15 April 2011 THE PHILIPPINE STOCK EXCHANGE 3/F ... - PSBank

15 April 2011 THE PHILIPPINE STOCK EXCHANGE 3/F ... - PSBank

15 April 2011 THE PHILIPPINE STOCK EXCHANGE 3/F ... - PSBank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>15</strong> <strong>April</strong> <strong>2011</strong><br />

<strong>THE</strong> <strong>PHILIPPINE</strong> <strong>STOCK</strong> <strong>EXCHANGE</strong><br />

3/F Philippine Stock Exchange Plaza<br />

Ayala Triangle, Ayala Avenue<br />

Makati City, Philippines 1226<br />

ATTENTION: MS. JANET A. ENCARNACION<br />

Head, Disclosure Department<br />

Dear Ms. Encarnacion,<br />

This is to furnish the Philippine Stock Exchange with a copy of the SEC<br />

17-A report of Philippine Savings Bank.<br />

We hope that you will find everything in order.<br />

Thank you.<br />

Very truly yours,<br />

PERFECTO RAMON Z. DIMAYUGA JR.<br />

SVP and Chief Finance Officer

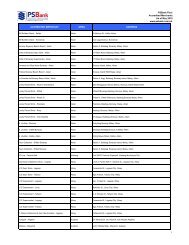

COVER SHEET<br />

P H I L I P P I N E S A V I N G S B A N K<br />

1 5 5 5 2<br />

SEC Registration Number<br />

(Company’s Full Name)<br />

P S B a n k C e n t e r , 7 7 7 P a s e o d e R o x a s<br />

c o r n e r S e d e ñ o S t r e e t , M a k a t i C i t<br />

y<br />

(Business Address: No. Street City/Town/Province)<br />

Perfecto Ramon Z. Dimayuga 885-8208<br />

(Contact Person)<br />

(Company Telephone Number)<br />

1 2 3 1 1 7 - A<br />

Month Day (Form Type) Month Day<br />

(Fiscal Year)<br />

(Annual Meeting)<br />

(Secondary License Type, If Applicable)<br />

SEC-Corporation Finance<br />

Dept. Requiring this Doc.<br />

Amended Articles Number/Section<br />

Total Amount of Borrowings<br />

1,725<br />

Total No. of Stockholders Domestic Foreign<br />

To be accomplished by SEC Personnel concerned<br />

File Number<br />

LCU<br />

Document ID<br />

Cashier<br />

S T A M P S<br />

Remarks: Please use BLACK ink for scanning purposes.

SEC NO. <strong>15</strong>552<br />

FILE NO.<br />

<strong>PHILIPPINE</strong> SAVINGS BANK<br />

(COMPANY’S NAME)<br />

PSBANK CENTER<br />

777 Paseo de Roxas cor. Sedeño St., Makati City<br />

(COMPANY’S ADDRESS)<br />

885-82-08<br />

(TELEPHONE NUMBER)<br />

DECEMBER 31<br />

(FISCAL YEAR ENDING MONTH & DAY)<br />

SEC FORM 17-A<br />

(FORM TYPE)<br />

December 31, 2010<br />

(PERIOD ENDED DATE)<br />

Government Securities Dealer<br />

(SECONDARY LICENSE TYPE AND FILE NUMBER)

SECURITIES AND <strong>EXCHANGE</strong> COMMISSION<br />

SEC FORM 17-A<br />

ANNUAL REPORT PURSUANT TO SECTION 17<br />

OF <strong>THE</strong> SECURITIES REGULATIONS CODE AND SECTION 141<br />

OF CORPORATION CODE OF <strong>THE</strong> <strong>PHILIPPINE</strong>S<br />

1. For the fiscal year ended : December 31, 2010<br />

2. SEC Identification No. : <strong>15</strong>552<br />

3. BIR Tax Identification No. : 000-663-983-000<br />

4. Exact name of registrant as specified in its charter : Philippine Savings Bank<br />

5. Province, Country or other jurisdiction or organization : Metro Manila, Philippines<br />

6. Industry Classification Code : (SEC Use only)<br />

7. Address of principal office : 777 Paseo de Roxas corner<br />

Sedeño St., Makati City<br />

8. Registrant’s telephone No. : (632) 885-82-08<br />

9. Former name, address, and former fiscal year,<br />

If changed since last report : Not Applicable<br />

10. Securities registered pursuant to<br />

Section 8 & 12 of the SRC<br />

Title of each class : Common Shares<br />

Number of shares outstanding : 240,252,491<br />

Amount of Debt Outstanding : P=1,977,141,032<br />

(Tier II Subordinated Notes Payable)<br />

11. Are any or all of these securities listed with the<br />

Philippine Stock Exchange : Yes<br />

12. Check whether the issuer:<br />

(a) has filed all report required to be filed<br />

under Section 17 of the SRC and SRC<br />

Rule 17 thereunder or Section 11 of the<br />

RSA and RSA Rule 11(a)-1 thereunder<br />

and Section 26 and 141 of The<br />

Corporation Code of the Philippines<br />

during the preceding 12 months (or for<br />

such shorter period that the registrant was<br />

required to file such<br />

reports) : Yes<br />

(b) has been subject to such filing<br />

requirements for<br />

the past ninety (90) days : Yes

13. State the aggregate market value of the voting stock<br />

held by non-affiliates of the registrant. The aggregate<br />

market value shall be computed by reference to the<br />

price at which the stock was sold or the average bid<br />

and asked prices of such stock, as of a specified date<br />

(March 9, <strong>2011</strong>) within sixty (60) days prior to the date<br />

of filing. If a determination as to whether a particular<br />

person or entity is an affiliate cannot be made without<br />

involving unreasonable effort and expense, the<br />

aggregate market value of the common stock held by<br />

non-affiliates may be calculated on the basis of<br />

assumptions reasonable under the circumstances,<br />

provided the assumptions are set forth in this Form. P 3,636,145,548<br />

APPLICABLE ONLY TO ISSUERS INVOLVED IN<br />

INSOLVENCY/SUSPENSION OF PAYMENTS PROCEEDINGS<br />

DURING <strong>THE</strong> PRECEDING FIVE YEARS:<br />

14. Check whether the issuer has filed all documents and reports<br />

required to be filed by Section 17 of the Code subsequent<br />

to the distribution of securities under a plan confirmed<br />

by a court of the Commission. : Not Applicable<br />

DOCUMENTS INCORPORATED BY REFERENCE<br />

<strong>15</strong>. If any of the following documents are<br />

incorporated by reference, briefly describe<br />

them and identify the part of SEC Form 17-1<br />

Into which the document is incorporated:<br />

(a)<br />

(b)<br />

Any annual report to security holders;<br />

Any proxy or information statement filed<br />

pursuant to SRC Rule 20 and 17.1(b);<br />

Any prospectus filed pursuant to SRC Rule 8.1-1

TABLE OF CONTENTS<br />

Page No.<br />

PART I - BUSINESS AND GENERAL INFORMATION<br />

Item 1. Description of Business 4<br />

Item 2. Properties 9<br />

Item 3. Submission of Matters to a Vote of Security Holders 9<br />

PART II - OPERATIONAL AND FINANCIAL INFORMATION<br />

Item 4. Market for Registrant’s Common Equity and<br />

Related Stockholder Matters 10<br />

Item 5. Plan of Operation and Management’s Discussion and Analysis <strong>15</strong><br />

Item 6. Financial Statements 24<br />

Item 7. Changes in and Disagreements with Accountants<br />

and Financial Disclosure 24<br />

PART III - CONTROL AND COMPENSATION INFORMATION<br />

Item 8. Directors and Executive Officers of the Registrant 25<br />

Item 9. Executive Compensation 35<br />

Item 10. Security Ownership of Certain Beneficial Owners<br />

and Management 36<br />

Item 11. Certain Relationships and Related Transactions 37<br />

PART IV – CORPORATE GOVERNANCE 38<br />

SIGNATURES 43<br />

PART V - EXHIBITS AND SCHEDULES 41<br />

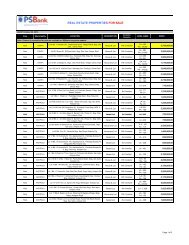

Exhibit 1 - Schedule of Bank/Branch Sites Owned by the Bank 44<br />

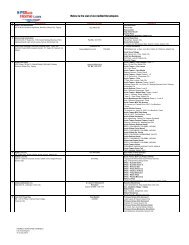

Exhibit 2 - Schedule of Bank/Branch Sites Under Lease Agreements 45<br />

Exhibit 3 - Events Reported under SEC FORM 17-C for the last 6 months 50<br />

PART VI - AUDITED FINANCIAL STATEMENTS<br />

Form and Contents 42<br />

(a) Statement of Management’s Responsibility<br />

(b) Independent Auditors’ Report<br />

(c) Statements of Condition<br />

(d) Statements of Income<br />

(e) Statements of Changes in Equity<br />

(f) Statements of Cash Flows<br />

(g) Notes to Financial Statements<br />

(h) Independent Auditors’ Report on Supplementary Schedules<br />

(i) Nature of Dividend Declared<br />

PART VII - O<strong>THE</strong>R RELEVANT SUBMISSIONS<br />

Chief Finance Officer’s Certificate Under Oath on the Submission of Compact Disc<br />

together with the Audited Financial Statements

PART I. BUSINESS AND GENERAL INFORMATION<br />

Item 1. Description of Business<br />

1. Business Development<br />

Philippine Savings Bank (<strong>PSBank</strong>) was incorporated on June 30, 1959 primarily to engage in<br />

savings and mortgage banking. In 1983, Metrobank acquired majority share in the Bank, and in<br />

2004 further increased its shareholdings to the present level of 76%.<br />

In 1991, the Bank was authorized to perform trust functions, and in 1995, was granted quasibanking<br />

license. In 1994, <strong>PSBank</strong> became the country’s first publicly listed thrift bank.<br />

It has outpaced its key competitors and is, today, the country’s second largest thrift bank in terms<br />

of assets. It caters mainly to the retail and consumer markets and offers a wide range of products<br />

and services such as deposits, loans, treasury and trust.<br />

The Bank has a 25% interest in Toyota Financial Services Philippines Corp. (TFSPC). It also has<br />

a 40% interest in Sumisho Motor Finance Corporation (SMFC), a partnership with Sumitomo<br />

Corporation. TFSPC and SMFC are not listed in the stock exchange.<br />

Its principal office is located at the <strong>PSBank</strong> Center, 777 Paseo de Roxas corner Sedeño Street,<br />

Salcedo Village, Makati City.<br />

The past 3 years marked very significant growth as the Bank continue to grow its core business<br />

and always on track in hitting its year-end targets. The Bank has sustained its focus on<br />

consumers, which corners approximately 80% of its portfolio by continuing to provide efficient and<br />

creative banking solutions through wider distribution network.<br />

Total Resources Net Income Branch Network<br />

2010 104.149 billion 1.808 billion 180 branches<br />

2009 93.088 billion 1.240 billion 170 branches<br />

2008 74.637 billion 940.<strong>15</strong>2 million 164 branches<br />

In 2010, the Bank showed a stronger balance sheet and double-digit growth across all loan<br />

products. The Bank aggressively expanded its network to 180 branches and 380 ATMs<br />

nationwide and offered the widest nationwide coverage among thrift banks.<br />

In partnership with Mastercard and Bancnet, the Bank launched the <strong>PSBank</strong> Prepaid Mastercard<br />

last October 11, 2010. This is an e-money instrument product that is an ATM card, debit card,<br />

remittance card and internet cash card all put into one. As of December 31, 2010, the Bank had<br />

a total of 21,171 active Prepaid Mastercard holders. Clients can reload their prepaid card via<br />

<strong>PSBank</strong> branches nationwide using cash or <strong>PSBank</strong> Remote Banking (PRB) with funds from PSB<br />

account. The card can also be loaded via ATM with funds from PSB account or from another<br />

bank. To promote this prepaid card, the Bank distributed campaign materials to its branches and<br />

had a media briefing to inform and encourage clients to avail this new product.<br />

As of year end, <strong>PSBank</strong> Remote Banking enrollees had gone up to over 40,000 from 30,000<br />

enrollees in 2009. As a result, PRB transactions doubled to more than 3.0 million from previous<br />

year’s 1.5 million.<br />

Mortgage Banking launched a number of campaigns to boost loan referrals, among them: “The<br />

Federal Investors’ Night” which took place last October 21, 2010. The event, which was held in<br />

cooperation with Federal Land, was attended by branch personnel and valued clients. This was<br />

aimed to generate better profitability for branches in mortgage lending.

In 2009, the Bank made significant improvements in loan processing that enabled a 100%<br />

delivery on its Thank Goodness its Five Days (TGIF) campaign promise. The TGIF came with<br />

free interest for the first year if the client does not get a credit decision in five days or less. It also<br />

reinforced its <strong>PSBank</strong> Auto Loan through its Isang Tulog Lang campaign which offers flexible<br />

financing terms, one of the lowest rates in the market and a credit decision via SMS in as fast as<br />

24 hours.<br />

Another industry milestone is the <strong>PSBank</strong> Prime Rebate, the only loan rebate program in the<br />

industry. When customers pay in advance or in excess than their monthly due, they earn<br />

rebates which effectively shortens their loan term, gives a discount on their total loan amount, or<br />

even both.<br />

To provide more convenience to its customers and address their fast-paced lifestyle, <strong>PSBank</strong><br />

issued the Instant ATM Card where customers can apply for their new or replacement <strong>PSBank</strong><br />

ATM card on the spot in any of its branches nationwide. Likewise, the <strong>PSBank</strong> Overseas Filipino<br />

(OF) Savings Account, which has no minimum deposit and no maintaining balance, allowed our<br />

modern-day heroes and their beneficiaries to have easier access to their funds. Throughout the<br />

year, the Bank continued its efforts to realign its organizational, operational and business<br />

processes to meet the growing customer demand. The Customer Service Division (CSD) took<br />

major initiatives in 2009 to further strengthen the service culture within the organization and meet<br />

customers’ needs. The Human Resources Group conducted various in-house programs through<br />

seminars, workshops and inter-departmental projects, which also serve as a training ground for<br />

management skills.<br />

In August 2009, the Bank entered into a joint venture agreement with the Sumitomo Corporation<br />

to primarily engage in the financing of motorcycle purchases. In September 2009, the Bangko<br />

Sentral ng Pilipinas approved the joint venture which was named Sumisho Motor Finance<br />

Corporation and was subsequently incorporated with the Securities and Exchange Commission in<br />

November 2009.<br />

In 2008, the Bank conducted a stock rights offer and generated P2 billion in fresh Tier 1 capital,<br />

resulting to an increase in capital to P8.4 billion in end-February 2008. The Bank continued its<br />

build-up of investments in branches and information technology. <strong>PSBank</strong> opened its second<br />

branch in Bacolod City and relocated nine branches to better reach more customers. Helping<br />

boost our presence in areas with high customer traffic were 23 new offsite ATMs installed in<br />

major malls and commercial areas in Metro Manila. The Bank’s network was comprised of 164<br />

branches and 189 ATMs nationwide. To support the bank’s business units, the Bank took major<br />

initiatives to improve its IT system infrastructure. The acquisition of the IBM Z9 mainframe<br />

boosted our scalability and capability. It also moved to the IP/VPN technology that give the bank<br />

higher bandwidth capability and significantly improved our response time. <strong>PSBank</strong> also set up an<br />

ATM center to better manage all ATM-related operations and institutionalized the Exception<br />

Management System to check and manage risks that may arise from day-to-day operations. The<br />

Bank launched the Monthly Millions Raffle Promo, which produced five millionaires, to boost<br />

deposit levels and create market buzz. The Save it Forward campaign reinforced customer<br />

loyalty, raised deposits and enabled <strong>PSBank</strong> to fulfill its corporate social responsibility by<br />

providing scholarships to nominated scholars from World Vision and Resources for the Blind. The<br />

Bank also launched tactical marketing campaigns for Money Card, re-launched the SME<br />

Business Credit Lines and increased awareness for time deposit products. In 2008, the Bank<br />

revised its Code of Conduct to adjust to new labor laws, BSP guidelines, and incorporate recent<br />

changes in policies and procedures of the Bank. It addressed the changes in disciplinary conduct,<br />

and the role of different units in strengthening the definition and control of business data,<br />

administration and management. It also established a succession planning and staffing program<br />

to ensure normal operations in case of separation, resignation, retirement and transfer of key<br />

management personnel. Although the Bank posted a decline in income for the year ended<br />

December 2008, its core business has significantly improved amidst the present economic<br />

scenario with its continued investments in people, IT capability and strengthening of its risk<br />

management functions.

2. Business of Registrant<br />

a) Products and Services<br />

Being a thrift bank, <strong>PSBank</strong> offers a wide array of products on deposits and loans and services<br />

that cater mainly to consumer and retail customers and distributed through the bank’s 180<br />

branches strategically located nationwide.<br />

Deposits<br />

<strong>PSBank</strong> ATM Savings<br />

<strong>PSBank</strong> Overseas Filipino (OF) Savings<br />

<strong>PSBank</strong> Regular Passbook Savings<br />

<strong>PSBank</strong> Passbook Savings with ATM<br />

<strong>PSBank</strong> Regular Checking<br />

<strong>PSBank</strong> Premium Checking<br />

<strong>PSBank</strong> Short-Term Peso Deposit<br />

<strong>PSBank</strong> Long-Term Peso Deposit<br />

<strong>PSBank</strong> Prime Time Deposit<br />

<strong>PSBank</strong> US Dollar Savings<br />

<strong>PSBank</strong> US Dollar Time Deposit<br />

<strong>PSBank</strong> Premium US Dollar Time Deposit<br />

Consumer Loans<br />

<strong>PSBank</strong> Auto Loan<br />

<strong>PSBank</strong> Flexi Personal Loan<br />

<strong>PSBank</strong> Multi-Purpose Loan<br />

<strong>PSBank</strong> Home Loan<br />

<strong>PSBank</strong> Home Credit Line<br />

<strong>PSBank</strong> Home Construction Loan<br />

Credit Card<br />

<strong>PSBank</strong> Mastercard<br />

Business Loans<br />

<strong>PSBank</strong> SME Business Credit Line<br />

<strong>PSBank</strong> Credit Line<br />

<strong>PSBank</strong> Term Loan<br />

<strong>PSBank</strong> Standby Credit Line Certification<br />

<strong>PSBank</strong> Domestic Bills Purchase Line<br />

<strong>PSBank</strong> Domestic Letter of Credit/Trust Receipt Line<br />

Floor Stock Financing Line<br />

Second Endorsed Check Accommodation<br />

Other Products & Services<br />

<strong>PSBank</strong> Remote Banking<br />

<strong>PSBank</strong> Prepaid Mastercard<br />

Payment Collection Services<br />

Products Accepted:<br />

<strong>PSBank</strong> MasterCard<br />

Metrobank VISA<br />

Metrobank Mastercard<br />

SSS<br />

Globe Telecom<br />

Remittances Services<br />

Domestic Remittances<br />

Foreign Remittances<br />

Foreign Demand Draft<br />

Trust Services<br />

Employee Benefit Trust<br />

Escrow Agency<br />

Investment Management Account<br />

Living Trust Account<br />

Other Services<br />

Payroll Services<br />

SSS Pensioner’s Remittance Program<br />

Safety Deposit Facility<br />

Overnight Depository Box<br />

Fund Transfer Services<br />

Gift Checks/Cashier’s Checks

) Business Contribution<br />

(In Millions) 2010 % 2009 % 2008 %<br />

INTEREST INCOME ON<br />

Loans and receivables P=5,872 71% P=5,376 85% P=4,745 95%<br />

Investment securities 1,7<strong>15</strong> 21% 1,945 31% 1,012 20%<br />

Due from BSP <strong>15</strong>9 2% 93 1% 85 2%<br />

Due from other banks 7 – 6 – 25 –<br />

Interbank loans receivable and securities purchased<br />

under resale agreements 161 2% 110 2% 262 5%<br />

7,913 96% 7,530 119% 6,129 123%<br />

INTEREST EXPENSE ON<br />

Deposit liabilities 2,693 33% 2,485 39% 2,197 44%<br />

Subordinated notes payable 206 2% 206 3% 206 4%<br />

Bills payable 1 – 5 – 17 –<br />

2,901 35% 2,696 43% 2,420 49%<br />

NET INTEREST INCOME 5,012 61% 4,834 77% 3,709 74%<br />

NET SERVICE FEES AND COMMISSION INCOME 692 8% 596 9% 534 11%<br />

O<strong>THE</strong>R OPERATING INCOME (CHARGES) 2,532 31% 842 13% 694 14%<br />

SHARE IN NET EARNINGS OF AN ASSOCIATE<br />

AND A JOINT VENTURE 42 1% 45 1% 47 1%<br />

INCOME, Net of Interest and Commission Expense P=8,278 100% P=6,316 100% P=4,984 100%<br />

c) Distribution Methods of Products and Services<br />

The Bank’s operating segments are organized and managed separately according to the<br />

nature of services provided and the different markets served, with each segment representing<br />

a strategic business unit that offers different products and serves different markets. The<br />

Bank’s reportable segments are as follows:<br />

a. Consumer Banking - principally provides consumer-type loans generated by the Home<br />

Office;<br />

a. Corporate Banking - principally handles loans and other credit facilities for corporate and<br />

institutional customers acquired in the Home Office;<br />

a. Branch Banking - serves as the Bank’s main customer touch point which offers consumer<br />

and corporate banking products; and<br />

a. Treasury - principally handles institutional deposit accounts, providing money market,<br />

trading and treasury services, as well as managing the Bank’s funding operations by use<br />

of government securities and placements and acceptances with other banks.<br />

The Bank has no single customer with revenues from which is 10.00% or more of the Bank’s<br />

total revenue. The Bank presented the disclosure requirements prescribed under PFRS in<br />

Note 6.<br />

The Bank’s assets generating revenues are all located in the Philippines.<br />

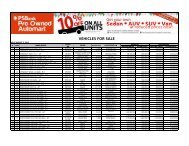

d) Status of any publicly-announced new products or services<br />

Products<br />

Date Launched<br />

<strong>PSBank</strong> Flexi Card Activation June 28, 2010<br />

<strong>PSBank</strong> Flexi-Cebu Pacific Tie-Up Promo<br />

July 23, 2010 (6 months)<br />

Check Image Viewing Facility July <strong>15</strong>, 2010<br />

<strong>PSBank</strong> Home Loan (new advertising campaign) May 10, 2010<br />

<strong>PSBank</strong> Auto Loan (new advertising campaign) July 26, 2010<br />

<strong>PSBank</strong> Flexi Personal Loan (new advertising campaign) January <strong>15</strong>, 2010<br />

Remote Banking Bills Payment Promo<br />

<strong>April</strong> <strong>15</strong>, 2010 (2.5 months)

e) Competition<br />

<strong>PSBank</strong> continues to rank as second in the thrift banking category and is larger in terms of<br />

total resources compared with other commercial banks. Although a thrift bank, <strong>PSBank</strong><br />

competes aggressively with other commercial banks in the field of retail and consumer<br />

banking. Competition has become even more challenging amidst the growing number of<br />

players in the consumer business and the vigorous campaign by competitor banks to acquire<br />

a bigger share of the market. While there are many factors beyond its control, the<br />

efficiencies it set into its operations help the Bank face market challenges. Consistency in<br />

product and service delivery remains to be its guidepost for growth. The Bank is taking full<br />

advantage of selected opportunities in the debt market to grow its corporate lending<br />

business.<br />

In 2010, <strong>PSBank</strong> was recognized for its compliance to Corporate Governance during the<br />

annual dinner of the Institute of Corporate Directors (ICD). <strong>PSBank</strong> got a score of 91% in the<br />

ICD scorecard for its corporate governance practices, which landed it in the Silver Category.<br />

The Bank obtained a composite rating of 4 from the Bangko Sentral ng Pilipinas in a letter<br />

released last May 2010, based on Report on Examination dated March 2009. The rating<br />

indicates that the BSP found no major supervisory concerns in the Bank and that it is<br />

fundamentally sound with minor weaknesses that can be addressed by Management in the<br />

normal course of business. Last but not least, Philippine Rating Services Corporation<br />

(Philratings) upgraded its rating for <strong>PSBank</strong>’s unsecured subordinated debt or Tier 2 bonds to<br />

PRS Aaa in October 2010 from PRS Aa plus. PRS Aaa is the highest rating that Philratings<br />

can assign and is defined as “high quality with minimal credit risk”. <strong>PSBank</strong> exercised the call<br />

option on the bonds last January <strong>2011</strong>.<br />

f) Customers/Clients<br />

While the Bank’s client base has been traditionally composed of big and small savers,<br />

<strong>PSBank</strong> persistently builds its CASA deposits. As of year-end, the Bank services about<br />

292,253 deposit accounts and 378,230 loan accounts. Many customers have remained loyal<br />

depositors and borrowers of the Bank through the years. There is no single customer that<br />

accounts for 20% or more of the Bank’s deposits and loans.<br />

g) Transactions with and/or dependence on related parties<br />

In the ordinary course of business, the Bank has loans and other transactions with its<br />

affiliates and with certain directors, officers, stockholders and related interests (DOSRI).<br />

These loans and other transactions are made substantially on the same terms as with other<br />

individuals and businesses of comparable risks. The Bank has complied with the limits<br />

prescribed by regulations.<br />

Other transactions conducted in the normal course of business include deposits with the<br />

parent company, interbank loan transactions and deposit liabilities with related parties.<br />

h) Patents, Trademarks, Copyrights, Licenses, Franchises, etc.<br />

The Bank sells its products and services thru the <strong>PSBank</strong> trademarks and/or tradenames.<br />

The Bank’s operations are not dependent on the terms of these agreements.<br />

i) Government approval of principal products or services<br />

Its authority to operate as a thrift bank governs the Bank’s principal products and services.<br />

Existing products and services are within the scope allowed under the Bank’s regulatory<br />

licenses and do not need special government approval.<br />

j) Research and Development Costs<br />

There are no major expenses on research and development activities. Expenses incurred<br />

related to these activities are included into the regular business expense of the Bank.

k) Employees<br />

<strong>PSBank</strong> considers its entire workforce as important. Everyone is expected to work together<br />

as a team to achieve the Bank’s goals and objectives.<br />

The following are the existing and projected manpower complement:<br />

As of 12/31/2010 Projected – Dec <strong>2011</strong><br />

Senior Officers 60 65<br />

Junior Officers 841 959<br />

Staff 1,854 2,084<br />

Total 2,755 3,108<br />

Although its rank-and-file employees are unionized, the Bank has been strike-free for its<br />

entire history. The Bank’s Management and the Employees’ Union reached an agreement<br />

and signed the Collective Bargaining Agreement (CBA) on January 20, 2010 covering the<br />

period of January 2010 to December 2012, significant features of which include goodwill and<br />

signing bonuses for the initial year 2010 as the Bank’s gesture of appreciation to the mutually<br />

agreed economic package. The CBA also includes salary increases amounting to P1,400,<br />

P1,300 and P1,200 for 2010, <strong>2011</strong> and 2012, respectively. The Bank recognizes the<br />

importance of its human resources, thus, continuing its officership program for head office<br />

and branch functions to its roster of organizational development activities and improving<br />

employee trainings and development to achieve the Bank’s current thrust on operations<br />

quality and competence, service quality and effective sales.<br />

l) Business Risks<br />

<strong>PSBank</strong> is exposed to all business risks that confront all banks in general, such as credit,<br />

market, interest, liquidity, legal, regulatory and operational risk. The Bank’s risk management<br />

structure and process that serve as mechanism to identify, assess and manage these risks<br />

are further discussed in Item 13. Compliance with Leading Practices on Corporate<br />

Governance.<br />

Item 2. Properties<br />

The Bank owns the premises it occupies for the Head Office and 23 of its branches. These<br />

offices and branches are all in good condition and there is no mortgage or lien on any of these<br />

properties owned by the Bank. Schedule of owned branch sites is shown in EXHIBIT 1. The rest<br />

of the Bank’s branch premises are under lease agreements. Terms of leases range from 1 month<br />

to 30 years renewable under certain terms and conditions. Rentals charged against operations<br />

under these lease contracts amounting to P=293.2 million in 2010. Please refer to EXHIBIT 2 for<br />

the Schedule of branch sites under lease agreements.<br />

Item 3. Submission of Matters to a Vote of Security Holders<br />

No matter was submitted during the fourth quarter of the fiscal year covered by this report to a<br />

vote of security holders through the solicitation of proxies or otherwise.

PART II. OPERATIONAL AND FINANCIAL INFORMATION<br />

Item 4. Market for Registrant’s Common Equity and Related Stockholder Matters<br />

a) Market Price Information<br />

<strong>PSBank</strong> common shares were listed in the Philippine Stock Exchange (PSE) in 1994. The shares<br />

are traded under the symbol “PSB”.<br />

The high and low sales prices of the Shares as reported in the PSE for each quarter in the years<br />

ending December 31, 2010, 2009 and 2008 were as follows:<br />

Highest<br />

Lowest<br />

In Php<br />

2010:<br />

First quarter 58.00 53.00<br />

Second quarter 55.00 49.00<br />

Third quarter 55.00 50.00<br />

Fourth quarter 65.00 52.00<br />

2009:<br />

First quarter 39.00 36.00<br />

Second quarter 41.00 38.00<br />

Third quarter 43.00 40.00<br />

Fourth quarter 58.00 42.00<br />

2008:<br />

First quarter 59.04 53.50<br />

Second quarter 53.50 40.00<br />

Third quarter 48.00 47.00<br />

Fourth quarter 47.00 36.00<br />

Source: Bloomberg.<br />

Closing price as of March 31, <strong>2011</strong> was P63.50 per share.

Top 20 Stockholders as of March 31, <strong>2011</strong><br />

Name of Stockholders No. of Shares % to Total<br />

1. Metropolitan Bank and Trust Co. 182,535,895 75.98%<br />

2. PCD Nominee Corporation (Filipino) 14,739,373 6.14%<br />

3. Dolor, Danilo L. 12,610,891 5.25%<br />

4. Dolor, Erlinda L. 7,605,832 3.17%<br />

5. De Leon, Maria Soledad S. 4,000,000 1.66%<br />

6. PSB TID FAO TA#94-00-2-2-006 3,001,369 1.25%<br />

7. De Leon, Gian Carlo S. 2,741,378 1.14%<br />

8. De Leon, Leonard Frederick S. 2,598,334 1.08%<br />

9. De Leon, Alvin Benjamin S. 2,437,887 1.01%<br />

10. De Leon, Kevin Anthony S. 2,407,964 1.00%<br />

11. PCD Nominee Corporation (Non-Filipino) 1,641,272 0.68%<br />

12. Go, James 298,823 0.12%<br />

13. Ng, Jane Frances 141,781 0.06%<br />

14. Chua, Gabriel 100,337 0.04%<br />

<strong>15</strong>. Chua, Josephine T. 81,056 0.03%<br />

16. Ng, Samuel Chua &/or Jocelyn Ngo Ng ITF /<br />

Steven Samuel Ngo Ng 80,100 0.03%<br />

17. Que, Liong H. 68,062 0.03%<br />

18. Choa, Johnny K. 64,843 0.03%<br />

19. Choa, Victoria K. 61,875 0.03%<br />

20. Ty, Alejandro 57,345 0.02%<br />

Total number of stockholders as of March 31, <strong>2011</strong> is 1,706.<br />

Dividends and Dividend Policy<br />

Dividends to be paid in cash by the Bank are subject to approval by a majority of the Board of<br />

Directors and no further approval from the Bank's shareholders is required. Dividends to be paid<br />

in the form of stock requires both the approval of a majority of the Board of Directors and the<br />

approval of shareholders representing not less than two-thirds of the Bank’s outstanding capital<br />

stock. All dividends to be declared are subject to the approval of the BSP and the SEC. There are<br />

no known restrictions to the Bank’s ability to pay dividends on shares.<br />

Pursuant to existing Philippine SEC rules, cash dividends declared by the Bank must have a<br />

record date not less than 10 or more than 30 days from the date the cash dividends are declared.<br />

With respect to stock dividends, the record date is to be not less than 10 or more than 30 days<br />

from the date of shareholders’ approval, provided however, that the set record date is not to be<br />

less than 10 trading days from receipt by the PSE of the notice of declaration of stock dividend. In<br />

relation to banks, however, the record date can only be fixed after receipt of the BSP's approval<br />

for the dividend declaration. In the event that a stock dividend is declared in connection with an<br />

increase in authorized capital stock, the corresponding record date is to be fixed by the SEC.<br />

Subject as described herein, the Bank has historically paid and intends to continue to pay<br />

(subject as described below) dividends on its Shares. The payment of dividends in the future will<br />

depend on the Bank's earnings, cash flow, financial condition and other factors. Dividends may<br />

be declared only from unrestricted retained earnings and subject to approval from the BSP.<br />

Circumstances which could restrict the payment of cash dividends include, but are not limited to,<br />

when the Bank undertakes major projects and developments requiring substantial cash<br />

expenditures or when it is restricted from paying cash dividends by its loan covenants. The Board<br />

of Directors may, at any time, modify the Bank's dividend payout ratio depending on the results of<br />

operations and future projects and plans of the Bank.

The bank declared cash dividends to stockholders on the following dates:<br />

Cash Dividends<br />

Date of Declaration<br />

Per Share Total Amount<br />

Date of BSP Record Date Payment Date<br />

Approval<br />

December 19, 2007 0.<strong>15</strong> 36,037,874 Feb 7, 2008 Feb 27, 2008 Mar 7, 2008<br />

February 13, 2008 0.<strong>15</strong> 36,037,874 May 19, 2008 Jun 05, 2008 Jun 16, 2008<br />

<strong>April</strong> 29, 2008 0.<strong>15</strong> 36,037,874 July 16, 2008 Aug 05, 2008 Aug 20, 2008<br />

July 21, 2008 0.<strong>15</strong> 36,037,874 Sep 11, 2008 Oct 13, 2008 Oct 27, 2008<br />

October 28, 2008 0.<strong>15</strong> 36,037,874 Mar 6, 2009 Mar 26, 2009 Apr <strong>15</strong>, 2009<br />

January 20, 2009 0.<strong>15</strong> 36,037,874 Jun 29, 2009 July 23, 2009 Aug 7, 2009<br />

May 18, 2009 0.<strong>15</strong> 36,037,874 Aug 17, 2009 Sep <strong>15</strong>, 2009 Sep 30, 2009<br />

July 28, 2009 0.<strong>15</strong> 36,037,874 Oct 20, 2009 Nov 13, 2009 Dec 1, 2009<br />

October 13, 2009 0.<strong>15</strong> 36,037,874 Dec <strong>15</strong>, 2009 Jan 14, 2010 Jan 28, 2010<br />

January 19, 2010 0.<strong>15</strong> 36,037,874 Mar 8, 2010 Mar 31, 2010 Apr 16, 2010<br />

February 19, 2010 2.75 660,694,350 Apr 22, 2010 May 17, 2010 May 31, 2010<br />

May 17, 2010 0.<strong>15</strong> 36,037,874 Jun <strong>15</strong>, 2010 Jul 13, 2010 Aug 3, 2010<br />

July 27, 2010 0.<strong>15</strong> 36,037,874 Sep 6, 2010 Sep 29, 2010 Oct 14, 2010<br />

October 14, 2010 0.<strong>15</strong> 36,037,874 Nov <strong>15</strong>, 2010 Dec 8, 2010 Dec 23, 2010<br />

January 20, <strong>2011</strong> 0.<strong>15</strong> 36,037,874 Feb 23, <strong>2011</strong> Mar 18, <strong>2011</strong> Apr 4, <strong>2011</strong><br />

<strong>April</strong> 4, <strong>2011</strong> 0.<strong>15</strong> 36,037,874<br />

No unregistered securities were sold or offered for sale by the Bank for the year 2010.

<strong>PHILIPPINE</strong> SAVINGS BANK<br />

STATEMENTS OF CONDITION<br />

Percent - Increase<br />

December 31<br />

Amount - Increase (Decrease)<br />

(Decrease)<br />

2010 2009 2008 2010 vs 2009 2009 vs 2008 2010 vs 2009 2009 vs 2008<br />

ASSETS<br />

Cash and Other Cash Items P 3,163,939,540 P 2,632,884,729 P 1,436,234,455 P 531,054,811 P 1,196,650,274 20.17% 83.32%<br />

Due from Bangko Sentral ng Pilipinas 2,899,592,073 4,937,990,387 3,228,768,914 (2,038,398,314) 1,709,221,473 -41.28% 52.94%<br />

Due from Other Banks 7,520,836,053 1,528,847,687 1,276,768,278 5,991,988,366 252,079,409 391.93% 19.74%<br />

Interbank Loans Receivable and Securities<br />

Purchased Under Resale Agreements 3,586,560,000 5,900,000,000 750,000,000 (2,313,440,000) 5,<strong>15</strong>0,000,000 -39.21% 686.67%<br />

Fair Value Through Profit or Loss Investments 868,316,442 248,043,099 1,081,772,381 620,273,343 (833,729,282) 250.07% -77.07%<br />

Available-for-Sale Investments 16,200,339,057 18,261,371,820 16,813,786,476 (2,061,032,763) 1,447,585,344 -11.29% 8.61%<br />

Held-to-Maturity Investments 9,162,584,959 4,772,851,076 1,610,283,750 4,389,733,883 3,162,567,326 91.97% 196.40%<br />

Loans and Receivables 53,207,635,160 47,308,237,957 41,603,346,112 5,899,397,203 5,704,891,845 12.47% 13.71%<br />

Investment in an Associate and Joint Venture 829,873,755 788,310,337 369,951,789 41,563,418 418,358,548 5.27% 113.08%<br />

Property and Equipment 2,107,316,622 1,985,474,732 1,765,934,385 121,841,890 219,540,347 6.14% 12.43%<br />

Investment Properties 2,772,308,932 2,582,767,705 2,776,144,811 189,541,227 (193,377,106) 7.34% -6.97%<br />

Deferred Tax Asset 705,361,217 1,256,530,049 1,110,811,220 (551,168,832) 145,718,829 -43.86% 13.12%<br />

Goodwill and Other Intangible Assets 240,684,552 197,472,852 <strong>15</strong>8,516,420 43,211,700 38,956,432 21.88% 24.58%<br />

Other Assets 884,120,899 687,047,211 654,400,472 197,073,688 32,646,739 28.68% 4.99%<br />

P 104,149,469,261 P 93,087,829,641 P 74,636,719,463 P 11,061,639,620 P 18,451,110,178 11.88% 24.72%<br />

LIABILITIES AND EQUITY<br />

Liabilities<br />

Deposit Liabilities<br />

Demand P 7,170,221,822 P 8,188,088,242 P 6,393,728,469 -P 1,017,866,420 P 1,794,359,773 -12.43% 28.06%<br />

Savings 10,147,794,079 9,403,399,256 8,607,973,024 744,394,823 795,426,232 7.92% 9.24%<br />

Time 70,200,793,366 59,798,723,788 46,676,781,428 10,402,069,578 13,121,942,360 17.40% 28.11%<br />

87,518,809,267 77,390,211,286 61,678,482,921 10,128,597,981 <strong>15</strong>,711,728,365 13.09% 25.47%<br />

Subordinated Notes 1,977,141,032 1,973,881,534 2,208,541,621 3,259,498 (234,660,087) 0.17% -10.63%<br />

Treasurer’s, Cashier's and Manager’s Checks 649,433,599 505,738,363 339,901,057 143,695,236 165,837,306 28.41% 48.79%<br />

Accrued Taxes, Interest and Other Expenses 1,132,129,341 895,023,135 904,943,414 237,106,206 (9,920,279) 26.49% -1.10%<br />

Income Tax Payable - 17,425,906 14,073,344 (17,425,906) 3,352,562 -100.00% 23.82%<br />

Other Liabilities 1,262,878,631 1,293,410,922 1,018,052,404 (30,532,291) 275,358,518 -2.36% 27.05%<br />

92,540,391,870 82,075,691,146 66,163,994,761 10,464,700,724 <strong>15</strong>,911,696,385 12.75% 24.05%<br />

Equity<br />

Common Stock 2,402,524,910 2,402,524,910 2,402,524,910 - - 0.00% 0.00%<br />

Capital Paid in Excess of Par Value 2,818,083,506 2,818,083,506 2,818,083,506 - - 0.00% 0.00%<br />

Surplus Reserves 1,035,275,317 854,463,783 730,462,341 180,811,534 124,001,442 21.16% 16.98%<br />

Surplus 5,055,131,075 4,232,673,110 3,296,849,504 822,457,965 935,823,606 19.43% 28.39%<br />

Net Unrealized Gain (Loss) on Available-for-Sale<br />

Investments 355,<strong>15</strong>1,266 819,829,053 (677,288,505) (464,677,787) 1,497,117,558 -56.68% -221.05%<br />

Cumulative Translation Adjustment (57,088,683) (1<strong>15</strong>,435,867) (97,907,054) 58,347,184 (17,528,813) -50.55% 17.90%<br />

11,609,077,391 11,012,138,495 8,472,724,702 596,938,896 2,539,413,794 5.42% 29.97%<br />

P 104,149,469,261 P 93,087,829,641 P 74,636,719,463 P 11,061,639,620 P 18,451,110,178 11.88% 24.72%<br />

See accompanying Notes to Financial Statements.<br />

12

<strong>PHILIPPINE</strong> SAVINGS BANK<br />

STATEMENTS OF INCOME<br />

2010 2009 2008 2010 vs 2009 2009 vs 2008 2010 vs 2009 2009 vs 2008<br />

INTEREST INCOME ON<br />

Loans and receivables P 5,872,206,677 P 5,376,067,642 P 4,745,054,266 P 496,139,035 P 631,013,376 9.23% 13.30%<br />

Investment securities 1,714,742,134 1,944,869,980 1,012,129,324 (230,127,846) 932,740,656 -11.83% 92.16%<br />

Due from BSP <strong>15</strong>8,509,526 92,985,420 85,433,773 65,524,106 7,551,647 70.47% 8.84%<br />

Due from other banks 7,126,287 5,844,863 24,609,925 1,281,424 (18,765,062) 21.92% -76.25%<br />

Interbank loans receivable and securities purchased<br />

under resale agreements<br />

160,512,694<br />

109,764,181 262,379,746 160,512,694 (<strong>15</strong>2,6<strong>15</strong>,565) 146.23% -58.17%<br />

7,913,097,318 7,529,532,086 6,129,607,034 383,565,232 1,399,925,052 5.09% 22.84%<br />

INTEREST EXPENSE ON<br />

Deposit liabilities 2,693,229,929 2,485,486,486 2,196,675,829 207,743,443 288,810,657 8.36% 13.<strong>15</strong>%<br />

Subordinated notes payable 206,037,289 205,737,407 205,983,474 299,882 (246,067) 0.<strong>15</strong>% -0.12%<br />

Bills payable 1,427,292 4,831,064 17,450,070 (3,403,772) (12,619,006) -70.46% -72.31%<br />

2,900,694,510 2,696,054,957 2,420,109,373 204,639,553 275,945,584 7.59% 11.40%<br />

NET INTEREST INCOME 5,012,402,808 4,833,477,129 3,709,497,661 178,925,679 1,123,979,468 3.70% 30.30%<br />

Service fees and commission income 758,628,630 642,921,038 631,459,004 1<strong>15</strong>,707,592 11,462,034 18.00% 1.82%<br />

Service fees and commission expense 66,947,148 46,679,681 97,093,744 20,267,467 (50,414,063) 43.42% -51.92%<br />

NET SERVICE FEES AND COMMISSION INCOME 691,681,482 596,241,357 534,365,260 95,440,125 61,876,097 16.01% 11.58%<br />

O<strong>THE</strong>R OPERATING INCOME (CHARGES) -<br />

Trading and securities gains - net 2,229,490,724 543,632,852 199,740,186 1,685,857,872 343,892,666 310.11% 172.17%<br />

Gain on foreclosure of investment properties 224,362,420 206,142,134 211,126,132 18,220,286 (4,983,998) 8.84% -2.36%<br />

Loss on foreclosure of chattel mortgage (108,401,098) (91,966,009) (60,137,420) (16,435,089) (31,828,589) 17.87% 52.93%<br />

Foreign exchange gain <strong>15</strong>,054,606 12,337,918 186,796,847 2,716,688 (174,458,929) 22.02% -93.40%<br />

Gain on sale of property and equipment 2,366,741 9,804,030 3,833,000 (7,437,289) 5,971,030 -75.86% <strong>15</strong>5.78%<br />

Gain on sale of investment properties <strong>15</strong>,239,<strong>15</strong>4 31,579,889 40,429,690 (16,340,734) (8,849,801) -51.74% -21.89%<br />

Gain on sale of chattel mortgage properties 45,391,188 41,803,965 28,578,089 3,587,223 13,225,876 8.58% 46.28%<br />

Miscellaneous 108,949,822 88,283,966 83,229,054 20,665,856 5,054,912 23.41% 6.07%<br />

2,532,453,558 841,618,744 693,595,578 1,690,834,813 148,023,166 200.90% 21.34%<br />

Total Operating Income 8,236,537,847 6,271,337,230 4,937,458,499 1,965,200,617 1,333,878,731 31.34% 27.02%<br />

O<strong>THE</strong>R EXPENSES<br />

Compensation and fringe benefits 1,740,616,046 1,488,633,458 1,223,833,877 251,982,588 264,799,581 16.93% 21.64%<br />

Provision for credit and impairment losses 912,282,236 1,109,756,584 577,400,627 (197,474,348) 532,355,957 -17.79% 92.20%<br />

Taxes and licenses 777,135,211 559,775,883 451,660,304 217,359,328 108,1<strong>15</strong>,579 38.83% 23.94%<br />

Occupancy and equipment-related costs 424,277,820 362,869,511 307,401,2<strong>15</strong> 61,408,309 55,468,296 16.92% 18.04%<br />

Depreciation and amortization 352,038,108 328,535,606 274,104,098 23,502,502 54,431,508 7.<strong>15</strong>% 19.86%<br />

Security, messengerial and janitorial services 163,935,978 147,976,617 128,687,095 <strong>15</strong>,959,361 19,289,522 10.79% 14.99%<br />

Amortization of intangibles 41,692,711 27,761,608 26,750,792 13,931,103 1,010,816 50.18% 3.78%<br />

Miscellaneous 1,212,927,582 917,642,194 853,688,641 295,285,388 63,953,553 32.18% 7.49%<br />

5,624,905,692 4,942,951,461 3,843,526,649 681,954,231 1,099,424,812 13.80% 28.60%<br />

INCOME BEFORE SHARE IN NET EARNINGS<br />

OF AN ASSOCIATE AND A JOINT VENTURE AND INCOME<br />

TAX<br />

SHARE IN NET EARNINGS OF AN ASSOCIATE AND A<br />

2,611,632,<strong>15</strong>5<br />

Years ended December 31<br />

1,328,385,769 1,093,931,850<br />

Amount - Increase (Decrease)<br />

1,283,246,387<br />

Percent - Increase<br />

(Decrease)<br />

234,453,919 96.60% 21.43%<br />

JOINT VENTURE AND INCOME TAX 41,563,418 45,129,698 46,820,603 (3,566,280) (1,690,905) -7.90% -3.61%<br />

INCOME BEFORE INCOME TAX 2,653,195,573 1,373,5<strong>15</strong>,467 1,140,752,453 1,279,680,107 232,763,014 93.17% 20.40%<br />

PROVISION FOR (BENEFIT FROM) INCOME TAX 845,080,234 133,501,051 200,600,860 711,579,183 (67,099,809) 533.01% -33.45%<br />

NET INCOME P 1,808,1<strong>15</strong>,339 P 1,240,014,416 P 940,<strong>15</strong>1,593 P 568,100,924 P 299,862,823 45.81% 31.90%<br />

Basic/Diluted Earnings Per Share 7.53 5.16 3.98<br />

13

Item 5. Plan of Operation and Management’s Discussion and Analysis<br />

A. Plan of Operation<br />

The Bank will further expand its geographic reach nationwide as it plans to open more branches<br />

in 2010. Expansion of ATM presence in non-branch locations will still be pursued given the<br />

growing demand for customer convenience. In line with the Bank’s strategic initiatives on<br />

information technology, it will provide reliable technology infrastructure to improve operating<br />

efficiency. The Bank will continue offering superior E-Banking services and pursue Sales<br />

Effectiveness and Customer Service-related programs that will provide existing and forthcoming<br />

customers the convenient solutions to their banking needs.<br />

B. Management’s Discussion and Analysis<br />

i. Analysis of Statements of Condition<br />

As of December 31, 2010 and 2009<br />

The Bank’s Total Assets for the year ending December 31, 2010 stood at P104.<strong>15</strong> billion. This<br />

was 12% better than the December 2009 level of P93.09 billion. Significant year-on-year<br />

increases were reflected in loans and receivables, held-to-maturity investment securities and due<br />

from other banks.<br />

Loans and Receivables climbed by 12% to P53.21 billion from P47.31 billion as the Bank<br />

continued to benefit from the growth trend in the consumer market sector boosted by higher<br />

confidence in the new administration.<br />

Held-to-Maturity Investments grew by 92% or P4.39 billion to P9.16 billion as the Bank continued<br />

to build up its long term portfolio investment in government securities and ROP bonds.<br />

Due from Other Banks rose by 392% to P7.52 billion from year-ago level of P1.53 billion due to<br />

the shift in investment strategy from AFS to short term placements with other banks. Cash and<br />

Other Cash Items were also higher by 20% to P3.16 billion.<br />

The Bank continued to maintain its 25% interest in Toyota Financial Services Philippines<br />

Corporation (TFSPC) and 40% interest in Sumisho Motor Finance Corporation (SMFC).<br />

The Bank’s 25% stake in TFSPC posted a 17% increase or P65.71 million to P458.92 million<br />

from P393.21 million in 2009 due to recognition of share in the associate’s profit amounting to<br />

P65.71 million in 2010.<br />

SMFC, the joint venture with Sumitomo Corporation, was incorporated on November 26, 2009 to<br />

engage in motorcycle financing in the Philippines. As of December 31, 2010, total current assets,<br />

non-current assets and non-current liabilities of SMFC amounted to P868.29 million, P124.4<br />

million and P65.3 million, respectively. SMFC started its commercial operations in March 2010.<br />

As of December 31, 2010, SMFC has a total of 9 branches situated in Metro Manila and strategic<br />

provinces.<br />

Property and Equipment was 6% higher year-on-year to P2.11 billion due to expansion of ATM<br />

network, opening of ten (10) new branches, relocation and renovation of some branches in 2010.<br />

Goodwill and Other Intangible Assets including software costs and license fees increased by 22%<br />

or P43.21 million to P240.68 million. Likewise, Other Assets were 29% higher at P884.12 million<br />

compared with the December 2009 level of P687.05 million due to increases in chattel mortgage<br />

and prepaid taxes on investment securities.<br />

Deferred Tax Assets (DTA) went down by 44% to P705.36 million from P1.26 billion to align the<br />

level of DTA with the 5-year forecasted taxable income.

Meanwhile, Fair Value through Profit or Loss (FVPL) Investments increased by 250% to P868.32<br />

million from P248.04 million as the Bank took advantage of the volatility in interest rate for its<br />

trading portfolio.<br />

Likewise, Investment Properties increased by 7% to P2.77 billion from P2.58 billion as a result of<br />

foreclosure of loan accounts with significant balances.<br />

The Bank’s deposit level grew by 13% to P87.52 billion from P77.39 billion recorded the previous<br />

year. The Bank continued to benefit from its various deposit generation campaigns and expanded<br />

branch and ATM network. Time deposits increased by 17% or P10.40 billion. Likewise, savings<br />

deposits grew by 8% or P744.39 million while Demand deposits decreased by 12% or P1.02<br />

billion.<br />

Last October 2010, Philippine Rating Services Corporation (Philratings) upgraded its rating for<br />

<strong>PSBank</strong>’s P2.0 billion Unsecured Subordinated Notes to PRS Aaa from PRS Aa plus. The<br />

Unsecured Subordinated Notes (Tier 2) is due in 2016, with step up in <strong>2011</strong>. The request of the<br />

Bank to exercise the call option on the Note was approved by the BSP on December 10, 2010.<br />

The Bank exercised the call option on January 28, <strong>2011</strong>.<br />

Treasurer’s, cashier’s and manager’s checks as of December 2010 was higher by 28% to<br />

P649.43 million from P505.74 million reflected in the same period last year.<br />

In 2010, there was no outstanding income tax payable due to application of MCIT credits.<br />

Compared to December 2009, Capital was 5% higher at P11.61 billion from the P11.01 billion<br />

due to higher net income by 30% or P568.10 million to P1.81 billion. In addition to quarterly<br />

dividends, special dividends of P660.69 million or P2.75 per share was declared last February<br />

19, 2010. Mark to market (MTM) gain on Available-for-Sale investments decreased by 57% or<br />

P464.68 million to P355.<strong>15</strong> million compared to last year’s MTM gain of P819.83 million. As of<br />

end 2010, Capital Adequacy Ratio (CAR) was at <strong>15</strong>.37%. This ratio remained way above the<br />

minimum regulatory requirement of 10%. As of December 31, 2010 and 2009, the Bank<br />

recorded ‘Cumulative translation adjustment’ under equity amounting to P57.1 million and P1<strong>15</strong>.4<br />

million, respectively.<br />

Meanwhile, Return on Average Equity (ROAE) increased to <strong>15</strong>.99% in 2010 versus 12.73% in<br />

2009. Likewise, Return on Average Assets (ROAA) went up to 1.83% in 2010 from 1.48% in<br />

2009.<br />

As of December 31, 2009 and 2008<br />

The Bank’s Total Assets for the year ending December 31, 2009 stood at P93.09 billion. This<br />

was 25% better than the December 2008 level of P74.64 billion. Significant year-on-year<br />

increase was attributed to the positive results in loans and receivables, securities purchased<br />

under resale agreements and investments in government securities.<br />

In 2009, Loans and Receivables increased by 14% to P47.31 billion from P41.60 billion as the<br />

Bank continued to benefit from the growth trend in the consumer loans sector and participated in<br />

corporate issuances of prime companies.<br />

Interbank Loans Receivable and Securities Purchased under Resale Agreements or the Bank’s<br />

lending to Bangko Sentral ng Pilipinas (BSP) collateralized by government securities increased<br />

by P5.<strong>15</strong> billion to P5.90 billion from last year’s P750 million.<br />

Held-to-Maturity Investments and Available-For-Sale Investments grew by P3.16 billion and<br />

P1.45 billion to P4.77 billion and P18.26 billion, respectively, as the Bank invested its excess<br />

funds in government securities and ROP bonds.<br />

Due from BSP rose by 53% to P4.94 billion from year-ago level of P3.23 billion. Due from Other<br />

Banks was P252.08 million higher at P1.53 billion due to increase in placements with other<br />

banks. Cash and Other Cash Items were also higher by 83% to P2.63 billion.

Investments in an Associate and a Joint Venture represent 25% interest in Toyota Financial<br />

Services Philippines Corporation (TFSPC) and 40% interest in Sumisho Motor Finance<br />

Corporation (SMFC).<br />

The Bank’s 25% stake in TFSPC, posted a 6% increase or P23.26 million to P393.21 million from<br />

P369.95 million in 2008 due to recognition of share in the associate’s profit amounting to P50.03<br />

million in 2009.<br />

SMFC, the joint venture with Sumitomo Corporation, was incorporated on November 26, 2009 to<br />

engage in motorcycle financing in the Philippines. As of December 31, 2009, total current assets,<br />

non-current assets and non-current liabilities of SMFC amounted to P=1.0 billion, P39.2 million<br />

and P=55.7 million, respectively. SMFC will start its commercial operations in the first quarter of<br />

2010.<br />

Property and Equipment was 12% higher year-on-year to P1.99 billion due to opening of six (6)<br />

additional branches, relocation of various branches, expansion of ATMs and purchases of<br />

computer equipment, furniture and fixtures in 2009.<br />

Goodwill and Other Intangible Assets including software costs and license fees increased by<br />

25% or P38.96 million to P197.47 million.<br />

Other Assets were 5% higher at P687.05 million compared with the December 2008 level of<br />

P654.40 million due to increases in Prepaid expenses, Stationeries and Supplies on Hand and<br />

Returned Checks and Other Cash items. On the other hand, it was partially offset by the decline<br />

in Chattel Mortgage by 27% or to P68.01 million due to this year’s higher disposal of<br />

repossessed vehicles acquired from settlement of loans and receivables.<br />

Deferred Tax Assets went up by 13% to P1.26 billion from P1.11 billion previously mainly due to<br />

payment of MCIT and increase in provisions for impairment and credit losses. This was offset by<br />

the decrease in NOLCO amounting to P211.88 million as the Bank applied the remaining<br />

NOLCO in 2009.<br />

Meanwhile, Fair Value through Profit or Loss (FVPL) Investments declined by 77% to P248.04<br />

million from P1.08 billion as the Bank took profit on its trading account portfolio.<br />

Likewise, Investment Properties decreased by 7% to P2.58 billion from P2.78 billion as a result of<br />

higher disposal of acquired properties.<br />

The Bank’s deposits grew by 25% to P77.39 billion from P61.68 billion recorded the previous<br />

year. Demand and time deposits both increased by 28% or P1.79 billion and P13.12 billion,<br />

respectively.<br />

Treasurer’s, cashier’s and manager’s checks as of December 2009 improved by 49% to P505.74<br />

million from P339.90 million reflected in the same period last year.<br />

Subordinated Notes and Bills Payable decreased by 11% to P1.97 billion as the Bank settled its<br />

interbank borrowings in 2009.<br />

Income Tax Payable slightly increased by P3.35 million to P17.43 million due to higher amount of<br />

gross income on loans subject to tax. Also, Other Liabilities inched up by P275.36 million to<br />

P1.29 billion from P1.02 billion in 2008.<br />

Compared to December 2008, Capital was 30% higher at P11.01 billion from the P8.47 billion<br />

due to movement in net unrealized gains on available-for-sale portfolio. Mark to market (MTM)<br />

gain on available-for-sale investments significantly increased by P1.50 billion to P819.83 million<br />

compared to last year’s MTM loss of P677.29 million. As a result, Capital Adequacy Ratio (CAR)<br />

reached a high of 14.44% in end-2009. This ratio remained way above the minimum regulatory<br />

requirement of 10%.

In 2009, the Bank reflected a negative P1<strong>15</strong>.44 million in its ‘Cumulative translation adjustment’<br />

under equity.<br />

Meanwhile, Return on Average Equity (ROAE) increased to 12.73% in 2009 versus 12.47% in<br />

2008. Likewise, Return on Average Assets (ROAA) went up to 1.48% in 2009 from 1.31% in<br />

2008.<br />

ii. Discussion of Results of Operations<br />

For the years ended December 31, 2010 and 2009<br />

In 2010, the Bank recorded a Net Income after Tax of P1.81 billion or 46% more than the P1.24<br />

billion it posted during the same period last year.<br />

Total Interest Income grew by 5% or P383.57 million, better than the P7.53 billion recorded in the<br />

same period last year.<br />

Interest income on Loans and Receivables showed a 9% improvement or an increase of P496.14<br />

million.<br />

Interest Income on Investment Securities was lower by 12% to P1.71 billion as the Interest<br />

earned from placements with the BSP rose 70% to P<strong>15</strong>8.51 million versus P92.99 million in<br />

2009.<br />

Also, Interest income from Deposits with Other Banks increased by 22% to P7.13 million and<br />

interest earned from Interbank Loans Receivable and Securities Purchased under Resale<br />

Agreements was up by 46% to P160.51 million.<br />

Net Service Fees and Commission Income increased by 16% to P691.68 million from P596.24 in<br />

2009.<br />

Other Operating Income also posted a favorable growth of 201% or P1.69 billion to P2.53 billion.<br />

The Bank took advantage of the trading opportunities in the bond market resulting in higher<br />

trading income of P2.23 billion vs. P543.62 million in 2009 or an increase of P1.69 billion.<br />

The Bank also reflected a lower income on sale of property and equipment which decreased by<br />

76% or P7.44 million to P2.37 million.<br />

The Bank registered higher income on foreclosure of investment properties which increased by<br />

9% or P18.22 million to P224.36 million. This was offset by the loss on foreclosure of chattel<br />

mortgage by 18% or P16.44 million to P108.41 million. On the other hand, gain on sale of<br />

investment properties slid by 52% or P16.34 million to P<strong>15</strong>.24 million, while gain on sale of<br />

chattel mortgage increased by 9% or P3.59 million to P45.39 million.<br />

Meanwhile, Foreign Exchange gain was higher at 22% or P<strong>15</strong>.05 million in 2010 versus P12.33<br />

million in 2009. Miscellaneous income which includes rent income from investment properties<br />

increased by 23% or P20.67 million to P108.95 million in 2010.<br />

Total Interest Expense increased by 8% to P2.90 billion. Interest Expense on Deposit Liabilities<br />

was higher by 8% to P2.69 billion versus the same period last year. In addition, Interest Expense<br />

on bills payable representing interest payments on interbank borrowings declined by 70% to<br />

P1.43 million from P4.83 million. In 2010, The Bank also recognized Interest Expense on Tier 2<br />

amounting to P206.24 million.<br />

Other Expenses was registered at P5.62 billion in 2010, up by 14% compared to 2009 level.<br />

Compensation and Fringe Benefits increased by 17% or P251.98 million due to increases in<br />

number of employees to 2,755 from 2,501 previously and the implementation of the revised<br />

employee benefits based on the new Collective Bargaining Agreement.

Occupancy and equipment costs increased by 17% or P61.41 million to P424.28 million due to<br />

branch and ATM expansion during the year. Likewise, Security, messengerial and janitorial<br />

services increased by 11% or P<strong>15</strong>.96 million to P163.94 million. Depreciation and amortization<br />

was higher by 7% or P23.50 million and Taxes and Licenses rose by 39% or P217.36 million due<br />

to payment of local taxes on renewal of business permits. The Bank’s provisioning levels<br />

decreased by P197.47 Million or 18% from P1.11 billion to P912.28 million in 2010.<br />

As of December 31, 2010, the Bank has a total branch network of 180 compared to 170 in 2009.<br />

By the end of 2010, the Bank had 380 ATMs nationwide versus 306 in 2009. Also in 2010, the<br />

Bank continued its investments in technology and further enhanced its Remote Banking facility.<br />

For the years ended December 31, 2009 and 2008<br />

In 2009, the Bank recorded a net income of P1.24 billion or 32% more than the P940.<strong>15</strong> million<br />

posted during the same period last year.<br />

Total Interest Income grew by 23% or P1.40 billion year-on-year. Interest income on Loans and<br />

Receivables showed a 13% improvement at P5.38 billion. Interest Income on Investment<br />

Securities was higher by 92% to P1.94 billion while Interest earned from placements with the<br />

BSP rose 9% to P92.99 million. Meanwhile, interest income from Deposits with Other Banks slid<br />

76% to P5.84 million while interest earned from Interbank Loans Receivable and Securities<br />

Purchased under Resale Agreements was down 58% to P109.76 million.<br />

The Bank’s Net Service Fees and Commissions rose by 12% to P596.24 million. Other<br />

Operating Income also posted a favorable growth of 21% or P148.02 million to P841.62 million<br />

as the Bank took advantage of the trading opportunities in the bond market. As a result, trading<br />

income rose by P343.89 million to P543.63 million.<br />

The Bank also reflected a higher income on sale of property and equipment which increased by<br />

<strong>15</strong>6% or P5.97 million to P9.80 million.<br />

The Bank registered lower income on foreclosure of investment properties which decreased by<br />

2% or P4.98 million to P206.14 million. Likewise, increase in loss on foreclosure of chattel<br />

mortgage by 53% or P31.83 million to P91.97 million was recognized. On the other hand, gain<br />

on sale of investment properties slid by 22% or P8.85 million to P31.58 million, while gain on sale<br />

of chattel mortgage increased by 46% or P13.23 million to P41.80 million.<br />

Meanwhile, Foreign Exchange gain was lower at P12.3 million in 2009 versus P186.80 million in<br />

2008. Miscellaneous income which includes rent income from investment properties increased by<br />

6% or P5.05 million to P88.28 million in 2009.<br />

Total Interest Expense increased by 11% to P2.70 billion. Interest Expense on Deposit Liabilities<br />

was higher by 13% to P2.49 billion versus the same period last year. In addition, Interest<br />

Expense on bills payable representing interest payments on interbank borrowings declined by<br />

72% to P4.83 million from P17.45 million.<br />

Other Expenses was registered at P4.94 billion in 2009, up by 29% compared to 2008 levels.<br />

Compensation and fringe benefits rose by P264.80 million, while Occupancy and equipment<br />

costs increased by P55.47 million to P362.87 million due to branch and ATM expansion during<br />

the year. Likewise, Security, messengerial and janitorial services increased by P19.29 million to<br />

P147.98 million. Depreciation and amortization was higher by 19% or P54.43 million and Taxes<br />

and Licenses rose by P108.12 million. The Bank also improved its provisioning levels by P532.36<br />

million or 92%.<br />

As of December 31, 2009, the Bank has a total branch network of 170 compared to 164 in 2008.<br />

By the end of 2009, the Bank had 306 ATMs nationwide versus 189 in 2008. Also in 2009, the<br />

Bank continued its investments in technology and further enhanced its Remote Banking facility.

iii. Analysis of Key Performance Indicators<br />

The following basic ratios measure the financial performance of the Bank:<br />

2010 2009 2008<br />

Return on Average Equity ROAE <strong>15</strong>.99% 12.73% 12.47%<br />

Return on Average Assets ROAA 1.83% 1.48% 1.31%<br />

Net Interest Margin on<br />

Average Earning Assets NIM 5.57% 6.43% 5.75%<br />

Earnings per share EPS 7.53 5.16 3.98<br />

Capital-to-Risk Assets Ratio CAR <strong>15</strong>.37% 14.44% 17.42%<br />

2010 vs. 2009 Comparative highlights on key performance indicators<br />

1. Return on Average Equity (ROAE) increased to <strong>15</strong>.99% in 2010 from 12.73% in 2009. ROAE<br />

measures how well the Bank is using common shareholders’ invested money. It is calculated by<br />

dividing net income by the year-on-year average of the outstanding shareholders’ equity.<br />

2. Return on Average Assets (ROAA) as of December 31, 2010 improved to 1.83% from last<br />

year’s 1.48%. ROAA is calculated by dividing net income by the year-on-year average of the<br />

outstanding total assets.<br />

3. Net Interest Margin on Average Earning Assets (NIM) decreased to 5.57% in 2010 from 6.43%<br />

in 2009. NIM is calculated by dividing the net interest income by the average earning assets.<br />

4. Earnings per Share (EPS) increased to P7.53 as of 2010 versus P5.16 in 2009. EPS is the<br />

net profit the Bank has generated per common share. It is computed by dividing net income by<br />

the number of outstanding common shares.<br />

5. Capital to Risk Assets Ratio (CAR) was at <strong>15</strong>.37% in 2010 from 14.44% in 2009. CAR is the<br />

measure of the Bank’s capital strength. It is calculated by dividing the qualified capital by riskweighted<br />

assets as defined by the Bangko Sentral ng Pilipinas (BSP).<br />

2009 vs. 2008 Comparative highlights on key performance indicators<br />

1. Return on Average Equity (ROAE) climbed steadily to 12.73% in 2009 from 12.47% in 2008.<br />

ROAE measures how well the Bank is using common shareholders’ invested money. It is<br />

calculated by dividing net income by the year-on-year average of the outstanding shareholders’<br />

equity.<br />

2. Return on Average Assets (ROAA) as of December 31, 2009 improved to 1.48% from last<br />

year’s 1.31%. ROAA is calculated by dividing net income by the year-on-year average of the<br />

outstanding total assets.<br />

3. Net Interest Margin on Average Earning Assets (NIM) increased to 6.43% in 2009 from 5.75%<br />

in 2008. NIM is calculated by dividing the net interest income by the average earning assets.<br />

4. Earnings per Share (EPS) likewise increased to P5.16 for the year 2009 as against the P3.98<br />

posted in the year 2008. EPS is the net profit the Bank has generated per common share. It is<br />

computed by dividing net income by average number of outstanding common shares.<br />

5. Capital to Risk Assets Ratio (CAR) declined to 14.44% in 2009 from 17.42% in 2008. CAR is<br />

the measure of the Bank’s capital strength. It is calculated by dividing the qualified capital by riskweighted<br />

assets as defined by the Bangko Sentral ng Pilipinas (BSP).

iv. Key Variables and Other Qualitative and Quantitative Factors<br />

a) Liquidity<br />

<strong>PSBank</strong> manages its liquidity position to ensure that it has more than adequate funds to meet its<br />

obligations at any given time. The Bank monitors its daily liquidity and reserve position by<br />

determining inflows and outflows, short-term and long-term obligations, holdings and repayments.<br />

Short-term liquidity management identifies obligations and repayments in the next 12-months,<br />

aids in the determination of the securities trading strategy, and influences the Bank’s pricing<br />

mechanism. On the other hand, long-term liquidity management covers maturing obligations and<br />

repayments of loans and investments beyond the next 12-months.<br />

The Bank’s consistent prudent management of its liquidity and sustained deposit growth in 2010<br />

has led to the further improvement of its liquidity profile. Furthermore, the level of liquid assets<br />

remained strong, exhibiting healthy growth in both interbank lendings and securities investments.<br />

With the Bank’s high capitalization, current liquidity position, strong deposit growth trend,<br />

continuing development of retail and corporate accounts, and prudent liquidity management,<br />

<strong>PSBank</strong> does not anticipate encountering any cash flow or liquidity problems in the next 12<br />

months. It remains confident of its ability to meet its obligations and is committed to providing the<br />

necessary funding to support the projected loan growth, investment activities and expenditures<br />

for 2010.<br />

b) Events that will trigger Direct or Contingent Financial Obligation<br />

In the normal course of the Bank's operations, there are various outstanding commitments and<br />

contingent liabilities such as guarantees and commitments to extend credit, which are not<br />

reflected in the accompanying financial statements. The Bank does not anticipate significant<br />

losses as a result of these transactions.<br />

Also, several suit and claims relating to the Bank’s lending operations and labor-related cases<br />

remain unsettled. In the opinion of management, these suits and claims, if decided adversely, will<br />

not involve sums having a material effect on the financial statements.<br />

c) Material Off-Balance Sheet Transactions, Arrangements and Obligations<br />

The following is a summary of the Bank’s commitments and contingent liabilities at their<br />

equivalent peso contractual amounts:<br />

2010 2009 2008<br />

Trust department accounts 631,063,745 630,040,803 508,442,498<br />

Stand-by credit line 112,514,393 104,023,029 <strong>15</strong>1,342,780<br />

Late deposits/ payments received 58,460,284 88,146,816 22,273,773<br />

Items held for safekeeping 336,370 232,334 208,889<br />

Outward bills for collection – 82,141 88,735<br />

Others 24,994 24,107 75,201<br />

None of these off-balance sheet transactions, arising in the ordinary course, either individually or<br />

in the aggregate, are expected to have a material adverse effect on the Bank of its financial<br />

condition.

d) Material Commitments for Capital Expenditures<br />

The Bank completed in 2008 the issuance of common shares through another stock rights<br />

offering and was able to raise P2.0 billion in capital. In general, the Bank used the net proceeds<br />

from the Offer in strengthening its capital adequacy ratio, taking into account the effects of the<br />

Basel II and continuously enhancing its financial flexibility as well as for general corporate<br />

purposes including but not limited to lending, working capital and investment purposes.<br />

The Bank’s Capital Expenditures in 2010 includes projected expenses for IT-related activities on<br />

systems, infrastructure, and licenses; computer and peripherals; upgrade of bank premises<br />

including furniture, fixtures and equipment. For <strong>2011</strong>, the Bank plans to open fifteen (<strong>15</strong>) more<br />

branches and put up 95 additional offsite ATMs.<br />

e) Causes for Any Material Changes from Period to Period of Financial Statements<br />

See previous discussion on Analysis of Statement of Condition and Discussion of Results of<br />

Operations.<br />

f) Known Trends, Events or Uncertainties or Seasonal Aspects<br />

The financial statements of the Bank have been prepared in compliance with Philippine Financial<br />

Reporting Standards (PFRS).<br />

g) Changes in Accounting Policies and Disclosures<br />

The accounting policies adopted are consistent with those of the previous financial year. The<br />

issuance of and the amendments to the following standards and interpretations which became<br />

effective as of January 1, 2010, did not have any impact on the accounting policies, financial<br />

position or performance of the Bank:<br />

• PFRS 2 Amendments - Group Cash-settled Share-based Payment Transaction, effective for<br />

annual periods beginning on or after January 1, 2010<br />

• PFRS 3, Business Combinations (Revised), effective for annual period beginning on or after<br />

July 1, 2009<br />

• Philippine Accounting Standard (PAS) 27, Consolidated and Separate Financial Statements<br />

(Amended), effective for annual periods beginning on or after July 1, 2009<br />

• PAS 39 Amendment - Eligible Hedged Items, effective for annual periods beginning on or<br />

after July 1, 2009<br />

• Philippine Interpretation International Financial Reporting Interpretation Committee (IFRIC)<br />

17, Distributions of Non-Cash Assets to Owners, effective for annual periods beginning on or<br />

after July 1, 2009 with early application permitted<br />

Improvements to PFRSs<br />

Improvements to PFRSs, an omnibus of amendments to standards, deal primarily with a view to<br />

removing inconsistencies and clarifying wording. There are separate transitional provisions for<br />

each standard. The adoption of the following amendments resulted in changes to accounting<br />

policies but did not have any impact on the financial position or performance of the Bank.<br />

Improvements to PFRSs 2008<br />

The amendment arising from the 2008 Improvements to PFRSs is effective for annual periods<br />

beginning on or after July 1, 2009.<br />

• PFRS 5, Non-current Assets Held for Sale and Discontinued Operations, clarifies that when a<br />

subsidiary is classified as held for sale, all its assets and liabilities are classified as held for<br />

sale, even when the entity remains a non-controlling interest after the sale transaction.

Improvements to PFRSs 2009<br />

The amendments in the 2009 Improvements to PFRSs are effective for annual periods beginning<br />

on or after July 1, 2009, except for the amendments to PFRS 5, PFRS 8, PAS 1, PAS 7, PAS 17,<br />

PAS 36 and PAS 39, which are effective for annual periods beginning on or after January 1,<br />

2010. The amendment to PAS 18 was effective from issue date of the standard in <strong>April</strong> 2009.<br />

• PFRS 5, clarifies that the disclosures required in respect of non-current assets and disposal<br />