The Hillside Project: Australia's Next Great Copper ... - SA Explorers

The Hillside Project: Australia's Next Great Copper ... - SA Explorers

The Hillside Project: Australia's Next Great Copper ... - SA Explorers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

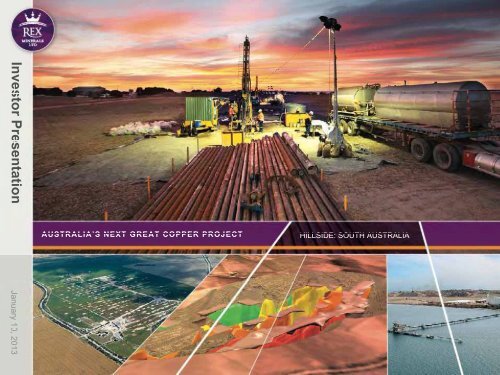

Investor Presentati on<br />

AUSTRALIA’S S NEXT GREAT COPPER PROJECT<br />

HILLSIDE: SOUTH AUSTRALIA<br />

January 10, 2013

DISCLAIMER<br />

Inves stor Pre esentati on<br />

January 10 0, 2013<br />

<strong>The</strong> presentation ti (in this projected form and as verbally presented) (“Presentation”) ti is provided d on the basis that t none of the<br />

Company nor its respective officers, shareholders, related bodies corporate, partners, affiliates, employees, representatives and<br />

advisers make any representation or warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the<br />

material contained in the Presentation and nothing contained in the Presentation is, or may be relied upon as a promise,<br />

representation or warranty, whether as to the past or the future. <strong>The</strong> Company herby excludes all warranties that can be excluded by<br />

law.<br />

<strong>The</strong> Presentation contains prospective financial material which is predictive in nature and may be affected by inaccurate assumptions<br />

or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved.<br />

<strong>The</strong> Presentation contains “forward-looking statements”. All statements other than those of historical facts included in the<br />

Presentation are forward-looking statements. Where the Company expresses or implies an expectation or belief as to future events or<br />

results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, forward-looking<br />

statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future<br />

results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper and<br />

other metals price volatility, currency fluctuations, increased production costs and variances in ore grade or recovery rates from<br />

those assumed in mining plans, as well as political and operational risks and governmental regulation and judicial outcomes. <strong>The</strong><br />

Company does not undertake any obligation to release publicly any revisions to any “forward-looking statement”.<br />

<strong>The</strong> Presentation contains general background information about the Company and its activities current as at the date of this<br />

presentation, 31 October 2012. <strong>The</strong> information in this Presentation is in summary form only and does not contain all the information<br />

necessary to fully evaluate any transaction or investment. It should be read in conjunction with the Company’s other periodic and<br />

continuous disclosure announcements lodged with the ASX, which are available at www.asx.com.au and other publicly available<br />

information on the Company available at www.rexminerals.com.au.<br />

<strong>The</strong> Presentation does not constitute an offer, invitation or recommendation to subscribe for or purchase any security and does not<br />

form the basis of any contract or commitment. <strong>The</strong> Presentation, the entitlement offer and the contracts formed on acceptance of the<br />

relevant applications are governed by the laws applicable in Victoria, Australia. Each person who applies for new shares submits to<br />

the jurisdiction of the courts of Victoria, Australia.<br />

All persons should consider seeking appropriate professional advice in reviewing the Presentation and the Company.<br />

<strong>The</strong> information in this presentation that relates to Exploration Results, Mineral Resources and Exploration Potential is based on<br />

information compiled by Mr Patrick Say. Mr Say is an employee of Rex Minerals Ltd, is a member of the Australian Institute of Mining<br />

and Metallurgy and is a Competent Person under the definition of the 2004 JORC Code. <strong>The</strong> Exploration Potential and Exploration<br />

Targets described in this Presentation is conceptual in nature, and there is insufficient information to establish whether further<br />

exploration will result in the determination of a Mineral Resource. Mr Say consents to the publication of this information in the form<br />

and content in which it appears.<br />

2

HILLSIDE PFS SUMMARY<br />

PFS Results Overvi iew<br />

January 10, 2013<br />

Annual production (>100kt CuEq)<br />

70kt<br />

50koz<br />

1.2Mt<br />

<strong>Copper</strong> Gold Iron Ore<br />

Australia’s largest undeveloped copper project<br />

Mine Life<br />

15+ years<br />

Cash Costs C1 costs ~US$1.2/lb<br />

Strong Margins<br />

Base case EBITDA of A$240M and<br />

potential for >A$380M<br />

Value Creation Effective financing is the key to<br />

unlocking the value at <strong>Hillside</strong><br />

3 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

ABOUT COPPER<br />

Corp<br />

30000<br />

Top 40 <strong>Copper</strong> <strong>Project</strong>s World Wide<br />

(after Goldman Sachs report, March 2012)<br />

orate an nd Over rview<br />

Ca apital Cos st US$/t<br />

25000<br />

20000<br />

15000<br />

10000<br />

Lower Capital c ost<br />

Top 40 Cu<br />

<strong>Project</strong>s<br />

<strong>Hillside</strong><br />

5000<br />

<strong>Hillside</strong> PFS<br />

January 10, 2013<br />

4<br />

Lower Operating Costs<br />

0<br />

$0.80 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 $2.20 $2.40<br />

Cash Cost US$/lb<br />

* Derived from: Goldman Sachs report, March 2012

ABOUT COPPER<br />

Corp orate and Over rview<br />

<strong>The</strong> world needs an estimated US$150 billion of new capital to deliver<br />

over 10Mtpa of new copper production by 2025.<br />

New mine supply?<br />

Existing mine supply<br />

January 10, 2013<br />

5 *BASED ON DATA SOURCED FROM CRU AND GOLDMAN <strong>SA</strong>CHS, MARCH 2012

Corporate a nd Ove erview<br />

1 > Corporate and Overview<br />

2 > <strong>Hillside</strong> <strong>Project</strong><br />

3 > Model and Economics<br />

January 10, 2013<br />

4 > Regional Potential<br />

6 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

CAPITAL STRUCTURE<br />

Corp orate and Over rview<br />

January 10, 2013<br />

<strong>Hillside</strong>id <strong>Copper</strong> <strong>Project</strong>, Sth Aust<br />

2Mt<br />

1.7Moz<br />

44Mt<br />

<strong>Copper</strong> Gold Iron Ore Fe<br />

Market Information<br />

ASX code RXM<br />

Shares<br />

188.9 million + 6.4m options<br />

Mkt Capitalisaton ~A$150 million<br />

Cash at Bank A$59.2 million at 30/9/2012<br />

7 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

THE TEAM<br />

Corp orate an nd Over rview<br />

January 10, 2013<br />

Directors<br />

Paul Chapman<br />

Non Executive Chairman<br />

Mark Parry<br />

Managing Director<br />

Steven Olsen<br />

Executive Director<br />

Richard Laufmann<br />

Non Executive Director<br />

Alister Maitland<br />

Non Executive Director<br />

Management Team<br />

Patrick Say<br />

Chief Geologist<br />

Amber Rivamonte<br />

Company Secretary<br />

Janet Mason<br />

CFO<br />

Marc Twining<br />

Exploration Manager<br />

Pam McRae Williams<br />

Community Manager<br />

John Burgess<br />

Study Manager<br />

(Metallurgy/Environmental)<br />

8 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

MARKET CAP PER TONNE OF FORECAST COPPER PRODUCTION COMPARISON<br />

40000<br />

Corp orate an nd Over rview<br />

35000<br />

30000<br />

25000<br />

20000<br />

15000<br />

10000<br />

5000<br />

0<br />

Financing and<br />

construction<br />

~$2,100/t<br />

~$18,000/t<br />

Australian <strong>Copper</strong> Producers<br />

~$20,000/t<br />

~$23,600/t<br />

~$35,100/t<br />

Rex Sandfire Pan Aust Oz Minerals Cudeco<br />

Mine life (years): 15+ 7 11 6 10<br />

Cash Costs: ~US$1.20/lb ~US$1.05/lb ~US$1.10/lb ~US$1.20’lb No PFS<br />

January 10, 2013<br />

Forecast copper 70,000t 70,000t 90,000t 105,000t ~28,000t<br />

production<br />

Effective financing of the <strong>Hillside</strong> project is the key to value creation at Rex.<br />

9 *SOURCE: PUBLICALLY AVAILABLE DATA AS AT 26/10/2012

<strong>Hillside</strong> Proj ect<br />

1 > Corporate and Overview<br />

2 > <strong>Hillside</strong> <strong>Project</strong><br />

3 > Model and Economics<br />

January<br />

4 > Regional Potential<br />

10, 2013<br />

10<br />

AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

LOCATION<br />

<strong>Hillside</strong> <strong>Project</strong> January 10, 2013<br />

11 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

RESOURCE<br />

Hillsi de Proj ect<br />

HILLSIDE PROJECT<br />

Discovered 2008–20092009<br />

Resource Drilling Jan 2010<br />

Starts<br />

Resource (July 2012)<br />

330Mt @0.8%CuEq<br />

(0.6%Cu, 0.16g/t Au, 13.7%Fe)<br />

High Grade Resource 116Mt @ 1.2% CuEq<br />

(0.9% Cu, 0.2g/t Au, 14.2% Fe)<br />

January 10, 2013<br />

Shallow High Grade<br />

(

RESOURCE<br />

<strong>Hillside</strong> <strong>Project</strong> January 10, 2013<br />

13 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

RESOURCE GROWTH OVER TIME<br />

<strong>Hillside</strong> <strong>Project</strong> January 10, 2013<br />

14 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

COMPARISON WITH OTHER AUSTRALIAN COPPER PROJECTS<br />

Australia’s largest undeveloped open pit copper Resource<br />

Hillsi<br />

de <strong>Project</strong> 15<br />

* Source: Publically available data as at 23 July 2012

RESOURCE – FUTURE GROWTH<br />

<strong>Hillside</strong> <strong>Project</strong> January 10, 2013<br />

16<br />

AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

Model and Econom ics<br />

1 > Corporate and Overview<br />

3 > <strong>Hillside</strong> <strong>Project</strong><br />

4 > Model and Economics<br />

January<br />

5 > Regional Potential<br />

10, 2013<br />

17<br />

AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

OPEN PIT MINE PLAN<br />

Model and Economics January 10, 2013<br />

18 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

WATER – AGREEMENT REACHED WITH <strong>SA</strong> WATER<br />

Model and Economics January 10, 2013<br />

19 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

SLURRY PIPELINE TO EXISTING PORT<br />

Model and Economics January 10, 2013<br />

20 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

MINERAL PROCESSING<br />

<strong>Copper</strong>-gold concentrate via<br />

conventional floatation<br />

Mode el and E<br />

Economics January 10, 2013<br />

Iron ore concentrate via<br />

conventional magnetic separation<br />

21 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

LOCATION ADVANTAGES<br />

Mode el and Econom ics<br />

January 10, 2013<br />

Issue<br />

<strong>Hillside</strong> Advantage<br />

Land Ownership<br />

Rex has 100% of freehold and mineral<br />

Mining Risks<br />

Processing Risks<br />

Site Access<br />

Transport to Port<br />

Power and Water<br />

Access to People<br />

rights over <strong>Hillside</strong><br />

Staged open pit design<br />

Good recoveries from standard floatation<br />

and magnetic separation<br />

Existing Highway (2hr to Adelaide) and<br />

road network to local towns<br />

12km pipeline to local port<br />

Access off state grid/pipeline<br />

Local work-force (not fly-in, fly-out)<br />

22 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

PROJECT REVENUE PRODUCTION<br />

Mode el and Econom ics<br />

Output Key Features Advantage<br />

100+ ktpa CuEq Integrated modular plant Economies of scale<br />

3 revenue streams<br />

<strong>Copper</strong> (Cu)<br />

70,000 tpa<br />

Gold (Au)<br />

50,000 ozpa<br />

• OpenPit<br />

• Shallow orebody<br />

• Moderate Strip<br />

• Conventional floatation to<br />

Quality Cu-Au concentrate.<br />

• Slurry pipeline to existing<br />

port (only 12kms).<br />

• Good recovery<br />

• Low impurities<br />

• Easily saleable<br />

concentrate<br />

January 10, 2013<br />

Magnetite<br />

12Mtpa 1.2 Conventional recovery from<br />

tailings of Cu/Au circuit.<br />

Refined product with<br />

>65%Fe and low<br />

Slurry pipeline to existing port. impurities.<br />

Very low cost<br />

delivered to port<br />

(~A$40/t)<br />

23 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

FINANCIALLY ROBUST AND EXPOSURE TO HIGH COPPER PRICES<br />

Mode el and Econom ics<br />

Commodity Base Case Upside Case<br />

<strong>Copper</strong> (US$ real) US$2.8/lb US$4.5/lb<br />

Gold ld(US$ real) US$1,200/oz US$1,600/oz<br />

Iron Ore (62%Fe) (US$ real) US$100/t US$120/t<br />

Iron ore premium (US$ real) US$25/t US$25/t<br />

Exchange Rate (USD:AUD) 0.8 1.0<br />

Pre-tax annual operating cash flow A$240 million >A$390 million<br />

January 10, 2013<br />

24 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

TIMELINE HORIZON<br />

Mode el and Econom ics<br />

Explore &<br />

Discovery<br />

Delineate and Drill<br />

2008 2011<br />

2012<br />

3 Resource Upgrades<br />

Pre Feasibility Work and Study<br />

Environment Approval Processes<br />

4 th Resource<br />

Concept<br />

Study<br />

Reserve pending<br />

Approvals &<br />

Bankable<br />

Crystalise<br />

2013 Permits<br />

Feasibility<br />

Funding<br />

January<br />

2014<br />

Construction<br />

18 Months<br />

2015<br />

Production &<br />

Ramp up<br />

10, 2013<br />

25 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

Regional Po otential<br />

1 > Corporate and Overview<br />

2 > <strong>Hillside</strong> <strong>Project</strong><br />

3 > Model and Economics<br />

January<br />

4 > Regional Potential<br />

10, 2013<br />

26<br />

AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

HILLSIDE: JUST THE START – A STRATEGICALLY IMPORTANT POSITION<br />

Regional Potential January 10, 2013<br />

27 AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA

CONCLUSION<br />

January<br />

PFS Results – <strong>Hillside</strong> is Australia’s largest undeveloped copper project.<br />

Production – 70,000tpa copper and over 100,000t CuEq pa.<br />

Mine Life – PFS shows potential for over 15 year mine life.<br />

Cash costs – C1 costs of ~US$1.2/lb deliver good annual cash margins.<br />

Infrastructure - <strong>Hillside</strong> has superior infrastructure advantages compared to<br />

development projects across the globe, leading to a low capital intensity.<br />

Sovereign Risk - A safe and enviable location.<br />

Unique - <strong>Hillside</strong> and the surrounding copper potential has important long<br />

term strategic value which is unique compare against other copper projects.<br />

Value Creation – <strong>The</strong> key to unlocking the value at <strong>Hillside</strong> is an effective<br />

financing package.<br />

10, 2013<br />

28<br />

AUSTRALIA’S NEXT GREAT COPPER PROJECT. HILLSIDE: SOUTH AUSTRALIA