eti facts behind the figures - The Nigerian Stock Exchange

eti facts behind the figures - The Nigerian Stock Exchange

eti facts behind the figures - The Nigerian Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

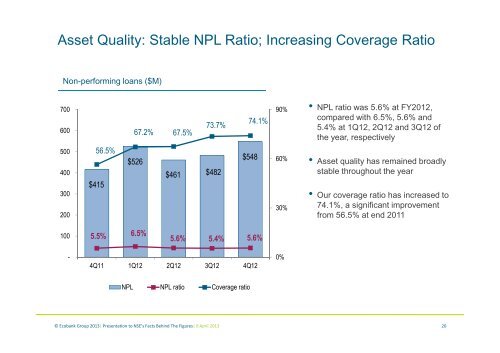

Asset Quality: Stable NPL Ratio; Increasing Coverage Ratio<br />

Non-performing loans ($M)<br />

700<br />

600<br />

67.2% 67.5%<br />

73.7%<br />

74.1%<br />

90%<br />

• NPL ratio was 5.6% at FY2012,<br />

compared with 6.5%, 5.6% and<br />

5.4% at 1Q12, 2Q12 and 3Q12 of<br />

<strong>the</strong> year, respectively<br />

500<br />

400<br />

300<br />

200<br />

56.5%<br />

$415<br />

$526<br />

$461 $482<br />

$548<br />

60%<br />

30%<br />

• Asset quality has remained broadly<br />

stable throughout <strong>the</strong> year<br />

• Our coverage ratio has increased to<br />

74.1%, a significant improvement<br />

from 56.5% at end 2011<br />

100<br />

5.5% 6.5%<br />

5.6% 5.4% 5.6%<br />

-<br />

4Q11 1Q12 2Q12 3Q12 4Q12<br />

0%<br />

NPL NPL ratio Coverage ratio<br />

© Ecobank Group 2013| Presentation to NSE’s Facts Behind <strong>The</strong> Figures| 8 April 2013<br />

20