2012 Registration Document - Groupe Casino

2012 Registration Document - Groupe Casino

2012 Registration Document - Groupe Casino

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2<br />

Presentation<br />

of the <strong>Casino</strong> Group<br />

Management<br />

report<br />

Consolidated<br />

financial statements<br />

Parent company<br />

financial statements<br />

Corporate<br />

governance<br />

General<br />

Meeting<br />

Additional<br />

information<br />

2.2. Parent company business review<br />

Net result amounted to €281.5 million versus €609.0 million in<br />

2011.<br />

As the parent company of the French tax group, <strong>Casino</strong>,<br />

Guichard-Perrachon recorded a tax benefit of €131.2 million in<br />

<strong>2012</strong>, corresponding to the tax saving arising from netting off the<br />

profit and losses of the companies in the tax group. After taking this<br />

benefit into account, net income for the year was €412.7 million<br />

compared with €731.4 million in 2011.<br />

2.2.3. Non-deductible expenses<br />

In accordance with the disclosures required by Articles 223 quater, quinquies, 39-4 and 39-5 of the French General Tax Code (Code<br />

général des impôts), no non-deductible expenses were incurred during the year.<br />

2.2.4. Dividends<br />

Including retained earnings brought forward from prior years, the<br />

sum available for distribution comes to €3,343,062,614.06. The<br />

Board is recommending a dividend of €3 per share.<br />

Private shareholders resident in France for tax purposes will be<br />

entitled to claim 40% tax relief on their dividends, in accordance<br />

with Article 158-3, paragraph 2, of the French Tax Code (Code<br />

général des impôts), and have the option of paying a flat-rate<br />

withholding tax.<br />

The dividend will be paid as of 29 April 2013. Dividends on any<br />

<strong>Casino</strong> shares held by the Company on that date will be credited<br />

to retained earnings.<br />

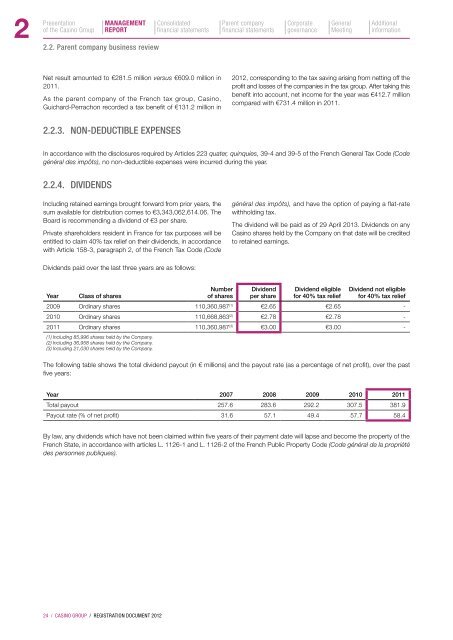

Dividends paid over the last three years are as follows:<br />

Year Class of shares<br />

Number<br />

of shares<br />

Dividend<br />

per share<br />

Dividend eligible<br />

for 40% tax relief<br />

Dividend not eligible<br />

for 40% tax relief<br />

2009 Ordinary shares 110,360,987 (1) €2.65 €2.65 -<br />

2010 Ordinary shares 110,668,863 (2) €2.78 €2.78 -<br />

2011 Ordinary shares 110,360,987 (3) €3.00 €3.00 -<br />

(1) Including 85,996 shares held by the Company.<br />

(2) Including 36,958 shares held by the Company.<br />

(3) Including 21,030 shares held by the Company.<br />

The following table shows the total dividend payout (in € millions) and the payout rate (as a percentage of net profit), over the past<br />

five years:<br />

Year 2007 2008 2009 2010 2011<br />

Total payout 257.6 283.6 292.2 307.5 381.9<br />

Payout rate (% of net profit) 31.6 57.1 49.4 57.7 58.4<br />

By law, any dividends which have not been claimed within five years of their payment date will lapse and become the property of the<br />

French State, in accordance with articles L. 1126-1 and L. 1126-2 of the French Public Property Code (Code général de la propriété<br />

des personnes publiques).<br />

24 / <strong>Casino</strong> Group / registration document <strong>2012</strong>