Personal Banking Brochure - Farmers & Merchants Bank

Personal Banking Brochure - Farmers & Merchants Bank

Personal Banking Brochure - Farmers & Merchants Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Personal</strong> <strong><strong>Bank</strong>ing</strong><br />

fmb.com | Member FDIC<br />

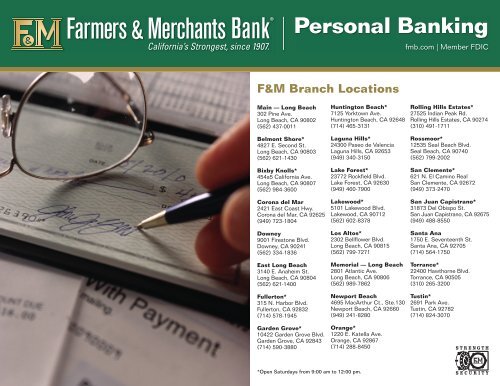

F&M Branch Locations<br />

Main — Long Beach<br />

302 Pine Ave.<br />

Long Beach, CA 90802<br />

(562) 437-0011<br />

Belmont Shore*<br />

4827 E. Second St.<br />

Long Beach, CA 90803<br />

(562) 621-1430<br />

Bixby Knolls*<br />

454a5 California Ave.<br />

Long Beach, CA 90807<br />

(562) 984-3600<br />

Corona del Mar<br />

2421 East Coast Hwy.<br />

Corona del Mar, CA 92625<br />

(949) 723-1804<br />

Downey<br />

9001 Firestone Blvd.<br />

Downey, CA 90241<br />

(562) 334-1836<br />

East Long Beach<br />

3140 E. Anaheim St.<br />

Long Beach, CA 90804<br />

(562) 621-1400<br />

Fullerton*<br />

315 N. Harbor Blvd.<br />

Fullerton, CA 92832<br />

(714) 578-1945<br />

Garden Grove*<br />

10422 Garden Grove Blvd.<br />

Garden Grove, CA 92843<br />

(714) 590-3880<br />

Huntington Beach*<br />

7125 Yorktown Ave.<br />

Huntington Beach, CA 92648<br />

(714) 465-3131<br />

Laguna Hills*<br />

24300 Paseo de Valencia<br />

Laguna Hills, CA 92653<br />

(949) 340-3150<br />

Lake Forest*<br />

23772 Rockfield Blvd.<br />

Lake Forest, CA 92630<br />

(949) 460-7900<br />

Lakewood*<br />

5101 Lakewood Blvd.<br />

Lakewood, CA 90712<br />

(562) 602-8378<br />

Los Altos*<br />

2302 Bellflower Blvd.<br />

Long Beach, CA 90815<br />

(562) 799-7271<br />

Memorial — Long Beach<br />

2801 Atlantic Ave.<br />

Long Beach, CA 90806<br />

(562) 989-7862<br />

Newport Beach<br />

4695 MacArthur Ct., Ste.130<br />

Newport Beach, CA 92660<br />

(949) 241-8280<br />

Orange*<br />

1220 E. Katella Ave.<br />

Orange, CA 92867<br />

(714) 288-8450<br />

Rolling Hills Estates*<br />

27525 Indian Peak Rd.<br />

Rolling Hills Estates, CA 90274<br />

(310) 491-1711<br />

Rossmoor*<br />

12535 Seal Beach Blvd.<br />

Seal Beach, CA 90740<br />

(562) 799-2002<br />

San Clemente*<br />

621 N. El Camino Real<br />

San Clemente, CA 92672<br />

(949) 373-2470<br />

San Juan Capistrano*<br />

31873 Del Obispo St.<br />

San Juan Capistrano, CA 92675<br />

(949) 488-8550<br />

Santa Ana<br />

1750 E. Seventeenth St.<br />

Santa Ana, CA 92705<br />

(714) 564-1750<br />

Torrance*<br />

22400 Hawthorne Blvd.<br />

Torrance, CA 90505<br />

(310) 265-3200<br />

Tustin*<br />

2691 Park Ave.<br />

Tustin, CA 92782<br />

(714) 824-3070<br />

*Open Saturdays from 9:00 am to 12:00 pm.

<strong>Personal</strong> <strong><strong>Bank</strong>ing</strong><br />

Additional Products and Services<br />

Credit & Loans *<br />

Home Equity Lines of Credit<br />

Home Mortgages<br />

Escrow Services<br />

> Residential Sales<br />

> Loan Escrows<br />

> Refinance Escrows<br />

F&M Visa ® Card<br />

Additional Savings Accounts<br />

Market Rate Certificates of Deposit (CDs)<br />

> $1,000 minimum opening<br />

> Decide the length of term and select when and how your interest<br />

payments will be made.<br />

Health Savings Account:<br />

> $100 minimum opening<br />

> Manage your out-of-pocket healthcare costs and take control of<br />

your savings.<br />

Christmas Club Savings Account:<br />

> No minimum opening<br />

> Let us help you start saving for the holidays.<br />

IRAs:<br />

> $500 minimum opening<br />

> Traditional, Roth or SEP-IRA plans.<br />

We Also Offer<br />

Mobile <strong><strong>Bank</strong>ing</strong> including Mobile Check Deposit<br />

Online <strong><strong>Bank</strong>ing</strong><br />

Bill Pay services available through Online <strong><strong>Bank</strong>ing</strong><br />

eStatements & eNotices<br />

Direct Deposit<br />

Check images on monthly statement<br />

24/7 telephone access<br />

No-fee access to F&M <strong>Bank</strong> ATMs<br />

Extended Friday hours at select branches<br />

Saturday banking hours at select branches<br />

Accounts can be combined into one easy-to-read<br />

monthly statement<br />

F&M Gift Cards<br />

Travelers Checks<br />

Money Orders & Cashier’s Checks<br />

Youth Accounts<br />

...and much more.<br />

*All credit and loan products subject to credit approval. For complete account details refer to fmb.com/fees

<strong>Personal</strong> <strong><strong>Bank</strong>ing</strong> Products<br />

General Description<br />

<strong>Personal</strong> Checking Interest Checking Varsity Checking Elite Checking<br />

A checking account for the person<br />

who wants an economical checking<br />

plan.<br />

A checking account that provides<br />

interest earnings for the person who<br />

maintains higher balances.<br />

A checking account for students<br />

ages 12 to 17, with an adult as a joint<br />

account holder.<br />

Minimum Opening Balance $100 $100 $25 $25<br />

Balance Required to Waive<br />

Minimum Balance Fees<br />

Minimum Balance Fees<br />

Account Features<br />

Minimum daily balance of $500 or an<br />

average daily balance of $1,000.<br />

$5.00 per month plus $0.30 per<br />

check paid.<br />

> Unlimited check writing<br />

> Check images included with<br />

monthly statement 7<br />

> FDIC insured<br />

Average daily balance for the month of<br />

$1,000.<br />

$5.00 per month plus $0.30 per<br />

check paid.<br />

> Unlimited check writing<br />

> FDIC insured<br />

None/Not Applicable<br />

None/Not Applicable<br />

> Free 1st order of checking deposit<br />

slips<br />

> Check images included with<br />

monthly statement 7<br />

> FDIC insured<br />

A checking account for college<br />

students ages 18 to 24.<br />

None/Not Applicable<br />

Not Applicable<br />

> Free 1st order of Mini-Pack Checks<br />

> Unlimited check writing<br />

> Check images included with<br />

monthly statement 7<br />

> FDIC insured<br />

> MasterMoney® Debit Card 1 > Varsity Debit MasterCard® 1 > Elite Debit MasterCard® 1<br />

Account Options 4 > MasterMoney® Debit Card 1<br />

online banking 2<br />

> No-fee access to F&M ATMs 1 online banking 2<br />

> No-fee access to F&M ATMs 1 institution’s ATM is used 1 online banking 2<br />

> No-fee access to F&M ATMs 1<br />

> Online <strong><strong>Bank</strong>ing</strong> 2<br />

> eStatements & eNotices 2<br />

> Overdraft protection 6<br />

> Bill Pay service available through<br />

> Online <strong><strong>Bank</strong>ing</strong> 2<br />

> eStatements & eNotices 2<br />

> Overdraft protection 6<br />

> Bill Pay service available through<br />

> Online <strong><strong>Bank</strong>ing</strong> 2<br />

> eStatements & eNotices 2<br />

> No-fee access to F&M ATMs 1<br />

> No F&M fee when another<br />

> Online <strong><strong>Bank</strong>ing</strong> 2<br />

> eStatements & eNotices 2<br />

> Overdraft protection 6<br />

> Bill Pay service available through<br />

> No F&M fee when another<br />

institution’s ATM is used 1<br />

Interest None/Not Applicable Competitive variable rate; interest<br />

accrues daily, paid to the account<br />

monthly. If the account is closed before<br />

interest is paid, the accrued interest will<br />

not be credited.<br />

Other Direct Service Fees 5<br />

<strong>Personal</strong> Checks - cost varies by style.<br />

$10 early closure fee, if the account is<br />

closed within 90 days of opening.<br />

<strong>Personal</strong> Checks - cost varies by style.<br />

$10 early closure fee, if the account is<br />

closed within 90 days of opening.<br />

None/Not Applicable<br />

To avoid a $3 paper statement fee<br />

assessed each month for a paper copy<br />

of an account statement or notice mailed<br />

or requested during the month, enroll<br />

for electronic delivery of statements and<br />

notices through Online <strong><strong>Bank</strong>ing</strong>. $10<br />

early closure fee, if the account is closed<br />

within 90 days of opening.<br />

None/Not Applicable<br />

To avoid a $3 paper statement fee<br />

assessed each month for a paper copy<br />

of an account statement or notice mailed<br />

or requested during the month, enroll<br />

for electronic delivery of statements and<br />

notices through Online <strong><strong>Bank</strong>ing</strong>. Bill Pay<br />

free for up to 5 payments per month, .50¢<br />

per each additional payment. $10 early<br />

closure fee, if the account is closed within<br />

90 days of opening.<br />

For details about your account, please ask our staff or refer to the account agreement and disclosures provided at time of opening. For Current Rates ask our branch staff.<br />

1. Some banks may charge a surcharge for use of their ATM. The fee is disclosed at the time of your transaction. This fee will be processed directly as a part of the debit to your account by the bank who owns the ATM. Refer to your Electronic<br />

Fund Transfer agreement and disclosure statement. 2. Online <strong><strong>Bank</strong>ing</strong> and Bill Pay service requires a separate application, agreement and approval (eStatements require enrollment). Transfers initiated through the Online <strong><strong>Bank</strong>ing</strong> system<br />

before 6:00 p.m. (Pacific Time) on a business day are posted to your account the same day. Transfers completed after 6:00 p.m. (Pacific Time) on a business day, Saturday, Sunday or <strong><strong>Bank</strong>ing</strong> holiday, will be posted on the next business day.<br />

Other transaction or account fees may apply. Refer to the <strong>Bank</strong>’s Services and Fees brochure for details. Online <strong><strong>Bank</strong>ing</strong> access for clients ages 13 and over. 3. No more than 6 transfers or withdrawals during any month may be made to<br />

another account of the Depositor or to a 3rd party by means of a pre-authorized, automatic or telephonic transfer, or by check, draft, debit card, ATM card or similar order payable to 3rd parties. Exceeding these limitations may result in the<br />

transfer of the account to one that pays no interest. 4. Account Options may require separate application, agreement or consent. Transaction limitations or fees may apply. Refer to the specific product or service disclosure or the <strong>Bank</strong>’s<br />

Services and Fees brochure for details. 5. Other fees and charges may apply for special services such as telephone transfers and special statements, etc. Refer to the <strong>Bank</strong>’s Services and Fees brochure for details 6. Overdraft protection<br />

options include sweep transfers from your related savings account, F&M Credit Card or Bounce Protection program. F&M Credit Cards require a separate application and credit approval. See Credit Card account agreement for restrictions and<br />

fees. Bounce Protection SM is an overdraft privilege limit that is automatically assigned to qualified consumer checking and money market accounts. Overdrafts created by check, in-person withdrawal, or other electronic means will be honored<br />

up to the account’s Bounce Protection SM limit. To receive the benefit of Bounce Protection SM overdraft coverage related to ATM and everyday debit transactions, an opt-in authorization form is needed. Use of this overdraft privilege may be<br />

utilized 90 days after the account is opened if the account is in good standing and no legal orders are outstanding. “Good standing” is defined as making regular deposits and bringing the account to a positive balance at least once every 30<br />

days. For each item paid through Bounce Protection SM , the <strong>Bank</strong>’s standard overdraft fee will be charged (refer to the <strong>Bank</strong>’s Services and Fees schedule). Bounce Protection SM is a non-contractual courtesy and we reserve the right not to pay.<br />

For example, we typically do not pay overdrafts if your account is not in good standing, or you are not making regular deposits, or you have too many overdrafts. 7. We will provide you with an image of your canceled check instead of returning<br />

the checks to you on your account statement. Check Imaging is a process of capturing, indexing, storing, and retrieving images of checks. The images are retained by the bank for a period of at least seven years from the date of posting.

<strong>Personal</strong> <strong><strong>Bank</strong>ing</strong> Products Cont’d<br />

General Description<br />

Youth Savings Market Rate Money Market Account 3 Market Rate Savings 3<br />

A joint account to hold funds belonging to a minor<br />

(under 21 years of age) and an adult.<br />

A limited transaction account that earns a<br />

competitive interest rate. Keep your funds liquid and<br />

secure.<br />

Minimum Opening Balance $25 $100 $100<br />

Balance Required to Waive<br />

Minimum Balance Fees<br />

Minimum Balance Fees<br />

A savings account that fits any budget and pays a<br />

competitive rate of interest.<br />

None/Not Applicable Minimum daily balance of $2,500 Average daily balance of $200 for quarter or minimum<br />

daily balance of $500.<br />

$2.00 for each withdrawal exceeding 3 during a<br />

quarter, if the minimum daily balance falls below $200.<br />

Account Features > Limited withdrawal privileges 3<br />

> Unlimited deposits<br />

> FDIC insured<br />

$7.00 per month $5.00 per quarter, if average daily balance falls below<br />

$200. $2.00 for each withdrawal exceeding 3 during a<br />

quarter, if the minimum daily balance falls below $500.<br />

> Limited withdrawal privileges 3<br />

> Unlimited deposits<br />

> Check images included with monthly<br />

statement 7<br />

> FDIC insured<br />

> Limited withdrawal privileges 3<br />

> Unlimited deposits<br />

> FDIC insured<br />

> MasterMoney® Debit Card 1<br />

> ATM access when linked to your F&M checking<br />

Account Options 4 > Online <strong><strong>Bank</strong>ing</strong> 2<br />

> eStatements & eNotices 2 > No-fee access to F&M ATMs 1<br />

> Online <strong><strong>Bank</strong>ing</strong> 2<br />

> eStatements & eNotices 2 MasterMoney Debit Card 1<br />

> No-fee access to F&M ATMs 1<br />

> Online <strong><strong>Bank</strong>ing</strong> 2<br />

> eStatements & eNotices 2<br />

Interest<br />

Other Direct Service Fees 5<br />

Competitive variable tiered rate based on balance;<br />

interest accrues daily, paid to the account quarterly.<br />

If the account is closed before interest is paid, the<br />

accrued interest will not be credited. Tiers offered:<br />

$0.01-$999.99; $1,000-$19,999.99; $20,000 or more.<br />

$5.00 early closure fee, if the account is closed within<br />

12 months of opening.<br />

Competitive variable tiered rate based on balance;<br />

interest accrues daily, paid to the account monthly.<br />

If the account is closed before interest is paid, the<br />

accrued interest will not be credited. Tiers offered:<br />

$0.01-$9,999.99; $10,000-$24,999.99; $25,000-<br />

$49,999.99; $50,000-$99,999.99; $100,000 or more.<br />

<strong>Personal</strong> Checks - cost varies by style. $10 early<br />

closure fee, if the account is closed within 90 days of<br />

opening.<br />

Competitive variable tiered rate based on balance;<br />

interest accrues daily, paid to the account quarterly.<br />

If the account is closed before interest is paid, the<br />

accrued interest will not be credited. Tiers offered:<br />

$0.01-$9,999.99; $10,000-$24,999.99; $25,000-<br />

$49,999.99; $50,000-$99,999.99; $100,000 or more.<br />

$5.00 early closure fee, if the account is closed within<br />

12 months of opening.<br />

For details about your account, please ask our staff or refer to the account agreement and disclosures provided at time of opening. For Current Rates ask our branch staff.<br />

1. Some banks may charge a surcharge for use of their ATM. The fee is disclosed at the time of your transaction. This fee will be processed directly as a part of the debit to your account by the bank who owns the ATM. Refer to your Electronic<br />

Fund Transfer agreement and disclosure statement. 2. Online <strong><strong>Bank</strong>ing</strong> and Bill Pay service requires a separate application, agreement and approval (eStatements require enrollment). Transfers initiated through the Online <strong><strong>Bank</strong>ing</strong> system<br />

before 6:00 p.m. (Pacific Time) on a business day are posted to your account the same day. Transfers completed after 6:00 p.m. (Pacific Time) on a business day, Saturday, Sunday or <strong><strong>Bank</strong>ing</strong> holiday, will be posted on the next business day.<br />

Other transaction or account fees may apply. Refer to the <strong>Bank</strong>’s Services and Fees brochure for details. Online <strong><strong>Bank</strong>ing</strong> access for clients ages 13 and over. 3. No more than 6 transfers or withdrawals during any month may be made to<br />

another account of the Depositor or to a 3rd party by means of a pre-authorized, automatic or telephonic transfer, or by check, draft, debit card, ATM card or similar order payable to 3rd parties. Exceeding these limitations may result in the<br />

transfer of the account to one that pays no interest. 4. Account Options may require separate application, agreement or consent. Transaction limitations or fees may apply. Refer to the specific product or service disclosure or the <strong>Bank</strong>’s<br />

Services and Fees brochure for details. 5. Other fees and charges may apply for special services such as telephone transfers and special statements, etc. Refer to the <strong>Bank</strong>’s Services and Fees brochure for details 6. Overdraft protection<br />

options include sweep transfers from your related savings account, F&M Credit Card or Bounce Protection program. F&M Credit Cards require a separate application and credit approval. See Credit Card account agreement for restrictions and<br />

fees. Bounce Protection SM is an overdraft privilege limit that is automatically assigned to qualified consumer checking and money market accounts. Overdrafts created by check, in-person withdrawal, or other electronic means will be honored<br />

up to the account’s Bounce Protection SM limit. To receive the benefit of Bounce Protection SM overdraft coverage related to ATM and everyday debit transactions, an opt-in authorization form is needed. Use of this overdraft privilege may be<br />

utilized 90 days after the account is opened if the account is in good standing and no legal orders are outstanding. “Good standing” is defined as making regular deposits and bringing the account to a positive balance at least once every 30<br />

days. For each item paid through Bounce Protection SM , the <strong>Bank</strong>’s standard overdraft fee will be charged (refer to the <strong>Bank</strong>’s Services and Fees schedule). Bounce Protection SM is a non-contractual courtesy and we reserve the right not to pay.<br />

For example, we typically do not pay overdrafts if your account is not in good standing, or you are not making regular deposits, or you have too many overdrafts. 7. We will provide you with an image of your canceled check instead of returning<br />

the checks to you on your account statement. Check Imaging is a process of capturing, indexing, storing, and retrieving images of checks. The images are retained by the bank for a period of at least seven years from the date of posting.