Secondments to and within Europe - Ius Laboris

Secondments to and within Europe - Ius Laboris

Secondments to and within Europe - Ius Laboris

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

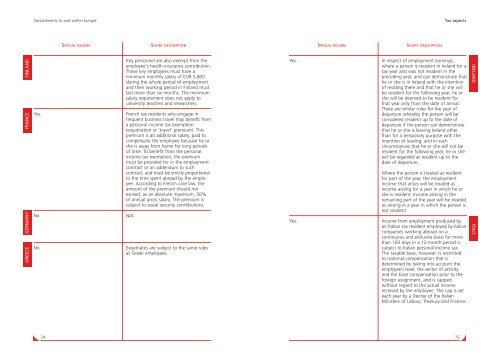

<strong>Secondments</strong> <strong>to</strong> <strong>and</strong> <strong>within</strong> <strong>Europe</strong><br />

Tax aspects<br />

SPECIAL REGIME<br />

SHORT DESCRIPTION<br />

SPECIAL REGIME<br />

SHORT DESCRIPTION<br />

GREECE GERMANY<br />

FRANCE<br />

FINLAND<br />

Yes.<br />

No.<br />

No.<br />

Key personnel are also exempt from the<br />

employee's health insurance contribution.<br />

These key employees must have a<br />

minimum monthly salary of EUR 5,800<br />

during the whole period of employment<br />

<strong>and</strong> their working period in Finl<strong>and</strong> must<br />

last more than six months. The minimum<br />

salary requirement does not apply <strong>to</strong><br />

university teachers <strong>and</strong> researchers.<br />

French tax residents who engage in<br />

frequent business travel may benefit from<br />

a personal income tax exemption<br />

(expatriation or ‘travel’ premium). This<br />

premium is an additional salary, paid <strong>to</strong><br />

compensate the employee because he or<br />

she is away from home for long periods<br />

of time. To benefit from the personal<br />

income tax exemption, the premium<br />

must be provided for in the employment<br />

contract or an addendum <strong>to</strong> such<br />

contract, <strong>and</strong> must be strictly proportional<br />

<strong>to</strong> the time spent abroad by the employee.<br />

According <strong>to</strong> French case law, the<br />

amount of the premium should not<br />

exceed, as an absolute maximum, 30%<br />

of annual gross salary. The premium is<br />

subject <strong>to</strong> social security contributions.<br />

N/A.<br />

Expatriates are subject <strong>to</strong> the same rules<br />

as Greek employees.<br />

Yes.<br />

Yes.<br />

In respect of employment earnings,<br />

where a person is resident in Irel<strong>and</strong> for a<br />

tax year <strong>and</strong> was not resident in the<br />

preceding year, <strong>and</strong> can demonstrate that<br />

he or she is in Irel<strong>and</strong> with the intention<br />

of residing there <strong>and</strong> that he or she will<br />

be resident for the following year, he or<br />

she will be deemed <strong>to</strong> be resident for<br />

that year only from the date of arrival.<br />

There are similar rules for the year of<br />

departure whereby the person will be<br />

considered resident up <strong>to</strong> the date of<br />

departure if the person can demonstrate<br />

that he or she is leaving Irel<strong>and</strong> other<br />

than for a temporary purpose with the<br />

intention of leaving, <strong>and</strong> in such<br />

circumstances that he or she will not be<br />

resident for the following year, he or she<br />

will be regarded as resident up <strong>to</strong> the<br />

date of departure.<br />

Where the person is treated as resident<br />

for part of the year, the employment<br />

income that arises will be treated as<br />

income arising for a year in which he or<br />

she is resident. Income arising in the<br />

remaining part of the year will be treated<br />

as arising in a year in which the person is<br />

not resident.<br />

Income from employment produced by<br />

an Italian tax resident employed by Italian<br />

companies working abroad on a<br />

continuous <strong>and</strong> exclusive basis for more<br />

than 183 days in a 12-month period is<br />

subject <strong>to</strong> Italian personal income tax.<br />

The taxable base, however, is restricted<br />

<strong>to</strong> notional compensation that is<br />

determined by taking in<strong>to</strong> account the<br />

employee’s level, the sec<strong>to</strong>r of activity<br />

<strong>and</strong> the base compensation prior <strong>to</strong> the<br />

foreign assignment, <strong>and</strong> is capped<br />

without regard <strong>to</strong> the actual income<br />

received by the employee. The cap is set<br />

each year by a Decree of the Italian<br />

Ministers of Labour, Treasury <strong>and</strong> Finance.<br />

IRELAND ITALY<br />

74<br />

75