- Page 1 and 2:

Pre-salt reservoir Annual</

- Page 3 and 4:

TABLEOFCONTENTS Page ForwardLooking

- Page 5 and 6:

Item16A. Item16B. Item16C. Item16D.

- Page 7 and 8:

Thecrudeoilandnaturalgasreservedata

- Page 9 and 10:

Presaltreservoir...................

- Page 11 and 12:

ABBREVIATIONS bbl .................

- Page 13 and 14:

Since December 31, 2008, PifCo has

- Page 15 and 16:

INCOMESTATEMENTDATA—PETROBRAS Fo

- Page 17 and 18:

ExchangeRates Subject to certain p

- Page 19 and 20:

drilling operations to be curtailed

- Page 21 and 22:

Natural gas demand is also influenc

- Page 23 and 24:

Our own financialcondition and resu

- Page 25 and 26:

Developments and the perception of

- Page 27 and 28:

were incorporated in a jurisdiction

- Page 29 and 30:

companies established in Brazil and

- Page 31 and 32:

Thefollowingtablessetforthourestima

- Page 33 and 34:

See Item 5. “Operating and Financ

- Page 35 and 36:

Thefollowingmapshowsourconcessionar

- Page 37 and 38:

On December 31, 2008, we held explo

- Page 39 and 40:

The following table describes our p

- Page 41 and 42:

totalrefiningcapacityandwesupplieda

- Page 43 and 44:

Thefollowingtableshowsourmostsignif

- Page 45 and 46:

Thetablebelowshowsouroperatingfleet

- Page 47 and 48:

Our fertilizer plants in Bahia and

- Page 49 and 50:

GasandEnergyKeyStatistics 2008 200

- Page 51 and 52:

Equity Participation in Distributio

- Page 53 and 54:

and we guarantee delivery of the co

- Page 55 and 56:

As part of this national trend, we

- Page 57 and 58:

Renewable Energy and Reduction of G

- Page 59 and 60:

In 2008, our net production outside

- Page 61 and 62:

Tusan block. The discovery is not c

- Page 63 and 64:

inPasadena,Texas.InOctober2008,anar

- Page 65 and 66:

ports'locations, this process may b

- Page 67 and 68:

Property,PlantsandEquipment Petrobr

- Page 69 and 70:

Espadarte, Jubarte, Peroá and Golf

- Page 71 and 72:

We continue to evaluate and develop

- Page 73 and 74:

Our revenuesare principallyderived

- Page 75 and 76:

years: Thetablebelowshowstheamountb

- Page 77 and 78:

ImpairmentofOilandGasProperties For

- Page 79 and 80:

millionfor2008comparedtoU.S.$5,888m

- Page 81 and 82:

Corporate Our Corporate segment inc

- Page 83 and 84:

ResearchandDevelopmentExpenses Rese

- Page 85 and 86:

higher transfer prices to our other

- Page 87 and 88:

management, central administrative

- Page 89 and 90:

Management's Discussion and Analysi

- Page 91 and 92:

SalesofCrudeOilandOilProductsandSer

- Page 93 and 94:

fundsraisedbyPifCothroughtheissuanc

- Page 95 and 96:

PifCo'sShortTermBorrowings PifCo’

- Page 97 and 98:

Between March 24, 2009, and May 20,

- Page 99 and 100:

ContractualObligations Petrobras Th

- Page 101 and 102:

in cash flows does not exceed our p

- Page 103 and 104:

DerivativeTransactions SFAS 133 req

- Page 105 and 106:

FASBFSPSFAS1404andFIN46(R)8 In Dece

- Page 107 and 108:

Item6. Directors,SeniorManagementa

- Page 109 and 110:

ofPetrobrasDistribuidoraS.A.—BR.H

- Page 111 and 112:

since June 2008. Mr. Pereira gradua

- Page 113 and 114:

Compensation Petrobras For 2008, th

- Page 115 and 116:

240.10A3. The third member of our A

- Page 117 and 118:

On July 1, 2007, we implemented the

- Page 119 and 120:

23toourauditedconsolidatedfinancial

- Page 121 and 122:

Item8. FinancialInformation Petrob

- Page 123 and 124:

are pending appeal at the administr

- Page 125 and 126:

2002, and the August 11, 2004 TAC,

- Page 127 and 128:

SharePriceHistory The following tab

- Page 129 and 130:

MandatoryDistribution that exceeds

- Page 131 and 132:

electordismissmembersofourboard ofd

- Page 133 and 134:

preferredshares,holdersofpreferreds

- Page 135 and 136:

DisputeResolution Ourbylawsprovidef

- Page 137 and 138:

Directorsarenotrequiredtoownshares.

- Page 139 and 140: MaterialContracts Petrobras For inf

- Page 141 and 142: BrazilianTaxConsiderations General

- Page 143 and 144: exchanges by an investor registered

- Page 145 and 146: decisions, all in effect as of the

- Page 147 and 148: to a U.S. holder will be allowed as

- Page 149 and 150: Inaddition,thissummarydoesnotdiscus

- Page 151 and 152: CommodityPriceRisk Oursalesofcrudeo

- Page 153 and 154: Thetablebelowprovidesinformationabo

- Page 155 and 156: Item12. DescriptionofSecuritiesothe

- Page 157 and 158: Item16C. AuditandNonAuditFees Petro

- Page 159 and 160: Item16G. CorporateGovernance Compar

- Page 161 and 162: Section NewYorkStockExchangeCorpora

- Page 163 and 164: No. Description 2.12 Indenture,da

- Page 165 and 166: No. 33314168)). Description 2.40

- Page 167 and 168: SIGNATURES Pursuanttotherequirement

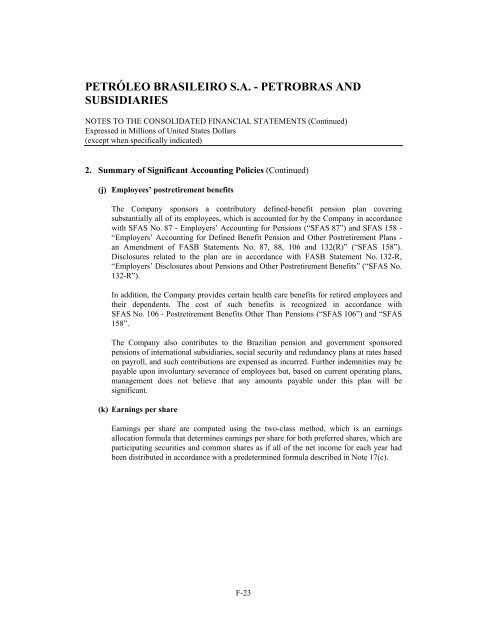

- Page 169 and 170: Petróleo Brasileiro S.A. - Petrobr

- Page 171 and 172: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 173 and 174: A Company’s internal control over

- Page 175 and 176: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 177 and 178: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 179 and 180: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 181 and 182: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 183 and 184: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 185 and 186: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 187 and 188: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 189: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 193 and 194: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 195 and 196: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 197 and 198: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 199 and 200: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 201 and 202: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 203 and 204: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 205 and 206: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 207 and 208: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 209 and 210: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 211 and 212: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 213 and 214: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 215 and 216: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 217 and 218: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 219 and 220: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 221 and 222: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 223 and 224: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 225 and 226: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 227 and 228: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 229 and 230: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 231 and 232: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 233 and 234: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 235 and 236: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 237 and 238: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 239 and 240: PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 241 and 242:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 243 and 244:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 245 and 246:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 247 and 248:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 249 and 250:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 251 and 252:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 253 and 254:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 255 and 256:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 257 and 258:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 259 and 260:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 261 and 262:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 263 and 264:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 265 and 266:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 267 and 268:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 269 and 270:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 271 and 272:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 273 and 274:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 275 and 276:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 277 and 278:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 279 and 280:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 281 and 282:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 283 and 284:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 285 and 286:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 287 and 288:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 289 and 290:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 291 and 292:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 293 and 294:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 295 and 296:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 297 and 298:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 299 and 300:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 301 and 302:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 303 and 304:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 305 and 306:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 307 and 308:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 309 and 310:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 311 and 312:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 313 and 314:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 315 and 316:

PETRÓLEO BRASILEIRO S.A. - PETROBR

- Page 317 and 318:

Petrobras International Finance Com

- Page 319 and 320:

Petrobras International Finance Com

- Page 321 and 322:

A company's internal control over f

- Page 323 and 324:

Petrobras International Finance Com

- Page 325 and 326:

Petrobras International Finance Com

- Page 327 and 328:

Petrobras International Finance Com

- Page 329 and 330:

Petrobras International Finance Com

- Page 331 and 332:

Petrobras International Finance Com

- Page 333 and 334:

Petrobras International Finance Com

- Page 335 and 336:

Petrobras International Finance Com

- Page 337 and 338:

Petrobras International Finance Com

- Page 339 and 340:

Petrobras International Finance Com

- Page 341 and 342:

Petrobras International Finance Com

- Page 343 and 344:

Petrobras International Finance Com

- Page 345 and 346:

Petrobras International Finance Com

- Page 347:

Petrobras International Finance Com

![[Traficando Conhecimento] Jéssica Balbino](https://img.yumpu.com/27871704/1/164x260/traficando-conhecimento-jacssica-balbino.jpg?quality=85)