Secondments to and within Europe - Ius Laboris

Secondments to and within Europe - Ius Laboris

Secondments to and within Europe - Ius Laboris

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

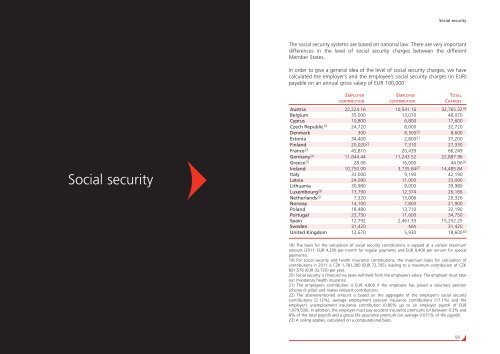

Social security<br />

The social security systems are based on national law. There are very important<br />

differences in the level of social security charges between the different<br />

Member States.<br />

In order <strong>to</strong> give a general idea of the level of social security charges, we have<br />

calculated the employer’s <strong>and</strong> the employee’s social security charges (in EUR)<br />

payable on an annual gross salary of EUR 100,000:<br />

Social security<br />

EMPLOYER EMPLOYEE TOTAL<br />

CONTRIBUTION CONTRIBUTION CHARGES<br />

Austria 22,224.16 10,541.16 32,765.32 18<br />

Belgium 35,000 13,070 48,070<br />

Cyprus 10,800 6,800 17,600<br />

Czech Republic 19 24,720 8,000 32,720<br />

Denmark 300 8,300 20 8,600<br />

Es<strong>to</strong>nia 34,400 2,800 21 37,200<br />

Finl<strong>and</strong> 20,020 22 7,310 27,330<br />

France 23 45,810 20,439 66,249<br />

Germany 24 11,644.44 11,243.52 22,887.96<br />

Greece 25 28.06 16,000 44.06 26<br />

Irel<strong>and</strong> 10,750.00 3,735.84 27 14,485.84<br />

Italy 33,000 9,190 42,190<br />

Latvia 24,090 11,000 33,090<br />

Lithuania 30,980 9,000 39,980<br />

Luxembourg 28 13,790 12,374 26,166<br />

Netherl<strong>and</strong>s 29 7,320 13,006 20,326<br />

Norway 14,100 7,800 21,900<br />

Pol<strong>and</strong> 18,480 13,710 32,190<br />

Portugal 23,750 11,000 34,750<br />

Spain 12,792 2,461.33 15,252.25<br />

Sweden 31,420 N/A 31,420<br />

United Kingdom 12,670 5,930 18,600 30<br />

18) The basis for the calculation of social security contributions is capped at a certain maximum<br />

amount (2011: EUR 4,200 per month for regular payments <strong>and</strong> EUR 8,400 per annum for special<br />

payments).<br />

19) For social security <strong>and</strong> health insurance contributions, the maximum basis for calculation of<br />

contributions in 2011 is CZK 1,781,280 (EUR 72,705), leading <strong>to</strong> a maximum contribution of CZK<br />

801,576 (EUR 32,720) per year.<br />

20) Social security is financed via taxes withheld from the employee’s salary. The employer must take<br />

out m<strong>and</strong>a<strong>to</strong>ry health insurance.<br />

21) The employee’s contribution is EUR 4,800 if the employee has joined a voluntary pension<br />

scheme (II pillar) <strong>and</strong> makes relevant contributions.<br />

22) The abovementioned amount is based on the aggregate of the employer's social security<br />

contributions (2.12%), average employment pension insurance contributions (17.1%) <strong>and</strong> the<br />

employer’s unemployment insurance contribution (0.80% up <strong>to</strong> an employer payroll of EUR<br />

1,879,500). In addition, the employer must pay accident insurance premiums (of between 0.3% <strong>and</strong><br />

8% of the <strong>to</strong>tal payroll) <strong>and</strong> a group life assurance premium (on average 0.071% of the payroll).<br />

23) A ceiling applies, calculated on a computational basis.<br />

59