purchase agreements<br />

Purpose<br />

Term of lo<strong>an</strong> Date started / /<br />

Purpose<br />

Term of lo<strong>an</strong> Date started / /<br />

Credit cards or store accounts<br />

Other—include <strong>an</strong>y money owed to you (give details)<br />

Savings <strong>an</strong>d investment accounts<br />

Shares, debentures, bonds, life insur<strong>an</strong>ce<br />

Have you signed <strong>an</strong>d dated the declaration on the front page?<br />

Total