WELC ME

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>WELC</strong><br />

<strong>ME</strong><br />

TO INSIGHT BASED-TOPIC DEVELOP<strong>ME</strong>NT<br />

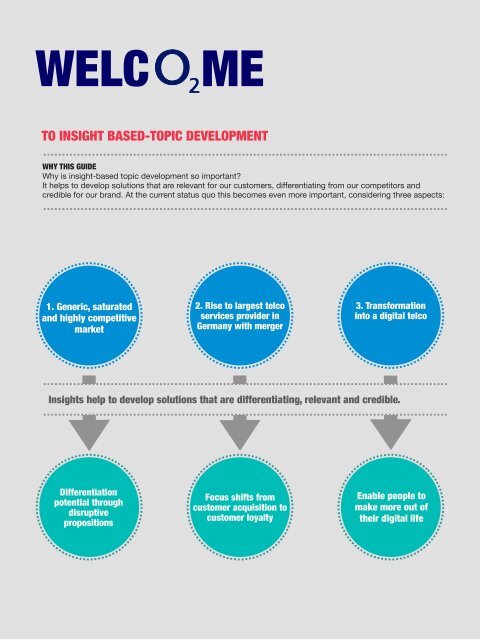

WHY THIS GUIDE<br />

Why is insight-based topic development so important? <br />

It helps to develop solutions that are relevant for our customers, differentiating from our competitors and<br />

credible for our brand. At the current status quo this becomes even more important, considering three aspects:<br />

!<br />

1. Generic, saturated<br />

and highly competitive<br />

market<br />

2. Rise to largest telco<br />

services provider in<br />

Germany with merger<br />

!<br />

3. Transformation<br />

into a digital telco<br />

!<br />

Insights help to develop solutions that are differentiating, relevant and credible.<br />

Differentiation<br />

potential through<br />

disruptive<br />

propositions<br />

Focus shifts from<br />

customer acquisition to<br />

customer loyalty<br />

!<br />

Enable people to<br />

make more out of<br />

their digital life

WHAT IS AN INSIGHT<br />

The biggest problem with insights is, they are one of the most misunderstood concepts in marketing. An insight<br />

is never your product description. People tend to formulate insights such as „I look for a solution that ...“. But<br />

people never look for a product solution; they look for a solution to their problem or need. <br />

!<br />

An insight is a fundamental human truth that addresses in the best way a BARRIER<br />

(problem/fear) and the resulting NEED (desire/motivation). It always comes from<br />

consumer perspective, NOT product perspective and explains why, rather than just<br />

observing that people do something. <br />

!<br />

Insights should illuminate us, expand our minds and unlock creativity. - Why is an insight like a<br />

fridge? Because as soon as you look at it a light goes on!<br />

!<br />

Often it is surprising, how many people have great insights. Because great insights are like<br />

coloured DIAMONDS, very precious and very rare. Or to bring another metaphor from the<br />

category: Finding strong insights is like digging for gold, hard work but at the end it’s worth it. <br />

!<br />

A great insight is surprising, because it is so simple and obvious. It is kind of an „Aha!“<br />

experience, they are things that other people think of, then you immediately wish you had. Or in<br />

the words of Simon Law:“An insight is a revelation that produces great work. There should be a<br />

degree of “Fuck me. I never thought of it like that!”<br />

THERE IS NO ONE SIZE-FITS ALL WHEN IT CO<strong>ME</strong>S TO INSIGHTS!<br />

Because the broader and more generic the insight, the more it sacrifices relevance and impact.<br />

YES, BUT WE WANT TO REACH THE MASS MARKET?<br />

Even though the business is universal, we offer different solutions for specific target groups. <br />

You cannot find the one insight for all of them, but you can follow an inductive approach from specific to broad:<br />

First identify the most significant insight for the core target group and then evaluate how it resonates on broader<br />

perspective for secondary target groups.

HOW TO USE THE HOW-TO-GUIDE<br />

This guide is a working guide with hands-on templates (cards) that you can write into, cut out, pin on<br />

your wall or take into workshops. It’s a guide to use - not just to read!<br />

STRUCTURE As introduction to each phase you find an<br />

overview page that gives you a brief summary about<br />

what happens in this stage. It gives you the single steps<br />

- from the objective to the desired outcome of the phase.<br />

COLOUR CODE Each phase is highlighted<br />

in its own colour. The flags on the right<br />

side makes it easy to jump between the<br />

phases or to look something up.<br />

INFO-BOXES Icon-assisted boxes at the end of the<br />

overview-boxes sum up important information such<br />

as:<br />

ICONS Some icons reoccur in the<br />

process to mark important informations<br />

such as:<br />

Watch outs Notes Tips<br />

PROCESS BAR Each phase is represented by<br />

its own icon. They reoccur in the process<br />

bar at the end of the page. The bar shows<br />

you, which phases you completed already.<br />

STARS Whenever you see a star<br />

at one of the steps at the<br />

overview page you find<br />

explanatory cards or working<br />

cards that support you to<br />

execute the respective step.<br />

CARDS The working cards present<br />

you essential information, helpful<br />

exercises, guiding questions and<br />

tools such as evaluation grids<br />

GLOSSARY What was an insight again? What<br />

is the difference between a finding and a<br />

learning? The glossary at the end gives you<br />

definitions of the most important terms.

PROCESS OVERVIEW<br />

The whole process is a condensation of knowledge. From broad information to the one insight that<br />

builds the basis for the concept.<br />

The OBJECTIVE consists of a business and a marketing objective and sets the<br />

frame for the whole concept development.<br />

FINDINGS are researchable facts related to the objective such as<br />

interesting figures, statistics, trend reports, info-graphics, etc.<br />

LEARNINGS are conclusions derived from your clustered<br />

findings such as correlations, influences, contradictions,<br />

shifts, developments or dilemmas.<br />

Based on the learnings, DRAFT-<br />

INSIGHTS are presumable first<br />

„fundamental human truths“ phrased<br />

from consumer perspective.<br />

The final INSIGHT<br />

expresses the most<br />

relevant barrier &<br />

resulting need with<br />

the greatest<br />

potential for a<br />

differentiating & <br />

credible <br />

proposition.

INTRODUCTION<br />

!<br />

In this phase it is crucial to define a<br />

clear, measurable objective and<br />

decide for one specific target <br />

group.<br />

1<br />

!<br />

All following steps are made on the<br />

estimation of contribution to the<br />

objective and relevance for the<br />

customer.<br />

PHASE 1<br />

DEFINE OVERALL OBJECTIVE & TARGET GROUP

Define<br />

overall objective<br />

& target group<br />

<strong>ME</strong>THODOLOGY<br />

Define the objective<br />

STEP 2<br />

Discuss marketing/business objective<br />

Gather Marketing Plan, Market Reports,<br />

Brand KPIs and derive a situation analysis.<br />

STEP 4<br />

Evaluate, rephrase & align on objective<br />

Use the attached guiding questions<br />

for evaluation<br />

STEP 6<br />

Decide for ONE target group<br />

Use the attached guiding questions<br />

to identify the target group.<br />

STEP 1<br />

Set up the team<br />

Book a room and block some<br />

time for brainstorming.<br />

STEP 3<br />

Phrase your objective<br />

Write first drafts on Post-its on a wall.<br />

See attached template on how to<br />

formulate objective.<br />

Define the target group<br />

STEP 5<br />

Analyse current segmentation data<br />

Discuss, which segment you want to address<br />

& consider existing customers and prospects.<br />

OUTCO<strong>ME</strong><br />

Clear objective<br />

ONE target group<br />

Responsible team<br />

!<br />

WATCH OUT<br />

As this is the process<br />

kick-off, defining the<br />

objective and target<br />

group should be a<br />

team decision.<br />

TIP/TEMPLATES<br />

1. Formulating objectives<br />

2. Guiding questions for<br />

objective evaluation<br />

3. How to use segmentation<br />

4. Guiding target group<br />

questions<br />

!<br />

NOTE<br />

Clearly define task & <br />

responsibilities<br />

SOURCES/HELP<br />

Marketing Plan<br />

Market Reports<br />

Brand KPIs<br />

Current Segmentation<br />

Customer database <br />

Churn & Migration Data<br />

!<br />

NEEDED MATERIAL<br />

A room<br />

some pens<br />

post-its<br />

!

Formulating objectives<br />

Step<br />

3<br />

A GOOD OBJECTIVE CONSISTS OF A BUSINESS & A MARKETING OBJECTIVE.<br />

SO LET’S SAY OUR PRODUCT IS APPLES.<br />

Business Objective <br />

Increase British apple sales by 50% by the end of 2015. <br />

<br />

Marketing Objective <br />

Drive positive brand perception by 75% by the end of 2015.<br />

!<br />

Make it measurable, <br />

or there is no way to<br />

evaluate the success.<br />

!<br />

AND IF OUR PRODUCT IS A NEW TARIFF?<br />

!<br />

Business Objective <br />

Push the blau Allnet flat to xy subscribers by the end of 2015.<br />

!<br />

Marketing Objective<br />

Raise brand awareness of prepaid-interested persons in Germany to 75% by the end of 2015.<br />

Guiding questions for objective evaluation<br />

Step<br />

4<br />

!<br />

REVIEW YOUR OBJECTIVE<br />

!<br />

• Is it fitting the “objective of the objective”, the overall long-term business goal?<br />

!<br />

• Is it fitting the current marketing strategy?<br />

!<br />

• Is it SMART? (specific, measurable, achievable, relevant, time bound)<br />

!<br />

• Is it precise and easy to understand?<br />

!<br />

Discuss your objectives on<br />

the guiding questions and<br />

chose the one that fulfils<br />

the aspects best.

Formulating objectives<br />

Back of the card always shows concrete example<br />

from the documented test process<br />

Guiding questions for objective evaluation<br />

Back of the card always shows concrete example<br />

from the documented test process

How to use the segmentation<br />

Step 5<br />

MATT<br />

Guiding target group questions<br />

Step 6<br />

THE FOLLOWING QUESTIONS HELP YOU TO IDENTIFY YOUR TARGET GROUP<br />

Analyse current segmentation data, and decide which segment to target.<br />

From<br />

broad<br />

!<br />

From To<br />

specific broad<br />

!<br />

!<br />

• The segment that has the biggest size?<br />

• The segment that holds the greatest growth potential? <br />

!<br />

• The segment that we can serve better than our competitors? <br />

• The segment in that we are particularly strong/weak? <br />

!<br />

• The segment that holds greatest value potential?<br />

• The segment that is most profitable? <br />

!<br />

• Those who gets half way along the path to <br />

purchase and then exits?<br />

!

How to use the the segmentation<br />

MATT<br />

Guiding target group questions<br />

!<br />

!<br />

It’s ONE or none. Otherwise you end<br />

up in generic solutions - there is no<br />

„one size fit’s all“!

INTRODUCTION<br />

!<br />

This phase is all about collecting as<br />

much relevant information as<br />

possible. The outcome should be a<br />

comprehensive grid containing a<br />

2<br />

!<br />

collection of findings related to the<br />

objective and deep understanding<br />

of the target group captured in a<br />

clear profile.<br />

PHASE 2<br />

GATHER & FILTER KNOWLEDGE

Gather & filter<br />

knowledge<br />

Gather knowledge<br />

<strong>ME</strong>THODOLOGY<br />

STEP 2<br />

Provide access to existing knowledge & sources<br />

A list of sources you find on the cards attached.<br />

STEP 4<br />

Review findings and filter existing facts<br />

You can use the attached questions/criteria<br />

to decide what is an interesting fact.<br />

Sort knowledge<br />

STEP 6<br />

Get some Metaplan boards & do a post-it battle<br />

Find keywords for all your important facts/figures/<br />

information gathered and write them on post-its<br />

Profile your target group<br />

STEP 1<br />

Set up a research team & assign research tasks<br />

Set your fields of interest and define concrete<br />

questions that need to be answered. Possible fields<br />

of interest you find in the grid attached.<br />

STEP 3<br />

Review existing knowledge<br />

What is already there? Where is<br />

need for further research?<br />

Filter knowledge<br />

STEP 5<br />

Get the team together & share your wisdom<br />

Present your findings to the team (in a verbal<br />

summary, a few slides, notes on a flip chart)<br />

STEP 7<br />

Sort the post-its<br />

The cluster grids attached will help you.<br />

STEP 8<br />

Combine segmentation with your findings<br />

The attached card helps you to write a clear profile<br />

OUTCO<strong>ME</strong><br />

Grid of<br />

relevant findings<br />

& target group<br />

profile<br />

!<br />

WATCH OUT<br />

At this state it is about<br />

a summary of<br />

FINDINGS, not yet a<br />

conclusion!<br />

!<br />

TIP/TEMPLATES<br />

1. Fields of interest<br />

2. List of sources<br />

3. Filter criteria for findings<br />

4. Sorting grids for findings<br />

5. Profiling target groups<br />

NOTE<br />

FINDINGS are interesting<br />

facts, figures, statistics,<br />

etc.<br />

SOURCES/HELP<br />

Great help you can get<br />

from Market Intelligence<br />

and Centre of Excellence<br />

for Business Intelligence, <br />

!<br />

NEEDED MATERIAL<br />

A room<br />

some pens<br />

post-its<br />

!

Fields of interest<br />

Step 1<br />

MACRO PERSPECTIVE<br />

What are cultural shifts/trends? Customs, traditions, social norms? (Cultural Findings)<br />

What are mega trends or future trends? (Future Findings)<br />

What are market trends? What are market conventions? (Market Findings)<br />

!<br />

<strong>ME</strong>SO PERSPECTIVE<br />

What are trends regarding brands? (Brand Findings)<br />

What are trends in media & communication?<br />

What are trends in channels/distribution/shopping?<br />

What are technological developments? Product trends? <br />

(Product Findings)<br />

!<br />

MICRO PERSPECTIVE<br />

What are consumer trends? What are lifestyle trends? (Consumer Findings)<br />

What are consumption trends? (e.g. Usage Findings, Owner Findings, Purchase Findings)<br />

What is the target group profile? (see segmentation)<br />

List of internal sources<br />

Step 2<br />

Internal research<br />

BIC, MI, Social Media<br />

Monitoring<br />

Product<br />

Product description<br />

Current & Planned Portfolio<br />

Market<br />

Existing trend- & competitoranalysis<br />

Brand/Communication<br />

Brand KPIs<br />

Comms of competitors<br />

Consumer<br />

Existing insights<br />

Existing trends studies<br />

Tip<br />

Learn about your customer<br />

from digital touch-points

Fields of interest<br />

MAP OUT YOUR FIELDS OF INTEREST (EXAMPLE FROM WORKSHOP)<br />

List of internal sources<br />

WHAT IS BIC?<br />

The „Centre of Excellence for Business Intelligence," offers services to all areas of Telefónica<br />

Germany: <br />

!<br />

• Our company-wide data warehouse provides a holistic view of our customers and<br />

processes as a basis for analytics, reporting and optimisation. <br />

!<br />

• Analyses, forecasts and reports provide valuable knowledge and insights about customers<br />

and business processes to derive measures and to make informed decisions. <br />

!<br />

• We also assist in the implementation, optimisation and monitoring of customised sales and<br />

relevant business processes.<br />

!<br />

• Data Warehousing is responsible for the data of the Enterprise Data Warehouse. Through<br />

integration and interpretation of information from the enterprise-wide data sources to BI<br />

departments a holistic view is placed on business processes and customers. <br />

!<br />

• Business Analytics offers based on internal and external data Business & Customer Insights<br />

for management and specialist areas. Furthermore, sales-related business processes are<br />

monitored, analysed and optimised. <br />

!<br />

• Reporting Services offers based on customer data in addition to standardised and<br />

multidimensional reporting for all relevant business areas. <br />

!<br />

• Customer Intelligence provides data-driven and analytical services to optimise customerspecific<br />

processes (e.g., Campaign Mgmt., Or Customer Risk Mgmt.)

List of external sources<br />

Step 2<br />

PRIMARY INFORMATION<br />

!<br />

E.g. interviews with experts, but why not also interview a shop agent or hotline agent?<br />

They are in contact with your customers every day and a great source of information.<br />

Or directly speak with your target group and do in-depth interviews/focus groups.<br />

SECONDARY INFORMATION<br />

Micro perspective Meso perspective Macro perspective Overall<br />

ZDF/ARD Online Studie<br />

Verbraucheranalyse<br />

KIM-Studie <br />

GfK Panel<br />

Haushaltspanel<br />

Digitalbuzz.com trendwatching.com<br />

W&V brand barometer zukunftsinstitut.de<br />

Mashable<br />

tnsdigitallife.com<br />

Horizont<br />

Comscore<br />

lead-digital.de Pfsk.com<br />

gartner.com<br />

kpmg.com<br />

jwtintelligence.com<br />

Millward brown<br />

Nielsen<br />

Bitkom<br />

Statista<br />

2.deloitte.com<br />

edelman.com<br />

destatis.de<br />

Filter criteria for findings<br />

Step 4<br />

ESTABLISH FILTERS TO DECIDE WHAT IS A RELEVANT FACT.<br />

You can use the following questions as guidelines:<br />

!<br />

• Does the finding show important developments?<br />

• How does the finding have to be evaluated in terms of newness and actuality?<br />

• Does is relate to the objective? It is proving the objective or challenging it?<br />

• Showing a barrier or lever?<br />

• Is it product relevant?<br />

• Is it target group relevant?<br />

• Is it future-proof?

List of external sources<br />

(What could be helpful<br />

information on the back of<br />

the card?)<br />

Filter criteria for findings<br />

ADD YOUR OWN FILTER CRITERIA<br />

1. _____________________________________________________________________<br />

!<br />

2. _____________________________________________________________________<br />

!<br />

3. _____________________________________________________________________<br />

!<br />

4. _____________________________________________________________________<br />

!<br />

5. _____________________________________________________________________<br />

!

Findings organigram<br />

Step 7<br />

Cluster 1 Cluster 2 Cluster …<br />

Finding a<br />

Finding …<br />

Sub-finding<br />

Finding b<br />

Essence<br />

of findings<br />

How to use the findings organigram<br />

Step 7<br />

The findings organigram helps you to cluster your findings and deduct the<br />

condensed „essence“ or key-finding.<br />

1.<br />

2.<br />

3.<br />

!<br />

Define your clusters<br />

On the back of the card you find exemplary clusters. Clusters are summarising<br />

topics under which you can group your single findings.<br />

!<br />

Sort and place your findings<br />

Sort your findings under the fitting clusters. Maybe one finding results out of<br />

the other, you can place them as „sub-findings“ at the respective branch.<br />

!<br />

Analyse your diagram and derive the essence<br />

What is the most crucial thing you learned? What is an umbrella learning? The<br />

root/cause of the single learnings?

Findings organigram<br />

(Show real example from workshop)<br />

!<br />

How to use the findings organigram<br />

EXEMPLARY CATEGORIES OF CLUSTERS<br />

Culture<br />

!<br />

Future<br />

Market<br />

Product/Brand<br />

!<br />

!<br />

Communication/<br />

Channels<br />

!<br />

!<br />

Consumption/<br />

Consumer

Sorting grid for findings<br />

Step 7<br />

Copy the grid on a whiteboard. Sort your findings on the post-its in the grid. Cluster them according<br />

to topics (territories) and according to the level they play on: Macro, meso or micro level.<br />

Territory 1 Territory 2 Territory 3<br />

Macro<br />

Context<br />

!<br />

(e.g. Economy, Society, Future)<br />

Meso<br />

Category<br />

!<br />

(Product, brand,<br />

communication, channel)<br />

Micro<br />

Consumer<br />

!<br />

(Behaviour, Attitude,<br />

Consumption)<br />

Profiling target groups<br />

Step 8<br />

USE EXISTING INFORMATION FROM THE SEG<strong>ME</strong>NTATION. ADD YOUR NEW FINDINGS TO A CLEAR TARGET GROUP PROFILE.<br />

1. Demographic aspects <br />

1. (e.g. age, gender, income) <br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________<br />

!<br />

2. Psychographic aspects <br />

2.<br />

(e.g. attitudes, values, opinions, interests, drivers & motivations, needs) <br />

___________________________________________________________________________________________ <br />

___________________________________________________________________________________________ <br />

___________________________________________________________________________________________ <br />

___________________________________________________________________________________________ <br />

<br />

3. Behavioural aspects <br />

3.<br />

(e.g. purchase behaviour, usage behaviour, decision making process) <br />

___________________________________________________________________________________________ <br />

___________________________________________________________________________________________ <br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________

Sorting grid for findings<br />

(EXAMPLES FROM WORKSHOP)<br />

Profiling target groups<br />

(EXAMPLES FROM WORKSHOP)

INTRODUCTION<br />

In this phase the goal is to link the<br />

single findings from the grid<br />

(information, facts and figures) to<br />

identify connections between them.<br />

3<br />

!<br />

This step is all about interpreting<br />

the findings that were collected in<br />

the grid and deducting concrete<br />

LEARNINGS as conclusion.<br />

CLUSTER RESULTS<br />

PHASE 3

Cluster<br />

results<br />

<strong>ME</strong>THODOLOGY<br />

Identify connections<br />

STEP 2<br />

Analyse your grid<br />

Draw lines where you see connections<br />

between your findings on the post-its.<br />

See the attached card shows you<br />

possible kinds of connections.<br />

STEP 1<br />

Get the team together & create a war-room<br />

This phase is realised in a brainstorm session. <br />

You will need your metaplan boards from phase 2.<br />

STEP 3<br />

Try additional exercises<br />

The cards explain you the exercises<br />

“Fishbone Model” and “5 Times Why”<br />

to identify possible connections.<br />

Phrase learnings<br />

STEP 4<br />

Write your learnings on post-its<br />

Phrase concrete learnings out of the identified<br />

connections and stick them on the wall.<br />

STEP 6<br />

Review findings based on your filters<br />

You can use the attached grid as an<br />

example.<br />

Filter learnings<br />

STEP 5<br />

Evaluate learnings<br />

The attached card gives you examples of<br />

criteria to evaluate the learning’s potential<br />

OUTCO<strong>ME</strong><br />

List of relevant<br />

learnings<br />

!<br />

WATCH OUT<br />

It’s not a summary of<br />

knowledge anymore<br />

it’s a conclusion!<br />

TIPS/TEMPLATES<br />

1. Types of connections<br />

2. The fishbone Model<br />

3. Five times why<br />

4. Evaluation criteria <br />

5. Evaluation grid<br />

NOTE<br />

The more links arise from<br />

an aspect the more<br />

driving force it is. <br />

SOURCES/HELP<br />

Use one of the exercises<br />

from step 3 if you have<br />

problems to identify cause<br />

and effect between your<br />

findings<br />

!<br />

NEEDED MATERIAL<br />

A room<br />

some pens<br />

post-its

Types of connections<br />

Step 2<br />

CONNECTIONS CAN HAVE DIFFERENT FORMS:<br />

!<br />

Correlations/<br />

Influences<br />

!<br />

Contradictions<br />

Positive/negative <br />

links<br />

Shifts<br />

!<br />

!<br />

Developments<br />

!<br />

!<br />

Dilemmas<br />

5 Times why<br />

Step 3<br />

EXPLORE CAUSE-AND-EFFECT RELATIONSHIPS<br />

PROBLEM<br />

!<br />

1. Write down the<br />

specific problem.<br />

2. Ask WHY the problem<br />

happens and write the<br />

answer.<br />

1. WHY<br />

2. WHY<br />

3. If the answer you just provided doesn’t<br />

identify the root cause of the problem ask<br />

WHY again and write that answer down.<br />

4. Loop back to ask WHY until the<br />

team is in agreement that the<br />

problem’s root cause is identified.<br />

3. WHY<br />

4. WHY<br />

5. This may take fewer or<br />

more times than five Whys.<br />

By repeatedly asking the question<br />

“Why” (five is a good rule of thumb), you can<br />

peel away the layers of symptoms which can<br />

lead to the root cause of a problem.<br />

!<br />

6. Keep asking until you<br />

found the problem’s cause.<br />

5. WHY<br />

(Cause)

Types of connections<br />

EXPLANATORY EXAMPLES<br />

!<br />

Correlations/Influences<br />

!<br />

Contradictions<br />

Positive/negative links<br />

Shifts<br />

!<br />

Developments<br />

!<br />

Dilemmas<br />

5 Times why<br />

PROBLEM<br />

!<br />

My car stopped<br />

1. WHY<br />

Because it ran<br />

out of gas<br />

2. WHY<br />

Because I didn’t buy any<br />

gas on my way to work<br />

3. WHY<br />

Because I didn’t<br />

have any money<br />

4. WHY<br />

Because I lost it all last<br />

night in a poker game<br />

5. WHY<br />

(Cause)<br />

Because I’m not very<br />

good at “bluffing”

Learning evaluation criteria<br />

Step 5<br />

Relevance<br />

? ?<br />

!<br />

Credibility<br />

? ?<br />

Differentiation<br />

!<br />

Goal-orientation<br />

!<br />

Learning evaluation grid<br />

Step 6<br />

Learning 1 Learning 2 Learning 3 Learning 4 Learning 5<br />

Relevance<br />

Credibility<br />

Differentiation<br />

Goalorientation<br />

Every participant gets one vote per<br />

learning (visualised by a post-it point). <br />

The learnings with the most points are<br />

the most interesting.

Learning evaluation criteria<br />

Step 5<br />

Relevance<br />

Connection of the<br />

learnings to our target<br />

group<br />

Credibility<br />

Fit of the learnings to<br />

our product/brand<br />

strength<br />

Differentiation<br />

Potential of the<br />

learnings to distinct us<br />

from competitors <br />

!<br />

Goal-orientation<br />

Use of the learnings to<br />

fulfil the objective <br />

!<br />

Learning evaluation grid<br />

Step 6<br />

(Show example from grid filled in workshop)

INTRODUCTION<br />

!<br />

In this step the learnings are<br />

transformed into presumable first<br />

“raw” Draft-Insights<br />

4<br />

!<br />

that can be tested and<br />

validated in scientific<br />

research. <br />

DEVELOP DRAFT-INSIGHTS<br />

PHASE 4

Develop<br />

Draft-Insights<br />

<strong>ME</strong>THODOLOGY<br />

Analyse the cause<br />

STEP 2<br />

Turn learnings into insights<br />

First establish the problem: <br />

What is the underlying barrier, fear?<br />

Secondly derive the resulting need: <br />

What is the motivation or desire?<br />

STEP 1<br />

What is an insight?<br />

Insights are diamonds. <br />

Why? See cards!<br />

Formulate your Draft-Insights<br />

Evaluate & filter Draft-Insights<br />

STEP 4<br />

Reduce the number of insights<br />

You can use the evaluation grid<br />

attached as decision basis. Narrow your<br />

Draft-Insights down to the strongest.<br />

STEP 3<br />

Develop as many insights as possible<br />

Watch language & perspective: Phrase insight<br />

from consumers point of view in his words.<br />

See card for help!<br />

OUTCO<strong>ME</strong><br />

3<br />

testable<br />

Draft-Insights<br />

!<br />

WATCH OUT<br />

Avoid marketing slang!<br />

TIP/TEMPLATES<br />

1. What is an insight?<br />

2. How to formulate <br />

an insight<br />

3. Insight evaluation grid<br />

NOTE<br />

An insight is never your<br />

product description.<br />

SOURCES/HELP<br />

May use MI expertise to<br />

transform your learnings<br />

into testable Draft-Insights <br />

!<br />

NEEDED MATERIAL<br />

Your list of learnings<br />

from the previous phase<br />

!

What is an insight?<br />

Step 1<br />

Barrier Need Illumination Aha-moment Diamond<br />

A fundamental human<br />

truth that addresses <br />

e.g. a problem or fear…<br />

… and the resulting<br />

NEED, e.g., a desire<br />

or motivation.<br />

It expands our<br />

minds & unlocks<br />

creativity.<br />

A great insight is<br />

surprising, because it is<br />

so simple and obvious.<br />

Insights are like <br />

diamonds - very rare<br />

& very precious.<br />

Why we need insight?<br />

Step 1<br />

It helps to develop solutions that are relevant for our customers, differentiating from our<br />

competitors and credible for our brand.<br />

Relevance<br />

Consumer<br />

SOLUTION<br />

Credibility<br />

Brand<br />

Differentiation<br />

Market

What is not an insight?<br />

An insight is never your product<br />

description. People tend to formulate<br />

insights such as „I look for a solution<br />

that...“. <br />

!<br />

But people never look for a product<br />

solution; they look for a solution to their<br />

problem or need. <br />

!<br />

An insight is not a statistical fact. E.g.<br />

„women are the fastest growing segment<br />

in the online game market“ is a fact. <br />

!<br />

But why is that so? - The woman’s need/<br />

motivation behind it would be an insight.<br />

An insight is a revelation<br />

that produces great work….<br />

There should be a degree of<br />

“Fuck me. I never thought of<br />

it like that!<br />

Simon Law<br />

Why we need insight?<br />

Not every insight is a useful insight.<br />

Without insights it is more likely to<br />

end up with generic,<br />

interchangeable messages.<br />

But it is also crucial to identify a<br />

fitting insight that can be<br />

connected to your brand or<br />

product.

How to formulate an insight?<br />

Step 3<br />

Barrier<br />

<br />

„xxxx“<br />

give strong o2 example<br />

Need<br />

<br />

„xxxx“<br />

give strong o2 example<br />

First establish the problem: <br />

What is the underlying barrier, fear?<br />

Secondly derive the resulting need: <br />

What is the motivation or desire?<br />

Insight evaluation grid<br />

Step 4<br />

A STRONG INSIGHT SHOULD TICK THE FOLLOWING BOXES<br />

Relevance<br />

How true is it for the<br />

consumer?<br />

Credibility<br />

How credible does the<br />

brand overcome the<br />

barrier/meet the need?<br />

Differentiation<br />

How much disruptive<br />

power lies in the insight?<br />

Effect to change<br />

How powerful is it to<br />

change behaviour/<br />

attitudes & therefore<br />

contributes to the goal?<br />

Simplicity<br />

How easy to<br />

understand, straightforward<br />

& singleminded<br />

is the insight?<br />

Fit Brand Strategy<br />

Does it fit the brand<br />

positioning, the design<br />

criteria & the marketing<br />

strategy?<br />

Newness<br />

How new in terms of<br />

actuality is it? Or how new<br />

in terms of a surprising<br />

way of thinking about it?

How to formulate an insight?<br />

Barrier<br />

<br />

_______________________<br />

______________________<br />

____________________<br />

_______________<br />

Need<br />

<br />

_______________________<br />

______________________<br />

____________________<br />

_______________<br />

Fill the cycles to formulate your insight.<br />

There can be more than one need or barrier.<br />

First collect, then link the fitting ones! <br />

Insight evaluation grid<br />

Every participant gets one vote per<br />

insight (visualised by a post-it point).<br />

The THREE insights with the most<br />

points are the most interesting. <br />

Draft-Insight 1 Draft-Insight 2 Draft-Insight 3 Draft-Insight 4 Draft-Insight 5<br />

Relevance<br />

Credibility<br />

Differentiation<br />

Effect to change<br />

Simplicity<br />

Fit Brand Strategy<br />

Newness

INTRODUCTION<br />

!<br />

This step is done in collaboration with a<br />

market research institute. Observations<br />

tend to be more valid than<br />

questionnaires or interviews. Why?<br />

! 5<br />

There is a huge difference what people<br />

say they do and what they actually do!<br />

Especially as they are not conscious of<br />

all their actions.<br />

IN-DEPTH OBSERVATION<br />

PHASE 5

In-depth<br />

observations<br />

<strong>ME</strong>THODOLOGY<br />

STEP 2<br />

Define recruiting criteria<br />

The criteria result out of your<br />

target group definition. The card<br />

shows you an example.<br />

STEP 4<br />

Conduct the research<br />

If possible, participate on the<br />

observation! This is the only chance<br />

Develop a research concept<br />

STEP 1<br />

Define your research questions<br />

The insight evaluation grid from the<br />

previous phase gives you fields of<br />

possible research questions.<br />

STEP 3<br />

Develop the research concept<br />

This step is done in collaboration with the institute.<br />

They help you to identify the best research method<br />

and to prepare the stimulus material. Some<br />

interesting facts you find on the card.<br />

to really connect to the customer! !<br />

NOTE<br />

The observation has two goals:<br />

EVALUATION: At first, the goal is to<br />

evaluate the Draft-Insights by<br />

observation.<br />

!<br />

EXPLORATION: Secondly, it’s about<br />

deepening the understanding of the<br />

people we want to address.<br />

3 evaluated<br />

Draft-Insight<br />

(Research Report)<br />

OUTCO<strong>ME</strong><br />

!<br />

WATCH OUT<br />

To ensure the findings are<br />

not influenced by the setting<br />

it is crucial to conduct the<br />

research in the target<br />

group’s natural environment.<br />

TIP/TEMPLATES <br />

Talk to your end-users<br />

that brings you the most<br />

fruitful ideas for later<br />

development.<br />

NOTE<br />

Observing might brings<br />

up interesting insights<br />

you haven’t thought<br />

about!<br />

SOURCES/HELP<br />

Use internal research<br />

expertise or help of the<br />

research institute to define<br />

the right methodology.<br />

!<br />

NEEDED MATERIAL<br />

The three strongest<br />

insights presented in a<br />

testable way<br />

!

Recruiting participants for observations<br />

Step 2<br />

Market research firms have developed large pools of individuals that are segmented by popular<br />

demographics so it is likely that they have a list of potential participants at their fingertips. But to recruit<br />

the right people, it is crucial to develop a short recruiting questionnaire (screener) that defines the<br />

mandatory criteria (see next card).<br />

!<br />

As crucial to define what you want, it is to define what you NOT want<br />

(see back of the card).<br />

!<br />

Tip: Over-invite participants to create an “alternate”<br />

list. Things always come up at the last minute that<br />

prevent a few folks from attending.<br />

!<br />

Recruiting criteria<br />

Step 2<br />

Make sure the demographics of the sample <br />

are representative for those of your target group.<br />

!<br />

These are the deep-seated drivers that influence<br />

behaviour, and that help to explain the reasons<br />

behind.<br />

!<br />

1Demographic<br />

characteristics<br />

e.g. age, location,<br />

gender, income level,<br />

education level, marital<br />

or family status,<br />

occupation, ethnic<br />

background<br />

!<br />

2 Behavioural<br />

characteristics<br />

e.g. usage, loyalty,<br />

occasions, buyer<br />

readiness stage, user<br />

status, special<br />

knowledge or<br />

experience<br />

!<br />

3 Psychografic<br />

characteristics<br />

e.g. lifestyle, interests,<br />

opinions, values,<br />

attitudes<br />

!<br />

The product category experience gives you a sense of: when your<br />

brand has been used; how often has it been used; why it has been<br />

used; and has it ever been used. If recruiting for “regular” or „lapsed“<br />

users, what is your definition of “regular”, “lapsed” or „non“ users?<br />

!

Recruiting participants for observations<br />

Respondents You Don’t Want<br />

1People without<br />

product category<br />

experience<br />

2<br />

Consumers who<br />

3<br />

work in the industry<br />

you’re studying<br />

!<br />

People who work<br />

in ad agencies and<br />

marketing research<br />

!<br />

4Professional<br />

respondents that<br />

frequently participate<br />

on researches<br />

!<br />

At best, they supply vague opinions,<br />

which may be irrelevant. But there is an<br />

exception: Prospects who don’t have<br />

category experience but are ready to try<br />

the category are worth observing.<br />

!<br />

The characteristics 2, 3 and 4<br />

define respondents with atypical<br />

knowledge or experience who are<br />

not representative of segments of<br />

interest.<br />

!<br />

Recruiting criteria<br />

Example<br />

1Demographic<br />

characteristics<br />

2Behavioural<br />

characteristics<br />

3<br />

Psychographic<br />

characteristics<br />

!<br />

e.g. very interested in technology

There exists many possible forms of observation<br />

Step 3<br />

There are different settings, e.g.:<br />

Self observation (e.g., video diary) or observation by others (researchers)?<br />

Situation-based observation or long-term observation?<br />

Covert observational research, overt observational research or researcher participation?<br />

And different tools, e.g.:<br />

Ethnographic <br />

Interviews <br />

Video Dairies<br />

Usage Dairies<br />

!<br />

Shopping Process <br />

Observation <br />

!<br />

Eye-tracking<br />

Benefits of observations as research method<br />

Step 3<br />

Observation is a very direct method for collecting data or information<br />

– perfect for the study of human behaviour.<br />

!<br />

The data collected is very accurate in nature and also very reliable because the<br />

setting is close to reality and authentic.<br />

!<br />

There is none or only minimal influence of the behaviour by the observer.<br />

!<br />

The social desirability bias gets reduced. Observations circumvent the tendency<br />

of respondents to answer questions in a manner that will be viewed favourably by<br />

others therefore the verisimilitude is higher.<br />

!<br />

Observations allow the coverage of spontaneous emotional reactions and<br />

comments<br />

revelation of unconscious, non-verbalizable aspects.<br />

!<br />

Observation allow access to people in real life situations and thus provide an indepth<br />

understanding.

There exists many possible research settings<br />

It is very important to define what you<br />

are actually want to know. It is essential<br />

to define concrete research questions<br />

to make the observation efficient.<br />

!<br />

Benefits of observations as research method<br />

!<br />

Consider the Observer Effect!<br />

The presence of an observer in some way influences<br />

the behaviour of those being observed. In order to<br />

avoid or minimise this, methods of observation<br />

attempt to be as unobtrusive as possible.

INTRODUCTION<br />

!<br />

In this step you use the learning<br />

from the previous research phase to<br />

evaluate your draft insights.<br />

6<br />

!<br />

A clear set of evaluation criteria will<br />

help you to identify the insights<br />

with the most potential.<br />

VALIDATE DRAFT INSIGHTS<br />

PHASE 6

Validate<br />

Draft Insights<br />

<strong>ME</strong>THODOLOGY<br />

Evaluate Draft-Insights<br />

STEP 2<br />

Use the following questions as guideline<br />

Does the insight help to meet our objective?<br />

Can we falsify or verify the draft insight? <br />

Are just some aspects true, which are wrong?<br />

How do the aspects have to be weighted?<br />

What are other influencing variables?<br />

What are overseen but relevant findings?<br />

What are opportunities of improvement?<br />

Choose your winners<br />

Analyse the research<br />

STEP 1<br />

Collect findings<br />

Write the most interesting findings<br />

on post-its and pin them on a wall.<br />

Discuss impact of Draft-Insights<br />

STEP 3<br />

Analyse the potential of the insights<br />

Use again the questions & the grid on the<br />

attached card to identify the strongest insights.<br />

STEP 4<br />

Select the two strongest insights<br />

OUTCO<strong>ME</strong><br />

2<br />

validated<br />

draft insights<br />

!<br />

WATCH OUT<br />

Maybe the research<br />

reveals complete new<br />

findings that you can<br />

built new insights on<br />

!<br />

TIP/TEMPLATES<br />

Insight evaluation grid<br />

NOTE<br />

In this stage there may be<br />

several insights to bring<br />

forward to the next<br />

stages<br />

SOURCES/HELP<br />

Your source is the research<br />

report. Support for<br />

estimating the insight’s<br />

potential you can get from<br />

the institute or MI<br />

!<br />

NEEDED MATERIAL<br />

Post-its<br />

Pens<br />

!

Insight evaluation grid<br />

Step 3<br />

A STRONG INSIGHT SHOULD TICK THE FOLLOWING BOXES<br />

Relevance<br />

How true is it for the<br />

consumer?<br />

Credibility<br />

How credible does the<br />

brand overcome the<br />

barrier/meet the need?<br />

Differentiation<br />

How much disruptive<br />

power lies in the insight?<br />

Effect to change<br />

How powerful is it to<br />

change behaviour/<br />

attitudes &t herefore<br />

contributes to the goal?<br />

Simplicity<br />

How easy to<br />

understand, straightforward<br />

& singleminded<br />

is the insight?<br />

Fit Brand Strategy<br />

Does it fit the brand<br />

positioning, the design<br />

criteria & the marketing<br />

strategy?<br />

Newness<br />

How new in terms of<br />

actuality is it? Or how new<br />

in terms of a surprising<br />

way of thinking about it?<br />

X<br />

Step<br />

X

Insight evaluation grid<br />

Every participant gets one vote per<br />

insight (visualised by a post-it point).<br />

The TWO insights with the most points<br />

are the most interesting. <br />

Insight 1 Insight 2 Insight 3<br />

Relevance<br />

Credibility<br />

Differentiation<br />

Effect to change<br />

Simplicity<br />

Fit Brand Strategy<br />

Newness<br />

X<br />

Step<br />

X

INTRODUCTION<br />

!<br />

In this phase you formulate your<br />

final insight. It is the basis for a<br />

proposition development. The final<br />

insight should be accurate<br />

7<br />

!<br />

and intuitive thus not only be<br />

based on rational aspects as it<br />

should strike an emotional chord<br />

with the consumer.<br />

FORMULATE FINAL INSIGHT<br />

PHASE 7

Formulate<br />

Final Insight<br />

<strong>ME</strong>THODOLOGY<br />

STEP 2<br />

Recap Market Research Learnings<br />

Summarise the input regarding the<br />

validity of the two insights.<br />

STEP 4<br />

Final Review<br />

You can use the evaluation grid from<br />

the previous phase to decide for the<br />

strongest final insight.<br />

STEP 1<br />

Recap draft insights<br />

Use your two draft insights as a starting point<br />

for discussion, as you will now have to narrow<br />

them down and make more specific.<br />

Formulate the insight<br />

STEP 3<br />

Phrase final insight<br />

Use the barrier and need approach shown at<br />

the attached card to rephrase the insights<br />

based on the input from market research <br />

OUTCO<strong>ME</strong><br />

ONE<br />

final insight<br />

!<br />

WATCH OUT<br />

Go beyond observations<br />

An insight has to capture<br />

cause & effect and explain<br />

a relation<br />

!<br />

TIP/TEMPLATES<br />

1. How to formulate <br />

an insight<br />

2. Evaluation grid from <br />

previous phase<br />

NOTE<br />

Think like a consumer<br />

and look at the insight<br />

from their perspective!<br />

!<br />

SOURCES/HELP<br />

Market research<br />

!<br />

NEEDED MATERIAL<br />

Pens<br />

Templates <br />

!

How to formulate an insight?<br />

Step 3<br />

Barrier<br />

<br />

_______________________<br />

_______________________<br />

____________________ <br />

________________<br />

Need<br />

<br />

_______________________<br />

_______________________<br />

____________________ <br />

________________<br />

First define the problem: <br />

What is the underlying barrier, fear?<br />

Secondly derive the resulting need: <br />

What is the motivation or desire?<br />

Insight evaluation grid<br />

Step 4<br />

A STRONG INSIGHT SHOULD TICK THE FOLLOWING BOXES<br />

Relevance<br />

How true is it for the<br />

consumer?<br />

Credibility<br />

How credible does the<br />

brand overcome the<br />

barrier/meet the need?<br />

Differentiation<br />

How much disruptive<br />

power lies in the insight?<br />

Effect to change<br />

How powerful is it to<br />

change behaviour/<br />

attitudes &t herefore<br />

contributes to the goal?<br />

Simplicity<br />

How easy to<br />

understand, straightforward<br />

& singleminded<br />

is the insight?<br />

Fit Brand Strategy<br />

Does it fit the brand<br />

positioning, the design<br />

criteria & the marketing<br />

strategy?<br />

Newness<br />

How new in terms of<br />

actuality is it? Or how new<br />

in terms of a surprising<br />

way of thinking about it?

How to formulate an insight?<br />

A great example: Schwäbisch Hall<br />

Barrier<br />

<br />

Saving with a building society<br />

is unsexy and boring. For us<br />

young people it is not relevant<br />

as our life is in constant<br />

change and with possessions<br />

just come burdens. <br />

Need<br />

<br />

But with my generations<br />

precarious lifestyle the desire of<br />

belonging and safety gets even<br />

bigger.<br />

Insight evaluation grid<br />

!<br />

Do a final check: Does your insight<br />

fulfil the following criteria? <br />

Insight<br />

Relevance<br />

Credibility<br />

Differentiation<br />

Effect to change<br />

Simplicity<br />

Fit Brand Strategy<br />

Newness

INTRODUCTION<br />

!<br />

This phase is done in a workshop<br />

session. A concept consists of<br />

insight, proposition and proof<br />

points.<br />

8<br />

!<br />

The starting point of every<br />

concept is the insight. A strong<br />

insight inspires different<br />

propositions/concepts.<br />

CONCEPT DEVELOP<strong>ME</strong>NT<br />

PHASE 8

Concept<br />

Development<br />

Set up a proposition workshop<br />

<strong>ME</strong>THODOLOGY<br />

STEP 2<br />

Re-collect needed input<br />

The input checklist helps to<br />

gather all necessary information<br />

from the previous phases.<br />

STEP 1<br />

Define the participants and the agenda<br />

Clear the purpose, outcome and steps of the<br />

workshop as well as the responsibilities of the<br />

participants: who has which role in the workshop?<br />

Execute the proposition workshop<br />

STEP 3<br />

Prepare the workshop<br />

Provide a room, pens, flip-charts,<br />

etc.<br />

insights, market situation, etc. STEP 5<br />

Condense your knowledge in a working session<br />

STEP 4<br />

Present each other the relevant information<br />

Make sure everyone is on the same knowledge<br />

level regarding the objective, the product,<br />

Concept development<br />

STEP 6<br />

Develop a proposition<br />

Use the exercises on the cards<br />

to come up with a proposition.<br />

Split in groups. Do the proposition canvas or<br />

Triangle of truth exercise. Share your results with<br />

the other groups and discuss the findings.<br />

STEP 7<br />

Develop, evaluate and choose concepts<br />

Together with your agency you will develop a<br />

set of concepts and choose the strongest<br />

ones for the final research.<br />

3<br />

Draft-Concepts<br />

OUTCO<strong>ME</strong><br />

!<br />

WATCH OUT<br />

There is always a lot to<br />

say, but what helps a good<br />

concept? A clear story! So<br />

keep it short and simple! <br />

!<br />

TIP/TEMPLATES<br />

1. Input checklist<br />

2. Proposition Canvas<br />

3. Triangle of truth exercise<br />

4. How to Develop Draft Proposition<br />

5. Inspiration exercises<br />

6. Four principles<br />

7. How to develop a concept<br />

8. Concept evaluation grid<br />

NOTE<br />

Focus on the ONE key<br />

benefit! The product<br />

explanation happens at<br />

the POS.<br />

SOURCES/HELP<br />

See input list<br />

!<br />

NEEDED MATERIAL<br />

Pens<br />

Post-its<br />

!

Input checklist for proposition workshop<br />

Step 2<br />

Consumer<br />

!<br />

Target group definition according <br />

to segmentation<br />

!<br />

!<br />

Existing Insight <br />

Basis of the insights (trend studies, <br />

research, feedback, sales, etc.)<br />

Market<br />

!<br />

!<br />

!<br />

Market development<br />

Competitor products<br />

Competitor communication<br />

Brand<br />

!<br />

!<br />

Current Brand KPIs<br />

Strength & weaknesses of the <br />

brand in the context of the design <br />

criteria / motivator role<br />

Product<br />

!<br />

Overview of current and <br />

planned product portfolio<br />

Proposition canvas exercise<br />

Step 5<br />

Consumers don’t buy products but solutions<br />

that help them to do more out of their life or to<br />

do their „consumer jobs“ better. <br />

!<br />

Consumer jobs can be functional (e.g. perform<br />

or complete a specific task, solve a specific<br />

problem …), social (e.g. trying to look good,<br />

gain power or status …), emotional (e.g.<br />

aesthetics, feel good, security …) or addressing<br />

basic needs (e.g. communication, sex ...)<br />

!<br />

This exercise presents you a systematic way to<br />

create great propositions that match your<br />

customer's needs (gains), barriers (pains) and<br />

jobs-to-be-done to ensure problem-solution fit. <br />

!<br />

You start by taking the insight from the previous<br />

phase and filling out the consumer pains<br />

(barriers), gains (needs) and jobs. <br />

!<br />

PRODUCT<br />

!<br />

MARKET<br />

!<br />

INSIGHT

Input checklist for proposition workshop<br />

!<br />

Consumer<br />

!<br />

!<br />

Target group definition <br />

according to segmentation<br />

Existing Insight <br />

<br />

Basis of the insights (trend studies, <br />

research, feedback, sales, etc.)<br />

Market<br />

!<br />

!<br />

!<br />

Market development<br />

Competitor products<br />

Competitor communication<br />

Brand<br />

!<br />

!<br />

Current Brand KPIs<br />

Strength & weaknesses of the <br />

brand in the context of the design <br />

criteria / motivator role<br />

Product<br />

!<br />

Overview of current and <br />

planned product portfolio<br />

Define responsibilities? <br />

How provides what?<br />

Proposition canvas exercise<br />

!<br />

Define the offer with the<br />

concrete product features<br />

!<br />

How can we create gains and<br />

solve pains better than our<br />

competition?<br />

!<br />

Step 1<br />

Use your insight<br />

to fill out<br />

consumer jobs,<br />

pains & gains<br />

!<br />

Step 2<br />

Describe your<br />

product/service<br />

!<br />

Step 3<br />

Define how your<br />

product/service<br />

is a gain creator<br />

or pain reliever<br />

!<br />

Step 4<br />

Reflect the market<br />

conventions and<br />

disruption<br />

possibilities<br />

!<br />

Step 5<br />

Link insight,<br />

product & market<br />

perspective to<br />

create a<br />

proposition<br />

!<br />

Pains = barriers<br />

negative emotions,<br />

undesired costs<br />

and situations, and<br />

risks, etc.<br />

!<br />

Gains = Needs<br />

desires, functional<br />

utility, social gains,<br />

positive emotions,<br />

cost savings, etc.<br />

!<br />

Define the benefit: How does<br />

your product/service create<br />

value for the consumer?<br />

!<br />

Think about a proposition that<br />

expresses which pains your<br />

product can solve and which<br />

gains it can create better than<br />

the competition.

Triangle of Truth exercise<br />

Step 5<br />

This exercise helps you to set the <br />

cornerstones for positioning finding: <br />

<br />

Relevance, Credibility and Differentiation.<br />

!<br />

It helps to link our insight from the previous<br />

phase (Customer Truth), with the emotional<br />

and rational strengths of the brand (Brand<br />

Truth) and the market conventions and<br />

competitor activities (Market truth).<br />

Conventions & Competition<br />

Market Truth<br />

Need & Barrier<br />

Consumer Truth<br />

PROPOSITION<br />

Proposition<br />

Product-/Brand Strength<br />

Brand Market Truth<br />

Develop a Draft-Proposition<br />

Consumer Truth<br />

Step 6<br />

Step<br />

If you have problems to develop a<br />

proposition use one of the inspiration<br />

exercises on the next card.<br />

Market Truth<br />

Which proposition connects <br />

the corners of the triangle?<br />

_____________________________<br />

____________________________<br />

__________________________ <br />

_________________________<br />

______________________<br />

___________________<br />

!<br />

Market<br />

Brand Truth

Triangle of Truth exercise<br />

How to do it<br />

!<br />

1. Step: Split in groups à 4 people. Draw the triangle on a flipchart<br />

and write the insight from the previous phase at the<br />

„Consumer Truth“ Corner.<br />

!<br />

2. Step: Collect your ideas for Brand and Market Truths by<br />

answering the questions in the bubbles. Write your ideas on postits<br />

and collect them at the respective corners.<br />

3. Step: Discuss them, develop new<br />

ones and sort out weak ones.<br />

!<br />

4. Step: Pick the Brand Truth and<br />

Market Convention that relate best<br />

to the Costumer Truth and phrase a<br />

statement for both. <br />

!<br />

6. Step: Put your statements at the<br />

corner of the triangle and present<br />

your findings to the audience.<br />

Conventions & Competition<br />

Market Truth<br />

Need & Barrier<br />

Consumer Truth<br />

PROPOSITION<br />

Proposition<br />

What are the conventions, the „unwritten laws“ in the<br />

market? What is everybody talking about? Which of these<br />

conventions could we potentially break?<br />

Product-/Brand Strength<br />

Brand Market Truth<br />

What does o2 Business have, what the<br />

other do not have? What are strengths? <br />

Emotional and rational?<br />

Develop a Draft-Proposition<br />

Consumer Truth<br />

EXAMPLE FROM WORKSHOP<br />

Market Truth<br />

Which proposition connects <br />

the corners of the triangle?<br />

_____________________________<br />

____________________________<br />

__________________________ <br />

_________________________<br />

______________________<br />

___________________<br />

!<br />

Market<br />

Brand Truth

Inspiration exercises for proposition development<br />

Step 6<br />

1Headline <br />

2 Exercise<br />

Demo<br />

Exercise<br />

You can use one or two<br />

of the following exercises<br />

to open your mind for a<br />

striking proposition.<br />

Consumer<br />

3 4<br />

R.I.P.<br />

Withdrawal <br />

Exercise<br />

Exercise<br />

Market<br />

Fill-in-the-blank text for proposition development<br />

Step 6<br />

Our product ____________ (product description)<br />

is for ________________ (target group)<br />

that are unhappy with ________________ (current alternative/pain)<br />

that’s why we offer _____________ (Benefit,gain)<br />

better than ___________ (product alternative)<br />

because _____________ (Reasons-to-believe)

Inspiration exercises for proposition development<br />

!<br />

1Headline <br />

2 Exercise<br />

Demo<br />

Exercise<br />

End of the year what will be the<br />

headline about o2 in the press?<br />

What will have made o2 famous? <br />

Watch out: only ! new news make<br />

it into the press. And headlines<br />

are very short. <br />

!<br />

!<br />

!<br />

Please write 3 different<br />

headlines.<br />

!<br />

What would be our war cry on a<br />

demo? What would we do<br />

differently, what o2 wants to<br />

Consumer<br />

!<br />

For a better…<br />

!<br />

Write 3 different ideas.<br />

change? What would o2 fight for?<br />

3 4<br />

R.I.P.<br />

Withdrawal <br />

Exercise<br />

Exercise<br />

!<br />

What would stand in O2’s<br />

obituary? For what would o2 be<br />

remembered?<br />

!<br />

Write 3 obituaries.<br />

Imagine a life without the o2<br />

product that you want to define<br />

the proposition for. What would<br />

be missing in people’s life?<br />

!<br />

Write down 3 ideas.<br />

Market<br />

Fill-out-blank text for proposition development<br />

Example from workshop

How to develop a concept<br />

Step 6<br />

1. Start with your INSIGHT from the previous phase<br />

__________________________________________________________________________________________<br />

__________________________________________________________________________________________<br />

__________________________________________________________________________________________<br />

__________________________________________________________________________________________<br />

2. Answer need and barrier with a relevant PROPOSITION<br />

What is our promise to the customer?________________________________________________________<br />

__________________________________________________________________________________________<br />

3. Support your proposition by PROOF POINTS<br />

Which product features pay into the proposition?______________________________________________<br />

__________________________________________________________________________________________<br />

Market<br />

4 rules to write a good concept<br />

Step 6<br />

1Stay<br />

2 single-minded<br />

Address a<br />

consumer benefit<br />

3 4<br />

Tell a<br />

Keep the consumer <br />

consistent story<br />

perspective

How to develop a concept<br />

(Example of a strong springboard from a o2 case)<br />

or example from workshop<br />

4 rules to write a good concept<br />

1Stay<br />

2 single-minded<br />

Address a<br />

consumer benefit<br />

If you throw three balls at<br />

somebody he will catch none.<br />

So don’t trow three thoughts at<br />

the consumer but concentrate<br />

on the ONE key argument. If<br />

your proposition contains „and“,<br />

„or“ it is a sign that your<br />

argumentation is not singleminded.<br />

!<br />

!<br />

!<br />

The proposition should never be<br />

the product itself but the<br />

resulting BENEFIT. This should<br />

not be just rational but<br />

emotional: For Dove the benefit<br />

is not „hydrating“ but the good<br />

feeling that real beauty is not<br />

size 0.<br />

!<br />

3 4<br />

Tell a<br />

Keep the consumer <br />

consistent story<br />

perspective<br />

!<br />

There should be a red threat<br />

through the whole concept. It is<br />

essential that the proposition<br />

answers the insight: How the<br />

product overcomes the barrier /<br />

fulfils the need?<br />

Don’t slip into marketing slang.<br />

We want to convince the<br />

consumer and should speak in<br />

his language.

Concept evaluation grid Step 7<br />

Concept 1 Concept 2 Concept 3<br />

Relevance<br />

Credibility<br />

Differentiation<br />

Effect to change<br />

Simplicity<br />

Fit Brand Strategy<br />

Newness<br />

Consistency

Concept evaluation grid

INTRODUCTION<br />

!<br />

In this phase the concepts get<br />

evaluated by a research institute.<br />

Usually this is done in a focus group<br />

set-up. Based on the learnings and<br />

9<br />

!<br />

recommendations of the research<br />

report the concepts are reworked<br />

and sent to Marketing Planning<br />

Board for final approval.<br />

CONCEPT DEVELOP<strong>ME</strong>NT<br />

PHASE 9

Concept<br />

Approval<br />

<strong>ME</strong>THODOLOGY<br />

STEP 2<br />

Test the concepts in focus groups<br />

It is always helpful to participate on the<br />

focus groups and not just rely on the final<br />

report. This is the chance to get firsthand<br />

information from the consumers!<br />

STEP 4<br />

Re-work the concepts<br />

Maybe you have to adjust<br />

parts of the concept.<br />

Conduct the concept research<br />

STEP 1<br />

Write the brief for the research institute<br />

It is important to clear the questions you want<br />

to find answers to. See the card for critical<br />

aspects that have to be defined in the brief.<br />

Finalise the concepts<br />

STEP 3<br />

Discuss the implications of the research<br />

What did we learn? <br />

Is the insight true? <br />

Are the propositions relevant? <br />

Are the proof points considered credible? <br />

Are there irritation points? <br />

Understanding problems? <br />

Which concepts are the strongest?<br />

STEP 5<br />

Get final approval<br />

1<br />

final & approved<br />

concept<br />

OUTCO<strong>ME</strong><br />

!<br />

WATCH OUT<br />

Don’t loose the focus in<br />

the research. It’s<br />

important to define the<br />

questions you want to<br />

find answers to.<br />

!<br />

TIP/TEMPLATES<br />

1. Tips for concept<br />

research briefings<br />

NOTE<br />

Have a meeting with the<br />

interviewer before the<br />

research to clear all<br />

points <br />

SOURCES/HELP<br />

Support you will get from<br />

the research institute<br />

!<br />

NEEDED MATERIAL<br />

Stimulus material for the<br />

research institute<br />

!<br />

Research report<br />

!

Tips for concept research briefings<br />

Step 1<br />

1. Define the objective<br />

a) Identifying the concept with the highest potential (to create awareness? Or raising disposition to<br />

buy? Creating a brand image?).<br />

!<br />

b) Testing the relevancy of the insights, attractiveness of the offer, credibility of the proposition and<br />

product proofs, easiness to understand, consistency, etc. <br />

2. Define the recruiting criteria<br />

See phase 6 for tips on recruiting the focus group participants. Make sure you have a good mixture<br />

of people representing the target group. In some cases it can make sense to have group<br />

differences on purpose: E.g. a younger and an older age average, a user and a non-user group…<br />

3. Define the research questions<br />

The research institute will develop a questionnaire with guiding questions that function as a<br />

common thread for the discussion. Make sure all relevant aspects are included. Also define, which<br />

questions have priority and which ones are optional.<br />

X<br />

Step<br />

X<br />

X<br />

XXXX

Tips for concept research briefings<br />

Step 1<br />

Contacts of research institutes<br />

X<br />

Step<br />

X<br />

X<br />

XXXX

GLOSSARY<br />

Anything unclear? Not sure, what was again the difference between a „finding“ and a „learning“? Or<br />

having an argument about what is an insight? This glossary will help!<br />

Barriers are what keeps the consumer from our desired behaviour or attitude. Barriers can have different<br />

forms such as problems, trade-offs, hurdles, fears or perceived “costs”.<br />

!<br />

Behavioural aspects describe the purchase and usage behaviour e.g. purchase occasions, degree of<br />

loyalty, decision making process, relation to a product. However, this approach does not really consider<br />

why consumers buy the product, their needs or barriers. Therefore they need to be combined with<br />

psychographic aspects. <br />

!<br />

Concept consists of an insight, the derived proposition and the underlying proof points (the concrete<br />

product or service features). Concepts are also called “springboards” and they are the basis of<br />

inspiration and guiding direction for the creative work.<br />

!<br />

Demographic aspects are socioeconomic characteristics of a target group, such as<br />

age, sex, education level, income level, marital status, household size, etc. They are the quantifiable<br />

statistics and often combined to define a demographic profile. However, segmentation based on<br />

demographic aspects can only offer limited understanding about the consumers themselves: It is based<br />

on an assumption that consumers in the same demographic group would have similar needs, which is<br />

not very likely. Also e.g. a thirty year old and a sixty year old can have the same desires/motivations.<br />

!<br />

Draft-Insight is a presumable first insight that can be validated in scientific research. To come up with a<br />

Draft-Insight you reflect your learnings: You start with establishing the barrier and then derive the<br />

resulting need. The Draft-Insight is phrased from consumer perspective, it is written in consumer<br />

language, NOT marketing slang.<br />

!<br />

Findings are researchable, factual information such as interesting figures, statistics, trend reports, infographics.<br />

Findings are countless, that’s why it is important to stay goal-related!<br />

!<br />

Insights are the most misunderstood concept in communication strategy. An insight is a revelation<br />

about a fundamental consumer truth: The most relevant and differentiating barrier (a problem or fear)<br />

and the resulting need (motivation, or desire). Three things are essential: First it gets always developed<br />

from consumer perspective, NOT product perspective. Second, it has to discover the “WHY” that<br />

means explaining behaviour or attitudes, and going beyond a product description, a statistic or a pure<br />

observation. Third it unlocks a certain “Aha Effect” as great insight are not just surprisingly new but<br />

surprisingly simple. They are the things that other people think of, and you immediately wish you had,<br />

but never though of it like that.<br />

!<br />

Learnings are conclusions derived from your findings. A learning positively or negatively links the single<br />

facts, figures, etc. and interprets them. Learnings can have various forms such as correlations,<br />

influences, contradictions, shifts, developments or dilemmas.

Needs are what customers intend to solve with the purchase of a product or service. But let’s start with<br />

what customer needs are not: A customer need is neither a product feature nor a statement that<br />

describes how to make products easier to purchase, set up or install. Customers don’t buy products<br />

to set them up. So a need is NOT a solution. A need is a consumer’s desire for a product category’s<br />

specific benefit on a functional or emotional level. The stronger needs are emotional, because<br />

functional benefits are easily copied or outflanked.<br />

!<br />

Observation is an extensive array of various research methods used with the intention of<br />

observing consumers in their natural surroundings. The main advantage to conducting observational<br />

research is that the consumer don’t feel monitored allowing the researcher to make<br />

an objective analysis.<br />

!<br />