Annual Report and Accounts 2008 (pdf-file) - Unibet

Annual Report and Accounts 2008 (pdf-file) - Unibet

Annual Report and Accounts 2008 (pdf-file) - Unibet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

44<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

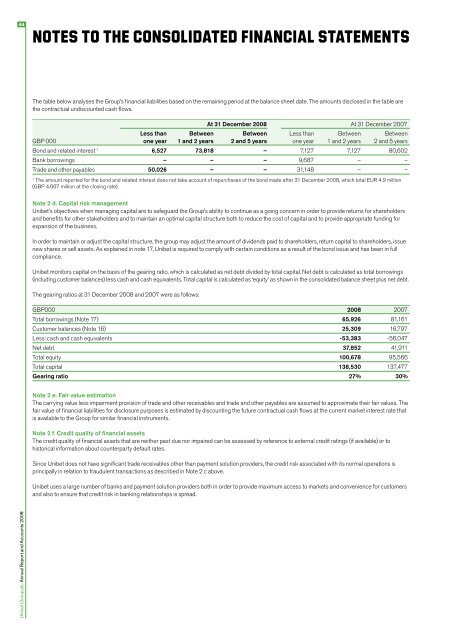

The table below analyses the Group’s financial liabilities based on the remaining period at the balance sheet date. The amounts disclosed in the table are<br />

the contractual undiscounted cash flows.<br />

At 31 December <strong>2008</strong> At 31 December 2007<br />

Less than Between Between Less than Between Between<br />

GBP 000 one year 1 <strong>and</strong> 2 years 2 <strong>and</strong> 5 years one year 1 <strong>and</strong> 2 years 2 <strong>and</strong> 5 years<br />

Bond <strong>and</strong> related interest 1 6,527 73,818 – 7,127 7,127 80,602<br />

Bank borrowings – – – 9,687 – –<br />

Trade <strong>and</strong> other payables 50,026 – – 31,148 – –<br />

1<br />

The amount reported for the bond <strong>and</strong> related interest does not take account of repurchases of the bond made after 31 December <strong>2008</strong>, which total EUR 4.9 million<br />

(GBP 4.667 million at the closing rate).<br />

Note 2 d. Capital risk management<br />

<strong>Unibet</strong>’s objectives when managing capital are to safeguard the Group’s ability to continue as a going concern in order to provide returns for shareholders<br />

<strong>and</strong> benefits for other stakeholders <strong>and</strong> to maintain an optimal capital structure both to reduce the cost of capital <strong>and</strong> to provide appropriate funding for<br />

expansion of the business.<br />

In order to maintain or adjust the capital structure, the group may adjust the amount of dividends paid to shareholders, return capital to shareholders, issue<br />

new shares or sell assets. As explained in note 17, <strong>Unibet</strong> is required to comply with certain conditions as a result of the bond issue <strong>and</strong> has been in full<br />

compliance.<br />

<strong>Unibet</strong> monitors capital on the basis of the gearing ratio, which is calculated as net debt divided by total capital. Net debt is calculated as total borrowings<br />

(including customer balances) less cash <strong>and</strong> cash equivalents. Total capital is calculated as ‘equity’ as shown in the consolidated balance sheet plus net debt.<br />

The gearing ratios at 31 December <strong>2008</strong> <strong>and</strong> 2007 were as follows:<br />

GBP000 <strong>2008</strong> 2007<br />

Total borrowings (Note 17) 65,926 81,161<br />

Customer balances (Note 16) 25,309 16,797<br />

Less: cash <strong>and</strong> cash equivalents -53,383 -56,047<br />

Net debt 37,852 41,911<br />

Total equity 100,678 95,566<br />

Total capital 138,530 137,477<br />

Gearing ratio 27% 30%<br />

Note 2 e. Fair value estimation<br />

The carrying value less impairment provision of trade <strong>and</strong> other receivables <strong>and</strong> trade <strong>and</strong> other payables are assumed to approximate their fair values. The<br />

fair value of financial liabilities for disclosure purposes is estimated by discounting the future contractual cash flows at the current market interest rate that<br />

is available to the Group for similar financial instruments.<br />

Note 2 f. Credit quality of financial assets<br />

The credit quality of financial assets that are neither past due nor impaired can be assessed by reference to external credit ratings (if available) or to<br />

historical information about counterparty default rates.<br />

Since <strong>Unibet</strong> does not have significant trade receivables other than payment solution providers, the credit risk associated with its normal operations is<br />

principally in relation to fraudulent transactions as described in Note 2 c above.<br />

<strong>Unibet</strong> uses a large number of banks <strong>and</strong> payment solution providers both in order to provide maximum access to markets <strong>and</strong> convenience for customers<br />

<strong>and</strong> also to ensure that credit risk in banking relationships is spread.<br />

<strong>Unibet</strong> Group plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2008</strong>