Účtovná uzávierka 2004

Účtovná uzávierka 2004

Účtovná uzávierka 2004

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes as at 31 December <strong>2004</strong><br />

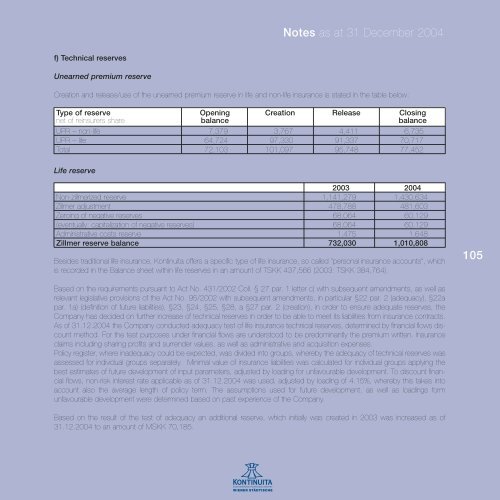

f) Technical reserves<br />

Unearned premium reserve<br />

Creation and release/use of the unearned premium reserve in life and non-life insurance is stated in the table below:<br />

Type of reserve Opening Creation Release Closing<br />

net of reinsurers share balance balance<br />

UPR – non-life 7,379 3,767 4,411 6,735<br />

UPR – life 64,724 97,330 91,337 70,717<br />

Total 72,103 101,097 95,748 77,452<br />

Life reserve<br />

2003 <strong>2004</strong><br />

Non-zillmerized reserve 1,141,279 1,430,634<br />

Zillmer adjustment 478,788 481,603<br />

Zeroing of negative reserves 68,064 60,129<br />

(eventually: capitalization of negative reserves) 68,064 60,129<br />

Administrative costs reserve 1,475 1,648<br />

Zillmer reserve balance 732,030 1,010,808<br />

Besides traditional life insurance, Kontinuita offers a specific type of life insurance, so called “personal insurance accounts”, which<br />

is recorded in the Balance sheet within life reserves in an amount of TSKK 437,566 (2003: TSKK 384,764).<br />

105<br />

Based on the requirements pursuant to Act No. 431/2002 Coll. § 27 par. 1 letter c) with subsequent amendments, as well as<br />

relevant legislative provisions of the Act No. 95/2002 with subsequent amendments, in particular §22 par. 2 (adequacy), §22a<br />

par. 1a) (definition of future liabilities), §23, §24, §25, §28, a §27 par. 2 (creation), in order to ensure adequate reserves, the<br />

Company has decided on further increase of technical reserves in order to be able to meet its liabilities from insurance contracts.<br />

As of 31.12.<strong>2004</strong> the Company conducted adequacy test of life insurance technical reserves, determined by financial flows discount<br />

method. For the test purposes under financial flows are understood to be predominantly the premium written. Insurance<br />

claims including sharing profits and surrender values, as well as administrative and acquisition expenses.<br />

Policy register, where inadequacy could be expected, was divided into groups, whereby the adequacy of technical reserves was<br />

assessed for individual groups separately. Minimal value of insurance liabilities was calculated for individual groups applying the<br />

best estimates of future development of input parameters, adjusted by loading for unfavourable development. To discount financial<br />

flows, non-risk interest rate applicable as of 31.12.<strong>2004</strong> was used, adjusted by loading of 4.15%, whereby this takes into<br />

account also the average length of policy term. The assumptions used for future development, as well as loadings form<br />

unfavourable development were determined based on past experience of the Company.<br />

Based on the result of the test of adequacy an additional reserve, which initially was created in 2003 was increased as of<br />

31.12.<strong>2004</strong> to an amount of MSKK 70,185.