Nov 2009 - Travel Business Analyst

Nov 2009 - Travel Business Analyst

Nov 2009 - Travel Business Analyst

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

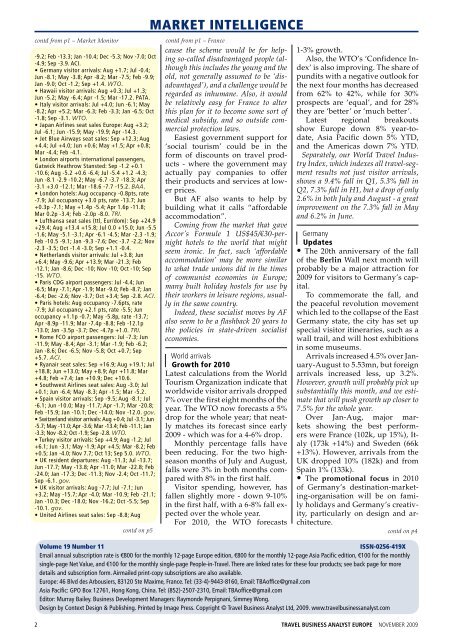

contd from p1 – Market Monitor<br />

-9.2; Feb -13.3; Jan -10.4; Dec -5.3; <strong>Nov</strong> -7.0; Oct<br />

-4.9; Sep -3.9. ACI.<br />

• Germany visitor arrivals: Aug +1.7; Jul -0.4;<br />

Jun -8.1; May -3.8; Apr -8.2; Mar -7.5; Feb -9.9;<br />

Jan -9.0; Oct -1.2; Sep +1.4. WTO.<br />

• Hawaii visitor arrivals: Aug +0.3; Jul +1.3;<br />

Jun -5.2; May -6.4; Apr -1.5; Mar -17.2. PATA.<br />

• Italy visitor arrivals: Jul +4.0; Jun -6.1; May<br />

-8.2; Apr +5.2; Mar -6.3; Feb -3.3; Jan -6.5; Oct<br />

-1.8; Sep -3.1. WTO.<br />

• Japan Airlines seat sales Europe: Aug +3.2;<br />

Jul -6.1; Jun -15.9; May -19.9; Apr -14.3.<br />

• Jet Blue Airways seat sales: Sep +12.3; Aug<br />

+4.4; Jul +4.0; Jun +0.6; May +1.5; Apr +0.8;<br />

Mar -4.4; Feb -4.1.<br />

• London airports international passengers,<br />

Gatwick Heathrow Stansted: Sep -1.2 +0.1<br />

-10.6; Aug -5.2 +0.6 -6.4; Jul -5.4 +1.2 -4.3;<br />

Jun -8.1 -2.9 -10.2; May -6.7 -3.7 -18.3; Apr<br />

-3.1 +3.0 -12.1; Mar -18.6 -7.7 -15.2. BAA.<br />

• London hotels: Aug occupancy -0.8pts, rate<br />

-7.9; Jul occupancy +3.0 pts, rate -13.7; Jun<br />

+0.3p -7.1; May +1.4p -5.4; Apr 1.6p -11.8;<br />

Mar 0.2p -3.4; Feb -2.0p -8.0. TRI.<br />

• Lufthansa seat sales (ttl, Eur/dom): Sep +24.9<br />

+29.4; Aug +13.4 +15.8; Jul 0.0 +15.0; Jun -5.5<br />

-1.6; May -5.1 -3.1; Apr -6.1 -4.5; Mar -2.3 -1.9;<br />

Feb -10.5 -9.1; Jan -9.3 -7.6; Dec -3.7 -2.2; <strong>Nov</strong><br />

-2.3 -3.5; Oct -1.4 -3.0; Sep +1.1 -0.4.<br />

• Netherlands visitor arrivals: Jul +3.8; Jun<br />

+6.4; May -9.6; Apr +13.9; Mar -21.3; Feb<br />

-12.1; Jan -8.6; Dec -10; <strong>Nov</strong> -10; Oct -10; Sep<br />

-15. WTO.<br />

• Paris CDG airport passengers: Jul -4.4; Jun<br />

-6.5; May -7.1; Apr -1.9; Mar -9.0; Feb -8.7; Jan<br />

-6.4; Dec -2.6; <strong>Nov</strong> -3.7; Oct +3.4; Sep -2.8. ACI.<br />

• Paris hotels: Aug occupancy -7.6pts, rate<br />

-7.9; Jul occupancy +2.1 pts, rate -5.5; Jun<br />

occupancy +1.1p -0.7; May -5.8p, rate -13.7;<br />

Apr -8.9p -11.9; Mar -7.4p -8.8; Feb -12.1p<br />

-13.0; Jan -3.5p -3.7; Dec -4.7p +1.0. TRI.<br />

• Rome FCO airport passengers: Jul -7.3; Jun<br />

-11.9; May -8.4; Apr -3.1; Mar -1.9; Feb -6.2;<br />

Jan -8.6; Dec -6.5; <strong>Nov</strong> -5.8; Oct +0.7; Sep<br />

+5.7. ACI.<br />

• Ryanair seat sales: Sep +16.9; Aug +19.1; Jul<br />

+18.8; Jun +13.0; May +8.9; Apr +11.8; Mar<br />

+4.8; Feb +7.4; Jan +10.9; Dec +10.6.<br />

• Southwest Airlines seat sales: Aug -3.0; Jul<br />

+0.1; Jun -6.4; May -8.3; Apr -1.5; Mar -5.2.<br />

• Spain visitor arrivals: Sep -9.5; Aug -8.1; Jul<br />

-6.1; Jun -10.0; May -11.7; Apr -1.7; Mar -20.8;<br />

Feb -15.9; Jan -10.1; Dec -14.0; <strong>Nov</strong> -12.0. gov.<br />

• Switzerland visitor arrivals: Aug +0.4; Jul -3.1; Jun<br />

-5.7; May -11.0; Apr -3.6; Mar -13.4; Feb -11.1; Jan<br />

-3.3; <strong>Nov</strong> -8.2; Oct -1.9; Sep -2.8. WTO.<br />

• Turkey visitor arrivals: Sep +4.9; Aug -1.2; Jul<br />

+6.1; Jun -3.1; May -1.9; Apr +4.5; Mar -8.2; Feb<br />

+0.5; Jan -4.0; <strong>Nov</strong> 7.7; Oct 13; Sep 5.0. WTO.<br />

• UK resident departures: Aug -11.3; Jul -13.7;<br />

Jun -17.7; May -13.8; Apr -11.0; Mar -22.8; Feb<br />

-24.0; Jan -17.3; Dec -11.3; <strong>Nov</strong> -2.4; Oct -11.7;<br />

Sep -6.1. gov.<br />

• UK visitor arrivals: Aug -7.7; Jul -7.1; Jun<br />

+3.2; May -15.7; Apr -4.0; Mar -10.9; Feb -21.1;<br />

Jan -10.3; Dec -18.0; <strong>Nov</strong> -16.2; Oct -5.5; Sep<br />

-10.1. gov.<br />

• United Airlines seat sales: Sep -8.8; Aug<br />

contd on p5<br />

MARKET INTELLIGENCE<br />

contd from p1 – France<br />

cause the scheme would be for helping<br />

so-called disadvantaged people (although<br />

this includes the young and the<br />

old, not generally assumed to be ‘disadvantaged’),<br />

and a challenge would be<br />

regarded as inhumane. Also, it would<br />

be relatively easy for France to alter<br />

this plan for it to become some sort of<br />

medical subsidy, and so outside commercial<br />

protection laws.<br />

Easiest government support for<br />

‘social tourism’ could be in the<br />

form of discounts on travel products<br />

- where the government may<br />

actually pay companies to offer<br />

their products and services at lower<br />

prices.<br />

But AF also wants to help by<br />

building what it calls “affordable<br />

accommodation”.<br />

Coming from the market that gave<br />

Accor’s Formule 1 US$45/€30-pernight<br />

hotels to the world that might<br />

seem ironic. In fact, such ‘affordable<br />

accommodation’ may be more similar<br />

to what trade unions did in the times<br />

of communist economies in Europe;<br />

many built holiday hostels for use by<br />

their workers in leisure regions, usually<br />

in the same country.<br />

Indeed, these socialist moves by AF<br />

also seem to be a flashback 20 years to<br />

the policies in state-driven socialist<br />

economies.<br />

World arrivals<br />

Growth for 2010<br />

Latest calculations from the World<br />

Tourism Organization indicate that<br />

worldwide visitor arrivals dropped<br />

7% over the first eight months of the<br />

year. The WTO now forecasts a 5%<br />

drop for the whole year; that neatly<br />

matches its forecast since early<br />

<strong>2009</strong> - which was for a 4-6% drop.<br />

Monthly percentage falls have<br />

been reducing. For the two highseason<br />

months of July and August,<br />

falls were 3% in both months compared<br />

with 8% in the first half.<br />

Visitor spending, however, has<br />

fallen slightly more - down 9-10%<br />

in the first half, with a 6-8% fall expected<br />

over the whole year.<br />

For 2010, the WTO forecasts<br />

1-3% growth.<br />

Also, the WTO’s ‘Confidence Index’<br />

is also improving. The share of<br />

pundits with a negative outlook for<br />

the next four months has decreased<br />

from 62% to 42%, while for 30%<br />

prospects are ‘equal’, and for 28%<br />

they are ‘better’ or ‘much better’.<br />

Latest regional breakouts<br />

show Europe down 8% year-todate,<br />

Asia Pacific down 5% YTD,<br />

and the Americas down 7% YTD.<br />

Separately, our World <strong>Travel</strong> Industry<br />

Index, which indexes all travel-segment<br />

results not just visitor arrivals,<br />

shows a 9.4% fall in Q1, 5.3% fall in<br />

Q2, 7.3% fall in H1, but a drop of only<br />

2.6% in both July and August - a great<br />

improvement on the 7.3% fall in May<br />

and 6.2% in June.<br />

Germany<br />

Updates<br />

• The 20th anniversary of the fall<br />

of the Berlin Wall next month will<br />

probably be a major attraction for<br />

<strong>2009</strong> for visitors to Germany’s capital.<br />

To commemorate the fall, and<br />

the peaceful revolution movement<br />

which led to the collapse of the East<br />

Germany state, the city has set up<br />

special visitor itineraries, such as a<br />

wall trail, and will host exhibitions<br />

in some museums.<br />

Arrivals increased 4.5% over January-August<br />

to 5.53mn, but foreign<br />

arrivals increased less, up 3.2%.<br />

However, growth will probably pick up<br />

substantially this month, and we estimate<br />

that will push growth up closer to<br />

7.5% for the whole year.<br />

Over Jan-Aug, major markets<br />

showing the best performers<br />

were France (102k, up 15%), Italy<br />

(173k +14%) and Sweden (66k<br />

+13%). However, arrivals from the<br />

UK dropped 10% (182k) and from<br />

Spain 1% (133k).<br />

• The promotional focus in 2010<br />

of Germany’s destination-marketing-organisation<br />

will be on family<br />

holidays and Germany’s creativity,<br />

particularly on design and architecture.<br />

contd on p4<br />

Volume 19 Number 11<br />

ISSN-0256-419X<br />

Email annual subscription rate is €800 for the monthly 12-page Europe edition, €800 for the monthly 12-page Asia Pacific edition, €100 for the monthly<br />

single-page Net Value, and €100 for the monthly single-page People-in-<strong>Travel</strong>. There are linked rates for these four products; see back page for more<br />

details and subscription form. Airmailed print-copy subscriptions are also available.<br />

Europe: 46 Blvd des Arbousiers, 83120 Ste Maxime, France. Tel: (33-4)-9443-8160, Email: TBAoffice@gmail.com<br />

Asia Pacific: GPO Box 12761, Hong Kong, China. Tel: (852)-2507-2310, Email: TBAoffice@gmail.com<br />

Editor: Murray Bailey. <strong>Business</strong> Development Managers: Raymonde Perpignani, Simmey Wong.<br />

Design by Context Design & Publishing. Printed by Image Press. Copyright © <strong>Travel</strong> <strong>Business</strong> <strong>Analyst</strong> Ltd, <strong>2009</strong>. www.travelbusinessanalyst.com<br />

2<br />

TRAVEL BUSINESS ANALYST EUROPE NOVEMBER <strong>2009</strong>