Card Application Form - OCBC Bank

Card Application Form - OCBC Bank

Card Application Form - OCBC Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BCCAPP June v. 042013 2014<br />

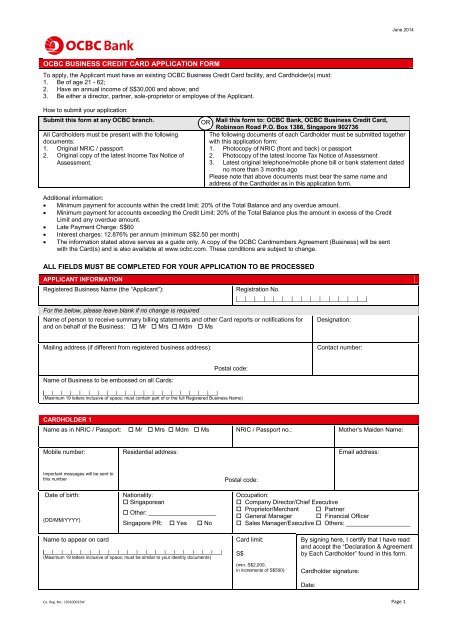

<strong>OCBC</strong> BUSINESS CREDIT CARD APPLICATION FORM<br />

To apply, the Applicant must have an existing <strong>OCBC</strong> Business Credit <strong>Card</strong> facility, and <strong>Card</strong>holder(s) must:<br />

1. Be of age 21 - 62;<br />

2. Have an annual income of S$30,000 and above; and<br />

3. Be either a director, partner, sole-proprietor or employee of the Applicant.<br />

How to submit your application:<br />

Submit this form at any <strong>OCBC</strong> branch.<br />

All <strong>Card</strong>holders must be present with the following<br />

documents:<br />

1. Original NRIC / passport<br />

2. Original copy of the Income latest Tax Income Notice Tax of Notice Assessment of<br />

for Assessment. Year 2012<br />

OR Mail this form to: <strong>OCBC</strong> <strong>Bank</strong>, <strong>OCBC</strong> Business Credit <strong>Card</strong>,<br />

Robinson Road P.O. Box 1386, Singapore 902736<br />

The following documents of each <strong>Card</strong>holder must be submitted together<br />

with this application form:<br />

1. Photocopy of NRIC (front and back) or passport<br />

2. Photocopy of the Income latest Tax Income Notice Tax of Notice Assessment of Assessment for Year 2012<br />

3. Latest original telephone/mobile phone bill or bank statement dated<br />

no more than 3 months ago<br />

Please note that above documents must bear the same name and<br />

address of the <strong>Card</strong>holder as in this application form.<br />

Additional information:<br />

Minimum payment for accounts within the credit limit: 20% of the Total Balance and any overdue amount.<br />

Minimum payment for accounts exceeding the Credit Limit: 20% of the Total Balance plus the amount in excess of the Credit<br />

Limit and any overdue amount.<br />

Late Payment Charge: S$60<br />

Interest charges: 12.876% per annum (minimum S$2.50 per month)<br />

The information stated above serves as a guide only. A copy of the <strong>OCBC</strong> <strong>Card</strong>members Agreement (Business) will be sent<br />

with the <strong>Card</strong>(s) and is also available at www.ocbc.com. These conditions are subject to change.<br />

ALL FIELDS MUST BE COMPLETED FOR YOUR APPLICATION TO BE PROCESSED<br />

APPLICANT INFORMATION<br />

Registered Business Name (the “Applicant”):<br />

Registration No.<br />

For the below, please leave blank if no change is required<br />

Name of person to receive summary billing statements and other <strong>Card</strong> reports or notifications for<br />

and on behalf of the Business: Mr Mrs Mdm Ms<br />

Designation:<br />

Mailing address (if different from registered business address):<br />

Contact number:<br />

Postal code:<br />

Name of Business to be embossed on all <strong>Card</strong>s:<br />

(Maximum 19 letters inclusive of space; must contain part of or the full Registered Business Name)<br />

CARDHOLDER 1<br />

Name as in NRIC / Passport: Mr Mrs Mdm Ms NRIC / Passport no.: Mother’s Maiden Name:<br />

Mobile number:<br />

Residential address:<br />

Email address:<br />

Important messages will be sent to<br />

this number<br />

Date of birth:<br />

(DD/MM/YYYY)<br />

Nationality:<br />

Singaporean<br />

Other: ____________________<br />

Singapore PR: Yes No<br />

Postal code:<br />

Occupation:<br />

Company Director/Chief Executive<br />

Proprietor/Merchant Partner<br />

General Manager<br />

Financial Officer<br />

Sales Manager/Executive Others: ___________________<br />

Name to appear on card<br />

(Maximum 19 letters inclusive of space; must be similar to your identity documents)<br />

<strong>Card</strong> limit:<br />

S$<br />

(min. S$2,000,<br />

in increments of S$500):<br />

By signing here, I certify that I have read<br />

and accept the “Declaration & Agreement<br />

by Each <strong>Card</strong>holder” found in this form.<br />

<strong>Card</strong>holder signature:<br />

Date:<br />

Co. Reg. No.: 193200032W Page 1

BCCAPP June v. 042013 2014<br />

CARDHOLDER 2<br />

Name as in NRIC / Passport: Mr Mrs Mdm Ms NRIC / Passport no.: Mother’s Maiden Name:<br />

Mobile number:<br />

Residential address:<br />

Email address:<br />

Important messages will be sent to<br />

this number<br />

Date of birth:<br />

(DD/MM/YYYY)<br />

Nationality:<br />

Singaporean<br />

Other: ____________________<br />

Singapore PR: Yes No<br />

Postal code:<br />

Occupation:<br />

Company Director/Chief Executive<br />

Proprietor/Merchant Partner<br />

General Manager<br />

Financial Officer<br />

Sales Manager/Executive Others: ___________________<br />

Name to appear on card<br />

(Maximum 19 letters inclusive of space; must be similar to your identity documents)<br />

<strong>Card</strong> limit:<br />

S$<br />

(min. S$2,000,<br />

in increments of S$500):<br />

By signing here, I certify that I have read<br />

and accept the “Declaration & Agreement<br />

by Each <strong>Card</strong>holder” found in this form.<br />

<strong>Card</strong>holder signature:<br />

Date:<br />

CARDHOLDER 3<br />

Name as in NRIC / Passport: Mr Mrs Mdm Ms NRIC / Passport no.: Mother’s Maiden Name:<br />

Mobile number:<br />

Residential address:<br />

Email address:<br />

Important messages will be sent to<br />

this number<br />

Date of birth:<br />

(DD/MM/YYYY)<br />

Nationality:<br />

Singaporean<br />

Other: ____________________<br />

Singapore PR: Yes No<br />

Postal code:<br />

Occupation:<br />

Company Director/Chief Executive<br />

Proprietor/Merchant Partner<br />

General Manager<br />

Financial Officer<br />

Sales Manager/Executive Others: ___________________<br />

Name to appear on card<br />

(Maximum 19 letters inclusive of space; must be similar to your identity documents)<br />

<strong>Card</strong> limit:<br />

S$<br />

(min. S$2,000,<br />

in increments of S$500):<br />

By signing here, I certify that I have read<br />

and accept the “Declaration & Agreement<br />

by Each <strong>Card</strong>holder” found in this form.<br />

<strong>Card</strong>holder signature:<br />

Date:<br />

DECLARATION & AGREEMENT BY EACH CARDHOLDER<br />

I understand that I am requesting for <strong>OCBC</strong> <strong>Bank</strong> to issue <strong>OCBC</strong> Business Credit <strong>Card</strong>(s) (“<strong>Card</strong>(s)”) to me and open and maintain <strong>Card</strong> Account(s) for<br />

<strong>Card</strong>(s) in my name. I acknowledge that the <strong>Card</strong>(s) may only be used upon approval subject to the terms and conditions of the <strong>OCBC</strong> <strong>Card</strong>members<br />

Agreement (Business) (the “<strong>Card</strong>members Agreement”), a copy of which is available on the <strong>OCBC</strong> <strong>Bank</strong> website (www.ocbc.com). I agree to be bound by<br />

the same which shall include any amendments, alteration and additions made thereto as may from time to time.<br />

By signing on this application form, I:<br />

i. agree that the Applicant and I shall be jointly and severally responsible and liable for all charges incurred on the <strong>Card</strong>(s);<br />

ii.<br />

agree that I shall ensure that payment is made promptly for all charges incurred on the <strong>Card</strong>(s);<br />

iii.<br />

represent and warrant that all information provided by me in this application is true and complete and undertake to notify <strong>OCBC</strong> <strong>Bank</strong> immediately<br />

of any change in such information;<br />

iv.<br />

represent and warrant that I have read, understood and agree to be bound by the <strong>Card</strong>members Agreement;<br />

v. confirm that I am not an undischarged bankrupt;<br />

vi.<br />

confirm that I am either a director, a partner, sole-proprietor or or employee, as as the the case case may may be, be, of the of the Applicant with with an annual annual income income of at of least at least<br />

S$30,000;<br />

vii.<br />

authorise <strong>OCBC</strong> <strong>Bank</strong> to conduct credit checks and verify information given in this application with any party (including, without limitation, with any<br />

credit bureau or any other organisation or corporation set up for the purpose of of collecting and providing information relating to to the the credit standing<br />

of persons) without reference to me;<br />

viii.<br />

irrevocably and unconditionally consent for for <strong>OCBC</strong> <strong>Bank</strong> <strong>Bank</strong> to to disclose any any information whatsoever relating relating to me to as me <strong>OCBC</strong> as <strong>OCBC</strong> <strong>Bank</strong> <strong>Bank</strong> shall consider shall consider<br />

appropriate to any person to to whom disclosure is is permitted or or required by by any any applicable law law or to or any to any other other person person wherever wherever situated situated for any for any<br />

purpose. Without prejudice to the foregoing, I I consent to to such disclosure to to any any credit bureau or or any any other other organisation or corporation set set up up for for<br />

the purpose of collecting and providing information relating to the credit standing of of persons, and to to the the disclosure by by such credit bureau or or other<br />

organisation or corporation to any member thereof, for the purposes of assessing my credit worthiness or for other purpose whatsoever;<br />

ix.<br />

agree that <strong>OCBC</strong> <strong>Bank</strong> has the the absolute discretion to to decline decline the the application for for the the <strong>Card</strong> <strong>Card</strong> without without giving giving any reason any reason and to and retain to retain documents documents<br />

submitted as property of <strong>OCBC</strong> <strong>Bank</strong>;<br />

x. agree and consent for <strong>OCBC</strong> <strong>Bank</strong> to to communicate with with me me with with regard regard to any to any promotion promotion relating relating to the to <strong>Card</strong> the <strong>Card</strong> by electronic by electronic mail, mail, SMS SMS or any or any<br />

other means which <strong>OCBC</strong> <strong>Bank</strong> may deem appropriate at my contact details set out in this application or which I I may furnish to to <strong>OCBC</strong> <strong>Bank</strong> from<br />

time to time. I hereby authorise <strong>OCBC</strong> <strong>Bank</strong> to accept and act upon all communications or instructions from me to to <strong>OCBC</strong> <strong>Bank</strong> via electronic mail<br />

or SMS with regard to such promotions and <strong>OCBC</strong> <strong>Bank</strong> shall not be liable if it acts upon such communications or instructions in good faith;<br />

Co. Reg. No.: 193200032W Page 2<br />

BCCAPP v. June 2014

xi.<br />

xii.<br />

xiii.<br />

BCCAPP v. 042013<br />

hereby understand that the mobile phone number(s) and email address(s) in this application may be used to update (where applicable) any of the<br />

records maintained by <strong>OCBC</strong> <strong>Bank</strong> in connection with my personal accounts with <strong>OCBC</strong> <strong>Bank</strong>, including but but not not limited to to my my personal savings,<br />

current and time deposit accounts, credit cards, unit trust/CPF investments/SRS accounts and loans;<br />

confirm that any funds and assets I place with <strong>OCBC</strong> <strong>Bank</strong> and any funds applied by me to repay <strong>OCBC</strong> <strong>Bank</strong> any monies owing in respect of<br />

the<br />

<strong>OCBC</strong> the <strong>OCBC</strong> Business Business Credit Credit <strong>Card</strong> <strong>Card</strong> and and any any profits profits that that they they generate (if (if applicable), will comply with the tax laws of the countries where I live I live or or of of<br />

which I am citizen or which I am otherwise subject to.<br />

agree and consent to the terms of <strong>OCBC</strong> <strong>Bank</strong>’s (i)Data Protection Policy and (ii)FATCA policy, both available at www.ocbc.com/policies or upon request.<br />

DECLARATION & AGREEMENT ON BEHALF OF THE APPLICANT<br />

By signing below, I/we understand that I am/we are on behalf of the Applicant requesting for <strong>OCBC</strong> <strong>Bank</strong> to issue an <strong>OCBC</strong> Business Credit <strong>Card</strong> (the<br />

“<strong>Card</strong>(s)”) to each of the <strong>Card</strong>holder(s) named in this application form (the “<strong>Card</strong>holder(s)”), and open and maintain a <strong>Card</strong> Account for each <strong>Card</strong> in the<br />

name of the respective <strong>Card</strong>holder. The Applicant acknowledges that the <strong>Card</strong>(s) may only be used upon approval subject to the <strong>OCBC</strong> <strong>Card</strong>members<br />

Agreement (Business) (the “<strong>Card</strong>members Agreement”), a copy of which is available on the <strong>OCBC</strong> <strong>Bank</strong> website (www.ocbc.com). The Applicant agrees to<br />

be bound by the same which shall include any amendments, alterations and additions made thereto as may from time to time.<br />

The <strong>Card</strong>holder(s) named in this form and/or in other letter(s) of instruction is/are authorised to perform and effect the transactions through the respective<br />

<strong>Card</strong>(s) issued to them at any time and from time to time for and on behalf of the Applicant. The Applicant confirms that all such transactions shall be binding<br />

and conclusive on the Applicant.<br />

By signing below, I/we, for and on behalf of the Applicant hereby:<br />

i. represent and warrant that all all information in in this this application (including that that on on the the <strong>Card</strong>holder(s)) is true is true and and complete complete and undertake and undertake to notify to notify<br />

<strong>OCBC</strong> immediately of any change in such information and to provide any information and documents required by <strong>OCBC</strong> <strong>Bank</strong> on request;<br />

ii.<br />

represent and warrant that each <strong>Card</strong>holder is either a director, partner, sole-proprietor or employee, as the case may be, of the Applicant with an<br />

annual income of at least S$30,000;<br />

iii.<br />

represent and warrant that the <strong>Card</strong>holder(s) is/are hereby authorised to to sign bills on on behalf of of the the Applicant. The The Applicant and and each each authorised<br />

<strong>Card</strong>holder shall be jointly and severally responsible and liable for all charges incurred on the <strong>Card</strong>(s);<br />

iv.<br />

confirm that the Applicant agrees to be bound by the <strong>Card</strong>members Agreement;<br />

v. authorise <strong>OCBC</strong> <strong>Bank</strong> to conduct credit checks and verify information given in this application with any party (including, without limitation, with any<br />

credit bureau or any other organisation or corporation set up for the purpose of of collecting and providing information relating to to the the credit standing<br />

of persons) without reference to the Applicant;<br />

vi.<br />

irrevocably and unconditionally consent for for <strong>OCBC</strong> <strong>Bank</strong> <strong>Bank</strong> to disclose to disclose any any information information whatsoever whatsoever relating relating to the to Applicant the Applicant or the Applicant’s or the Applicant’s account<br />

as as <strong>OCBC</strong> <strong>OCBC</strong> <strong>Bank</strong> <strong>Bank</strong> shall shall consider consider appropriate to any to any person person to whom to whom disclosure disclosure permitted is permitted or required or required by any by applicable any applicable law or to law any or other to any<br />

account<br />

other person person wherever wherever situated situated for any for purpose. any purpose. Without Without prejudice prejudice to the to foregoing, the foregoing, the Applicant the Applicant consent consent to such to disclosure such disclosure to any to credit any bureau credit bureau or<br />

or any any other other organisation or corporation set set up for up the for purpose the purpose of collecting of collecting and providing and providing information information relating relating to the to credit the credit standing standing of persons, of persons, and<br />

and to the to disclosure the disclosure by such by credit such credit bureau bureau or other or organisation other organisation corporation corporation to any member to any member thereof, thereof, for purposes for the purposes of assessing of assessing my/our credit my/our<br />

credit worthiness worthiness for other or for purpose other purpose whatsoever; whatsoever;<br />

vii.<br />

agree that <strong>OCBC</strong> <strong>Bank</strong> has the absolute discretion to to decline the the application for for the the <strong>Card</strong>(s) without giving giving any any reason reason and and to retain to retain documents<br />

submitted as property of <strong>OCBC</strong> <strong>Bank</strong>;<br />

viii.<br />

agree and consent for <strong>OCBC</strong> <strong>Bank</strong> to to communicate with with the the Applicant with with regard regard to any to any promotion promotion relating relating to the to <strong>Card</strong>(s) the <strong>Card</strong>(s) by electronic by electronic mail, mail,<br />

SMS or any other means which <strong>OCBC</strong> <strong>Bank</strong> may deem appropriate at the Applicant’s contact details set out in the Business FlexCash <strong>Application</strong><br />

<strong>Form</strong> or which the Applicant may furnish to to <strong>OCBC</strong> <strong>Bank</strong> from time to to time. The The Applicant hereby authorises <strong>OCBC</strong> <strong>Bank</strong> <strong>Bank</strong> to to accept accept and and act act upon upon<br />

all communications or instructions from the Applicant to to <strong>OCBC</strong> <strong>Bank</strong> via via electronic mail or or SMS with with regard to to such such promotions and and <strong>OCBC</strong> <strong>Bank</strong> <strong>Bank</strong><br />

shall not be liable if it acts upon such communications or instructions in good faith;<br />

ix.<br />

agree to hold harmless and to indemnify and keep <strong>OCBC</strong> <strong>Bank</strong> indemnified against all all actions, proceedings, liabilities, losses, damages, claims, claims,<br />

demands and expenses and including all all legal costs (on (on a a solicitor and and client client basis) basis) and and other other costs costs charges charges and and expenses expenses which which <strong>OCBC</strong> <strong>OCBC</strong> <strong>Bank</strong> <strong>Bank</strong><br />

may incur or sustain by reason of or in connection with the issue of the <strong>Card</strong>(s);<br />

x. confirm that any funds and assets that the Applicant places with <strong>OCBC</strong> <strong>Bank</strong>, and and any any profits that that they they generate, will will comply with with the the tax tax laws laws of of<br />

the countries where the the Applicant is is established or incorporated or of or which of which the Applicant the Applicant is carrying is carrying on business on business or which or the which Applicant the Applicant is other-is<br />

otherwise subject subject to. to.<br />

xi agree and consent to the terms of <strong>OCBC</strong> <strong>Bank</strong>’s (i)Data Protection Policy and (ii)FATCA policy, both available at www.ocbc.com/policies or upon request.<br />

To be signed by persons authorised to sign <strong>OCBC</strong> Business Credit <strong>Card</strong> <strong>Application</strong> <strong>Form</strong>s:<br />

(Sole Proprietorship – Sole Proprietor / Partnerships – All partners / Companies or LLP – As per directors’ or partners’ resolution)<br />

Authorised Person<br />

Name:<br />

ID no.:<br />

Date:<br />

Authorised Person<br />

Name:<br />

ID no.:<br />

Date:<br />

Authorised Person<br />

Name:<br />

ID no.:<br />

Date:<br />

FOR BANK’S USE<br />

Staff name: Staff ID: Source code:<br />

FOR BRANCH’S USE<br />

Submission checklist:<br />

For Singaporeans and PRs: To photocopy and O/S NRIC and<br />

NOA. Address on NOA must match NRIC and application form.<br />

For foreigners: To photocopy and O/S passport and NOA.<br />

Address on NOA must match application form.<br />

EMB007 EMBCOM EMB002 EMBCSU BRANCH<br />

(default to “OTHCHN” if no option selected)<br />

Attended by:<br />

Signature:<br />

Verified by CSM/BM<br />

Signature:<br />

Branch stamp:<br />

Date:<br />

Name:<br />

Date:<br />

Co. Reg. No.: 193200032W Page 3