Download guide (PDF) - Euromoney

Download guide (PDF) - Euromoney

Download guide (PDF) - Euromoney

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8<br />

The 2012 <strong>guide</strong> to<br />

GLOBAL RISK TRENDS<br />

Eurozone bank stability<br />

remains key focus<br />

Far from stabilizing, the risks associated with the eurozone<br />

debt crisis are still rising and infecting other parts of the world,<br />

as banking sector problems deepen and extend their reach<br />

Bank stability has become an<br />

increasingly dominant factor<br />

for counterparties and deposit<br />

holders seeking safety. Each of<br />

ECR’s country experts is asked to quantify<br />

bank stability risk, by awarding a score<br />

ranging from 10, typifying a perfectly<br />

functioning system where all possible<br />

exposures are comfortably covered, to<br />

zero, where a systemic breakdown in the<br />

banking system has occurred.<br />

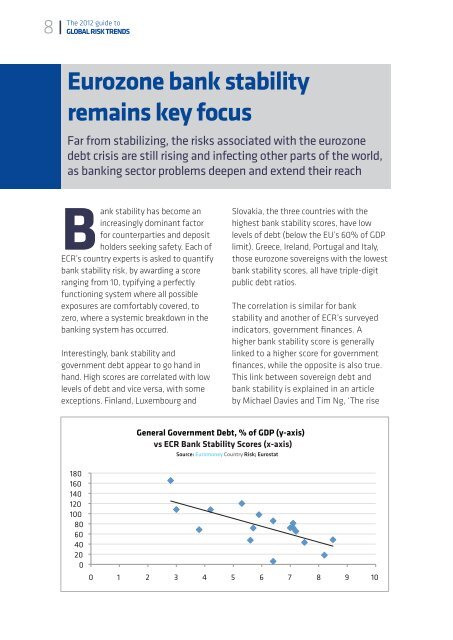

Interestingly, bank stability and<br />

government debt appear to go hand in<br />

hand. High scores are correlated with low<br />

levels of debt and vice versa, with some<br />

exceptions. Finland, Luxembourg and<br />

Slovakia, the three countries with the<br />

highest bank stability scores, have low<br />

levels of debt (below the EU’s 60% of GDP<br />

limit). Greece, Ireland, Portugal and Italy,<br />

those eurozone sovereigns with the lowest<br />

bank stability scores, all have triple-digit<br />

public debt ratios.<br />

The correlation is similar for bank<br />

stability and another of ECR’s surveyed<br />

indicators, government finances. A<br />

higher bank stability score is generally<br />

linked to a higher score for government<br />

finances, while the opposite is also true.<br />

This link between sovereign debt and<br />

bank stability is explained in an article<br />

by Michael Davies and Tim Ng, ‘The rise<br />

Eurostat<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

General Government Debt, % of GDP (y-axis)<br />

vs ECR Bank Stability Scores (x-axis)<br />

Source: <strong>Euromoney</strong> Country Risk; Eurostat<br />

0 1 2 3 4 5 6 7 8 9 10