Despite Growth, Firms Worry - Railworks Corporation

Despite Growth, Firms Worry - Railworks Corporation

Despite Growth, Firms Worry - Railworks Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

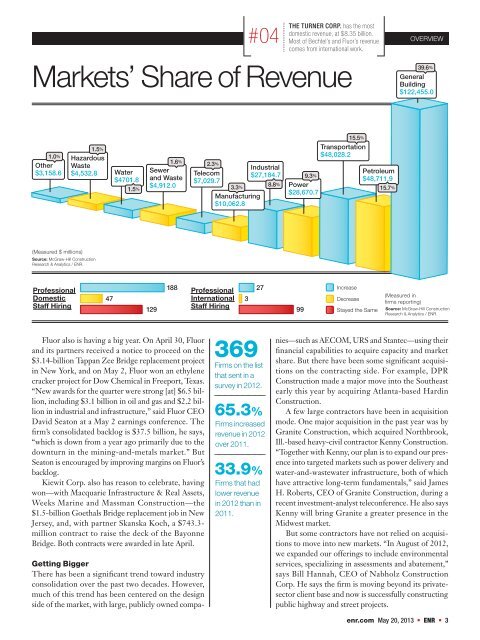

#04<br />

THE TURNER CORP. has the most<br />

domestic revenue, at $8.35 billion.<br />

Most of Bechtel’s and Fluor’s revenue<br />

comes from international work.<br />

Markets’ Share of Revenue<br />

OVERVIEW<br />

39.6%<br />

General<br />

Building<br />

$122,455.0<br />

1.0%<br />

Other<br />

$3,158.6<br />

1.5%<br />

Hazardous<br />

1.6%<br />

Waste<br />

2.3%<br />

$4,532.8 Water Sewer<br />

Telecom<br />

$4701.8 and Waste<br />

$7,029.7<br />

$4,912.0<br />

1.5%<br />

3.3%<br />

Manufacturing<br />

$10,062.8<br />

Industrial<br />

$27,184.7<br />

8.8%<br />

9.3%<br />

Power<br />

$28,670.7<br />

15.5%<br />

Transportation<br />

$48,028.2<br />

Petroleum<br />

$48,711.9<br />

15.7%<br />

(Measured $ millions)<br />

Source: McGraw-Hill Construction<br />

Research & Analytics / ENR.<br />

Professional<br />

Domestic<br />

Staff Hiring<br />

47<br />

129<br />

188<br />

Professional<br />

International<br />

Staff Hiring<br />

3<br />

27<br />

99<br />

Increase<br />

Decrease<br />

Stayed the Same<br />

(Measured in<br />

firms reporting)<br />

Source: McGraw-Hill Construction<br />

Research & Analytics / ENR.<br />

Fluor also is having a big year. On April 30, Fluor<br />

and its partners received a notice to proceed on the<br />

$3.14-billion Tappan Zee Bridge replacement project<br />

in New York, and on May 2, Fluor won an ethylene<br />

cracker project for Dow Chemical in Freeport, Texas.<br />

“New awards for the quarter were strong [at] $6.5 billion,<br />

including $3.1 billion in oil and gas and $2.2 billion<br />

in industrial and infrastructure,” said Fluor CEO<br />

David Seaton at a May 2 earnings conference. The<br />

firm’s consolidated backlog is $37.5 billion, he says,<br />

“which is down from a year ago primarily due to the<br />

downturn in the mining-and-metals market.” But<br />

Seaton is encouraged by improving margins on Fluor’s<br />

backlog.<br />

Kiewit Corp. also has reason to celebrate, having<br />

won—with Macquarie Infrastructure & Real Assets,<br />

Weeks Marine and Massman Construction—the<br />

$1.5-billion Goethals Bridge replacement job in New<br />

Jersey, and, with partner Skanska Koch, a $743.3-<br />

million contract to raise the deck of the Bayonne<br />

Bridge. Both contracts were awarded in late April.<br />

369<br />

<strong>Firms</strong> on the list<br />

that sent in a<br />

survey in 2012.<br />

65.3%<br />

<strong>Firms</strong> increased<br />

revenue in 2012<br />

over 2011.<br />

33.9%<br />

<strong>Firms</strong> that had<br />

lower revenue<br />

in 2012 than in<br />

2011.<br />

Getting Bigger<br />

There has been a significant trend toward industry<br />

consolidation over the past two decades. However,<br />

much of this trend has been centered on the design<br />

side of the market, with large, publicly owned companies—such<br />

as AECOM, URS and Stantec—using their<br />

financial capabilities to acquire capacity and market<br />

share. But there have been some significant acquisitions<br />

on the contracting side. For example, DPR<br />

Construction made a major move into the Southeast<br />

early this year by acquiring Atlanta-based Hardin<br />

Construction.<br />

A few large contractors have been in acquisition<br />

mode. One major acquisition in the past year was by<br />

Granite Construction, which acquired Northbrook,<br />

Ill.-based heavy-civil contractor Kenny Construction.<br />

“Together with Kenny, our plan is to expand our presence<br />

into targeted markets such as power delivery and<br />

water-and-wastewater infrastructure, both of which<br />

have attractive long-term fundamentals,” said James<br />

H. Roberts, CEO of Granite Construction, during a<br />

recent investment-analyst teleconference. He also says<br />

Kenny will bring Granite a greater presence in the<br />

Midwest market.<br />

But some contractors have not relied on acquisitions<br />

to move into new markets. “In August of 2012,<br />

we expanded our offerings to include environmental<br />

services, specializing in assessments and abatement,”<br />

says Bill Hannah, CEO of Nabholz Construction<br />

Corp. He says the firm is moving beyond its privatesector<br />

client base and now is successfully constructing<br />

public highway and street projects.<br />

enr.com May 20, 2013 ENR 3