Doing Business in - JHI

Doing Business in - JHI

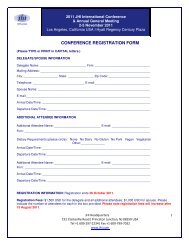

Doing Business in - JHI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Do<strong>in</strong>g</strong> <strong>Bus<strong>in</strong>ess</strong> <strong>in</strong><br />

Liechtenste<strong>in</strong><br />

Govern<strong>in</strong>g Bodies<br />

The general meet<strong>in</strong>g is the supreme authority and must<br />

occur at least once a year to approve the annual<br />

accounts and to deal with any other duties as provided<br />

for by law and articles. The board of directors conducts<br />

and manages the company bus<strong>in</strong>ess. It is the duty of the<br />

audit authority to exam<strong>in</strong>e the annual accounts and to<br />

report to the general meet<strong>in</strong>g.<br />

Submission of Balance Sheet<br />

The annual accounts exam<strong>in</strong>ed by the audit authority are<br />

required to be submitted to the Liechtenste<strong>in</strong> Tax<br />

Adm<strong>in</strong>istration.<br />

Taxes<br />

The special corporation tax (capital tax) amount<strong>in</strong>g to<br />

0.1% of the equity, at least, however, CHF 1,000 is<br />

payable annually. Coupon tax, amount<strong>in</strong>g to 4% of the<br />

distributed profits, is also payable. The profit achieved<br />

out of offshore activities isnot subject to tax.<br />

Establishment and Trust Enterprise (Trust reg.)<br />

These two legal forms, of purely Liechtenste<strong>in</strong> orig<strong>in</strong>, are<br />

extremely versatile. The scope for determ<strong>in</strong><strong>in</strong>g the<br />

organisation is very wide. They may be structured <strong>in</strong> the<br />

manner of a corporation, or their ma<strong>in</strong> characteristics<br />

may be foundation-like and thus, depend<strong>in</strong>g upon the<br />

structure, may provide an <strong>in</strong>strument for commercial<br />

objects or for the adm<strong>in</strong>istration of assets.<br />

Nom<strong>in</strong>al Capital<br />

The m<strong>in</strong>imum capital must be CHF 30,000, EUR €30,000<br />

or USD $30,000 and may be divided <strong>in</strong>to units of shares<br />

(with or without the character of securities). A division <strong>in</strong><br />

shares would however require a m<strong>in</strong>imum capital of CHF<br />

50,000, EUR €50,000 or USD $50,000 and would release<br />

4% taxation on distributed profits.<br />

PAGE 12 |<br />

DOING BUSINESS IN LIECHTENSTEIN