NIRC News July 2011.pmd - Icsi

NIRC News July 2011.pmd - Icsi

NIRC News July 2011.pmd - Icsi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>July</strong>, 2011 1 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

<strong>July</strong>, 2011 2 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

From the Chairman<br />

Dear Professional<br />

Colleagues,<br />

The world is becoming the<br />

global village day by day<br />

and there is no dearth of<br />

opportunities for<br />

competent professionals.<br />

In the global competitive<br />

environment, we can not<br />

compromise with<br />

professional excellence. It should be our<br />

endeavour to strive for excellence. The gates are<br />

wide open for us. The only thing which is<br />

important is to have faith in ourselves.<br />

At <strong>NIRC</strong>, it is our persistent endeavour to equip<br />

our members with sound knowledge and attitude<br />

so as to enable them to face dynamic challenges<br />

offered by the world. A number of initiatives have<br />

been taken and a lot needs to be taken to realize<br />

our vision. Our <strong>NIRC</strong> is fully charged and is<br />

moving on the fast track to organize various<br />

professional development programs at various<br />

platforms to ensure that the member’s come up<br />

on learning curve. The brief highlights of the<br />

programs organized for the members and students<br />

during the month are as under:<br />

On 17 th & 18 th June, 2011 <strong>NIRC</strong> organized a<br />

Northern Region PCS Conference on the topic<br />

“Calibrating Competence for Professional<br />

Excellence” at Mussoorie. Mr. Trivendra Singh<br />

Rawat, Hon’ble Minister for Agriculture,<br />

Horticulture and Fishery, Government of<br />

Uttarakhand was the Chief Guest and<br />

Mr. G P Patel, Managing Director, UJVN Ltd.<br />

Mr. Om Praksh Uniyal, Chairman, Municipal<br />

Committee, Mussoorie and Mr. Bhaskar<br />

Naithani, Vice Chairman, Prime Minister’s<br />

Gram Sadak Yojna & Monitoring Board,<br />

Government of Uttarakhand were the Guests<br />

of Honours on the occasion.<br />

On 25 th June, 2011 a Seminar on the topic<br />

“Private Equity-Catalyst to Economic<br />

Growth” was organized by <strong>NIRC</strong> –ICSI at<br />

Hotel Le Meridien, New Delhi. Mr. Ravi<br />

Narain, Managing Director & CEO, National<br />

Stock Exchange was the Chief Guest &<br />

Mr. O P Vaish, Senior Advocate & Founder<br />

Vaish Associates, Advocates was the Guest of<br />

Honour and Mr. P N Vijay of P N Vijay<br />

Financial Services Pvt. Ltd. was Key Note<br />

speaker on the occasion. The seminar was a<br />

grand success and attended by approx. 400<br />

members and students. The seminar was<br />

webcasted all over Northern India.<br />

On 24 th June, 2011 a Study Circle Meeting was<br />

organized on the topic “XBRL concepts and<br />

practical approach to MCA filing” at YMCA<br />

Conference Hall, New Delhi.<br />

On 2 nd <strong>July</strong>, 2011, <strong>NIRC</strong>-ICSI jointly with The<br />

BSE SME Exchange and CDSL organized an<br />

interactive seminar on E-voting for<br />

shareholders and Raising of Equity and listing<br />

of SMEs on BSE SME Exchange at New Delhi.<br />

Mr. Lakshman Gugulothu, CEO, BSE SME<br />

Exchange was the Chief Guest and Mr. Jignesh<br />

Gandhi, Vice President, CDSL was the guest<br />

speaker on the occasion.<br />

In the drive to accomplish the prestigious task<br />

of conducting the Investor Awareness<br />

Programs in the different districts given by<br />

Ministry of Corporate Affairs to the Institute,<br />

during the month of June, <strong>NIRC</strong> organized<br />

Six Investor Awareness Programs in the<br />

different locations of Delhi.<br />

On 22nd June, 2011, <strong>NIRC</strong>-ICSI organized the<br />

Regional Round of 9 th All India Moot Court<br />

Competition. The team from Jodhpur Chapter<br />

was winner of the Regional Round. The<br />

wining team of each Regional Council<br />

participated in the National Round conducted<br />

by Pune Chapter of WIRC-ICSI on 2 nd <strong>July</strong>,<br />

2011.<br />

This Year <strong>NIRC</strong> –ICSI is hosting the National<br />

Round of 11 th All India Company Law Quiz<br />

for students to be held on 22nd <strong>July</strong>, 2011. The<br />

Regional Round of the same was organized<br />

by <strong>NIRC</strong>-ICSI on 1 st <strong>July</strong>, 2011 and 24 Teams<br />

of two students each participated in the Quiz.<br />

I wish to place on record my sincere gratitude to<br />

the Chief Guests, Guests of Honours, all the Guest<br />

Speakers and the Judges of various quiz and<br />

competitions for gracing the programs by their<br />

presence and sharing their rich knowledge and<br />

experience.<br />

<strong>July</strong>, 2011 3 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

From the Chairman<br />

We all know that XBRL is now a day a buzz word<br />

in the Corporate World, with a view to equip our<br />

members with complete and practical knowledge<br />

on the subject, <strong>NIRC</strong> is organizing two day<br />

workshop on Practical Aspect of XBRL on 21 st and<br />

22 nd <strong>July</strong>, 2011.<br />

Friends, I am happy to inform you that with a<br />

view to support the noble cause of Benevolence<br />

to our members and to strengthen the corpus of<br />

the Company Secretaries Benevolent Fund (CSBF),<br />

<strong>NIRC</strong> in its last meeting has decided that <strong>NIRC</strong><br />

will donate 5% of its surplus to the CSBF and a<br />

cheque of Rs. 4,86,600/-, (being 5 % of surplus<br />

for the year 2010-11) has been sent to the CSBF.<br />

This year <strong>NIRC</strong> will observe its Foundation week<br />

from 25 th <strong>July</strong>, 2011. The enhancement of the<br />

membership of the Company Secretaries<br />

Benevolent Fund will be focused during the week.<br />

We request our members to come forward and<br />

become member of CSBF in large number and<br />

request the existing members to donate some<br />

amount to the Fund, which will renew our pursuit<br />

and commitment for strengthening of the corpus<br />

of CSBF and will help to this noble cause. The<br />

week will conclude with Cultural Evening on 31 st<br />

<strong>July</strong>, 2011, which is our Foundation Day.<br />

On 30 th <strong>July</strong>, 2011 <strong>NIRC</strong> is organizing a seminar<br />

on the topic “Wealth Management – Concerns<br />

and Challenges” followed by Annual General<br />

Meeting at Hotel Le Meridien, New Delhi, The<br />

Annual General Meeting of <strong>NIRC</strong> will start at 4.00<br />

PM. I request to all the members to kindly attend<br />

the Seminar & AGM of <strong>NIRC</strong> in large number.<br />

I appeal to all of you to send your valuable<br />

suggestions, which will be guiding factor for us<br />

while we plan for our future academic as well as<br />

professional activities.<br />

With warm regards,<br />

Yours sincerely,<br />

(CS RANJEET PANDEY)<br />

cs.ranjeet@gmail.com<br />

5th <strong>July</strong>, 2011 Mobile : 9810558049<br />

AN APPEAL<br />

FOR BECOMING MEMBER OF COMPANY<br />

In recent past, some of our members have died leaving behind the<br />

spouse and minor children. In some cases providing adequate<br />

financial assistance to the bereaved family becomes an<br />

impediment. Although the Managing Committee of the CSBF<br />

wanted to help the bereaved family members, but it was<br />

constrained to do so in view of financial position of the Fund. At<br />

present around 7900 members are the members of the CSBF. The<br />

fund can provide the much needed financial assistance in such<br />

cases if the corpus of the Fund increases substantially which is<br />

possible if more number of members are enrolled to the fund.<br />

The members in all earnestness are therefore sincerely requested<br />

to become the members of the CSBF by paying one time Life<br />

membership fee of Rs. 5,000/-.<br />

The payments made to the Fund are exempted under Section 80G<br />

of the Income Tax Act, 1961.<br />

The members have to just fill up Form-A (available on<br />

the web-site of the Institute, i.e. www.icsi.edu) and send<br />

the same along with a cheque for Rs. 5,000 favouring<br />

‘Company Secretaries Benevolent Fund’ payable at New<br />

Delhi to <strong>NIRC</strong> Office.<br />

Following benefits are presently provided by the CSBF<br />

1. Financial assistance in the event of death of a member<br />

of CSBF<br />

Upto the age of 60 years<br />

Group Life Insurance Policy for a sum of Rs. 2,00,000;<br />

and<br />

Upto Rs. 1,00,000 in deserving cases on receipt of request<br />

subject to the Guidelines approved by the Managing<br />

Committee from time to time.<br />

Above the age of 60 years<br />

Upto Rs. 1,00,000 in deserving cases on receipt of<br />

request subject to the Guidelines approved by the<br />

Managing Committee from time to time.<br />

2. Other benefits (in deserving cases on receipt of<br />

request subject to the Guidelines approved by the<br />

Managing Committee from time to time).<br />

Reimbursement of Medical Expenses<br />

Upto Rs. 40,000<br />

Financial Assistance for Children’s Education (one time)<br />

Upto Rs. 10,000 per child (Maximum for two children)<br />

in case of the member leaving behind minor children.<br />

<strong>July</strong>, 2011 4 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Article<br />

RAISING OF EQUITY AND LISTING OF SMEs ON BSE SME EXCHANGE<br />

INTRODUCTION<br />

SEBI has time to time issued the<br />

circulars and guidelines for setting up<br />

of the exchange for small and<br />

medium enterprises. These circulars<br />

have been revised after taking<br />

suggestions from market participants<br />

for the SME exchange. The final<br />

circular was issued on 18 th May,<br />

2010.The necessary provisions for the listing of specified<br />

securities under the SME exchange have been made in<br />

the Chapter XA of Issue of Capital and Disclosure<br />

Requirements (ICDR). The guidelines emphasis on the<br />

following:<br />

• The post issue face value capital should not exceed<br />

rupees ten crores.<br />

• The minimum application and trading lot size shall<br />

not be less than Rs. 1, 00,000/-.<br />

• The existing members would be eligible to participate<br />

in SME exchange.<br />

• The issues shall be 100% underwritten and merchant<br />

bankers shall underwrite 15% in their own account.<br />

• The SMEs with post issue paid capital between Rs.<br />

10 crores and Rs. 25 crores has been given the option<br />

to list either on SME Exchange or on the main board.<br />

MARKET MAKERS – OBLIGATIONS<br />

SEBI has compulsorily mandated market making for all<br />

scrips listed and traded on SME exchange. The obligations<br />

for market makers are as follows:<br />

• The merchant bankers to the issue will undertake<br />

market making through a stock broker who is<br />

registered as market maker with the SME<br />

exchange.<br />

• The merchant bankers shall be responsible for<br />

market making for a minimum period of 3 years.<br />

• The market makers are required to provide two<br />

way quotes for 75% of the time in a day. The<br />

same shall be monitored by the exchange.<br />

• There will not be more than 5 market makers<br />

for scrip.<br />

• Market makers will compete with other market<br />

makers for better price discovery.<br />

• The exchange shall prescribe the minimum<br />

spread between the bid and ask price.<br />

• During the compulsory market making period,<br />

the promoter holding shall not be eligible for the<br />

offering to market makers.<br />

• Market Maker shall be allowed to deregister by<br />

giving one month notice to the exchange.<br />

• Trading system may be either order driven or<br />

quote driven.<br />

Lakshman Gugulothu<br />

CEO, BSE SME Exchange<br />

TRADING LOTS<br />

The application and trading lot size is being kept at Rs.<br />

1,00,000/- so as to curtail the entry of small investors. It<br />

has also been stated that the minimum depth of the quote<br />

in secondary market shall be of one lakh rupees. The<br />

investors holding with value less than Rs. 1, 00,000/-<br />

shall be allowed to offer their holding to the market maker<br />

in one lot. However, in functionality the market lot will be<br />

subject to revival after a stipulated time.<br />

Frequently Asked Questions(FAQs) on Listing of<br />

SMEs:<br />

Q: How is it different from main board?<br />

A: The new thing about the SME Exchange is that the<br />

issue will be 100% underwritten and this means that the<br />

issue will be 100% success. Other new aspect is that<br />

there will be support of three years in the secondary<br />

market through market making activity. The SME<br />

Exchange is different to current stock exchanges on<br />

following parameters:<br />

• The SMEs with paid up capital up to Rs. 10 crores<br />

can come on the SME Exchange, in contrast to<br />

the paid up capital of Rs. 10 crores or more for<br />

the main board.<br />

• The Listing norms have been simplified. The<br />

issuer has to take the approval of the Exchange<br />

and SEBI approval is not required. A copy of the<br />

offer document will be sent to the SEBI for their<br />

information.<br />

• The Compliance norms were simplified. Half<br />

yearly compliance is required instead of quarterly<br />

compliance. The abridged version of the annual<br />

reports need to be sent to the investors instead<br />

of the entire annual report and keeping the soft<br />

copy of the report on the website is sufficient.<br />

• The issue expenses will be minimal on the<br />

marketing and stationery. However, the issue will<br />

be charged for underwriting, sub-underwriting<br />

and responsibility of three years market making.<br />

• Market making is compulsory for three years,<br />

which is not there on main platform.<br />

• The listing fees on BSE SME platform are minimal<br />

compared to the main board.<br />

• The SMEs with the paid up capital between Rs.<br />

10 crores and Rs. 25 crores has the option to get<br />

listed at either on main board or on the SME<br />

Exchange.<br />

Q: How the Indian SME Exchange is different from SME<br />

Exchanges elsewhere?.<br />

<strong>July</strong>, 2011 5 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Article<br />

A: The Indian SME Exchange has been formulated after<br />

detailed study of the best SME Exchanges across the<br />

world and taking into account the feedback from the<br />

market participants.<br />

Q: How the SME Exchange is different from the OTCEI<br />

Exchange?<br />

A: The concept of SME Exchange wise very much similar<br />

to the OTCEI Exchange. However, OTCEI was far ahead<br />

of its time. It has launched screen based trading with<br />

depository concept which at that point of time was new<br />

to the market intermediaries and they were not so much<br />

equipped to adopt to the OTCEI model.<br />

During the last two decades, the capital market has<br />

matured and adopted well the changes brought by the<br />

regulators and exchanges, viz online trading, rolling<br />

settlement and depositories. At the same time, the<br />

financial institutions, venture capitalists, Bank SME<br />

divisions, institutional investors, QIBs, and HNIs have<br />

started investing in the SMEs in a big way. This has<br />

created conducive environment for raising of the equity<br />

capital by the SMEs and thus we are well positioned to<br />

successfully launch the SME Platform.<br />

Q: What are the simplifications to compliance norms on<br />

the SME Exchange?<br />

A: SEBI has made amendments in the ICDR Regulations<br />

simplifying the compliance norms for SMEs listed on the<br />

SME Exchange. The chapter XA has been introduced<br />

which states the guidelines for the SME Exchange/<br />

Platform. The salient features are:<br />

• Financial results shall be submitted on half yearly<br />

basis instead on quarterly basis.<br />

• SMEs need not publish their financial results, as<br />

required in main board, and they can make it<br />

available on their website.<br />

• SMEs can send the abridged version of the<br />

annual report of few pages with the details of<br />

the profit & loss account and balance sheet to<br />

the shareholders instead of sending full annual<br />

report.<br />

Q: Whether the norms on profit making for 3 out of 5<br />

years on the main board are applicable to the SMEs?.<br />

A: The SMEs have been exempted from the criteria of<br />

three years profit making track record (profit in 3 out of<br />

5 years) for listing on SME Exchange. Any company with<br />

one or two years of good track record can consider listing<br />

on SME Exchange.<br />

Q: What is the minimum dilution the SMEs need to do<br />

for listing on SME Exchange?.<br />

A: As per ICDR Regulations, the company with the IPO<br />

has to offer a minimum of 25% to the investors and<br />

some exemptions have been given for the finance<br />

companies.<br />

Q: Which merchant bankers can bring the IPO on the<br />

SME Exchange?<br />

A: All the Merchant bankers empanelled by the SEBI<br />

can bring the IPO on SME Exchange.<br />

Q: Whether there will be any changes to the Offer<br />

Document?<br />

A: There is no need to file the DRHP and RHP is sufficient.<br />

The Offer Document of the SME Exchange will be on the<br />

same lines as that of the main board, but condensed<br />

one. In addition, the Offer Document will also include the<br />

agreement between the merchant banker and the market<br />

maker as well as the agreement between the merchant<br />

banker and the nominated investors. The model listing<br />

agreement has been notified vide the SEBI Circular dated<br />

17 th May, 2010 for the SME segment. The check list for<br />

the Offer Document will be published by the SME Exchange<br />

on its website, once the final approval of the SEBI is<br />

received. This will help the merchant bankers in preparing<br />

the Offer Document.<br />

Q: What kind of preparedness is required before getting<br />

listed on BSE SME?<br />

A: Some of the steps necessary for the preparation for<br />

the listing on the BSE SME Platform are as follows:<br />

• Keeping the Annual Reports on accounts ready<br />

• Documenting the Past performance<br />

• Due diligence on the applicability of various<br />

regulations<br />

• Due Diligence on the various approvals required<br />

from regulatory bodies<br />

• Documenting the Risk factors associated with the<br />

company<br />

• Documenting the External environment effecting<br />

the company<br />

• Listing out the litigations, its magnitude and<br />

ramifications<br />

• Documenting the Business activity<br />

• Documenting the Material contracts and<br />

agreements<br />

• Detailed report on promoters & management<br />

• Selection of investment banker<br />

• Selection of registrar and transfer agent (RTA)<br />

• Selection of syndicate member /sub- syndicate<br />

members<br />

• Selection of electronic media and advertising<br />

agency<br />

• Selection of Escrow Bankers<br />

The IPO is all about:<br />

• Effective equity story supplemented by proper<br />

research<br />

• Presentation to the investors and the analysts<br />

• Regular interaction with Member brokers / sub<br />

brokers, CAs, CSs, FIs.<br />

• Positioning of company through sustained media<br />

efforts including visual media<br />

• Selection of potential bidding centers<br />

• Creating sustainable valuation and shareholder<br />

base<br />

<strong>July</strong>, 2011 6 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Article<br />

• Effective communication for better results<br />

Q: What are the additional responsibilities of Merchant<br />

bankers in SME Exchange?<br />

A: The Merchant Bankers in the main board assist the<br />

company in raising equity capital through primary record,<br />

but in the SME Platform the Merchant Bankers’ have to<br />

hand hold the company for 3 years and ensure that there<br />

is continuity in market making.<br />

The other additional responsibility is that the issue should<br />

be 100% underwritten and the merchant banker has to<br />

compulsory underwrite 15% in his own book of accounts.<br />

There is need for syndication for the purpose of under<br />

writing and the responsibility lies with the merchant<br />

banker. There is no such responsibility for the merchant<br />

banker on the main board.<br />

Q: Who can be the Members of the SME Exchange?.<br />

A: All the members of the equity (cash) segment of the<br />

BSE main board are by default the members of the BSE<br />

SME Exchange also.<br />

Q: Who can be the market makers in the SME Platform?<br />

A: Only the Members of the stock exchanges recognized<br />

by the SEBI can act as a market maker. The members<br />

desirous of becoming market maker have to get<br />

themselves registered as market maker with the<br />

exchange by filing the registration form. These members<br />

should have a minimum experience of 3 years, minimum<br />

net worth of Rs. 5 crores and a daily turn over of Rs. 10<br />

crores. The market maker shall have additional net worth<br />

of Rs. 2 crores for additional scrip.<br />

Q: How does the Market Making work?<br />

A: Market Making is an activity where the Member Brokers<br />

registered as market makers will undertake to support<br />

the scrip by providing two way quotes. All the market<br />

makers in a scrip will provide 2-way quotes for 75% of<br />

the time in a trading day. The market makers will have<br />

to hold 5% of the specified security to be listed at the<br />

time of allotment in their inventory to do the market<br />

making. In addition to this, the market makers can also<br />

buy from or sell to the nominated investors the required<br />

shares for market making. The merchant banker and<br />

nominated investor need to enter into an agreement in<br />

this regard.<br />

Q: Who can be the Nominated Investors?<br />

A: The nominated investors can be QIBs and PE Firms<br />

who are registered with the respective Regulator.<br />

Q: What is the rationale of keeping the lot size of one<br />

lakh rupees?.<br />

A: The lot size of one lakh rupees is kept, so that only<br />

the informed investors can invest in these companies.<br />

Q: What is the provision on odd lots?<br />

A: Odd lots may get created because of the corporate<br />

action taken by the company from time to time, like<br />

issuing bonus shares, warrants and rights issues. The<br />

Regulations warrants that the odd lots can be sold only<br />

to market makers and the investor has to give the<br />

declaration that he is selling all the odd lot shares of the<br />

particular scrip. This is to minimize the odd lots in the<br />

system.<br />

Q: Whether the BSE SME Exchange is quote driven or<br />

hybrid?<br />

A: BSE SME Platform will be a hybrid system i.e. a<br />

combination of quote and order driven systems.<br />

Investors will put the orders, where as the quote driven<br />

system will be for the market makers for providing the<br />

quotes. BSE will provide the FastTrade system to market<br />

makers free of cost for the purpose of providing the<br />

quotes. However, the market markers are permitted to<br />

use their own systems as well as third party systems<br />

with quote driven capacity.<br />

Q: Whether the promoter holding can be sold in the<br />

market?<br />

A: The promoter holding is not eligible to sell to the<br />

market maker for the market making activity. The entire<br />

promoter holding is locked for one year and 20% of the<br />

promoter holding is locked for three years as per ICDR<br />

Guidelines. After one year, promoter can sell his holding<br />

in the market, other than 20% under lock-in.<br />

Q: What are the compliance requirements for migration<br />

from the BSE SME Platform to the main Board?<br />

A: Any SME on BSE SME Platform having a paid up<br />

capital more than Rs. 10 crores can move to the main<br />

board provided that the special resolution is passed in<br />

the AGM in favor with at least two third of the number<br />

of votes cast by shareholders other than promoter<br />

shareholders and then apply to BSE SME. The SME<br />

migrating to the main board has to comply with all the<br />

main board norms like minimum 1000 investors, pay<br />

main board listing fees and do the quarterly compliance<br />

etc.<br />

Q: What are the capital gain tax benefits by listing on<br />

BSE SME?<br />

A: The sale of unlisted shares in short term attract the<br />

capital gain tax of 30% and the long term capital gain<br />

tax of 10%, where as in the case of listed securities the<br />

short term capital gain tax is 10% and there is no long<br />

term capital gains tax. This makes it clear that the listing<br />

of shares very attractive.<br />

Q: Whether Grading of IPOs is compulsory on SME<br />

Exchange?<br />

A: As per ICDR guidelines, the grading is compulsory<br />

on the SME Exchange.<br />

Q: Whether the website is mandatory for the SMEs?<br />

A: The Regulator has made it mandatory for the<br />

companies to have websites, if they propose to be listed<br />

on the main board. The same applies to the SME<br />

companies, if they want to get listed on the BSE SME<br />

Exchange.<br />

Q: Whether in the case chapter XA of ICDR is silent,<br />

what provisions will be applicable?<br />

A: ICDR Guidelines chapter XA clearly specifies that it<br />

will attract all the provisions of main ICDR guidelines<br />

where the exemptions are not being provided under<br />

these provisions.<br />

<strong>July</strong>, 2011 7 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Article<br />

Q: Whether BSE is proposing any Index for the SMEs?<br />

A: In order to provide the insight on the performance of<br />

the SME companies, BSE will launch the SME index in the<br />

near future, once the critical mass of the companies is<br />

listed on the BSE SME Exchange.<br />

Q: Whether the BSE is considering any relaxation of<br />

Listing Fees for the SMEs?<br />

A: BSE has been always forthcoming and considerate in<br />

matters related to the SMEs. We have more than 1500<br />

companies listed on the main board whose paid up capital<br />

is less than Rs. 10 crores. More than 2500 companies<br />

listed on the main board have the paid up capital between<br />

Rs. 10 crores and Rs. 25 crores. Altogether, more than<br />

4000 companies (constituting about 83%) listed on the<br />

main board qualify to be listed on the BSE SME Exchange.<br />

Keeping up with the tradition and commitment for nurturing<br />

the SME companies, we have kept the Listing and other<br />

fees related to the primary markets for SMEs about 50%<br />

compared to the Listing and other fees on the main board.<br />

Q: What is the spread prescribed for the market maker<br />

on the SME Exchange?<br />

A: BSE has prescribed the slab wise spread for the scrips<br />

depending upon their price. A minimum spread of 5% is<br />

prescribed, which shall facilitate the market making and<br />

make it easier for the members empanelled.<br />

Q: What are the penalties for the market making<br />

violations?<br />

A: All the market makers for scrip together shall do<br />

market making more than 75% of the market timings. In<br />

case the market makers for scrip fail to comply these<br />

provisions up to 15 days, BSE has prescribed the monetary<br />

penalties. Beyond 15 days, the scrip will be temporarily<br />

suspended.<br />

Q: Whether the insider trading regulations apply to the<br />

SME Exchange?<br />

A: Insider Trading Regulations will be applicable to the<br />

SME Exchange also. However, the merchant banker to<br />

the issue can be on the board of the SME Company.<br />

Q: Whether Takeover code will be applicable?<br />

A: Takeover code will not be applicable in case of the<br />

Market Maker buy or sell of the shares for Market Making<br />

activity. However, the takeover code will apply for the<br />

investors.<br />

Q: Whether the investors are protected under the IPF on<br />

the SME Exchange?<br />

A: IPF (Investor Protection Fund) has been extended to<br />

the SME Exchange also. The investors in the secondary<br />

market are covered under this. The provisions of the IPF<br />

for the main board apply to the SME Exchange also.<br />

Q: Whether there is any floor price for the scrips listed<br />

on the SME Exchange?<br />

A: There will not be any floor price for the scrips on the<br />

first day of the listing on the SME Exchange. However,<br />

the circuit filter will apply from the next day. The circuit<br />

filters on the main board also apply for the SME Exchange<br />

and they can have check from the next day.<br />

Q: Whether companies listed on RSEs allowed for direct<br />

listing on the SME Exchange?<br />

A: Direct Listing of companies listed in RSEs is not<br />

permitted as of now.<br />

Q: Whether the suspended companies will be allowed<br />

to list on the SME Exchange?<br />

A: The companies are suspended on the main board for<br />

the non-compliance of the listing agreement. Once the<br />

compliance is done, the companies are allowed to list<br />

on the main board of the exchange as per the present<br />

norms. These companies have the choice to get them<br />

transferred, after taking the approval of 2/3rd of the<br />

non-promoter investors.<br />

Q: What is the clearing and settlement mechanism in<br />

the SME Exchange?<br />

A: The settlement will be T+2. There will be common<br />

collateral for the equity and cash segments. The<br />

Settlement Guarantee Fund of the equity covers the SME<br />

segment also. The existing clearing and settlement of<br />

the equity (cash) segment will be extended to the SME<br />

segment also.<br />

Q: What are the corporate governance norms for the<br />

SME Exchange?<br />

A: Clause 49 of the listing agreement and corporate<br />

governance will be applicable for the SME segment.<br />

There will be 50% independent Directors and remaining<br />

50% will be promoter Directors.<br />

Q: How is the Risk Management done in the SME<br />

Exchange?<br />

A: The Risk Management will be applicable the same<br />

way as that of the main board. The M-to-M (Mark to<br />

Mark) Margins, VAR Margins, ELM (Extreme Loss Margin)<br />

and special margins as applicable to the main board will<br />

also apply for the SME Exchange.<br />

Q: What is the Grievance Redressal system in the SME<br />

Exchange?<br />

A: The Exchange has the IGRC (Investor Grievance<br />

Redressal Committee) to redress the complaints of the<br />

investors against the members. If amicable solution is<br />

not reached, the members can opt for arbitration. There<br />

is also a complaint cell for redressal of grievances of<br />

the investors against the companies. The Grievance<br />

Redressal System of the equity (cash) segment will be<br />

made available for the SME Exchange also.<br />

Q: What problems are faced by SMEs as well as BSE to<br />

launch the SME exchange?<br />

A: The working of SME Exchange is not well understood<br />

in the country. The SMEs are mostly not well informed<br />

of the capital market issues and modalities of raising<br />

equity capital. There is need for conducting lot of<br />

awareness programs to educate them.<br />

Merchant Bankers used to handle only the primary<br />

market issues so far. On the SME platform, he has to<br />

assist the company in the secondary market through<br />

market making for three years. Merchant banker, issuer<br />

and market maker have to work as team for three years<br />

to make the market making activity a success. This is a<br />

<strong>July</strong>, 2011 8 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Article<br />

huge challenge. The investor base is limited and only the<br />

investors with a minimum investment of Rs. One lakh<br />

are allowed to participate.<br />

We have interacted with the market intermediaries over<br />

the last six months. There were apprehensions of the<br />

SME model in the beginning. After few rounds of<br />

discussions, we see the substantial change in the<br />

perception of the SME platform. Many merchant bankers<br />

are optimistic and the members with market making<br />

experience are positive about the SME Platform. We are<br />

hopeful that the hurdles will not be a roadblock for the<br />

successful take off of the BSE SME Platform.<br />

Q: How equipped is BSE to launch the new SME exchange?<br />

A: The BSE is leveraging the existing equity platform for<br />

the BSE SME. The systems necessary for monitoring the<br />

market making and quote driven systems for the market<br />

makers are made to comply with SEBI Regulations. BSE<br />

is fully equipped to launch the BSE SME platform.<br />

Q: How is an SME exchange going to help smaller firms?<br />

A: There have been a traditional ways of funding available<br />

to the SME Companies. A dedicated exchange for these<br />

SMEs will help them in finding a solution to their financial<br />

requirements and crunching expansion plans. Listing of<br />

a company on the exchange gives better valuation to the<br />

company. The debt and equity ratios will improve and<br />

the balance sheet will look much healthier. The listed SMEs<br />

will unlock their wealth in the medium to long term and<br />

will do the wealth creation for the promoters and the<br />

investors.<br />

The listed SMEs will get better visibility among the<br />

investors. The investor base of the company improves<br />

for the listed companies in medium term. The repose of<br />

faith by the investors – domestic and foreigners in the<br />

listed SMEs is high. Transparency and corporate<br />

governance will improve manifold by listing on SME<br />

Platform.<br />

Listed company will have easy accessibility to alternate<br />

funding options. The banks, P/E funds and other financial<br />

institutions provide them the loans very easily. The fund<br />

raising through ADRs and GDRs become easier. Also, the<br />

company can raise more funds through follow on public<br />

offering. The tax benefits are also immense. The long<br />

term capital gain tax on listed company is zero.<br />

Q: What is the outlook of the Market participants about<br />

the SME Exchange / Platform?<br />

A: A large number of merchant bankers are optimistic<br />

about the SME Exchange/ Platform. The market makers<br />

will get the fees out of the issue expenses, like the<br />

merchant bankers. The members who have the<br />

experience of market making in the past are positive on<br />

the scope of market making in this segment. Investors’<br />

outlook is not yet clear. But the investors who have<br />

medium to long term perspective are optimistic on huge<br />

wealth creation opportunity in this segment. Regarding<br />

the SMEs, the response has been extra ordinarily exciting.<br />

The SMEs are enthusiastic about the opportunity to raise<br />

the equity capital on BSE SME.<br />

The professionals like and Company Secretaries have<br />

an important role to play in educating the promoters of<br />

the SMEs and guiding them in raising equity capital on<br />

SME Platform. The member brokers and the sub brokers<br />

having branches and franchises spread across the country<br />

can play important role in mobilising and educating the<br />

SMEs with their market knowledge and experience.<br />

Q: How do you see the future of SME exchange in India?<br />

A: The SMEs are the backbone of the Indian economy.<br />

The SMEs in India produce about 45% of the<br />

manufacturing output and contribute about 40% of the<br />

country’s exports. They are the largest employment<br />

provider in the country. SMEs are craving for the better<br />

funding sources all along. The BSE SME is going to bring<br />

the entire pool of investors on a single platform and hence<br />

it will be easier for the SMEs to raise the capital through<br />

this platform in a cost effective manner.<br />

The need and the requirement of the SME exchange for<br />

the SMEs to raise the equity capital are there for very<br />

long. The SMEs have responded positively in a big way<br />

and coming forth for the listing. There is a good future<br />

for the SME Exchange, considering the huge demand and<br />

requirement of capital for the growth of SMEs.<br />

Q: How do you propose to reach out to the SMEs across<br />

India?<br />

A: First of all, we had detailed discussions with the market<br />

intermediaries, like the Merchant Bankers, Member<br />

Brokers etc to brief them on BSE SME Platform and also<br />

took their feedback.<br />

Second, we have been conducting the Seminars for<br />

educating the SMEs on the benefits of listing and the<br />

preparations required for listing on the BSE SME Platform.<br />

We have already conducted the Seminars in Maharastra,<br />

Gujarat, Andhra Pradesh, New Delhi, Kolkatta etc and<br />

lined up large number of Seminars to cover other parts<br />

of the country.<br />

Third, we have detailed Marketing plan to reach out to<br />

the SMEs spread across the country. We are tying up with<br />

channel partners which include various institutes and<br />

associations engaged in the development of SMEs so as<br />

to create awareness among the SME companies about<br />

the benefits of listing at this platform. We are also educating<br />

the professionals through the platform of ICSI and ICAI<br />

etc, so that the professionals can play important role in<br />

educating the promoters and management of SMEs.<br />

Q: By when do you expect to start the SME exchange?<br />

A: BSE SME already received the ‘in Principle’ approval<br />

from the SEBI. We are waiting for the final approval of<br />

the SEBI. We intend to create awareness about the BSE<br />

SME Platform among the SMEs and various market<br />

intermediaries, before going live. We are likely to be<br />

operational by September, 2011.<br />

<strong>July</strong>, 2011 9 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

XBRL<br />

SIMPLIFIED NOTE ON STEPS FOR FILING ANNUAL REPORT IN XBRL<br />

(EXTENSIBLE BUSINESS REPORTING LANGUAGE) MODE<br />

Applicability<br />

1. All companies listed in India.<br />

2. Indian subsidiaries of listed companies;<br />

3. All companies having a paid up capital of Rs.5 crore and<br />

above<br />

4. All companies having a turnover of Rs.100 crore and above.<br />

Exemption-<br />

1.Banking Companies<br />

2.Insurance Companies<br />

3.Power Companies<br />

4.Non Banking Financial Companies<br />

Steps for filing Financial Statements –<br />

Step 1 (Preparation of Financial Statement)<br />

Begin with Company’s financial Statements.<br />

Step 2 (Mapping/Tagging)<br />

Map Company’s each financial statement element to a<br />

corresponding element in published taxonomy.<br />

Mapping: Mapping is the process of comparing the concepts<br />

in the financial statements to the elements in the published<br />

taxonomy, assigning a taxonomy element to each financial<br />

statement concept.<br />

Mapping is done by tagging/linking of the XBRL taxonomy<br />

elements with the various accounting heads in the books of<br />

accounts of the company. This would result in mapping of<br />

the various taxonomy elements with the accounting heads so<br />

that the accounting information can be converted into XBRL<br />

form.<br />

Taxonomy: Taxonomy can be referred as electronic dictionary<br />

of the reporting concepts. It includes terms such as net<br />

income, EPS, cash etc. Taxonomy may represent hundreds or<br />

even thousands of individual reporting concepts.<br />

Concepts/Reporting concepts refer to various accounts heads<br />

in which financial data is displayed<br />

Step 3 (Instance Document)<br />

Creation of instance document.<br />

Instant Document: An instance document is a XML file that<br />

contains business reporting information and represents a<br />

collection of financial facts and report-specific information<br />

using tags from the XBRL taxonomy.<br />

Note:<br />

Separate instance documents need to be created for the<br />

following:<br />

1. Stand Alone Balance sheet of the company<br />

2. Stand Alone Profit and Loss Account of the company<br />

3. Consolidated Balance sheet<br />

Compiled by: CS. Amit Walia<br />

F.C.S., L.L.B., L.I.I.I.<br />

4. Consolidated Profit and Loss Account of the company.<br />

The manner of creation of instance document has not been<br />

specified but it seems that the same will be done at the press<br />

of a button as is done while filing online Income Tax returns<br />

wherein an xml file is generated on the press of a button which<br />

is further filed with the department.<br />

Step 4 (Validation):<br />

Once the instance document is prepared, it needs to be ensured<br />

that it is a valid instance document and all the information has<br />

been correctly captured in the instance document.<br />

It shall be done in the following manner.<br />

1. There shall be a tool provided at the MCA portal for<br />

validating the generated XBRL instance document.<br />

2. Download the tool.<br />

3. Validate the document using the tool.<br />

Following validations shall be performed by the tool-<br />

• Validating that the instance document is as per the<br />

latest and correct version of taxonomy prescribed<br />

by MCA.<br />

• All mandatory elements have been entered.<br />

• Other validations as per taxonomy<br />

Step 5 (Pre-scritiny)<br />

Perform pre-scrutiny of the validated instance documents<br />

through the same tool.<br />

Step 6 (Filling of Forms)<br />

• Fill up the form 23AC and Form 23ACA.<br />

• Attach the validated and pre-scrutinised instance<br />

document for Balance sheet to Form 23AC.<br />

• Attach the validated and pre-scrutinised instance<br />

document for Profit and Loss account to Form<br />

23ACA.<br />

Note: Separate instance documents need to be attached with<br />

respect to Standalone financial statements and consolidated<br />

financial statements.<br />

Step 7 (Form Submission)<br />

• Complete the Forms.<br />

• Perform pre-scrutiny of the form<br />

• Sign the form<br />

• Upload the form as per the normal e-form filing<br />

process.<br />

<strong>July</strong>, 2011 10 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

COMPLIANCE CHECKLIST FROM 10 TH JULY TO 10 TH AUGUST, 2011<br />

Compliance Checklist<br />

Sr. Activities Sections/Rules/ Acts/Regulations, Compliance To whom to<br />

No. Clauses, etc. etc. Due Date be submitted<br />

1. Monthly Excise Return Rule 12 Central Excise, 10 th <strong>July</strong> Superintendent of<br />

Rules, 2002<br />

Central Excise<br />

2. File TDS/TCS quarterly statement in Section 192 to 195 Income Tax Act, 15 th <strong>July</strong> Income-Tax<br />

Form24 Q/26Q/ for April-June 1961 Authorities<br />

3. Submit quarterly Corporate Clause 49 Listing Agreement 15 th <strong>July</strong> Stock Exchanges<br />

Governance Compliance Certificate<br />

4. Annual Return on foreign Liabilities A.P (DIR Series) FEMA 15 th <strong>July</strong> RBI<br />

& Assets Rep orting by Indian Circular No. 45<br />

companies<br />

5. File liquidity return in Form Para 2 & 3 RBI (NBFC) Returns 15 th <strong>July</strong> RBI<br />

NBS-3(NBFC) Specifications, 1997<br />

6. File a quarterly result on frauds Master Circular Department of Non<br />

outstanding dated 01/07/2010 Banking Supervision 15 th <strong>July</strong> RBI<br />

7. Submit a case wise progress report Master Circular Department of Non<br />

on frauds involving Rs.1 lakh and more dated 01/07/2010 Banking Supervision 15 th <strong>July</strong> RBI<br />

8. Submit shareholding pattern as at Clause 35 Listing Agreement 21 st <strong>July</strong> Stock Exchanges<br />

the end of the previous quarter<br />

9. Submit quarterly audit report on Regulation 55A SEBI(Depositories 30 th <strong>July</strong> Stock Exchanges<br />

reconciliation of capital, updation of<br />

and Participants)<br />

register of members and Regulations, 1996<br />

dematerializations<br />

10 Income Tax Return for Non- Corporates Section 139(1) Income Tax Act 31 st <strong>July</strong> Income tax<br />

& Individuals Who are under non-<br />

Authorities<br />

audited u/s 44AB<br />

11 Furnish Unaudited quarterly financial Clause 41 Listing Agreement 14th August Stock Exchanges<br />

results in the prescribed format<br />

12. Issue TDS Certificate in form 16A to Section 203 Income Tax Act, 15th <strong>July</strong> Income-Tax<br />

vendors 1961 Authorities<br />

13. Intimation of date of Board Meeting Clause 41 Listing Agreement 7 days in Stock<br />

to consider quarterly results advance Exchanges<br />

14. Issue press release about Board Clause 41 Listing Agreement Simultaneo- One National & one<br />

Meeting to consider quarterly results meeting usly after regional newspaper<br />

Board<br />

15. Intimation of quarterly results Clause 41 Listing Agreement Within 15 Stock Exchanges<br />

minutes of<br />

Board Meeting<br />

16. Publish quarterly Results Clause 41 Listing Agreement Within 48 One English and<br />

hours of BM one regional<br />

newspaper<br />

<strong>July</strong>, 2011 11 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Compliance Checklist<br />

Sr. Activities Sections/Rules/ Acts/Regulations, Compliance To whom to<br />

No. Clauses, etc. etc. Due Date be submitted<br />

17. Submit three COMPLIANCE copies of quarterly CHECKLIST Clause 41FROM 10Listing TH JULY Agreement TO 10 TH Immediately AUGUST, on 2011 Stock Exchanges<br />

results singed by the MD<br />

conclusion of Board Meeting<br />

18. Pay Service Tax collected during the Section 68 read with The Finance Act, 5 th August Service Tax<br />

previous month by persons other Rule 6 1994, Service Tax Authorities<br />

than individuals, proprietors and Rules, 1994<br />

partnership firms in GAR-7<br />

19 Payment of excise duty Rule 8 Central Excise 5 th August Central Board of<br />

Excise and Customs Rules, 2002.<br />

20. Deposit TDS from Salaries for the Section 192 Income Tax Act, 7 th August Income-Tax<br />

previous month in Challan No.281 1961 Authorities<br />

21. Deposit TDS on Contractor’s Bill/Rent Section 194C to Income Tax Act, 7 th August Income-Tax<br />

Advertising/Professional Service Tax Section 194J 1961 Authorities<br />

deducted in the previous month<br />

22. Submit monthly statement on Regulation 54(5) SEBI (Depositories 7 th August Stock Exchanges<br />

substitution of names of depositories<br />

and Participants)<br />

in the previous quarter Regulations, 1996<br />

23. File return of exposure to capital Para 22 NBFC-D 7 th August RBI<br />

markets in Form NBS-6<br />

Prudential Norms<br />

Directions, 2007<br />

24. File a monthly return in prescribed RBI Circular Department of Non<br />

format (NBFC-ND) No.DNBS(RID) CC -Banking Supervision,<br />

No.57/02.02.15/20 RBI 7 th August RBI<br />

05-06<br />

Note : Members are requested to check the latest position with the original sources. <strong>NIRC</strong> of ICSI is, any way not<br />

responsible for the result of any action taken on the basis of the above compliances published in the <strong>News</strong>letter.<br />

ATTENTION<br />

MEMBERS / STUDENTS<br />

The details of Members Programs like Seminar, Conferences, etc. and soft copies<br />

of <strong>NIRC</strong>-ICSI <strong>News</strong>letters & Students’ programs viz TOP, SIP, ADP, MSOP,<br />

Students Activities, such as viz Moot Court Competitions, Elocution Competition,<br />

Essay writing, Company Law Quiz and Student Conferences are regularly<br />

updated on the <strong>NIRC</strong> Portal at ICSI website.<br />

To get updated information, Members & Students are requested to visit our<br />

following website regularly.<br />

www.icsi.edu/niro<br />

<strong>July</strong>, 2011 12 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

PROFESSIONAL DEVELOPMENT & TRAINING PROGRAMS<br />

<strong>NIRC</strong> organised the following programs:<br />

Members<br />

<strong>News</strong> from <strong>NIRC</strong><br />

Date Program Chief Guest/Speakers Present<br />

11.6.2011 Investor Awareness Program on<br />

Investor Protection and Corporate<br />

Governance<br />

14.6.2011 Investor Awareness Program on<br />

Understanding the Capital Market<br />

17-18.6.2011 Northern Region PCS Conference –<br />

2011 on Calibrating Competence for<br />

Professional Excellence<br />

18.6.2011 Investor Awareness Program on<br />

How to Read Annual Report of the<br />

Company<br />

Chief Guest:Mr. Ashok K<br />

Jethy,Chairman, Mother Teresa<br />

Institute of Management<br />

Speakers: Mr. Ajay Garg,<br />

Practising Company Secretary &<br />

Mr. Nandi Vinay Kumar S,<br />

Manager, RBI<br />

Guest of Honour: Dr. G P Agarwal,<br />

Principal, Shyam Lal College<br />

Speakers: Mr. Rajesh Nirula of<br />

Delhi Stock Exchange, CS J K Bareja,<br />

Mr V K S Nandi, Manager, RBI and<br />

CS Anupam Jha<br />

Chief Guest:<br />

Mr. Trivendra Singh<br />

Rawat,Hon’ble Minister for<br />

Agriculture, Horticulture and<br />

Fishery, Government of<br />

Uttarakhand;<br />

Guests of Honour:<br />

Mr. G. P. Patel, Managing<br />

Director, UJVN Limited; Mr. Om<br />

Prakash Uniyal, Chairman,<br />

Municipal Committee, Mussoorie<br />

& Mr. Bhaskar Naithani, Vice-<br />

Chairman, Prime Minister’s<br />

Gram Sadak Yojna & Monitoring<br />

Board, Govt. of Uttrakhand<br />

Speakers:<br />

Mr. Atul Mittal, Council Member,<br />

ICSI, Mr. Suneel<br />

Keswani,Corporate Trainer; Dr. S.<br />

Chandrasekaran, Company<br />

Secretary in Practice; Mr.<br />

Siddharth Bambha, Advocate<br />

and Mr. Dhiraj Dev Phukan,CEO,<br />

DijITware Technologies Private<br />

Limited<br />

CS Yogesh Gupta, Past<br />

Chairman, <strong>NIRC</strong>-ICSI, CS J.K.<br />

Bareja Mr. Chandan Rukhaiyar,<br />

Manager, RBI,<br />

Ms. Mandvi Sharma, Mr.<br />

Ashish Gupta, Mr. J.K. Bareja,<br />

Mr. Satya Narain, AGM, RBI,<br />

Mr. T R Mehta, members,<br />

students & Investors<br />

Members, students and<br />

investors<br />

Mr. Ranjeet Pandey,Mr.<br />

Deepak Kukreja,Ms. Ashu<br />

Gupta, Mr. Dhananjay<br />

Shukla,Mr. Manish<br />

Gupta,Mr. Madan Gopal<br />

Jindal,Mr. Rajiv Bajaj,Mr.<br />

Shyam Agrawal,Mr. Vineet K.<br />

Chaudhary, Chairman &<br />

other Office Bearers of<br />

Dehradun Chapter, Mr. T.R.<br />

Mehta and other members<br />

Mr. Pradeep Debnath,<br />

Mr. Vikas Gera & other<br />

members<br />

<strong>July</strong>, 2011 13 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

24.6.2011 Study Circle Meeting on XBRL<br />

Concepts and Practical Approach<br />

to MCA Filing<br />

25.6.2011 Seminar on Private Equity: Catalyst<br />

to Economic Growth<br />

26.6.2011 North Zone Study Group Meeting<br />

on Techno-Economic Feasibility<br />

Study & Opportunities for<br />

Company Secretaries<br />

26.6.2011 Investor Awareness Program on<br />

Investment Avenues in Capital<br />

Market<br />

CS Rajender Kapoor & CS Vijay<br />

Sahni of Webtel Electrosoft Pvt.<br />

Ltd.<br />

Chief Guest : Mr. Ravi Narain<br />

(Managing Director & CEO,<br />

National Stock Exchange),<br />

Guest of Honour : Mr. O.P. Vaish<br />

(Senior Advocate, Founder,<br />

Vaish Associates, Advocates),<br />

Speakers : Mr. P.N. Vijay<br />

(Founder, P N Vijay Financial<br />

Services Pvt. Ltd.), Mr. Arvind<br />

Mathur (Chairman, Private<br />

Equity Pro Partners & Ex-Head,<br />

Capital Markets, Asian<br />

Development Bank), Mr. Gagan<br />

Verma, (Ex-Morgan Stanley and<br />

Tailwind Capital, USA), Mr.<br />

Sandeep Kapoor (Vice President,<br />

Sequioa Capital), Mr. David<br />

Getzinger (Director-Legal, Intel<br />

Capital, Asia Pacific, Hong<br />

Kong), Mr. Gaurav Dani,<br />

(Partner, Induslaw), Mr. Simon<br />

Cox (Partner, Norton Rose LLP,<br />

London), Mr. Rupesh Jain<br />

(Partner, Vaish Associates,<br />

Advocates) and Mr. Satwinder<br />

Singh (Partner, Vaish<br />

Associates, Advocates)<br />

CS Rajesh Khurana<br />

<strong>News</strong> from <strong>NIRC</strong><br />

Date Program Chief Guest/Speakers Present<br />

19.6.2011 Investor Awareness Program on<br />

Capital Market – Investing in IPOs<br />

28.6.2011 Investor Awareness Program on<br />

Investment Opportunities in<br />

Capital Market<br />

Mr. B K Sabarwal, Executive<br />

Director, Jaypee Capital Services<br />

Ltd., Mr. Ashok Nimbekar,<br />

AGM, SEBI Mr. Satya Narain,<br />

AGM, RBI & CS J.K. Bareja,<br />

CS Ashok Juneja, Mr. Chandan<br />

Rukhaiyar (Manager, RBI), Mr.<br />

Narendra Rawat (DGM, SEBI)<br />

and Mr. Lalit Khanna.<br />

Chief Guest:Mr. C.M. Chang<br />

(Member of Parliament & Member,<br />

Parliamentary Standing<br />

Committee on Finance)<br />

Speakers: Mr. Anuradha Sharma<br />

(Asstt. Manager, RBI), Ms. Anusha<br />

Maheshwari (COO, Farsight<br />

Secruties Ltd.), Mr. Narendra<br />

Rawat & Ms. Versha from SEBI and<br />

Mr. Rajeev Goel, Practising<br />

Company Secretary,<br />

Mr. T.R. Mehta and other<br />

investors<br />

Mr. NPS Chawla, Mr. Yogesh<br />

Gupta & other members<br />

Mr. Nesar Ahmad, Mr. P.K.<br />

Mittal, Mr. Ranjeet Pandey,<br />

Mr. Dhananjay Shukla, Mr.<br />

NPS Chawla, Mr. G.P.<br />

Madaan, Mr. T.R. Mehta and<br />

other members<br />

Mr. Chetan Gupta, Mr. Nitesh<br />

Sinha and other members<br />

CS J.K. Bareja, Mr. T.R.<br />

Mehta, members & investors<br />

Mr. N.K. Jain, Mr. Ranjeet<br />

Pandey, Ms. Sonia Baijal, Mr.<br />

T.R. Mehta, investors, students<br />

and others<br />

<strong>July</strong>, 2011 14 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Students<br />

6-14.6.2011 20 th Student Induction Program<br />

(SIP)<br />

16-24.6.2011 21 st Student Induction Program<br />

(SIP)<br />

22.6.2011 Regional Round of 9 th All India<br />

Moot Court Competion<br />

27.6.2011 to 22 nd Student Induction Program<br />

3.7.2011 (SIP)<br />

1.7.2011 Regional Round of 11th All India<br />

Company Law Quiz<br />

Members of the Institute and<br />

other professionals<br />

Members of the Institute and<br />

other professionals<br />

Judges: Mr. K.S. Chandiok,<br />

Advocate; Mr. Jeetender Kapoor,<br />

Advocate; CS Vishal Aggarwal<br />

and CS Dinesh Aggarwal<br />

Members of the Institute and<br />

other professionals<br />

Judges: CS S. Koley, CS S.<br />

Narayanan, CS Naveen Bhatnagar<br />

& CS Vishal Aggarwal<br />

Quiz Masters : CS Vishal Arora &<br />

CS Divya Goel.<br />

<strong>News</strong> from <strong>NIRC</strong><br />

Date Program Chief Guest/Speakers Present<br />

30.6.2011 South Zone Study Group Meeting<br />

on Green Initiative on Corporate<br />

Governance- Role of CS<br />

02.7.2011 Seminar on Raising of Equity and<br />

Listing of SMEs on BSE SME<br />

Exchange<br />

CS Ranjeet Pandey, Chairman,<br />

<strong>NIRC</strong>-ICSI<br />

Chief Guest : Mr. Lakshman<br />

Gugulothu, CEO, BSE SME<br />

Exchange<br />

Speakers: Mr. Jignesh Gandhi,<br />

Vice-President, CDSL<br />

Mr. Navneet Arora, Mr.<br />

Dinesh Vashistha, Mr. RV<br />

Navik & other members<br />

Mr. Pavan Kumar Vijay, Mr.<br />

Ranjeet Pandey, Mr. Deepak<br />

Kukreja, Mr. Rajiv Bajaj, Mr.<br />

Manish Gupta, Mr. Vineet K.<br />

Chaudhary & other members<br />

Students of the Institute<br />

Students of the Institute<br />

Mr. Ranjeet Pandey, Mr. S.<br />

Koley, Mr. T.R. Mehta and<br />

students<br />

Students of the Institute<br />

Mr. Deepak Kukreja Mr. T.R.<br />

Mehta, Ms. Alka Arora and<br />

students<br />

COMPANY SECRETARIES<br />

BENEVOLENT FUND<br />

Members Enrolled Regionwise As Life Members of The<br />

Company Secretaries Benevolent Fund During the Period<br />

21.04.2011 to 20.06.2011<br />

S.No. Name Membership No.<br />

1 Mr. Nandan Kumar ACS - 20440<br />

2 Ms. Nishant Nayan ACS - 20106<br />

3 Ms. Ruchika Jain ACS - 23705<br />

4 Mr. Gaurav Agrawal ACS - 20645<br />

5 Mr. Vikas Saxena ACS - 10597<br />

6 Ms. Neha Ralhan ACS - 27629<br />

7 Mr. Pradeep Kumar Chawla ACS - 26881<br />

8 Mr. Chetan Goel ACS - 28069<br />

9 Mr. Suresh Chand Kumawat ACS - 26549<br />

10 Mr. Rajesh Taneja ACS - 27949<br />

11 Mr. Akshay Singh Naruka ACS - 27859<br />

12 Mr. Praveen Sharma FCS - 5234<br />

13 Mr. Ashish Thakur ACS - 25019<br />

<strong>July</strong>, 2011 15 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

NEWS FROM CHAPTERS<br />

<strong>News</strong> from Chapters<br />

Name of Date of Program/Meeting & topic Chief Guest/Speaker(s)<br />

Chapter Program/Meeting<br />

Agra 5.6.2011 Study Circle Meeting on M & A Restructuring Tools<br />

Speaker : CS. Pankaj Jain<br />

12-19.6.2011 1 st Student Induction ProgramInaugurated by: Honourable Dr. R. P. Mangal<br />

18.6.2011 Company Law Quiz for students<br />

18-19.6.2011 Participation in 2-Days’ Career Fair organised by Infra Educa- 2011<br />

19.6.2011 Seminar Jointly with National Stock Exchange of India on Capital<br />

Market & Investor Awareness Speaker: CS Trilok Singla<br />

Allahabad 28.5.2011 Study Circle Meeting on Money Laundering<br />

12-18.6.2011 Student Induction Program<br />

Bareilly 21.5.2011 Webcasting of National Seminar on XBRL - An emerging professional<br />

opportunities<br />

25.06.2011 Webcasting of Seminar on Private Equity - Catalyst to Economic Growth<br />

Bhilwara 13.06.2011 to 19.06.2011 16 th Student Induction programme<br />

20.06.2011 to 26.06.2011 17 th Student Induction programme<br />

25.06.2011 Webcasting of National Seminar on Private Equity- Catalyst to<br />

Economic Growth<br />

Gurgaon 28.5.2011 Talk on Regulatory Provisions Of the Companies Act1956<br />

13.6.2011 1 st Student Induction Program<br />

18.6.2011 Company Law Quiz for students<br />

Jaipur 18.05.2011 4 th Executive Development Program<br />

28.05.11 to 05.06.11 Rajasthan Patrika Career Fair<br />

11, 16 & 17.06.2011 Investor Awareness Programs<br />

17.06.2011 Moot Court Competition for students<br />

24.06.2011 Company Law Quiz Competition for students<br />

Jodhpur 13-19.6.2011 9 th Student Induction Program - Chief Guest Inaugural Session: CA<br />

Kailash Bhansali, MLA, Government of Rajasthan - Chief Guest<br />

Valedictory Session: Hon’ble Colonel D S Lohamaror, Commander,<br />

NCC & Personality Developer and Motivator<br />

Lucknow 27.5.2011 & 05.6.2011 Investor Awareness Programs<br />

11-17.6.2011 9th Student Induction Program<br />

17.6.2011 Study Circle Meeting<br />

18-24.6.2011 10th Student Induction Program<br />

18-19.6.2011 Participation in Education & Career Expo 2011<br />

25.6.2011 Investor Awareness Program<br />

25.6.2011 Webcasting of Seminar on Private Equity: Catalyst to Economic Growth<br />

Ludhiana 4.6.2011 Seminar on (i) Practical Aspects of XBRL & (ii) Analysis of recent circulars/<br />

notifications under Companies Act, 1956<br />

Speakers: Mr. Ranjeet Pandey, Chairman <strong>NIRC</strong> & Mr. Vinod Kashyap,<br />

Chartered Accountant<br />

<strong>July</strong>, 2011 16 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

PUBLIC RELATIONS COMMITTEE<br />

Sl. No. Name ACS / FCS Contact No. Email<br />

1. Mr. Shyam A-19344 09314923451 agrawalshyam@hotmail.com<br />

Agrawal,Chairman<br />

2. Mr. Saurabh Kalia A-17690 09810979440 saurabhkalia@hotmail.com<br />

(Convener)<br />

3. Mr. Sunil Bhatia F-5120 09810040895 bhatia.s@dseindia.org.in<br />

4. Ms. Anju Jain F-5282 09897602111 anjujain_cs@rediffmail.com<br />

5. Mr. Rahul Jain F-5804 09212605999 rjcocs@gmail.com<br />

6. Mr. Pavan Talesra A-9008 09414158294 tcsindia@sify.com<br />

7. Mr. Puneet Duggal A-11007 09899474999 puneetduggal@hotmail.com<br />

8. Mr. Girish Goyal A-11442 09413390003 girishgoyal_a3@yahoo.com<br />

9. Mr. Vishal Arora A-12535 09814296288 csvishalarora@gmail.com<br />

10. Mr. Rakesh Kumar A-15902 09891239100 info@marsandpartners.com<br />

11. Mr. Pankaj Jain A-16303 09654958921 pankajjain101@yahoo.co.in<br />

12. Mr. Amol Vyas A-19768 09414222876 amolvyas@live.com<br />

13. Mr. Sumit Batra A-22299 09873428930 skbatrapcs@gmail.com<br />

14. Mr. Gaurav Arora A-22691 09910383038 gauravaroracacs@gmail.com<br />

15. Mr. Amit Chhabra A-26555 09999100888 csamit.chhabra@gmail.com<br />

FUND RAISING COMMITTEE<br />

List of Functional Committees<br />

LIST OF FUNCTIONAL COMMITTES OF <strong>NIRC</strong>-ICSI FOR THE YEAR 2011<br />

S.No. Name ACS/FCS No. Contact No. E-mail<br />

1 Mr. Shyam A-19344 09314923451 agrawalshyam@hotmail.com<br />

Aggarwal,<br />

Chairman<br />

2 Mr. Rajiv Bajaj, F-3662 09811453353 bajaj.rajiv@mtaic.panasonic.co.in<br />

Convener<br />

3 Mr. Lalit Jain F-2370 09811320240 lalit_jain@jubl.com<br />

4 Mr. Anil Shrivastav F-4893 09810000183 anil.srivastava@tv18online.com<br />

5 Mr. Sanjay Gupta F-3348 09810906470 sanjaykumar.gupta@havells.com<br />

6 Mr. Krishnan F-2075 09971194333 srkrishnan.oil@gmail.com<br />

7 Mr. N.K Sinha F-1807 09868282032 sinha_nk3@ongc.co.in<br />

8 Mr. A.K Rastogi F-1748 011-24360071 akrastogi@ntpc.co.in<br />

9 Mr. Gaganjit Kashyap F-3270 09872204150 gaganjitkashyap@yahoo.co.in<br />

10 Dr. Sanjeev Gemavat F-3669 09810403095 gemawat.sanjeev@dlf.in<br />

11 Mr. Ajay Krishna A-3296 09810799818 akrishna@uflexltd.com<br />

12 Mr. Sanjeev Kr. Singh F-6295 09811417517 finance@mankindpharma.com<br />

13 Dr. Satish kashi F -3663 09873561826 drsanjeev@bajajhindusthan.com<br />

Rajgaria<br />

14 Mr. Lalit F-5961 09971590597 chaturvedilalit@yahoo.com<br />

Chaturvedi<br />

15 Mr. Varun ACS 26119 09971505010 varun.778899@gmail.com<br />

<strong>July</strong>, 2011 17 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Research Paper Competition<br />

RESEARCH AND PUBLICATION COMMITTEE OF <strong>NIRC</strong>- ICSI<br />

PROUDLY ANNOUNCES<br />

"RESEARCH PAPER COMPETITION"<br />

For the members of ICSI-<strong>NIRC</strong><br />

OBJECTIVE:<br />

The competition is aimed at sharing the skills of the Members of ICSI-<strong>NIRC</strong>:<br />

• Enticing Members to excel and update their knowledge; and<br />

• To bring together the views and experiences of different people on similar issue.<br />

PROCESS:<br />

• 2 Tier competition is envisaged.<br />

• The word limit varies accordingly.<br />

• Research papers will be judged by a panel of jury members for each group.<br />

SUBMISSION OF PAPERS:<br />

• The last date for the submission of Research Paper - 31st <strong>July</strong>, 2011<br />

• The Research papers shall be submitted (via e-mail: niro@icsi.edu and also through signed hard copy addressed to The Convenor, Research<br />

and Publication Committee, <strong>NIRC</strong> of ICSI, ICSI-<strong>NIRC</strong> Building, Plot No.4, Prasad Nagar Institutional Area, Near Rajendra Place, New<br />

Delhi - 110005).<br />

• The hard copy shall be supported by two passport size photograph, membership number, e-mail ID and declaration regarding originality.<br />

• Prescribed word limit shall be adhered to; only eligible entries shall be scrutinized.<br />

• The decision of the Jury shall be final & binding on all the participants.<br />

ELIGIBILITY CRITERIA:<br />

• Members of <strong>NIRC</strong>- ICSI as on cut-off date.<br />

• Elected Council Members; Regional Council Members; Staff Members of <strong>NIRC</strong> - ICSI and Members of Research & Publication Committee<br />

are not eligible to participate.<br />

SUGGESTED TOPICS:<br />

GROUP I<br />

GROUP II<br />

Company Secretaries with experience of<br />

0-5 years<br />

more than 5 years<br />

900 - 1100 words (Procedural)<br />

1400 - 1600 words (Technical)<br />

Incorporation of Companies in other countries.<br />

De-meger through slump sale<br />

FDI Policy of India - practice and procedure.<br />

Remuneration of Independent Directors<br />

ECB policy - practice and procedure.<br />

Professional liability : while dealing with fraud<br />

Setting of a non-profit organization<br />

Taxation on LLP<br />

Delegation of regulatory powers to professional practitioners<br />

Working Profile of Company Secretaries in smaller towns.<br />

Globalization of CS Profession - Scope and Hope<br />

Whistle blowing and professional responsibilities<br />

Managing a Global depository receipt of a Indian Company<br />

Liability of Indian company under listing agreement in USA<br />

Legal compliances at Commodity Exchanges<br />

Provision of Income tax - Limiting Indian Businesses’ social responsibility<br />

initiatives<br />

RECOGNITION & AWARDS:<br />

The best article on each topic is proposed to be included in CD to be released by RPC. Three best entries in each group shall be awarded with a<br />

Citation, Trophy and Cash Prize.<br />

Ist Prize IInd Prize IIIrd Prize<br />

GROUP I Rs. 3,100/- Rs. 2,100/- Rs. 1,100/-<br />

GROUP II Rs. 5,100/- Rs. 3,100/- Rs. 2,100/-<br />

END USE :<br />

Research and Publication Committee reserves the right to publish the Articles / Excerpts either in print or in electronic media.<br />

<strong>July</strong>, 2011 18 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Delhi Study Group Meetings<br />

DELHI STUDY GROUPS FORTHCOMING MEETINGS<br />

Day, Date & Time Program Program Venue<br />

Credit Hours<br />

Saturday WEST Zone Study Group Meeting on ONE CMC Ltd. Community Centre<br />

23.07.2011, 6.00 PM Business Taxation and Overview C-58, 6th Floor, Behind Janak Cinema<br />

Janak Puri New Delhi<br />

Saturday EAST Zone Study Group Meeting on ONE Mother Teresa Public School<br />

16.07.2011, 6.00 PM (Topic will be informed through e-mail) C-Block, Preet Vihar, Delhi<br />

Sunday NORTH Zone Study Group Meeting on ONE Hero Mind Mine, 3rd Floor,<br />

24.07.2011, 5.00 PM (Topic will be informed through e-mail) Building No. FD-4, (Near<br />

Pitampura Metro Station),<br />

New Delhi<br />

Friday SOUTH Zone Study Group Meeting ONE A.M.D.A. Conference Hall, 7/9, Sirifort<br />

29.07.2011, 6.00 PM (Topic will be informed through e-mail) Institutional Area, August Kranti Road,<br />

New Delhi<br />

CREDIT HOUR : 1<br />

cordially invites members at<br />

Study Circle Meeting<br />

on<br />

LLP-Legal & Tax Implications<br />

on<br />

Friday, the 15 th <strong>July</strong>, 2011 at 6.00 PM<br />

at<br />

ICSI-<strong>NIRC</strong> Building Auditorium,<br />

4, Prasad Nagar Institutional Area, New Delhi<br />

CONGRATULATIONS<br />

Ms. Vimla Rupani (ACS-24636), Practising Company Secretary from Jodhpur on her securing<br />

TOP position in LL.B. from coveted Jai Narayan Vyas University of Rajasthan in the result of<br />

session ending 2011.<br />

<strong>July</strong>, 2011 19 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Corporate Membership<br />

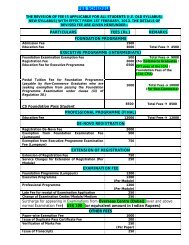

CORPORATE MEMBERSHIP FOR PROFESSIONAL PROGRAMS<br />

The concept of Corporate Membership for Professional Development Programs, as started by <strong>NIRC</strong>, is well appreciated and<br />

acknowledged by the members and corporates as it is convenient to make payment/take approval at onetime to attend<br />

different Professional Development Programs during the year.<br />

The Corporate Membership is open for the financial year 2011-2012. Members are invited to opt for Corporate Membership<br />

for Professional Development Programs for the financial year 2011-2012 (April 2011 to March 2012) at the following fee<br />

structure.<br />

S. No. Particulars Fees<br />

1. For Members of ICSI (If paid by individual) Rs. 8,000/-<br />

2. For PCS Rs. 7,500/-<br />

3. For Members / Non-Members (If sponsored by corporate) Rs. 9,000/-<br />

4. For Senior Citizens Rs. 7,000/-<br />

The terms & conditions/benefits of the scheme shall be as under:<br />

a) To attend all the paid professional development programs (except Workshops and Residential programs) organized by<br />

<strong>NIRC</strong> free of charge throughout the year.<br />

b) Free Membership of all study groups.<br />

c) Free monthly e-<strong>NIRC</strong>-ICSI <strong>News</strong>letter for the Member organization.<br />

d) The member may depute some other officer only from his/her organization with authorization on letter head of the<br />

company and certifying that the nominated person is from his/her organization.<br />

e) The individual member/PCS may depute any member /student of ICSI authorizing in writing to attend the program.<br />

f) Credit hours will be given to only those corporate members who joins the programs upto 11.00 a.m.<br />

FORM OF CORPORATE MEMBERSHIP<br />

FOR PROFESSIONAL DEVELOPMENT PROGRAMS FINANCIAL YEAR 2011-12<br />

(1) Name of Nominated Person : ..........................................................................................<br />

(2) Membership No (ACS/FCS) : ..........................................................................................<br />

(3) Corporate Membership No. of <strong>NIRC</strong> : ..........................................................................................<br />

(For existing members only)<br />

(4) Sponsoring Organisation : ..........................................................................................<br />

Telephone .............................. Fax ..........................................<br />

Mobile ... ............................................................................<br />

E-mail ................................................................................<br />

(5) Details of Payment of Fee Cash/Cheque/DDNo/ ..........................dated..........................<br />

Bank ................................... Amount ......................................<br />

Date : ...........................<br />

Signature<br />

Note : Cheque/DD to be issued in favour of “<strong>NIRC</strong> of the ICSI” and sent to Executive Officer, <strong>NIRC</strong> of ICSI, 4<br />

Prasad Nagar Institution Area, New Delhi.<br />

<strong>July</strong>, 2011 20 <strong>NIRC</strong>-ICSI <strong>News</strong>letter

Forthcoming Programs<br />

TWO DAY WORKSHOP<br />

on<br />

“XBRL – Practical aspect of MCA Financial Reporting”<br />

on<br />

Tuesday & Wednesday, the 26th & 27th <strong>July</strong>, 2011<br />

10.00 a.m. onwards (Registration starts at 9.30 AM)<br />

at<br />

New Delhi YMCA Conference Hall, 1, Jai Singh Road, New Delhi<br />

Fee: Rs.3,500/- per delegate including Corporate Members of <strong>NIRC</strong><br />

Registration:<br />

In order to make necessary arrangements, Members are requested to enrol well in advance with<br />

Executive Officer, <strong>NIRC</strong>-ICSI, 4, Prasad Nagar Institutional Area, New Delhi-110 005.<br />

The cheque for delegate fee may please be drawn in favour of <strong>NIRC</strong> of ICSI payable at New Delhi.<br />

Tel.:+91-11-49343000, Fax: 25722662 E-mail: eoniro@icsi.edu;<br />

(PROGRAM CREDIT HOUR: EIGHT)<br />

<strong>NIRC</strong> cordially invites members & students at the following programs during<br />