PSAB at a Glance: Section PS 1201 - Financial ... - BDO Canada

PSAB at a Glance: Section PS 1201 - Financial ... - BDO Canada

PSAB at a Glance: Section PS 1201 - Financial ... - BDO Canada

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

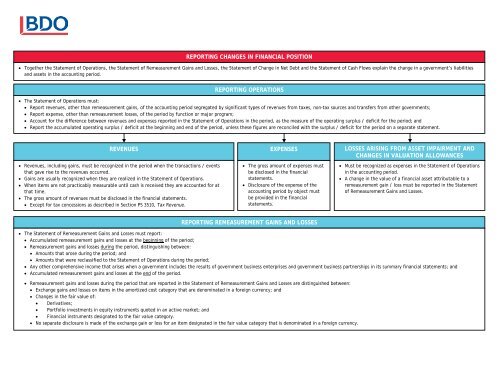

REPORTING CHANGES IN FINANCIAL POSITION<br />

• Together the St<strong>at</strong>ement of Oper<strong>at</strong>ions, the St<strong>at</strong>ement of Remeasurement Gains and Losses, the St<strong>at</strong>ement of Change in Net Debt and the St<strong>at</strong>ement of Cash Flows explain the change in a government’s liabilities<br />

and assets in the accounting period.<br />

REPORTING OPERATIONS<br />

• The St<strong>at</strong>ement of Oper<strong>at</strong>ions must:<br />

• Report revenues, other than remeasurement gains, of the accounting period segreg<strong>at</strong>ed by significant types of revenues from taxes, non-tax sources and transfers from other governments;<br />

• Report expense, other than remeasurement losses, of the period by function or major program;<br />

• Account for the difference between revenues and expenses reported in the St<strong>at</strong>ement of Oper<strong>at</strong>ions in the period, as the measure of the oper<strong>at</strong>ing surplus / deficit for the period; and<br />

• Report the accumul<strong>at</strong>ed oper<strong>at</strong>ing surplus / deficit <strong>at</strong> the beginning and end of the period, unless these figures are reconciled with the surplus / deficit for the period on a separ<strong>at</strong>e st<strong>at</strong>ement.<br />

REVENUES<br />

• Revenues, including gains, must be recognized in the period when the transactions / events<br />

th<strong>at</strong> gave rise to the revenues occurred.<br />

• Gains are usually recognized when they are realized in the St<strong>at</strong>ement of Oper<strong>at</strong>ions.<br />

• When items are not practicably measurable until cash is received they are accounted for <strong>at</strong><br />

th<strong>at</strong> time.<br />

• The gross amount of revenues must be disclosed in the financial st<strong>at</strong>ements.<br />

• Except for tax concessions as described in <strong>Section</strong> <strong>PS</strong> 3510, Tax Revenue.<br />

EXPENSES<br />

• The gross amount of expenses must<br />

be disclosed in the financial<br />

st<strong>at</strong>ements.<br />

• Disclosure of the expense of the<br />

accounting period by object must<br />

be provided in the financial<br />

st<strong>at</strong>ements.<br />

LOSSES ARISING FROM ASSET IMPAIRMENT AND<br />

CHANGES IN VALUATION ALLOWANCES<br />

• Must be recognized as expenses in the St<strong>at</strong>ement of Oper<strong>at</strong>ions<br />

in the accounting period.<br />

• A change in the value of a financial asset <strong>at</strong>tributable to a<br />

remeasurement gain / loss must be reported in the St<strong>at</strong>ement<br />

of Remeasurement Gains and Losses.<br />

REPORTING REMEASUREMENT GAINS AND LOSSES<br />

• The St<strong>at</strong>ement of Remeasurement Gains and Losses must report:<br />

• Accumul<strong>at</strong>ed remeasurement gains and losses <strong>at</strong> the beginning of the period;<br />

• Remeasurement gains and losses during the period, distinguishing between:<br />

• Amounts th<strong>at</strong> arose during the period; and<br />

• Amounts th<strong>at</strong> were reclassified to the St<strong>at</strong>ement of Oper<strong>at</strong>ions during the period;<br />

• Any other comprehensive income th<strong>at</strong> arises when a government includes the results of government business enterprises and government business partnerships in its summary financial st<strong>at</strong>ements; and<br />

• Accumul<strong>at</strong>ed remeasurement gains and losses <strong>at</strong> the end of the period.<br />

• Remeasurement gains and losses during the period th<strong>at</strong> are reported in the St<strong>at</strong>ement of Remeasurement Gains and Losses are distinguished between:<br />

• Exchange gains and losses on items in the amortized cost c<strong>at</strong>egory th<strong>at</strong> are denomin<strong>at</strong>ed in a foreign currency; and<br />

• Changes in the fair value of:<br />

• Deriv<strong>at</strong>ives;<br />

• Portfolio investments in equity instruments quoted in an active market; and<br />

• <strong>Financial</strong> instruments design<strong>at</strong>ed to the fair value c<strong>at</strong>egory.<br />

• No separ<strong>at</strong>e disclosure is made of the exchange gain or loss for an item design<strong>at</strong>ed in the fair value c<strong>at</strong>egory th<strong>at</strong> is denomin<strong>at</strong>ed in a foreign currency.