Congratulations: Corey Brown - Rodeo Media Relations

Congratulations: Corey Brown - Rodeo Media Relations

Congratulations: Corey Brown - Rodeo Media Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

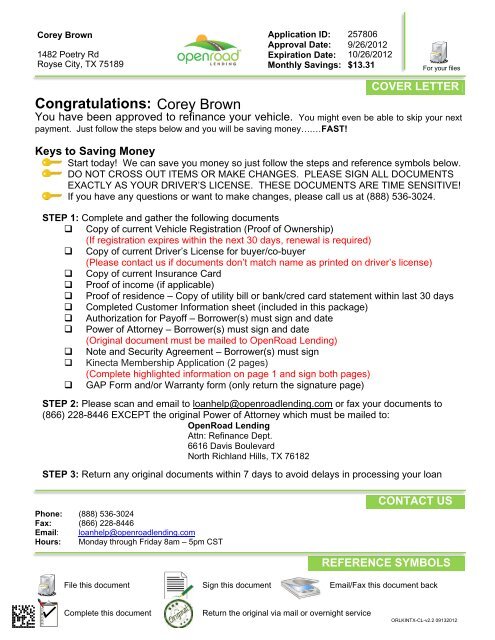

<strong>Corey</strong> <strong>Brown</strong><br />

1482 Poetry Rd<br />

Royse City, TX 75189<br />

Application ID:<br />

Approval Date:<br />

Expiration Date:<br />

257806<br />

9/26/2012<br />

10/26/2012<br />

Monthly Savings: $13.31<br />

For your files<br />

<strong>Congratulations</strong>:<br />

<strong>Corey</strong> <strong>Brown</strong><br />

COVER LETTER<br />

You have been approved to refinance your vehicle. You might even be able to skip your next<br />

payment. Just follow the steps below and you will be saving money….…FAST!<br />

Keys to Saving Money<br />

Start today! We can save you money so just follow the steps and reference symbols below.<br />

DO NOT CROSS OUT ITEMS OR MAKE CHANGES. PLEASE SIGN ALL DOCUMENTS<br />

EXACTLY AS YOUR DRIVER’S LICENSE. THESE DOCUMENTS ARE TIME SENSITIVE!<br />

If you have any questions or want to make changes, please call us at (888) 536-3024.<br />

STEP 1: Complete and gather the following documents<br />

Copy of current Vehicle Registration (Proof of Ownership)<br />

(If registration expires within the next 30 days, renewal is required)<br />

Copy of current Driver’s License for buyer/co-buyer<br />

(Please contact us if documents don’t match name as printed on driver’s license)<br />

Copy of current Insurance Card<br />

Proof of income (if applicable)<br />

Proof of residence – Copy of utility bill or bank/cred card statement within last 30 days<br />

Completed Customer Information sheet (included in this package)<br />

Authorization for Payoff – Borrower(s) must sign and date<br />

Power of Attorney – Borrower(s) must sign and date<br />

(Original document must be mailed to OpenRoad Lending)<br />

Note and Security Agreement – Borrower(s) must sign<br />

Kinecta Membership Application (2 pages)<br />

(Complete highlighted information on page 1 and sign both pages)<br />

GAP Form and/or Warranty form (only return the signature page)<br />

STEP 2: Please scan and email to loanhelp@openroadlending.com or fax your documents to<br />

(866) 228-8446 EXCEPT the original Power of Attorney which must be mailed to:<br />

OpenRoad Lending<br />

Attn: Refinance Dept.<br />

6616 Davis Boulevard<br />

North Richland Hills, TX 76182<br />

STEP 3: Return any original documents within 7 days to avoid delays in processing your loan<br />

Phone: (888) 536-3024<br />

Fax: (866) 228-8446<br />

Email: loanhelp@openroadlending.com<br />

Hours: Monday through Friday 8am – 5pm CST<br />

CONTACT US<br />

REFERENCE SYMBOLS<br />

File this document Sign this document Email/Fax this document back<br />

Complete this document<br />

Return the original via mail or overnight service<br />

ORLKINTX-CL-v2.2 09132012

TO: OpenRoad Lending FROM: <strong>Corey</strong> Lynn <strong>Brown</strong><br />

FAX: (866) 228-8446 Application ID:<br />

ATTN: Funding Department # of Pages: (including cover)<br />

Expiration Date:<br />

257806<br />

10/26/2012<br />

CUSTOMER INFORMATION SHEET<br />

Don’t forget to include a copy of a valid Driver’s License for each borrower, a copy of your current<br />

insurance card and vehicle registration.<br />

My References: No references in the same household.<br />

Complete<br />

Sign<br />

Email/Fax back<br />

1) Name: 2) Name:<br />

Address:<br />

Address:<br />

City:<br />

City:<br />

State: Zip: State: Zip:<br />

Phone #: Phone #:<br />

Relation:<br />

Relation:<br />

My Driver Information:<br />

Borrower<br />

Driver’s License #:<br />

Driver’s License<br />

Expire Date:<br />

License Plate #:<br />

Vehicle Color:<br />

Co-Borrower<br />

My Current Automobile Insurance Information:<br />

Insurance Company: Agent’s Phone #:<br />

Agent’s Name: (if applicable)<br />

Policy Number:<br />

My Employment Information:<br />

Employer Name: R & R MILLWORK<br />

HR/Payroll or Manager Phone #:<br />

HR/Payroll or Manager:<br />

Borrower Signature:<br />

You are giving OpenRoad Lending authorization to verify your employment as stated on the application.<br />

SIGN HERE<br />

Co-Borrower Employment Information:<br />

Employer Name: HR/Payroll or Manager Phone #:<br />

HR/Payroll or Manager:<br />

Co-Borrower Signature:<br />

You are giving OpenRoad Lending authorization to verify your employment as stated on the application.<br />

CO-SIGN HERE<br />

ORLST-FCL-v2.0 04012012

Application ID:<br />

Approval Date:<br />

Expiration Date:<br />

257806<br />

9/26/2012<br />

10/26/2012<br />

Sign<br />

Email/Fax back<br />

Current Lienholder:<br />

Lienholder Phone:<br />

Borrower:<br />

Co-Borrower:<br />

Loan Account #:<br />

Payoff Amount:<br />

Good Through:<br />

Vehicle:<br />

VIN #:<br />

New Lender:<br />

AUTHORIZATION FOR PAYOFF<br />

Wells Fargo Dealer Services<br />

800-289-8004<br />

<strong>Corey</strong> Lynn <strong>Brown</strong><br />

5780190774<br />

$15,248.48<br />

10/12<br />

2008 MAZDA CX-7-4 CYL TURBO<br />

JM3ER293680214658<br />

OpenRoad Lending, LLC<br />

I hereby authorize Wells Fargo Dealer Services to accept enclosed funds from OpenRoad Lending to pay off<br />

the balance due on the Loan Account number and Vehicle described above. I authorize Wells Fargo Dealer Services<br />

to release information on the above noted Loan Account to OpenRoad Lending, including but not limited to the terms<br />

of the account, the payoff amount, the daily per diem, the number of payments, and the last payment applied. I<br />

authorize OpenRoad Lending to add up to 10% to the Payoff Amount if the above amount does not pay off the existing<br />

lien. Upon receipt of the above amount, Wells Fargo Dealer Services<br />

is instructed to surrender the title to the<br />

above described Vehicle as indicated below. If this transaction relates to a branded, salvaged or reconditioned title, or<br />

title listing additional lienholders, or a shortage in the amount of the payoff, please contact OpenRoad Lending<br />

immediately at (888) 536-3024.<br />

In the event that Wells Fargo Dealer Services<br />

mistakenly remits the title to the Borrower and/or Co-<br />

Borrower, the undersigned Borrower and/or Co-Borrower will notify OpenRoad Lending immediately at (888) 536-3024<br />

Option 3. The Borrower and/or Co-Borrower will forward the title to OpenRoad Lending at the following address:<br />

OpenRoad Lending, Attention: Refinance Department, 6616 Davis Boulevard, North Richland Hills, TX 76182<br />

<strong>Corey</strong> Lynn <strong>Brown</strong><br />

Date<br />

Date<br />

SEND PROPERLY ENDORSED TITLE TO:<br />

OpenRoad Lending<br />

6616 Davis Boulevard<br />

North Richland Hills, TX 76182<br />

Phone (888) 536-3024<br />

SIGN HERE<br />

CO-SIGN HERE<br />

Phone: (888) 536-3024<br />

Fax: (866) 228-8446<br />

Email: loanhelp@openroadlending.com<br />

Hours: Monday through Friday 8am – 5pm CST<br />

CONTACT US<br />

ORL-AFP-v2.0 12052011

Application ID: 257806<br />

Approval Date: 9/26/2012<br />

Expiration Date: 10/26/2012<br />

Sign<br />

Return the original<br />

POWER OF ATTORNEY TO TRANSFER MOTOR VEHICLE<br />

POWER OF ATTORNEY<br />

This is to certify that I,<br />

<strong>Corey</strong> Lynn <strong>Brown</strong><br />

, of the County of _______________ and the State of<br />

TX , owner of the following described motor vehicle, do make, constitute and appoint Pam Box of<br />

OpenRoad Lending, LLC, 6616 Davis Boulevard, North Richland Hills, TX 76182, my true and lawful attorney, for me<br />

and in my name, place and stead to perfect the lien, sell, transfer and assign the motor vehicle described as follows:<br />

Year Make Model<br />

2008 MAZDA CX-7-4 CYL TURBO<br />

Body Style<br />

WAGON 4D SPORT AWD<br />

VIN<br />

JM3ER293680214658<br />

Giving and granting unto my said attorney full power and authority to do and perform all and every act requisite and<br />

necessary to transfer and assign the legal title to said motor vehicle to anyone whomsoever as may be designated by<br />

my said attorney, and to make, execute, acknowledge, verify, swear to, deliver, endorse, negotiate, record and file, in<br />

my name, place and stead, all agreements, instruments, documents, assignments and certificates, including a title lien<br />

statement, that my said attorney in its sole discretion deems advisable, desirable, proper and/or necessary for my said<br />

attorney to grant, receive, maintain or perfect a security interest in said vehicle.<br />

Federal Law (and State Law, if applicable) requires that you state the mileage upon transfer of ownership. Failure to<br />

complete or providing false statement may result in fines and/or imprisonment.<br />

I further certify that the current odometer reading is 64047 miles and to the best of my knowledge the<br />

odometer is the ACTUAL mileage of the vehicle unless one of the following statements is checked:<br />

1. The mileage listed above reflects my actual mileage.<br />

2. The mileage stated is in EXCESS of the mechanical limits.<br />

3. The odometer reading is NOT the actual mileage.<br />

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE READ THE FOREGOING DOCUMENT AND THAT<br />

THE FACTS STATED IN IT ARE TRUE.<br />

<strong>Corey</strong> Lynn <strong>Brown</strong><br />

Name of Owner<br />

Signature of Owner<br />

1482 Poetry Rd Royse City, TX 75189<br />

Borrower Address<br />

City, State Zip<br />

SIGN HERE<br />

Date<br />

* Any alteration or erasure voids this Power of Attorney<br />

Phone: (888) 536-3024<br />

Fax: (866) 228-8446<br />

Email: loanhelp@openroadlending.com<br />

Hours: Monday through Friday 8am – 5pm CST<br />

CONTACT US<br />

ORL-POA-v2.0 12232011

NOTE AND SECURITY AGREEMENT<br />

Sign Email/Fax back<br />

Date of Note: 9/28/2012 Application ID: 257806<br />

BORROWER:<br />

CO-BORROWER:<br />

ADDRESS:<br />

<strong>Corey</strong> Lynn <strong>Brown</strong><br />

1482 Poetry Rd<br />

Royse City, TX 75189<br />

LENDER:<br />

OpenRoad Lending, LLC<br />

6616 Davis Boulevard<br />

North Richland Hills, TX 76182<br />

I promise to pay the Amount Financed plus the accrued interest to the order of you, the Lender or your successors and assigns. I will make the<br />

payments at your address above or at any other address you may provide me. I will make the payments on the dates and in the amounts shown in the<br />

Payment Schedule. If the first payment date falls on the 29 th , 30 th or 31 st day of the month, I will make the payment in any month without such a date<br />

on the last day of such month. Each payment I make will be applied to the amounts owing under this Note in any order you choose that is permitted<br />

by applicable law. In this Note and Security Agreement (“Note”), Borrower is referred to as “I” or “me.” The Lender is referred to as “you” or<br />

“your.”<br />

TRUTH IN LENDING ACT DISCLOSURES<br />

ANNUAL PERCENTAGE RATE FINANCE CHARGE Amount Financed Total of Payments<br />

The cost of my credit as a yearly rate.<br />

8.49%<br />

The dollar amount the credit will<br />

cost me.<br />

$3,162.71 e<br />

The amount of credit provided<br />

to me or on my behalf.<br />

$15,895.48 e<br />

The amount I will have paid<br />

after I have made all payments<br />

as scheduled.<br />

$19,058.19 e<br />

My Payment Schedule Will Be:<br />

Number of Payments Amount of payments When Payments Are Due<br />

51 $373.69 e<br />

Monthly, beginning 30 days from the date of funding until paid in full.<br />

Security: I am giving you a security interest in the motor vehicle described as follows:<br />

2008 MAZDA CX-7-4 CYL TURBO VIN: JM3ER293680214658 and all collateral as defined in this Note.<br />

Prepayment: If I pay off early, I will not have to pay a penalty.<br />

Filing Fee: I agree to pay any lien filing fees.<br />

Insurance: Property insurance is required. I may obtain property insurance from anyone that is acceptable to you.<br />

Late Charge: If payment is not received in full within 10 days after it is due, I will pay you a late charge of 5% of the full amount of the<br />

payment.<br />

Other Terms: See the terms and conditions of this Note for any additional information about nonpayment, default, any required repayment in<br />

full before the scheduled due date, and prepayment refunds and penalties.<br />

e means an estimate<br />

The estimates that appear above are based upon information provided by my previous lender. See page 2 for additional information if the actual<br />

amounts differ from the estimated amounts. The final terms of my repayment obligation will be provided to me in a separate Disclosure Pursuant to<br />

the Truth in Lending Act, which is incorporated herein by reference.<br />

POWER OF ATTORNEY. I appoint<br />

you, through your appointed officer or<br />

employee, as my attorney-in-fact. As my<br />

attorney-in-fact, you can sign on my behalf<br />

all Certificates of Title, Registration Cards<br />

or other documents required to register and<br />

maintain a properly perfected security<br />

interest in the vehicle in your favor until all<br />

obligations I owe under this Note are paid<br />

in full.<br />

ITEMIZATION OF AMOUNT FINANCED<br />

I authorize you to pay the following amounts on my behalf:<br />

1. Amount given directly to me $ 0.00 (1)<br />

2. Amount paid on my account $ 0.00 (2)<br />

3. Other charges including amounts paid to others on my behalf<br />

(Lender may retain a portion of these amounts)<br />

A. To Wells Fargo Dealer Services For Loan/Lease Payoff $ 15,248.48<br />

B. To EFG Companies For GAP Insurance $<br />

599.00<br />

C. To For $<br />

0.00<br />

D. To For $<br />

0.00<br />

E. To Government Agency For Titling Fees $<br />

33.00<br />

F. To Membership Fee For CU Membership $<br />

15.00<br />

G. To For $<br />

0.00<br />

Total Other Charges (3A through 3G) $ 15,895.48 (3)<br />

4. Amount Financed (1+2+3) $ 15,895.48 (4)<br />

5. Administrative Fee (Prepaid Finance Charge) $ 0.00 (5)<br />

This written loan agreement is the final agreement between you and me and may not be changed by prior, current, or future oral agreements<br />

between you and me. There are no oral agreements between you and me relating to this loan agreement. Any change to this agreement must<br />

be in writing. Both you and I have to sign written agreements. BY SIGNING THIS NOTE I AGREE WITH AND ACKNOWLEDGE RECEIPT<br />

OF THE ABOVE DISCLOSURES AND THE ADDITIONAL TERMS AND CONDITIONS ON PAGE 2&3.<br />

SIGN HERE<br />

CO-SIGN HERE<br />

9/28/2012 9/28/2012<br />

Borrower Signs - <strong>Corey</strong> Lynn <strong>Brown</strong><br />

Borrower Signs -<br />

THIS NOTE CONTAINS AN ARBITRATION PROVISION, WHICH AFFECTS MY RIGHTS.<br />

This is page 1 of a 3 page Note. See next page for additional terms. ORL-NSAR1-KINTX-5.0 04012012

NOTE AND SECURITY AGREEMENT<br />

For your files<br />

Additional Terms and Conditions<br />

Application ID: 257806<br />

INTEREST. The annual rate of interest is 8.49% . Interest will be computed on a daily basis on the unpaid Amount Financed by the simple<br />

interest method. Interest will accrue based upon 365 days in each year. The Finance Charge shown in the Truth in Lending Disclosures may vary<br />

depending upon my payment patterns. Early payments will have the effect of reducing the Finance Charge, while payments made after their<br />

respective due dates will increase the Finance Charge. The amount of my final payment will depend upon the amounts and dates of the payments<br />

I make. If I do not pay all that I owe when the final payment is due, I will pay interest on the amount that is still unpaid at the annual rate of<br />

interest above, but not to exceed the maximum rate allowed by law, until paid.<br />

REPAYMENT. If the original payoff quoted by my previous lender(s) is not enough to satisfy my loan obligation, and my previous lender(s)<br />

requires additional funds to release its security interest, I authorize you to pay such funds on my behalf and to add such amounts to the Amount<br />

Financed. I further authorize you to advance to others amounts necessary, including taxes, fees, charges and other obligations, for you to obtain<br />

and/or maintain a first priority perfected security interest in the Collateral and add such amounts to the Amount Financed. I agree that the amount<br />

of my monthly payment will be adjusted so that the Amount Financed (as adjusted) plus accrued interest figured at the annual rate of interest is<br />

payable in substantially equal monthly payments during the term of this Note.<br />

PREPAYMENT. I may pay the unpaid balance, or any part thereof, of this Note at any time without penalty. If I make a partial prepayment, I<br />

am still required to make the next payment as scheduled. I may not skip payments.<br />

REQUIRED INSURANCE. I must keep the collateral insured against damage or loss in the amount I owe. I may obtain property<br />

insurance from anyone I want or provide proof of insurance I already have. The insurer must be authorized to do business in Texas. The<br />

deductible for any specific coverage shall not exceed $500 and the policy term may not be less than 6 months. I agree to give you proof of<br />

property insurance. I must name you as the person to be paid under the policy in the event of damage or loss. If I fail to meet any of these<br />

requirements, you may obtain Collateral protection insurance at my expense. If you obtain Collateral protection insurance, you will mail notice to<br />

my last known address.<br />

SECURITY INTEREST. To secure the loan evidenced by this Note, I give you a security interest in the “Collateral”. The Collateral includes (i)<br />

the motor vehicle and other goods being purchased including all proceeds of the vehicle and goods; (ii) accessories, equipment and replacement<br />

parts installed in such vehicle; (iii) all insurance, maintenance, service, debt cancellation or debt waiver contracts you finance for me; and (iv)<br />

proceeds, including, without limitation, refunds of premiums and charges, of any insurance, maintenance, service, debt cancellation or debt waiver<br />

contracts you finance for me.<br />

COLLATERAL RESTRICTIONS. I won’t sell or transfer the Collateral without your written permission. I won’t allow anyone else to have an<br />

interest in the Collateral except you. I will keep the collateral at my address shown above. I will promptly tell you in writing if I change my<br />

address. I won’t permanently remove the collateral from Texas unless you give me written permission. I will timely pay all taxes and license fees<br />

on the collateral. I will keep it in good repair. I won’t use the collateral illegally.<br />

DEFAULT. To the extent permitted by applicable law, I will be in default under this Note if any of the following things happen: (1) I fail to<br />

make any payment in full or fail to pay any other charge when it is due; (2) I break any promise, agreement or condition made in the Note or in<br />

any other agreement I have with you; (3) I fail to keep required insurance in force; (4) I give you false or misleading information on my<br />

application or any of the documents I provide or have provided to you; (5) I die, am declared incompetent, become insolvent, or file a bankruptcy<br />

petition, or have a bankruptcy petition filed against me; (6) The Vehicle is destroyed, stolen, damaged beyond repair, seized, confiscated, levied<br />

upon by governmental or legal process; or (7) anything else happens that you reasonably believe in good faith endangers the vehicle or my ability<br />

to pay. If I am in default, you may require me to pay the entire unpaid principal balance, any accrued but unpaid interest and other charges due at<br />

once, subject to any right the law gives me to reinstate this Note. If you do not enforce your rights every time, you can still enforce them later.<br />

REPOSSESSION. If I default under this Note, you shall have all the rights granted to a secured party under the Uniform Commercial Code and<br />

other applicable law. Unless prohibited by applicable law, these rights include, but are not limited to, the right to repossess the Collateral, sell the<br />

Collateral if I fail to redeem it, and deduct from the sale proceeds, as allowed by applicable law, the expenses of retaking, holding, preparing for<br />

disposition, processing and disposing of the Collateral. Unless prohibited by applicable law, I agree to pay your reasonable costs and expenses<br />

arising from repossession and sale of the Collateral. If there is a surplus as a result of the sale, it will be paid to me unless you must pay it to<br />

someone else. To the extent permitted by applicable law, if the money from the sale is not enough to pay all I owe, I must pay the difference,<br />

including accrued interest. I waive the provisions of the California vehicle Code Section 1808.21 and authorize the California Department of<br />

Motor Vehicles to furnish my residence address to you.<br />

MAILING ADDRESS. You can mail any notice to me at my last address in your records. Your duty to give me notice will be satisfied when<br />

you mail it.<br />

COLLECTION COSTS. I agree to pay a fee of fifteen dollars ($15) for the return by a depository institution of a dishonored check, negotiable<br />

order of withdrawal, or share draft. I also agree to pay reasonable attorney’s fees and legal expenses to the extent permitted by applicable law.<br />

MISCELLANEOUS. I promise that all information I gave you is true. The promises in this Note are joint and several. I understand that you<br />

may seek payment from only me without first looking to any other Borrower.<br />

SAVINGS CLAUSES. I don’t have to pay interest or other amounts that are more than the law allows. If any part of this contract is declared<br />

invalid, the rest of the contract remains valid.<br />

APPLICABLE LAW. This Note is governed by the laws of the State of California.<br />

NOTICE TO BORROWERS. This loan is made by OpenRoad Lending, 6616 Davis Blvd, North Richland Hills, TX 76182, and Lender<br />

License File No. 603-I315, pursuant to the California Finance Lenders Law, Division 9 (commencing with section 22000) of the Financial Code.<br />

By entering into this Note, you represent that no person has performed any act as a broker in connection with the making of this loan.<br />

FOR INFORMATION, CONTACT THE DEPARTMENT OF CORPORATION — STATE OF CALIFORNIA.<br />

This is page 2 of a 3 page Note. See next page for additional terms. ORL-NSAR2-KINTX-v5.0 04012012

NOTE AND SECURITY AGREEMENT<br />

Application ID:<br />

For your files<br />

257806<br />

ARBITRATION PROVISION. Upon written request by me or you submitted according to the rules for arbitration, any Claim, except those<br />

specified below, shall be resolved by binding arbitration in accordance with: (i) the Federal Arbitration Act, (ii) the Rules of the chosen<br />

Administrator, and (iii) this Arbitration Provision.<br />

(a) Claims Covered. “Claim” means any claim, dispute, or controversy now or hereafter existing between me and you, including without limitation,<br />

any claims arising out of, in connection with, or relating to this Note, and any modification, extension, application, or inquiry of credit or forbearance<br />

of payment; any trade-in of a vehicle; any products, goods and/or services, including the installation thereof, purchased in connection with this Note;<br />

any insurance, service contract, extended warranty, auto club membership or debt cancellation agreement purchased in connection with this Note; the<br />

closing, servicing, collecting or enforcing of this Note; whether the claim or dispute must be arbitrated; the validity of this Arbitration Provision; any<br />

negotiations between you and me; any claim or dispute based on an allegation of fraud or misrepresentation, including without limitation, fraud in the<br />

inducement of this or any other agreement; and any claim or dispute based on state or federal law, or an alleged tort. You and I also agree to submit to<br />

final, binding arbitration any claim or dispute that you or I have against all persons and /or entities: (i) who are involved with this Note, (ii) who<br />

signed or executed any document relating to this Note or any Claim, and (iii) who may be jointly or severally liable to either me or you regarding any<br />

Claim.<br />

EXCLUSION FROM ARBITRATION. The following types of matters will not be arbitrated: (1) The exercise of extra-judicial or self-help<br />

repossession under applicable law or any action seeking to enforce a security interest or any action to effect the sale or transfer of the property being<br />

foreclosed (collectively “Excluded Actions”). However, any claim or dispute arising out of or relating to the exercise of such Excluded Actions is<br />

subject to arbitration in accordance with this Arbitration Provision; or (2) Any Claim where all parties collectively (including multiple named parties)<br />

seek, in the aggregate, $15,000 or less in total monetary relief, including but not limited to compensatory, statutory and punitive damages, restitution,<br />

disgorgement, and costs and fees (including attorney’s fees); or any Claims brought and maintained as an individual (as opposed to class) action in a<br />

small claims court. If I attempt to assert any Claim on behalf of a putative class of persons, in violation of other terms in this Arbitration Provision,<br />

the value of such Claim will, for purposes of this exclusion, be deemed to exceed $15,000. If any party fails to specify the amount being sought for<br />

any relief, or any form or component of relief, the amount being sought shall, for purposes of this exclusion, be deemed to exceed $15,000.<br />

Participation in a lawsuit or seeking enforcement of this section by a court shall not waive the right to arbitrate.<br />

(b) Commencing Arbitration. The party initiating arbitration must choose one of the following arbitration Administrators and follow the rules and<br />

procedures that govern disputes established by the Administrator (“Rules”). The Administrator shall be the American Arbitration Association, 335<br />

Madison Avenue, New York, NY 10017-4605, www.adr.org, or any other organization that I may choose provided you approve of my choice in<br />

writing. The Rules and a form of demand for arbitration are available from the Administrator. You or I may bring an action, including a summary or<br />

expedited proceeding, to compel arbitration of any Claim, and/or to stay the litigation of any Claim pending arbitration, in any court having<br />

jurisdiction. Such action may be brought at any time, even if a Claim is part of a lawsuit, up until the entry of a final judgment.<br />

(c) Place of Arbitration. Arbitration shall be conducted in the county of my residence, unless all parties agree to another location.<br />

(d) No Class Actions/No Joinder of Parties. Claims and disputes by or on behalf of other persons not a party to this Note will not be arbitrated in any<br />

proceeding considering your Claims. I MAY NOT SERVE AS A CLASS REPRESENTATIVE OR PARTICIPATE AS A MEMBER OF A CLASS<br />

OF CLAIMANTS OR ACT AS A PRIVATE ATTORNEY GENERAL WITH RESPECT TO ANY CLAIM AGAINST ANY PARTY ENTITLED<br />

TO COMPEL ARBITRATION UNDER THIS ARBITRATION PROVISION. This is referred to in this Note as the “class action waiver.”<br />

(e) Governing Law for Arbitration. The Federal Arbitration Act, 9 U.S.C. §§ 1 et seq., shall govern this Arbitration Provision. The arbitrator shall<br />

make his or her decision in accordance with applicable substantive law consistent with the Federal Arbitration Act and applicable statutes of<br />

limitations, and shall be empowered to award any damages or other relief provided for under applicable law. Judgment upon any arbitration award<br />

may be entered in any court having jurisdiction.<br />

(f) Costs of Arbitration. You will advance my filing, administration, service or case management fees and my arbitrator or hearing fee all up to<br />

$2,500, which may be reimbursed by the decision of the arbitrator at the arbitrator’s discretion. Each party shall be responsible for its own attorney,<br />

expert and other fees, unless awarded by the arbitrator under applicable law.<br />

(g) Other Important Agreements. This Arbitration Provision applies even if this Note has been paid in full, charged-off by you, or discharged in<br />

bankruptcy. In the event of a conflict or inconsistency between this Arbitration Provision and the arbitration Rules or the other provisions of this<br />

Note, this Arbitration Provision shall govern.<br />

If the class action waiver above is determined to be unenforceable, void, illegal or otherwise against applicable law, then the remainder of this<br />

Arbitration Provision shall be unenforceable.<br />

Special Acknowledgments. I understand: (i) the Vehicle and other goods, products and services related to this Note, as well as the funding for my<br />

credit transaction, come in whole or in part from sources outside this state, which constitute interstate commerce within the meaning of the Federal<br />

Arbitration Act; and (ii) a court or jury will not hear or decide any Claim governed by this Arbitration Provision.<br />

NOTICE: ANY HOLDER OF THIS CONSUMER CREDIT CONTRACT IS SUBJECT TO ALL CLAIMS AND DEFENSES WHICH<br />

THE DEBTOR COULD ASSERT AGAINST THE SELLER OF GOODS OR SERVICES OBTAINED WITH THE PROCEEDS<br />

HEREOF. RECOVERY HEREUNDER BY THE DEBTORS SHALL NOT EXCEED AMOUNTS PAID BY THE DEBTOR<br />

HEREUNDER.<br />

This is page 3 of a 3 page Note.<br />

ORL-NSAR3-KINTX-v4.0 04012012

App ID:257806<br />

MEMBERSHIP APPLICATION<br />

(SHORT FORM)<br />

Complete<br />

Sign<br />

Email/Fax back<br />

PRIMARY ACCOUNT HOLDER INFORMATION<br />

LAST NAME MS. MR. MRS. FIRST NAME & MIDDLE INITIAL SOCIAL SECURITY #<br />

BROWN COREY LYNN 462-51-5102<br />

DRIVER’S LICENSE #/ STATE MOTHER’S MAIDEN NAME DATE OF BIRTH<br />

RESIDENTIAL ADDRESS CITY STATE & ZIP<br />

MAILING ADDRESS CITY STATE & ZIP<br />

HOME PHONE # WORK/DAYTIME PHONE# FAX EMAIL ADDRESS<br />

EMPLOYER (IF RETIRED, FORMER EMPLOYER NAME) SCHOOL/OCCUPATION RETIRED UNEMPLOYED STUDENT<br />

Employed<br />

4/3/1969<br />

1482 Poetry Rd ROYSE CITY TX, 75189<br />

1482 Poetry Rd ROYSE CITY TX, 75189<br />

(214) 354-4238 (903) 873-6600 info@4Bwebdesign.com<br />

R & R MILLWORK<br />

plant manager<br />

EMPLOYER OR SCHOOL ADDRESS EMPLOYER OR SCHOOL PHONE #<br />

> (903) 873-6600<br />

MEMBERSHIP ELIGIBILITY<br />

I AM ELIGIBLE TO JOIN KINECTA PURSUANT TO MY MEMBERSHIP IN THE CONSUMERS COOPERATIVE SOCIETY OF SANTA MONICA, IINC. (SEE ATTACHED APPLICATION.)<br />

A$5.00 minimum savings account deposit is required for membership.<br />

JOINT OWNER INFORMATION<br />

NAME (FIRST, MIDDLE, LAST) MS. MR. MRS. SOCIAL SECURITY # DATE OF BIRTH<br />

<br />

STREET ADDRESS DAYTIME PHONE #<br />

<br />

EMPLOYER (IF RETIRED, FORMER EMPLOYER NAME)<br />

><br />

EMPLOYER OR SCHOOL ADDRESS<br />

SCHOOL / OCCUPATION RETIRED UNEMPLOYED STUDENT<br />

EMPLOYER OR SCHOOL PHONE<br />

DRIVERS’S LICENSE # / STATE<br />

BENEFICIARY INFORMATION<br />

Pay-on-Death Provisions: In the event of my/our death, I/WE hereby designate the following beneficiary:<br />

PAYEE RELATIONSHIP DATE OF BIRTH SOCIAL SECURITY #<br />

CERTIFICATION FOR TAXPAYER IDENTIFICATION NUMBER AND ACCOUNT AGREEMENT<br />

A. Certification for Taxpayer Identification: Under penalty of perjury, I certify that: (1) the number on this form reference above is my correct Social Security number/taxpayer<br />

identification number (TIN); (2) I am not subject to backup withholding because : (a) I am exempt from backup withholding; or (b) I have not been notified by the Internal<br />

Revenue Service (IRS) that I am subject to withholding as a result of a failure to report all interest or dividends; or (c) the IRS has notified me that I am no longer subject to<br />

withholding; and (3) I am a U.S. person or resident alien. Note: I must cross out item (2) above if I have been notified by the IRS that I am currently subject to backup<br />

withholding.<br />

B. Account Agreement: I/We agree to conform to the Credit Union by-laws, the terms and conditions of the Application for Membership and Agreements & Disclosures (Share Accounts,<br />

Truth in Savings, and Electronic Services). I hereby apply for membership and I/we authorize Kinecta Federal Credit Union to verify all the information supplied herein and to verify<br />

my/our creditworthiness. Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account, in order to help the<br />

government fight the funding of terrorism and money laundering activities. What this means for you: When you open an account, we will ask for your name, address, date of birth and<br />

other information that will allow us to identify you. I waive the provisions of California Vehicle Code 1808.21 (or any other state) and authorize the California Department of Motor<br />

Vehicles (or any other state) to furnish my residence address to you. I/We agree that an electronically transmitted copy of this document shall be considered as an original document and<br />

shall be admissible as evidence in any court competent jurisdiction. The Internal Revenue Service does not require consent to any provision of this document other than the certification<br />

required to avoid backup withholding.<br />

SIGN<br />

Co-SIGN<br />

Primary Acct Holder Signature: ________________________________________ HERE Date: ________________ Joint Acct Holder Signature: _____________________________________ HERE Date: _____________<br />

There is a $2 paper statement processing fee per deposit statement (such as checking, savings, or money market accounts). To save this fee, log on to www.kinecta.org to sign up for free and secure online banking and electronic statements.<br />

Kinecta/SM COOP use ONLY<br />

FOR OFFICE USE ONLY<br />

NEW MEMBER NUMBER ___________________________________________________________________<br />

CO-OP NUMBER __________________________________________________________________________<br />

MEMBERSHIP OFFICER APPROVAL _______________________________________________ DATE __________________________________ REP# _________________________________________ OFFICE # ____________________<br />

Page 1<br />

450146B (10/11)

App ID:257806<br />

MEMBERSHIP APPLICATION<br />

(SHORT FORM)<br />

Complete<br />

Sign<br />

Email/Fax back<br />

MEMBER INFORMATION<br />

LAST NAME MS. MR. MRS. FIRST NAME & MIDDLE INITIAL SOCIAL SECURITY #<br />

BROWN COREY LYNN 462-51-5102<br />

DATE OF BIRTH<br />

STREET ADDRESS CITY STATE & ZIP<br />

MAILING ADDRESS CITY STATE & ZIP<br />

<br />

4/3/1969<br />

1482 Poetry Rd ROYSE CITY TX, 75189<br />

1482 Poetry Rd ROYSE CITY TX, 75189<br />

HOME PHONE # WORK/DAYTIME PHONE # FAX EMAIL ADDRESS<br />

(214) 354-4238 (903) 873-6600 <br />

info@4Bwebdesign.com<br />

JOINT TENANT INFORMATION<br />

NAME (FIRST, MIDDLE, LAST) MS. MR. MRS. SOCIAL SECURITY # DATE OF BIRTH<br />

<br />

STREET ADDRESS CITY STATE ZIP DAYTIME PHONE #<br />

<br />

DRIVERS’S LICENSE # / STATE<br />

I/We are applying for membership in the Consumers Cooperative Society of Santa Monica, Inc., (Santa Monica Co-Op). I agree to abide by the by-laws<br />

of the Santa Monica Co-Op and to cooperate with the other members in promoting the objectives of the organization as set forth in the by-laws. A copy of<br />

the by-laws is on file at the Consumers Cooperative Society of Santa Monica Inc., 3027 Wilshire Blvd., Santa Monica, California 90403-2301, or visit<br />

www.ccssm.org and click on “Membership.” A description of the Santa Monica Co-Op and its objectives is contained in its brochure, which has been<br />

provided to me (or will be provided by mail).<br />

Membership in the Santa Monica Co-Op may be held as a single person (Single Tenancy) or jointly as joint tenants with Right of Survivorship (NOT as<br />

Tenants-in-Common). If membership is to be held by more than one person, complete all information for both parties. On all memberships:<br />

• Membership becomes effective on receipt of a $10 application fee and acceptance of this application by the Board of Directors.<br />

• Either Joint Tenant, but not both, has the right to vote at membership meetings or by mail ballots.<br />

• Continued membership in the Santa Monica Co-Op will be subject to an Annual Membership Renewal Fee* of $10.00.<br />

I/We agree that an electronically transmitted copy of this document shall be considered as an original document and shall be admissible as evidence in<br />

any court of competent jurisdiction.<br />

I would like to receive all Co-Op member notices in electronic format (e-mail)<br />

SIGN<br />

HERE<br />

Member Signature____________________________________________ Date: _____________________ Joint Tenant Signature: __________________________________________________ Date: __________________________<br />

FOR CO-OP USE ONLY<br />

Co-SIGN<br />

HERE<br />

CO-OP NUMBER ______________________________________<br />

MEMBERSHIP OFFICER APPROVAL ________________________________________ DATE ________________________ REP# _____________________________________________ OFFICE # _________________________<br />

*No annual fee is required to maintain membership in Kinecta Federal Credit Union.<br />

Rev (12/10)<br />

Page 2

OPTIONAL GAP ADDENDUM<br />

CONTRACT NO.<br />

818442578062<br />

Inception Date: 09/28/2012 Account Number: 0000081844<br />

Buyer Name: COREY LYNN BROWN<br />

Address: 1482 POETRY RD<br />

City: ROYSE CITY State: TX Zip: 75189<br />

Protected Vehicle Year/Make/Model: 2008 MAZDA<br />

CX-7-4 CYL TURBO<br />

VIN: (17 Characters) JM3ER293680214658<br />

New Used<br />

Dealer/Seller: OpenRoad Lending<br />

Address: 6616 Davis Blvd. City: NRH<br />

8885363024<br />

State: TX Zip: 76182<br />

Creditor/Assignee: Kinecta<br />

Address: 1440 Rosecrans Ave City: Manhattan Bch State: CA Zip: 90266<br />

FINANCING CONTRACT Amount: $_______ ADDENDUM/FINANCING CONTRACT Term:<br />

15,895.48 51<br />

8.49 ✔<br />

APR ___% Does the FINANCING CONTRACT contain uniform payments? Yes No<br />

Max. Financing Contract Amount: Autos, SUVs & light trucks: Unlimited All other Collateral: $50,000<br />

Max. Limit of Liability: Autos, SUVs & light trucks: $50,000 All other Collateral: $25,000<br />

Max. Financing Contract Term: 84 Mos. Max. % of Vehicle Value at Inception: 125% Max. Deductible Buyback: $500<br />

months<br />

This GAP protection contract addendum, which is effective as of the inception date above, amends the FINANCING CONTRACT. This addendum is<br />

between the BUYER shown above (YOU or YOUR) and the DEALER/SELLER shown above (WE, US or OUR) or if the FINANCING<br />

CONTRACT is assigned to another party, the ASSIGNEE.<br />

GAP does not take the place of insurance on the PROTECTED VEHICLE. You are responsible for maintaining collision and comprehensive<br />

insurance for the full value of the vehicle and any other insurance required by the FINANCING CONTRACT or applicable law. You are responsible<br />

for all notifications or claims that are required to be filed with your automotive insurance company. We will not process or handle your insurance claims<br />

for you. If you move during the term of this contract, it is your responsibility to notify US or our Administrator of your change of address.<br />

You may wish to consult an alternative source to determine whether similar protection may be obtained and at what cost. If you purchase GAP<br />

from this source, you understand that we may retain all or a portion of the charge for this GAP addendum. You should carefully read the back<br />

of this addendum for additional information on eligibility, requirements, conditions and exclusions that could prevent you from receiving<br />

benefits under this addendum.<br />

LIMITATIONS–THIS IS ONLY A PARTIAL LIST. YOU MUST READ THIS ENTIRE GAP ADDENDUM FOR ALL LIMITATIONS:<br />

A. We will not waive that portion of the UNPAID NET BALANCE that results from the original FINANCING CONTRACT amount exceeding the<br />

Max. % of Vehicle Value at Inception stated above at the inception date of this addendum.<br />

B. FINANCING CONTRACTS with terms greater than the Maximum Financing Contract Term stated above are ineligible.<br />

C. Any addendum issued for an amount financed in excess of A above will be deemed eligible for enrollment as limited by this section.<br />

D. FINANCING CONTRACTS that do not have uniform monthly repayment terms for the full period of the FINANCING CONTRACT are<br />

ineligible.<br />

BY YOUR SIGNATURE BELOW YOU ACKNOWLEDGE AND AGREE TO THE FOLLOWING:<br />

• THAT THIS GAP ADDENDUM IS NOT AN INSURANCE POLICY OR PART OF AN INSURANCE POLICY.<br />

• THAT YOUR ACCEPTANCE OF THIS GAP ADDENDUM IS VOLUNTARY AND IS NOT REQUIRED IN ORDER FOR YOU TO<br />

OBTAIN CREDIT, DOES NOT IMPACT YOUR ABILITY TO OBTAIN ANY PARTICULAR OR MORE FAVORABLE CREDIT<br />

TERMS AND HAS NO EFFECT ON THE TERMS OF THE RELATED SALE OF THIS VEHICLE.<br />

• THAT YOU HAVE READ AND UNDERSTAND THIS ADDENDUM AND ITS PROVISIONS AND AGREE THAT NO VERBAL<br />

REPRESENTATIONS HAVE BEEN MADE TO YOU THAT DIFFER FROM THESE WRITTEN PROVISIONS.<br />

• YOU AUTHORIZE RELEASE OF FINANCING CONTRACT INFORMATION REQUIRED FOR PROCESSING OF A LOSS.<br />

• LOSSES MUST BE REPORTED TO THE BELOW ADMINISTRATOR WITHIN NINETY (90) DAYS OF THE PRIMARY CARRIER’S<br />

SETTLEMENT OR, IF THERE IS NO PRIMARY CARRIER, WITHIN NINETY (90) DAYS OF THE DATE OF LOSS.<br />

Yes, I elect GAP and acknowledge understanding of all provisions above and on succeeding pages.<br />

The Charge for this GAP Addendum is: $________ 599.00<br />

Buyer’s Signature:<br />

Date: _____________<br />

09/28/2012<br />

Buyer’s Signature:<br />

Date: _____________<br />

09/28/2012<br />

Dealer/Seller Signature:<br />

Date:_____________<br />

09/28/2012<br />

Administered by: Enterprise Financial Group, Inc. (EFG) P.O. Box 167667 Irving, TX 75016 800-527-1984<br />

GAP-WAIVER-125% PR TX (10/11) ORL LZX 85432 Page 1 of 3

WE will cancel certain amounts YOU owe under this FINANCING<br />

CONTRACT in the event of a CONSTRUCTIVE TOTAL LOSS or<br />

UNRECOVERED THEFT to the PROTECTED VEHICLE subject to<br />

the LIMITS OF LIABILITY on the reverse side and the terms, conditions<br />

and exclusions hereof. You will remain responsible for payment of any<br />

items stated under Exclusions and that remain unpaid in the FINANCING<br />

CONTRACT.<br />

TERMINATION OF ADDENDUM: This addendum will terminate on<br />

the earliest date that any of the following events occur: 1. the date your<br />

FINANCING CONTRACT is scheduled to terminate; 2. in the event<br />

that the FINANCING CONTRACT is terminated prior to its maturity<br />

date; 3. in the event that a PROTECTED VEHICLE is sold, assigned or<br />

transferred by You before the expiration date of the FINANCING<br />

CONTRACT unless the assignee provides prior written consent; 4.<br />

expiration of any redemption period following the repossession or<br />

surrender of the PROTECTED VEHICLE; or 5. the date the<br />

FINANCING CONTRACT is prepaid or the FINANCING<br />

CONTRACT is refinanced.<br />

YOUR RIGHT TO CANCEL: You may cancel this addendum before<br />

midnight of the 60th day after the inception date shown above and receive a<br />

full refund/credit. In the event of early termination of the addendum after<br />

the 60 th day, provided no loss under this addendum has occurred, any<br />

refund will be calculated on the basis of a Pro Rata refund method unless<br />

other state regulatory methods apply. In the event of acceleration or<br />

demand in full of the FINANCING CONTRACT’s unpaid balance, a<br />

refund calculated as of the date of acceleration or demand in full will be<br />

provided. In the event of the total denial of a debt cancellation request, a<br />

refund calculated as of the date of denial will be provided. We will apply<br />

all refund proceeds to any remaining balance. It is your responsibility to<br />

notify the GAP Administrator shown below, in writing, of your request<br />

to cancel this addendum and request a refund/credit of the GAP<br />

charges. If you do not receive the refund/credit within 60 days of<br />

notice of cancellation/termination, contact the GAP Administrator<br />

shown below.<br />

LIMITS OF LIABILITY<br />

The amount WE will waive under this addendum will be the lesser of:<br />

A. The amount shown as the MAXIMUM LIMIT OF LIABILITY<br />

on Page 1; or<br />

B. If the collateral is protected by a PRIMARY CARRIER; the amount obtained by<br />

subtracting the primary insurance settlement, including any amount that the<br />

primary deductible exceeds the Max. Deductible Buyback reflected on Page 1,<br />

from the UNPAID NET BALANCE. If a portion of the PROTECTED VEHICLE is not<br />

covered by a PRIMARY CARRIER, the ACTUAL CASH VALUE AT LOSS of that<br />

portion and the amount of any unrepaired prior damage or the value of any<br />

retained salvage shall be added to the primary insurance settlement. The total will<br />

then be subtracted from the UNPAID NET BALANCE; or<br />

C. If the PROTECTED VEHICLE is not protected by a PRIMARY CARRIER;<br />

the amount obtained by subtracting the ACTUAL CASH VALUE AT LOSS of<br />

the PROTECTED VEHICLE, reduced by the amount of any prior damage or<br />

retained salvage, from the UNPAID NET BALANCE.<br />

DEFINITIONS<br />

A. FINANCING CONTRACT: The contract which represents the financing<br />

agreement between YOU and US for the purchase of the PROTECTED<br />

VEHICLE, and which sets forth the terms, conditions, inception date and<br />

expiration date of the financing agreement.<br />

B. PROTECTED VEHICLE: The vehicle shown on Page 1. The vehicle shown<br />

on Page 1 must be a private passenger automobile, SUV, light truck of no more<br />

than 12,500 Gross Vehicle Weight Rating (GVWR) or Recreational Vehicle (RV),<br />

which is a motor home. If the vehicle does not meet this definition, a full refund of<br />

the charge for this addendum will be provided.<br />

C. COMMERCIAL PURPOSES: Vehicles used for carrying goods or<br />

passengers for livery or delivery purposes for compensation. COMMERCIAL<br />

PURPOSES shall also include vehicles used for any of the following purposes at<br />

the time of the accident or UNRECOVERED THEFT: security services, police<br />

vehicles and emergency vehicles. Share-the-expense car pools are not considered a<br />

COMMERCIAL PURPOSE under this addendum.<br />

D. VEHICLE VALUE AT PURCHASE: The lesser of (1) the manufacturer’s<br />

suggested retail price, (2) the selling price of the vehicle or (3) the vehicle’s retail<br />

value from the current, at date of purchase or, National Automobile Dealer’s<br />

Association (NADA) guide.<br />

E. PRIMARY CARRIER: The insurance company that: 1) is secured by YOU to<br />

provide physical damage coverage, as required in the FINANCING CONTRACT,<br />

or 2) provides liability coverage to any person who has caused YOUR vehicle to<br />

incur a CONSTRUCTIVE TOTAL LOSS and for which that person is legally<br />

liable. Additionally, the PRIMARY CARRIER shall be any other coverage YOU<br />

may have protecting YOUR interest in the PROTECTED VEHICLE, contingent<br />

upon the failure or absence of YOUR coverage.<br />

F. CONSTRUCTIVE TOTAL LOSS: A loss where the cost to repair or replace<br />

the PROTECTED VEHICLE plus its salvage value would exceed the ACTUAL<br />

CASH VALUE AT LOSS.<br />

G. UNRECOVERED THEFT: A PROTECTED VEHICLE reported as stolen<br />

to both the police and the PRIMARY CARRIER who have made every effort, yet<br />

have failed to find and return the PROTECTED VEHICLE. A PROTECTED<br />

VEHICLE that is confiscated or improperly taken or secreted by YOU, where both<br />

YOUR and the PROTECTED VEHICLE’S whereabouts are not known shall not<br />

be deemed for the purposes of this addendum as an UNRECOVERED THEFT<br />

loss.<br />

H. ACTUAL CASH VALUE AT LOSS: The retail value of the PROTECTED<br />

VEHICLE or any portion thereof with appropriate adjustments for mileage,<br />

optional equipment or unrepaired prior damage. The retail value will be determined<br />

from the current, at DATE OF LOSS, National Automobile Dealers Association<br />

guide.<br />

I. UNPAID NET BALANCE: The amount owed to US by YOU, in<br />

accordance with the terms and conditions of the FINANCING CONTRACT,<br />

resulting from early termination of the FINANCING CONTRACT. This<br />

amount may not include any unearned finance charges, late charges; any<br />

DELINQUENT PAYMENTS; any uncollected service charges; refundable<br />

prepaid taxes or fees; or any other proceeds YOU may duly recover by canceling<br />

insurance coverages, service contracts or warranties or other items added to the<br />

initial FINANCING CONTRACT balance after the inception of the<br />

FINANCING CONTRACT. If two or more pieces of collateral are secured under<br />

a FINANCING CONTRACT, WE will not waive more than the proportionate<br />

share of the total UNPAID NET BALANCE that the balance applicable to the<br />

PROTECTED VEHICLE represents to the total FINANCING CONTRACT<br />

balance.<br />

J. DELINQUENT PAYMENT(S): Any payment, as described in the<br />

FINANCING CONTRACT, which remains unpaid for a period of more than ten<br />

(10) days after the date stated in the FINANCING CONTRACT.<br />

DELINQUENT PAYMENTS will also include any late charges or finance charges<br />

that have accrued due to past due FINANCING CONTRACT payments.<br />

K. DATE OF LOSS: The date on which the actual physical damage or<br />

UNRECOVERED THEFT occurs. If such date is indeterminable, the DATE OF<br />

LOSS shall be the date the PRIMARY CARRIER makes settlement and payment<br />

to You.<br />

L. UNIFORM MONTHLY REPAYMENT TERMS: A repayment schedule<br />

required in the FINANCING CONTRACT such that all of the payments are<br />

consecutive, substantially equal, and monthly. The first payment due date must be<br />

due within one month and 15 days from the effective date of the FINANCING<br />

CONTRACT.<br />

EXCLUSIONS<br />

This addendum does not cover loss or damage:<br />

A. Occurring prior to the effective date of this addendum.<br />

B. In connection with a FINANCING CONTRACT effected prior to the<br />

effective date of this addendum.<br />

C. Resulting directly or indirectly from any dishonest, fraudulent, criminal, or<br />

illegal act or arising from an intentional act committed by YOU.<br />

D. Due to or resulting from mechanical or electrical breakdown or failure.<br />

E. Resulting from the vehicle being operated, used, or maintained in any race,<br />

speed contest or other contest.<br />

F. If the vehicle was ever titled as a salvage or rebuilt vehicle. If loss is excluded<br />

under this exclusion, full refund of the charge for this addendum will be provided.<br />

G. If the FINANCING CONTRACT term exceeds the Maximum FINANCING<br />

CONTRACT Term reflected on the reverse side. If loss is excluded under this<br />

exclusion, full refund of the charge for this addendum will be provided.<br />

H. For vehicles used for COMMERCIAL PURPOSES.<br />

I. For any amounts deducted from the PRIMARY CARRIER’s settlement due to<br />

wear and tear, prior damage, unpaid insurance premiums, salvage, towing and<br />

storage and other condition adjustments.<br />

J. Attributable to other than the standard or optional equipment available<br />

from the manufacturer of the PROTECTED VEHICLE, including but not<br />

limited to: special carpeting, furniture, bars, audio, video or data equipment,<br />

cooking and sleeping facilities, customized paint, or any equipment installed<br />

to overcome a physical handicap. Factory approved conversion packages and<br />

dealer installed options usually included in used car value guidebooks are not<br />

excluded.<br />

K. If YOU intentionally concealed or misrepresented any material fact; engaged in<br />

fraudulent conduct; or made a materially false statement in submitting a potential<br />

loss.<br />

L. Due to UNRECOVERED THEFT, if no police report has been filed.<br />

Administered by: Enterprise Financial Group, Inc. (EFG) P.O. Box 167667 Irving, TX 75016 800-527-1984<br />

GAP-WAIVER-125% PR TX (10/11) ORL LZX 85432 Page 2 of 3

M. If the loss is not reported within ninety (90) days of settlement with the<br />

PRIMARY CARRIER or, should there be no PRIMARY CARRIER, within<br />

ninety (90) days of the DATE OF LOSS.<br />

N. Occurring after the expiration of any redemption period following the<br />

repossession or surrender of the PROTECTED VEHICLE.<br />

O. Occurring to a PROTECTED VEHICLE that is a Recreational Vehicle (RV)<br />

if physical damage insurance from a PRIMARY CARRIER is not effective on the<br />

DATE OF LOSS.<br />

P. If the FINANCING CONTRACT does not schedule uniform monthly<br />

payments throughout its term. If loss is excluded under this exclusion, full refund<br />

of the charge for this addendum will be provided.<br />

CONDITIONS<br />

A. ADDENDUM PERIOD, TERRITORY: This addendum shall be effective for<br />

the term reflected on Page 1, and will only cover losses that occur during the<br />

original FINANCING CONTRACT term of a PROTECTED VEHICLE in the<br />

United States, its territories and possessions or Canada.<br />

B. MITIGATION OF LOSS: YOU should do all things reasonable and practical<br />

to avoid or reduce any loss under this addendum and to protect the PROTECTED<br />

VEHICLE from any further loss. YOU should also take reasonable measures to<br />

ensure that the maximum amount of actual cash value of a PROTECTED<br />

VEHICLE is paid by the PRIMARY CARRIER. Any loss due to YOUR<br />

failure to protect the vehicle or maximize settlement from the PRIMARY<br />

CARRIER shall not be recoverable under this addendum.<br />

C. DECLARATIONS: By accepting this addendum, You acknowledge the<br />

agreements and representations in the addendum and agree that this addendum is<br />

issued based upon the truth of such representations.<br />

D. ASSIGNMENT: This GAP addendum will follow the FINANCING<br />

CONTRACT with no subrogation rights against the Buyer, if the FINANCING<br />

CONTRACT is sold or assigned by the DEALER/SELLER. This addendum shall<br />

not be assigned, ceded or transferred by YOU unless the assignee provides prior<br />

written consent.<br />

COMPLAINTS: YOU may file a complaint with the Texas Office of<br />

Consumer Credit Commissioner located at 2601 N. Lamar Blvd.,<br />

Austin, TX 78705. Their phone number is 800-538-1579 and their<br />

website is http://www.occc.state.tx.us<br />

LOSS DOCUMENT REQUIREMENTS: YOU shall report any potential loss to the administrator shown on the front of this addendum within ninety<br />

(90) days of settlement with the PRIMARY CARRIER or, should there be no PRIMARY CARRIER, within ninety (90) days of the DATE OF<br />

LOSS. For each loss YOU must provide the following: 1) a copy of the primary insurance settlement worksheet and check; 2) verification of any other<br />

insurance or other recoverables (including sale of salvage) and any other refundable amounts; 3) a copy of this GAP addendum; 4) verification of the<br />

primary insurance deductible and the date of loss; 5) a copy of the police report, in the case of an UNRECOVERED THEFT; 6) a copy of the<br />

FINANCING CONTRACT, payment history and calculation of UNPAID NET BALANCE amount.. No amount shall be waived by US if the loss is<br />

not reported or if the documentation is not provided within the stated time period. With reasonable advance notice, WE may request to inspect the<br />

PROTECTED VEHICLE. YOU will not be required to provide additional documentation not listed in this addendum to substantiate the<br />

CONSTRUCTIVE TOTAL LOSS or UNRECOVERED THEFT to determine the amount of debt to be waived All amounts waived shall be applied<br />

to the FINANCING CONTRACT balance within thirty (30) days after satisfactory presentation and acceptance of all information listed above. Loss<br />

processing will not be made until YOU have recovered all amounts from any insurance or other indemnity which is valid and collectible and from any<br />

other recoverable or refundable source.<br />

Administered by: Enterprise Financial Group, Inc. (EFG) P.O. Box 167667 Irving, TX 75016 800-527-1984<br />

GAP-WAIVER-125% PR TX (10/11) ORL LZX 85432 Page 3 of 3