summarised audited consolidated financial statements - Altron

summarised audited consolidated financial statements - Altron

summarised audited consolidated financial statements - Altron

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Altron</strong> Summarised Audited Consolidated Financial Statements for the year ended 28 February 2013<br />

NOTES continued<br />

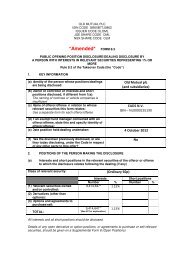

2013 2012<br />

R millions (Audited) (Audited)<br />

2. Reconciliation between attributable earnings and headline earnings<br />

Attributable to <strong>Altron</strong> equity holders (298) 174<br />

Capital items – gross 1 449 900<br />

Tax effect of capital items – (10)<br />

Non-controlling interest in capital items (720) (461)<br />

Headline earnings 431 603<br />

3. Reconciliation between attributable earnings and diluted earnings<br />

Attributable to <strong>Altron</strong> equity holders (298) 174<br />

Dilutive earnings attributable to B-BBEE non-controlling interest in subsidiaries – (4)<br />

Diluted earnings (298) 170<br />

4. Reconciliation between headline earnings and diluted headline earnings<br />

Headline earnings 431 603<br />

Dilutive earnings attributable to B-BBEE non-controlling interest in subsidiaries – (4)<br />

Dilutive earnings attributable to dilutive options at subsidiary level (11) (10)<br />

Non-controlling interest in adjustments 4 4<br />

Diluted headline earnings 424 593<br />

26<br />

Fully diluted earnings and diluted headline earnings have been calculated in accordance with IAS 33: Earnings per Share, on the basis that:<br />

– The recognition of the deferred sale of a 30% interest in Aberdare Cables to the Izingwe Consortium based on the assumption that the<br />

outstanding purchase price will be settled in cash for R46 million, adjusted for the dilutive effect of the option price at the Aberdare level and<br />

after taking into account the 16.5% investment in the Izingwe Consortium by Power Technologies Proprietary Limited.<br />

– The earnings effect of dilutive options at Allied Technologies Limited level.<br />

5. Acquisitions of subsidiaries<br />

Acquisition of 100% interest in Unisys Africa Proprietary Limited (“Unisys Africa”) and Alliance Business Solutions Proprietary Limited (“Alliance’)<br />

During the year the Bytes group acquired two operations, namely Unisys Africa and Alliance, for an aggregate consideration of R150 million, of which<br />

R43 million is deferred.<br />

The acquired businesses contributed revenues of R238 million and net profit after tax of R18 million to the group.<br />

If the acquisitions had occurred on 1 March 2012, group revenue and net profit after tax would have increased by R329 million and R18 million<br />

respectively.<br />

These amounts have been calculated using the group’s accounting policies.<br />

Unisys Africa provides IT services and technology offerings to customers in both the public and private sectors.<br />

The full issued share capital was acquired effective 31 March 2012. Alliance provides Oracle end-to-end offerings and cloud-based solutions to<br />

customers.<br />

The operations of Alliance were acquired effective 1 October 2012.<br />

Recognised Fair value Carrying<br />

values adjustments amount<br />

The acquirees’ balance sheets at the date of acquisition were as follows:<br />

Non-current assets 12 25 37<br />

Current assets 223 – 223<br />

Current liabilities (219) (12) 231<br />

Total net assets on acquisitions 16 13 29<br />

Goodwill on acquisition 121<br />

Total consideration 150<br />

Cash and cash equivalents in subsidiary acquired (35)<br />

Less: Amounts due to vendors (43)<br />

Net cash outflow on acquisitions 72