Business Models in TelecoMMunicaTions - Comarch

Business Models in TelecoMMunicaTions - Comarch

Business Models in TelecoMMunicaTions - Comarch

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6 > In Focus<br />

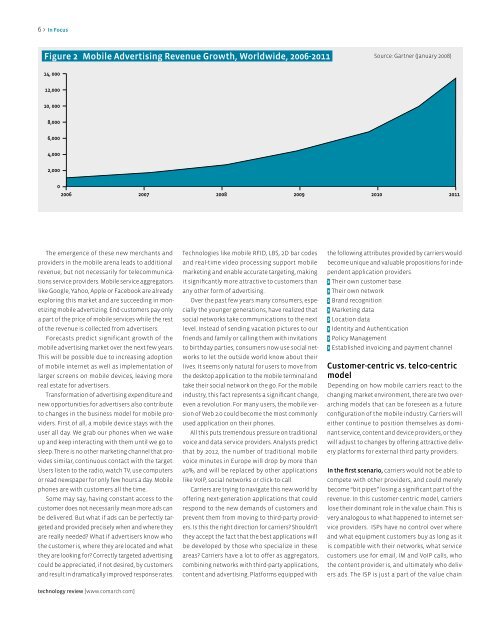

Figure 2 Mobile Advertis<strong>in</strong>g Revenue Growth, Worldwide, 2006-2011<br />

Source: Gartner (January 2008)<br />

14, 000<br />

12,000<br />

10, 000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

2006 2007 2008 2009 2010 2011<br />

The emergence of these new merchants and<br />

providers <strong>in</strong> the mobile arena leads to additional<br />

revenue, but not necessarily for telecommunications<br />

service providers. Mobile service aggregators<br />

like Google, Yahoo, Apple or Facebook are already<br />

explor<strong>in</strong>g this market and are succeed<strong>in</strong>g <strong>in</strong> monetiz<strong>in</strong>g<br />

mobile advertiz<strong>in</strong>g. End-customers pay only<br />

a part of the price of mobile services while the rest<br />

of the revenue is collected from advertisers.<br />

Forecasts predict significant growth of the<br />

mobile advertis<strong>in</strong>g market over the next few years.<br />

This will be possible due to <strong>in</strong>creas<strong>in</strong>g adoption<br />

of mobile <strong>in</strong>ternet as well as implementation of<br />

larger screens on mobile devices, leav<strong>in</strong>g more<br />

real estate for advertisers.<br />

Transformation of advertis<strong>in</strong>g expenditure and<br />

new opportunities for advertisers also contribute<br />

to changes <strong>in</strong> the bus<strong>in</strong>ess model for mobile providers.<br />

First of all, a mobile device stays with the<br />

user all day. We grab our phones when we wake<br />

up and keep <strong>in</strong>teract<strong>in</strong>g with them until we go to<br />

sleep. There is no other market<strong>in</strong>g channel that provides<br />

similar, cont<strong>in</strong>uous contact with the target.<br />

Users listen to the radio, watch TV, use computers<br />

or read newspaper for only few hours a day. Mobile<br />

phones are with customers all the time.<br />

Some may say, hav<strong>in</strong>g constant access to the<br />

customer does not necessarily mean more ads can<br />

be delivered. But what if ads can be perfectly targeted<br />

and provided precisely when and where they<br />

are really needed? What if advertisers know who<br />

the customer is, where they are located and what<br />

they are look<strong>in</strong>g for? Correctly targeted advertis<strong>in</strong>g<br />

could be appreciated, if not desired, by customers<br />

and result <strong>in</strong> dramatically improved response rates.<br />

Technologies like mobile RFID, LBS, 2D bar codes<br />

and real-time video process<strong>in</strong>g support mobile<br />

market<strong>in</strong>g and enable accurate target<strong>in</strong>g, mak<strong>in</strong>g<br />

it significantly more attractive to customers than<br />

any other form of advertis<strong>in</strong>g.<br />

Over the past few years many consumers, especially<br />

the younger generations, have realized that<br />

social networks take communications to the next<br />

level. Instead of send<strong>in</strong>g vacation pictures to our<br />

friends and family or call<strong>in</strong>g them with <strong>in</strong>vitations<br />

to birthday parties, consumers now use social networks<br />

to let the outside world know about their<br />

lives. It seems only natural for users to move from<br />

the desktop application to the mobile term<strong>in</strong>al and<br />

take their social network on the go. For the mobile<br />

<strong>in</strong>dustry, this fact represents a significant change,<br />

even a revolution. For many users, the mobile version<br />

of Web 2.0 could become the most commonly<br />

used application on their phones.<br />

All this puts tremendous pressure on traditional<br />

voice and data service providers. Analysts predict<br />

that by 2012, the number of traditional mobile<br />

voice m<strong>in</strong>utes <strong>in</strong> Europe will drop by more than<br />

40%, and will be replaced by other applications<br />

like VoIP, social networks or click-to-call.<br />

Carriers are try<strong>in</strong>g to navigate this new world by<br />

offer<strong>in</strong>g next-generation applications that could<br />

respond to the new demands of customers and<br />

prevent them from mov<strong>in</strong>g to third-party providers.<br />

Is this the right direction for carriers? Shouldn’t<br />

they accept the fact that the best applications will<br />

be developed by those who specialize <strong>in</strong> these<br />

areas? Carriers have a lot to offer as aggregators,<br />

comb<strong>in</strong><strong>in</strong>g networks with third-party applications,<br />

content and advertis<strong>in</strong>g. Platforms equipped with<br />

the follow<strong>in</strong>g attributes provided by carriers would<br />

become unique and valuable propositions for <strong>in</strong>dependent<br />

application providers.<br />

> Their own customer base<br />

> Their own network<br />

> Brand recognition<br />

> Market<strong>in</strong>g data<br />

> Location data<br />

> Identity and Authentication<br />

> Policy Management<br />

> Established <strong>in</strong>voic<strong>in</strong>g and payment channel<br />

Customer-centric vs. telco-centric<br />

model<br />

Depend<strong>in</strong>g on how mobile carriers react to the<br />

chang<strong>in</strong>g market environment, there are two overarch<strong>in</strong>g<br />

models that can be foreseen as a future<br />

configuration of the mobile <strong>in</strong>dustry. Carriers will<br />

either cont<strong>in</strong>ue to position themselves as dom<strong>in</strong>ant<br />

service, content and device providers, or they<br />

will adjust to changes by offer<strong>in</strong>g attractive delivery<br />

platforms for external third party providers.<br />

In the first scenario, carriers would not be able to<br />

compete with other providers, and could merely<br />

become “bit pipes” los<strong>in</strong>g a significant part of the<br />

revenue. In this customer-centric model, carriers<br />

lose their dom<strong>in</strong>ant role <strong>in</strong> the value cha<strong>in</strong>. This is<br />

very analogous to what happened to <strong>in</strong>ternet service<br />

providers. ISPs have no control over where<br />

and what equipment customers buy as long as it<br />

is compatible with their networks, what service<br />

customers use for email, IM and VoIP calls, who<br />

the content provider is, and ultimately who delivers<br />

ads. The ISP is just a part of the value cha<strong>in</strong><br />

technology review [www.comarch.com]