AIA HealthShield Gold Max Special - brochure Feb ... - AIA Singapore

AIA HealthShield Gold Max Special - brochure Feb ... - AIA Singapore

AIA HealthShield Gold Max Special - brochure Feb ... - AIA Singapore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> <strong>Special</strong><br />

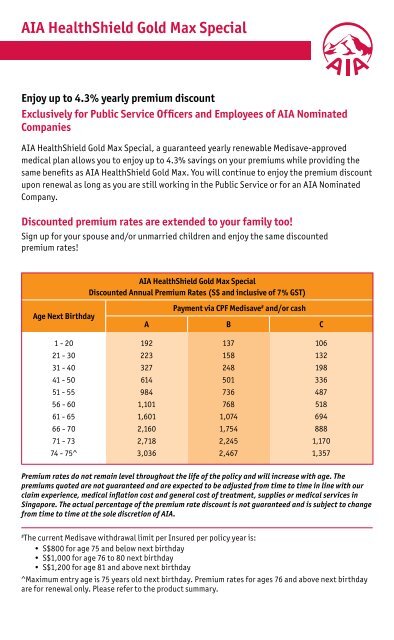

Enjoy up to 4.3% yearly premium discount<br />

Exclusively for Public Service Officers and Employees of <strong>AIA</strong> Nominated<br />

Companies<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> <strong>Special</strong>, a guaranteed yearly renewable Medisave-approved<br />

medical plan allows you to enjoy up to 4.3% savings on your premiums while providing the<br />

same benefits as <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong>. You will continue to enjoy the premium discount<br />

upon renewal as long as you are still working in the Public Service or for an <strong>AIA</strong> Nominated<br />

Company.<br />

Discounted premium rates are extended to your family too!<br />

Sign up for your spouse and/or unmarried children and enjoy the same discounted<br />

premium rates!<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> <strong>Special</strong><br />

Discounted Annual Premium Rates (S$ and inclusive of 7% GST)<br />

Age Next Birthday<br />

Payment via CPF Medisave # and/or cash<br />

A B C<br />

1 - 20<br />

21 - 30<br />

31 - 40<br />

41 - 50<br />

51 - 55<br />

56 - 60<br />

61 - 65<br />

66 - 70<br />

71 - 73<br />

74 - 75^<br />

192<br />

223<br />

327<br />

614<br />

984<br />

1,101<br />

1,601<br />

2,160<br />

2,718<br />

3,036<br />

137<br />

158<br />

248<br />

501<br />

736<br />

768<br />

1,074<br />

1,754<br />

2,245<br />

2,467<br />

106<br />

132<br />

198<br />

336<br />

487<br />

518<br />

694<br />

888<br />

1,170<br />

1,357<br />

Premium rates do not remain level throughout the life of the policy and will increase with age. The<br />

premiums quoted are not guaranteed and are expected to be adjusted from time to time in line with our<br />

claim experience, medical inflation cost and general cost of treatment, supplies or medical services in<br />

<strong>Singapore</strong>. The actual percentage of the premium rate discount is not guaranteed and is subject to change<br />

from time to time at the sole discretion of <strong>AIA</strong>.<br />

#<br />

The current Medisave withdrawal limit per Insured per policy year is:<br />

• S$800 for age 75 and below next birthday<br />

• S$1,000 for age 76 to 80 next birthday<br />

• S$1,200 for age 81 and above next birthday<br />

^<strong>Max</strong>imum entry age is 75 years old next birthday. Premium rates for ages 76 and above next birthday<br />

are for renewal only. Please refer to the product summary.

Enhance your <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> <strong>Special</strong> with the following plans:<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential is the perfect complement to your <strong>AIA</strong> <strong>HealthShield</strong><br />

<strong>Gold</strong> <strong>Max</strong> <strong>Special</strong> as it covers the deductible and co-insurance portions of your hospital<br />

bill. You’ll also enjoy valuable additional benefits such as daily hospital incentive, posthospitalisation<br />

home nursing and alternative medicine (for cancer and stroke), emergency<br />

outpatient treatment due to an accident, etc. Premiums for this plan are payable by<br />

cash only. For more information, please refer to the <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong>/<strong>AIA</strong><br />

<strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential <strong>brochure</strong>.<br />

<strong>AIA</strong> Health CashPlus complements your coverage by providing you with a cash income<br />

during hospital stays as compensation for potential loss of earnings, and to help you cope<br />

with one-off expenses that may come your way. Enjoy up to 20% discount on your<br />

<strong>AIA</strong> Health CashPlus premiums if you are also covered by an <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong><br />

series plan. Premiums for this plan are payable by cash only. For more information,<br />

please refer to the <strong>AIA</strong> Health CashPlus <strong>brochure</strong>.<br />

Apply Now!<br />

To find out more about the plans, please contact your <strong>AIA</strong> Financial Services Consultant<br />

today! Alternatively, you may contact our <strong>AIA</strong> Customer Care Hotline at 1800 248 8000 or<br />

email us at sg.corporatecare@aia.com<br />

An <strong>AIA</strong> Nominated Company is a company selected by <strong>AIA</strong>. <strong>AIA</strong> reserves the right to nominate any<br />

company it chooses to be an <strong>AIA</strong> Nominated Company, at its sole discretion. The discounted premium<br />

rates will cease if certain events as set out in the Policy Contract occur, such as leaving the Public<br />

Service or an <strong>AIA</strong> Nominated Company. Thereafter, the standard premium rates apply to you and<br />

your spouse/unmarried children from the next policy anniversary. Please refer to page 9 of the <strong>AIA</strong><br />

<strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong>/<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential <strong>brochure</strong> for the standard premium rates.<br />

Important Notes:<br />

These insurance plans are underwritten by <strong>AIA</strong> <strong>Singapore</strong> Private Limited (Reg. No. 201106386R)<br />

(“<strong>AIA</strong>”). All insurance applications are subject to <strong>AIA</strong>’s underwriting and acceptance. This <strong>brochure</strong><br />

insert is not a contract of insurance. The precise terms and conditions of these plans, including<br />

exclusions whereby the benefits under these plans may not be paid out, are specified in the relevant<br />

policy contracts. You are advised to read the relevant policy contracts. This is only product information<br />

provided by us. You should seek advice from a qualified adviser if in doubt. Buying health insurance<br />

products that are not suitable for you may impact your ability to finance your future healthcare needs.<br />

You are discouraged from switching from an existing accident and/or health insurance policy to a new<br />

one without considering whether the switch is detrimental, as there may be potential disadvantages<br />

with switching. A penalty may be imposed for early policy termination and the new policy may cost<br />

more or have fewer benefits at the same cost.<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> <strong>Special</strong> is issued under a joint insurance arrangement with the Central<br />

Provident Fund (CPF) Board to enhance the coverage provided by MediShield. Please note that you can<br />

use your CPF Medisave account to purchase only one Medisave-approved medical insurance scheme<br />

per Insured at any one time. The information in this <strong>brochure</strong> insert is correct as at 21 <strong>Feb</strong>ruary 2013.<br />

<strong>AIA</strong> <strong>Singapore</strong> Private Limited (Reg. No. 201106386R)<br />

1 Robinson Road, <strong>AIA</strong> Tower, <strong>Singapore</strong> 048542 Monday - Friday 8.45am - 5.30pm<br />

<strong>AIA</strong> Customer Care Hotline: 1800 248 8000 aia.com.sg<br />

SGPD2013001-221-21022013

<strong>AIA</strong> HEALTHSHIELD GOLD MAX<br />

<strong>AIA</strong> HEALTHSHIELD GOLD MAX ESSENTIAL<br />

PROTECTION<br />

Is your Shield plan<br />

keeping up with<br />

the times?<br />

Introducing <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong>, a Medisave-approved<br />

medical plan that helps you cope with rising healthcare costs.<br />

aia.com.sg

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> and <strong>Max</strong> Essential 3<br />

72 %<br />

of <strong>Singapore</strong>ans agree<br />

that they cannot afford<br />

to get sick these days<br />

due to the high<br />

medical costs*<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> and <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential<br />

represent the basic components of comprehensive health insurance<br />

planning.<br />

Medical or<br />

hospital<br />

expense plans<br />

“I’m concerned about<br />

paying for medical<br />

expenses if I am<br />

hospitalised.”<br />

Hospital income,<br />

or hospital<br />

cash plans<br />

“I’m concerned<br />

about loss of income<br />

or expenses not covered by<br />

my basic medical plan.”<br />

Personal<br />

accident plans<br />

“I’m concerned<br />

about medical bills<br />

and loss of income<br />

if I am injured<br />

in an accident.”<br />

Critical<br />

illness plans<br />

“I’m concerned about<br />

the costs associated<br />

with a major illness,<br />

like Cancer.”<br />

*Source: <strong>Singapore</strong>’s Emigration Conundrum, The Business Times, 6-7 October 2012

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> and <strong>Max</strong> Essential 4<br />

As the common saying goes: your health is your wealth.<br />

It couldn’t be more true<br />

Unexpected medical expenses could represent a significant threat to your finances. If you have<br />

no protection, or only partial protection, the impact on your savings might be substantial. Wise<br />

financial planning involves both saving for the things you want and protecting yourself against the<br />

unexpected. Isn’t it time to consider a plan that helps with both?<br />

<strong>AIA</strong> <strong>HealthShield</strong><br />

<strong>Gold</strong> <strong>Max</strong><br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong><br />

<strong>Max</strong> is a medical expense<br />

reimbursement plan<br />

that offers protection<br />

against medical bills. It<br />

reimburses your medical<br />

bills up to the amount<br />

charged and offers<br />

unlimited lifetime claims 1 .<br />

You pay:<br />

You pay:<br />

Your medical bill<br />

Co-insurance<br />

Deductible<br />

<strong>AIA</strong> <strong>HealthShield</strong><br />

<strong>Gold</strong> <strong>Max</strong> +<br />

<strong>AIA</strong> <strong>HealthShield</strong><br />

<strong>Gold</strong> <strong>Max</strong> Essential<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong><br />

<strong>Max</strong> Essential is an<br />

optional add-on that<br />

fills the gaps of your<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong><br />

<strong>Max</strong> plan by reimbursing<br />

the deductible and<br />

co-insurance portions<br />

of your hospital bill.<br />

This means you enjoy<br />

coverage from the first<br />

dollar.<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> and <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong><br />

<strong>Max</strong> Essential offer affordable lifetime protection against<br />

unexpected medical bills.<br />

About <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong><br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> is a Medisave-approved medical expense<br />

reimbursement plan designed to meet most of the medical expenses you<br />

are likely to incur in public or private hospitals in <strong>Singapore</strong>, to lessen<br />

your financial burden.<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> offers you a choice of 3 plan types to<br />

match your individual needs, allows unlimited lifetime claims 1<br />

and most of the benefits under <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> A and B<br />

are offered on an ‘as charged’ 2 basis. If you prefer treatment in a lower<br />

ward of class in a public hospital, <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> C will cover most of your hospital<br />

bill up to the stipulated benefit limits 2 , therefore offering you affordable medical coverage.<br />

Enjoy more extensive coverage with these benefits:<br />

• Covers inpatient stay in Community Hospital<br />

• Congenital abnormalities benefit for insured (no waiting period) and female insured’s<br />

biological child 3<br />

• Living donor organ transplant benefits for insured and non-insured donor<br />

• Post-hospitalisation psychiatric treatment<br />

• Additional claim limits and extended post-hospitalisation treatment for 30 critical illnesses<br />

• Waive one year’s premium upon total and permanent disability<br />

Please refer to the Benefit Table for details.<br />

Guaranteed<br />

lifetime renewal<br />

and unlimited<br />

lifetime claims 1<br />

USE<br />

your<br />

CPF<br />

Affordable premium payments using your CPF<br />

You can simply use your CPF Medisave funds 4 to pay for<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> premiums for you and your family members.

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> and <strong>Max</strong> Essential 6<br />

Benefits of <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong><br />

Limits of Compensation (S$ and inclusive of GST)<br />

Plan Type A B C<br />

Hospital Ward Entitlement<br />

1. Hospitalisation and Surgical Benefits<br />

Daily Room and Board Benefit<br />

Daily ICU Benefit<br />

Community Hospital Benefit (per day)<br />

Surgical Benefit<br />

(include Organ Transplant Benefit and<br />

Stem Cell Transplant Benefit)<br />

• Surgical Procedures 5<br />

• Surgical Implants and Approved<br />

Medical Consumables<br />

• Stereotactic Radiosurgery<br />

2. Pre-Hospitalisation Benefit<br />

(within 100 days before confinement)<br />

3. Post-Hospitalisation Benefit<br />

Post-Hospitalisation Treatment<br />

(within 100 days after confinement)<br />

Extended Post-Hospitalisation<br />

Treatment for 30 Critical Illnesses<br />

(within 100 days following the expiry<br />

of Post-Hospitalisation Treatment)<br />

4. Accidental Inpatient Dental<br />

Treatment Benefit<br />

Standard Room in<br />

Private Hospital<br />

and below<br />

Standard Room in<br />

Government/<br />

Restructured Hospital<br />

As Charged<br />

As Charged<br />

As Charged<br />

Standard Room in<br />

Private Hospital<br />

and below<br />

Subject to the respective Limits of Compensation<br />

applicable to benefits under points (1) to (3)<br />

450 per day<br />

900 per day<br />

450 per day<br />

As Charged in<br />

Government/<br />

Restructured Hospital 6<br />

7,000 per treatment<br />

9,600 per procedure<br />

500 per confinement<br />

1,000 per confinement<br />

5. Pregnancy Complications Benefit 7 As Charged NIL<br />

6. Congenital Abnormalities Benefits<br />

For female insured’s biological child<br />

from birth 8<br />

For insured<br />

7. Living Donor Organ Transplant<br />

Benefits<br />

Insured donating an organ<br />

Non-insured donating an organ to the<br />

insured<br />

8. Emergency Overseas Medical<br />

Treatment Benefit<br />

20,000 per lifetime<br />

Limit to 5,000<br />

per child<br />

60,000<br />

per transplant<br />

16,000 per lifetime<br />

Limit to 4,000<br />

per child<br />

Subject to the respective Limits of Compensation<br />

applicable to benefits under points (1) to (3)<br />

40,000<br />

per transplant<br />

NIL<br />

20,000<br />

per transplant<br />

Subject to the respective Limits of Compensation<br />

applicable to benefits under point (1)<br />

Limits of Compensation (S$ and inclusive of GST)<br />

Plan Type A B C<br />

Hospital Ward Entitlement<br />

9. Psychiatric Treatment Benefits<br />

In-Hospital Psychiatric Treatment<br />

Post-Hospitalisation Psychiatric<br />

Treatment<br />

(within 200 days after confinement)<br />

10. Outpatient Benefits 9<br />

Radiotherapy for cancer<br />

Stereotactic Radiotherapy for cancer<br />

Chemotherapy for cancer<br />

Immunotherapy for cancer<br />

Renal Dialysis<br />

Erythropoietin<br />

Approved Immunosuppressants<br />

prescribed for organ transplant<br />

Standard Room in<br />

Private Hospital<br />

and below<br />

5,000 per policy year<br />

5,000 per policy year<br />

Standard Room in<br />

Government/<br />

Restructured Hospital<br />

As Charged<br />

4,000 per policy year<br />

2,500 per policy year<br />

Standard Room in<br />

Private Hospital<br />

and below<br />

3,500 per policy year<br />

500 per policy year<br />

280 per day<br />

2,000 per treatment<br />

1,240 per month<br />

700 per month<br />

24,000 per policy year<br />

5,000 per policy year<br />

5,000 per policy year<br />

11. Final Expense Benefit 9 5,000 per policy 3,500 per policy 2,500 per policy<br />

12. Waiver of Premium for 1 year Benefit<br />

(upon Total and Permanent<br />

9, 10<br />

Disability)<br />

Waive one year’s premium<br />

13. Extra Cover for 30 Critical Illnesses<br />

Benefit<br />

<strong>Max</strong>imum Claim Limit<br />

<strong>Max</strong>imum Limit per policy year<br />

<strong>Max</strong>imum Limit per lifetime<br />

100,000 per policy year<br />

Unlimited per lifetime<br />

600,000<br />

Unlimited<br />

75,000 per policy year<br />

Unlimited per lifetime<br />

450,000<br />

Unlimited<br />

30,000 per policy year<br />

Unlimited per lifetime<br />

150,000<br />

Unlimited<br />

Pro-ration Factor 6 NIL 70% 50%<br />

Deductible (per policy year)<br />

Below age 82 next birthday 11<br />

C class ward<br />

1,500<br />

B2 class ward<br />

2,000<br />

B1 class ward<br />

2,500<br />

A class ward<br />

3,500<br />

Private Hospital (All ward types, except day<br />

3,500<br />

surgery and short stay ward)<br />

Day surgery/Short stay ward<br />

2,000<br />

Co-insurance 10%<br />

Last Entry Age (next birthday) 75<br />

<strong>Max</strong>imum Coverage Period<br />

Lifetime<br />

1,500<br />

2,000<br />

2,500<br />

2,500<br />

2,500<br />

2,000

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> and <strong>Max</strong> Essential 8<br />

About <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential is an optional add-on that complements your<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> plan to cover any deductible or co-insurance portions of your<br />

hospital bill.<br />

Benefits of <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential<br />

Limits of Compensation (S$ and inclusive of GST)<br />

Plan Type A B C<br />

Additional valuable benefits include:<br />

• Daily hospital incentive<br />

• Immediate family member accommodation<br />

• Post-hospitalisation alternative medicine (for cancer and stroke)<br />

• Post-hospitalisation home nursing<br />

• Emergency outpatient treatment due to an accident<br />

Are you already adequately protected?<br />

While CPF Medisave, CPF MediShield, and employer-provided health benefits offer some level of<br />

protection for most people, these measures do not add up to a comprehensive lifetime solution:<br />

Hospital Ward Entitlement<br />

Deductible and Co-insurance<br />

Daily Hospital Incentive Benefit 12<br />

Standard Room in<br />

Private Hospital<br />

and below<br />

250 per day<br />

(Admission in<br />

Government/<br />

Restructured Hospital<br />

B1/B2/C class ward)<br />

150 per day<br />

(Admission in<br />

Government/<br />

Restructured Hospital<br />

A class ward)<br />

Standard Room in<br />

Government/<br />

Restructured Hospital<br />

Covered<br />

150 per day<br />

(Admission in<br />

Government/<br />

Restructured Hospital<br />

B2/C class ward)<br />

100 per day<br />

(Admission in<br />

Government/<br />

Restructured Hospital<br />

B1 class ward)<br />

Standard Room in<br />

Private Hospital<br />

and below<br />

50 per day<br />

(Admission in<br />

Government/Restructured<br />

Hospital C class ward)<br />

CPF Medisave<br />

A serious accident or illness could wipe out<br />

your entire account balance.<br />

Immediate Family Member<br />

Accommodation Benefit 13<br />

(upon physician’s or specialist’s advice in<br />

writing for period of confinement)<br />

Standard charges<br />

for an additional bed<br />

Standard charges<br />

for an additional bed<br />

Up to 70 per day<br />

Standard charges<br />

for an additional bed<br />

Up to 50 per day<br />

CPF MediShield<br />

May cover a portion of the medical cost.<br />

Coverage ends when you reach 90 years old.<br />

For more information, please visit www.cpf.gov.sg.<br />

Post-Hospitalisation Alternative<br />

Medicine Benefit 13<br />

for cancer and stroke<br />

(within 100 days after confinement)<br />

Post-Hospitalisation Home Nursing<br />

Benefit 13<br />

(within 26 weeks after confinement)<br />

Emergency Outpatient Treatment due to<br />

Accident Benefit<br />

5,000 per policy year 3,000 per policy year 1,000 per policy year<br />

500 per day<br />

5,000 per policy year<br />

300 per day<br />

3,000 per policy year<br />

100 per day<br />

1,000 per policy year<br />

Employee health<br />

benefits<br />

Coverage typically ends when you leave the<br />

company or retire.<br />

2,000 per policy year 1,000 per policy year 500 per policy year

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> and <strong>Max</strong> Essential 10<br />

Annual Premiums (S$ and inclusive of GST)<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong><br />

Age Next Birthday<br />

A B C<br />

1 - 20<br />

21 - 30<br />

31 - 40<br />

41 - 50<br />

51 - 55<br />

56 - 60<br />

61 - 65<br />

66 - 70<br />

71 - 73<br />

74 - 75 14 200<br />

232<br />

341<br />

639<br />

1,025<br />

1,147<br />

1,667<br />

2,250<br />

2,831<br />

3,162<br />

143<br />

165<br />

258<br />

518<br />

763<br />

800<br />

1,119<br />

1,827<br />

2,339<br />

2,570<br />

110<br />

136<br />

207<br />

345<br />

500<br />

533<br />

723<br />

925<br />

1,219<br />

1,414<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential<br />

Age Next Birthday<br />

A B C<br />

Example<br />

Mr Khor, a 32-year-old sales engineer is covered under the <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> A with<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential A plan. After experiencing an unexplained weight loss and<br />

blood in his stool, he visited a specialist for a colonoscopy examination, which revealed a stage 3<br />

colon cancer. He was hospitalised in a Government Hospital A class ward for 30 days and underwent<br />

surgery. After being discharged from the hospital, Mr Khor went for chemotherapy treatments for a<br />

year. His condition has now stabilised.<br />

The following table illustrates the list of benefits and claims payable by <strong>AIA</strong>:<br />

Medical Expenses<br />

Amount Payable (S$)<br />

Pre-Hospitalisation Benefit (specialist consultation and colonoscopy) 549<br />

Hospitalisation and Surgical Benefits<br />

• Daily Room and Board (30 days in Government Hospital A ward)<br />

• Surgery<br />

Outpatient Benefit<br />

• Chemotherapy for cancer<br />

Total medical expenses subject to Deductible and Co-insurance<br />

Less Deductible (not applicable to Outpatient Benefit)<br />

27,243<br />

10,590<br />

31,458<br />

69,840 (X)<br />

3,500 (Y)<br />

1 - 20<br />

330<br />

21 - 30<br />

350<br />

31 - 40<br />

390<br />

41 - 50<br />

430<br />

51 - 55<br />

530<br />

56 - 60<br />

730<br />

61 - 65<br />

1,120<br />

66 - 70<br />

1,730<br />

71 - 73<br />

2,220<br />

74 - 75 14 2,260<br />

215<br />

235<br />

260<br />

370<br />

480<br />

695<br />

1,005<br />

1,660<br />

2,170<br />

2,205<br />

140<br />

160<br />

190<br />

295<br />

435<br />

525<br />

825<br />

1,125<br />

1,345<br />

1,565<br />

Balance less Deductible 66,340<br />

Less 10% Co-insurance (10% x S$66,340)<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> A pays<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential A pays:<br />

• Deductible and Co-insurance<br />

• Daily hospital incentive (S$150 x 30 days)<br />

6,634 (Z)<br />

59,706 (X–Y–Z)<br />

10,134 (Y+Z)<br />

4,500<br />

Mr Khor pays 0<br />

Premium rates do not remain level throughout the life of the policy and will increase with age.<br />

The premiums quoted are not guaranteed and are expected to be adjusted from time to time in line<br />

with our claim experience, medical inflation cost and general cost of treatment, supplies or medical<br />

services in <strong>Singapore</strong>.

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> and <strong>Max</strong> Essential 12<br />

Frequently Asked Questions<br />

It is always our intention to write in plain English, and to be as transparent as possible when<br />

describing our products. The questions and answers below reflect the most common concerns<br />

raised by our customers. If you have any other questions not addressed here, please ask your<br />

<strong>AIA</strong> Financial Services Consultant for more information. Alternatively, you may visit our website<br />

at aia.com.sg or contact our <strong>AIA</strong> Customer Care Hotline at 1800 248 8000.<br />

Q1. Am I eligible to apply for <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> for myself and my family members?<br />

You can apply for <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> for yourself and your family members<br />

(grandparents, parents, spouse or children) if you and your family members are <strong>Singapore</strong>ans or<br />

<strong>Singapore</strong> Permanent Residents aged 75 years or below on your/their next birthday.<br />

Q2. How can I pay premiums for myself and my family members?<br />

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> premiums can be paid from your CPF Medisave account, subject to the<br />

CPF Medisave withdrawal limit 4 . If you have insufficient funds in your CPF Medisave account, or if<br />

your premium exceeds the CPF Medisave withdrawal limit 4 , the balance of the premium payment<br />

must be made by cash. <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential premiums can only be paid by cash.<br />

Q3. Will my premium change when I renew my policy?<br />

Your premium will change as you move into the next age group.<br />

Q4. Are these plans guaranteed renewable?<br />

Yes, they are guaranteed yearly renewable on your policy anniversary date by payment of the<br />

annual premium in advance before the end of the grace period.<br />

Q5. Do I have to take a medical examination?<br />

Subject to underwriting, you may be required to take a medical examination.<br />

Q6. What are deductible and co-insurance?<br />

The deductible is a fixed amount of up to a stipulated amount on a policy year basis that you have<br />

to pay first before the benefits are paid. The co-insurance is a fixed percentage of the medical bill<br />

that you have to pay after deducting the deductible amount.<br />

Q7. What conditions are excluded under these plans?<br />

Exclusions common to many medical expense reimbursement plans apply to <strong>AIA</strong> <strong>HealthShield</strong><br />

<strong>Gold</strong> <strong>Max</strong> and <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential, including:<br />

• Pre-existing conditions, which means any illness or condition that occurred before the date<br />

your policy began or the date your policy was last reinstated, whichever is later (unless a<br />

declaration has been made by the Insured at the time of application or reinstatement of the<br />

policy and we have specifically accepted the application).<br />

• Treatment for infertility, sub-fertility, assisted conception or any contraceptive operation<br />

and sex change operations.<br />

• Treatment arising from injuries sustained during wars (whether war be declared or not), civil<br />

commotion, riots, revolutions, strikes, nuclear reaction or any war-like operations.<br />

There are other conditions whereby the benefits under these plans will not be payable. You are<br />

advised to read the policy contracts for the full list of exclusions.<br />

Q8. Is there a waiting period before I am eligible for certain benefits?<br />

There are waiting periods applicable to some benefits under these plans. Such benefits shall<br />

not be payable if the condition relating to or covered by the benefits is diagnosed during the<br />

waiting period. These waiting periods start from the date your respective plan began, the last<br />

reinstatement date of your respective plan (if any) or effective date of plan upgrade (if any),<br />

whichever is latest.<br />

(i) For pregnancy complications benefit, a waiting period of 10 months applies.<br />

(ii) For congenital abnormalities of insured’s biological child from birth, a waiting period of<br />

10 months applies.<br />

(iii) For insured (as living donor) donating an organ, a waiting period of 24 months applies.<br />

The date the recipient of the organ is first diagnosed with organ failure must be after the<br />

24 months waiting period.<br />

Q9. Can I buy <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential after my <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> plan<br />

is incepted?<br />

Yes you can. However, the waiting periods applicable to benefits under <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong><br />

<strong>Max</strong> Essential will start from the inception date or the last reinstatement date of the rider,<br />

whichever is later. Please refer to the policy contract for more information.<br />

Q10. How will I receive my claim payout?<br />

Most benefits payable under the plans are paid on a reimbursement basis (except for Waiver of<br />

Premium Benefit (upon Total and Permanent Disability) under <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> and<br />

Daily Hospital Incentive Benefit under <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential), which means that<br />

any claim needs to be supported by original hospital or medical bills.<br />

Q11. Can I change my mind and cancel the policy after I’ve purchased?<br />

Yes you can. You may cancel <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> by writing to us within 2 calendar<br />

months from the date you receive your <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> policy document (free-look<br />

period). You may cancel <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential by writing to us within 14 days<br />

from the date you receive your <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> Essential policy document (free-look<br />

period) or within the free-look period of your <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> (whichever is later).

<strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> and <strong>Max</strong> Essential 14<br />

1<br />

Subject to policy year limit and any overall benefit limits.<br />

2<br />

We shall pay the Eligible Expenses incurred, subject to any applicable Pro-ration Factor,<br />

Deductible and/or Co-insurance and any other benefit limits as stated in the Benefit Table and<br />

subject to the terms and conditions of the policy contract.<br />

3<br />

This benefit is not applicable to <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> C plan.<br />

4<br />

The current Medisave withdrawal limit per Insured per policy year is:<br />

• S$800 for age 75 and below next birthday<br />

• S$1,000 for age 76 to 80 next birthday<br />

• S$1,200 for age 81 and above next birthday<br />

5<br />

Surgical Procedures refer to the types of surgical operations listed in the “Table of Surgical<br />

Procedures” under the Medisave Scheme operated by the Ministry of Health excluding all<br />

surgical operations stated in the General Exclusions and any other surgical operations that<br />

are not specified in the “Table of Surgical Procedures”. The costs of any surgical implants,<br />

Approved Medical Consumables and/or Stereotactic Radiosurgery procedure are not included<br />

in this portion of the benefit.<br />

6<br />

For <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> B, all Eligible Expenses incurred are subject to the Pro-ration<br />

Factor, if such expenses are incurred in a private hospital/private medical institution or<br />

any hospital outside of <strong>Singapore</strong>. For <strong>AIA</strong> <strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> C, only Eligible Expenses<br />

incurred for Surgical Procedures under Surgical Benefit is subject to the Pro-ration Factor if<br />

such expenses are incurred in a private hospital/private medical institution or any hospital<br />

outside of <strong>Singapore</strong>.<br />

7<br />

Pregnancy complications covered are Ectopic pregnancy, Pre-eclampsia or eclampsia,<br />

Disseminated Intravascular Coagulation (DIC), Miscarriage (after 21 weeks of pregnancy),<br />

Acute Fatty Liver Pregnancy and Choriocarcinoma and Hydatidiform Mole.<br />

8<br />

Reimburse Eligible Expenses incurred during the first 24 months from date of birth of the child.<br />

9<br />

Eligible Expenses incurred under the Outpatient Benefit are not subject to the Deductible but<br />

are subject to Co-insurance. The Final Expense Benefit and Waiver of Premium for 1 Year Benefit<br />

(upon TPD) are not subject to either the Deductible or Co-insurance. Eligible Expenses incurred<br />

under all other benefits are subject to the Deductible and Co-insurance.<br />

10<br />

The benefit expires on the policy anniversary occurring on or immediately following the<br />

insured’s 70 th birthday. Please refer to the policy contract for the exact definitions of Total<br />

Permanent Disability.<br />

11<br />

For ages 82 and above next birthday, please refer to the product summary.<br />

12<br />

Exclude day surgery, short stay ward in an emergency department of a hospital, hospitalisation<br />

in a community hospital, hospitalisation overseas due to emergency and hospitalisation due to<br />

psychiatric condition.<br />

13<br />

These benefits are not payable if the insured is diagnosed and confined in a hospital due to a<br />

psychiatric condition.<br />

14<br />

<strong>Max</strong>imum entry age is 75 years old next birthday. Premium rates for ages 76 and above next<br />

birthday are for renewal only. Please refer to the product summary.<br />

Important Notes:<br />

These insurance plans are underwritten by <strong>AIA</strong> <strong>Singapore</strong> Private Limited (Reg. No. 201106386R)<br />

(“<strong>AIA</strong>”). All insurance applications are subject to <strong>AIA</strong>’s underwriting and acceptance. This<br />

<strong>brochure</strong> is not a contract of insurance. The precise terms and conditions of these plans,<br />

including exclusions whereby the benefits under these plans may not be paid out, are specified<br />

in the relevant policy contracts. You are advised to read the policy contracts. This is only product<br />

information provided by us. You should seek advice from a qualified adviser if in doubt. Buying<br />

health insurance products that are not suitable for you may impact your ability to finance your<br />

future healthcare needs. You are discouraged from switching from an existing accident and/or<br />

health insurance policy to a new one without considering whether the switch is detrimental, as<br />

there may be potential disadvantages with switching. A penalty may be imposed for early policy<br />

termination and the new policy may cost more or have fewer benefits at the same cost. <strong>AIA</strong><br />

<strong>HealthShield</strong> <strong>Gold</strong> <strong>Max</strong> is issued under a joint insurance arrangement with the Central Provident<br />

Fund (CPF) Board to enhance the coverage provided by MediShield. Please note that you can use<br />

your CPF Medisave account to purchase only one Medisave-approved medical insurance scheme<br />

per Insured at any one time. The information is correct at the time of printing (16 January 2013).<br />

About <strong>AIA</strong> Group<br />

<strong>AIA</strong> Group Limited and its subsidiaries (collectively “<strong>AIA</strong>” or “the Group”) comprise the<br />

largest independent publicly listed pan-Asian life insurance group. It has operations<br />

in 16 markets in Asia Pacific – wholly owned branches and subsidiaries in Hong Kong,<br />

Thailand, <strong>Singapore</strong>, Malaysia, China, Korea, the Philippines, Australia, Indonesia,<br />

Taiwan, Vietnam, New Zealand, Macau, Brunei, a 92 per cent subsidiary in Sri Lanka<br />

and a 26 per cent joint-venture in India.<br />

The business that is now <strong>AIA</strong> was first established in Shanghai over 90 years ago. It is<br />

a market leader in the Asia Pacific region (ex-Japan) based on life insurance premiums<br />

and holds leading positions across the majority of its markets. It had total assets of<br />

US$119,494 million as of 31 May 2012.<br />

<strong>AIA</strong> meets the savings and protection needs of individuals by offering a range of<br />

products and services including retirement savings plans, life insurance and accident<br />

and health insurance. The Group also provides employee benefits, credit life and pension<br />

services to corporate clients. Through an extensive network of agents and employees<br />

across Asia Pacific, <strong>AIA</strong> serves the holders of more than 24 million individual policies and<br />

over 10 million participating members of group insurance schemes.<br />

<strong>AIA</strong> Group Limited is listed on the Main Board of The Stock Exchange of Hong Kong<br />

Limited under the stock code “1299” with American Depositary Receipts (Level 1) traded<br />

on the over-the-counter market (ticker symbol: “AAGIY”).

<strong>AIA</strong> <strong>Singapore</strong> Private Limited<br />

(Reg. No. 201106386R)<br />

1 Robinson Road, <strong>AIA</strong> Tower, <strong>Singapore</strong> 048542<br />

Monday - Friday 8.45am - 5.30pm<br />

<strong>AIA</strong> Customer Care Hotline: 1800 248 8000<br />

aia.com.sg<br />

SGPD2013001-186-16012013